🧐The Truth of the Crypto Market: 90% of Anxiety Comes from Ineffective "Diligence"|Behind the Continuous Breakthrough of SSI Rewards and TVL:

We need to make investments smarter: MAG7.ssi, a tool with unlimited liquidity to enjoy market dividends—

Today, the market is in a downward trend, and many people are starting to panic and feel anxious, especially those friends who seem very "diligent," working hard but not making much money:

We always think that investing requires "very hard work"—frequent operations, chasing hot trends, predicting ups and downs.

But reality is often cruel. Data shows that from 2021 to 2023, the average return of active traders is 37% lower than that of passive Bitcoin holders, and losses due to emotional trading account for as much as 68%.

Ironically, those investors who try to "diversify risks" often suffer heavy losses by blindly betting on a single track (such as MEME coins or Layer 1 public chains).

1️⃣ Why was dollar-cost averaging Bitcoin once the ultimate answer?

Before 2024, "monthly dollar-cost averaging Bitcoin" was indeed the most rational choice: it uses the simplest strategy to combat human weaknesses—no need to predict the market, just believe in the long-term value of the crypto revolution. But problems have emerged: Bitcoin's market cap share has dropped from 70% in 2020 to 45% in 2023, completely missing out on the dividends from ecosystems like Ethereum and Solana;

More critically, as the market enters a multipolar era, relying solely on a single asset is no longer sufficient to withstand black swan risks.

2️⃣ A Smarter Choice is Emerging: MAG7.ssi

When SoSo launched a few days ago, it amazed everyone, and the price surge caught many people's attention. Previously, if there were some interactive returns, they were also considerable.

In addition, many people have not noticed that SoSo @SoSoValueCrypto actually has a greater strength, which is its tool line and product line;

If SoSoValue only had conventional functions like aggregating news and data dashboards, it might be similar to most data service providers—"indistinguishable from the crowd."

But SoSoValue is not. In addition to high-quality information aggregation and insight tools, SoSoValue has created a very interesting ace technology—SSI Protocol on-chain spot ETF protocol.

In short, it brings traditional financial ETFs on-chain, creating an on-chain BlackRock. For example, if you want to invest in the meme sector but don't know which token to buy, you can directly purchase the index token (like meme.ssi) provided by SoSoValue, allowing you to hold all the spot assets in this index at once, significantly alleviating your choice anxiety, which can be roughly understood as buying a thematic fund.

For more related information, you can refer to the article I wrote earlier: https://x.com/btw0205/status/1881928794711494705?s=46&t=1fmViEEp4ahAv6QgAcIA2g

In addition, there is another amazing product. While using SoSoValue's data tools, I discovered this novel feature—MAG7.ssi. After researching, I strongly recommend everyone to pay attention to this product.

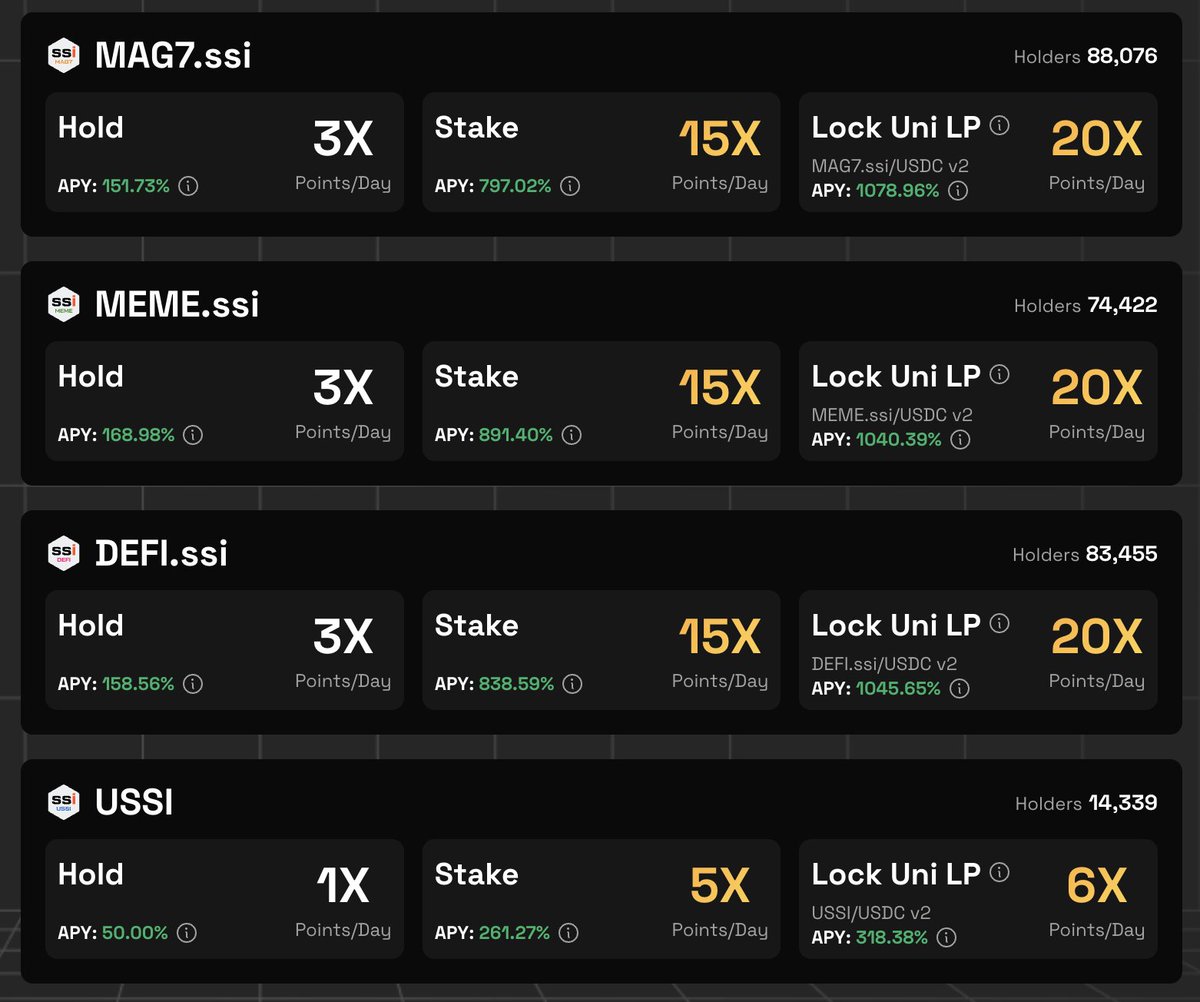

We can see that today, SSI rewards and total TVL have once again broken through:

70.04m TVL = 54.1m(mag7) + 3.53m(defi) + 2.46m(meme) + 9.95m(ussi)

It does not require you to become an "all-knowing prophet," nor does it force you to bet on the future among thousands of tokens, but instead uses a precisely designed mechanism to accomplish the three most important things for you:

- Reject Gambler's Mentality: Use "Passive" to Overcome "Human Nature"

Behind MAG7.ssi is the first true "lazy index" in the crypto world—it automatically tracks the seven major cryptocurrencies: Bitcoin, Ethereum, Solana, etc., and dynamically adjusts weights based on monthly market performance. This means:

1) You don't have to struggle with "which coin to buy": when Solana rises due to DePIN, it will automatically increase its allocation; when Bitcoin starts to rally due to halving, it will quickly increase its position.

2) You are no longer enslaved by FOMO emotions: 2023 testing data shows that MAG7.ssi's "rebalancing mechanism" successfully reduced exposure to related assets before the LUNA crash, with a drawdown rate 22% lower than Bitcoin during the same period.

3) You can finally "forget the password": just buy once, and the system will continuously optimize the portfolio, like having a top-notch research team working around the clock.

- Harvest Industry Dividends: Go Long on the Entire Crypto Civilization

Bitcoin is digital gold, Ethereum is a decentralized computing platform, Solana is a high-performance application chain… the future winners will not be just one.

The underlying logic of MAG7.ssi is to bet on the overall evolution of the crypto world:

1) Reject the illusion of "winner takes all": After 2024, tracks like AI + blockchain, RWA, and DePIN will give rise to multiple trillion-dollar ecosystems, and no single asset can monopolize the dividends.

2) Avoid the risk of "technology becoming obsolete": Many "Ethereum killers" that once shone in 2022 are now mostly silent, while MAG7.ssi's monthly rebalancing can automatically eliminate weak assets, ensuring that it always holds the most viable targets.

3) Capture opportunities for "cross-border explosions": When Bitcoin rises due to institutional entry, it shares the dividends of value storage; when SOL surges due to GameFi, it enjoys growth at the application layer.

- Unlimited Liquidity: A Revolution in "Long-Termism"

The biggest pain point of traditional index funds is the lag in subscriptions and redemptions and liquidity traps, while MAG7.ssi achieves two breakthroughs through the native synthetic asset protocol on the Base chain:

1) 7x24 Hour Instant Trading: No matter how the market fluctuates, you can exit anytime like buying and selling ETH, completely saying goodbye to the nightmare of "cutting losses in a bear market and missing out in a bull market."

2) Zero Friction Compound Growth: All holding returns are automatically reinvested, with no management fee erosion, no redemption fees eating into profits. Historical backtesting shows its three-year cumulative return is 15% higher than manual rebalancing strategies.

3️⃣ Why is Now the Best Time to Position?

In 2025, the crypto market will face two decisive variables: the full entry of Bitcoin ETF funds and the start of the Federal Reserve's interest rate cut cycle. Against the backdrop of massive capital inflow, the Matthew effect of leading assets will become more pronounced, and MAG7.ssi's "stronger gets stronger" mechanism is born for this moment.

As I write this, I want to say to every "ordinary person who wants to win but is afraid of losing," the crypto circle is indeed very difficult, but many people's original intention for investing may just be to achieve small, stable growth, which should not be a painful practice.

The ultimate mission of MAG7.ssi is to allow ordinary people to become "shareholders" in the growth of crypto civilization in the easiest way—without being short-term gamblers or research laborers, just believe in the power of mathematics and time.

As John Bogle, the father of index funds, said: "Never overestimate your stock-picking ability; the market's total return minus your costs is your ultimate return." In the crypto world, this can be stated more straightforwardly: instead of being anxious in the noise, it is better to lie flat in the trend.

So, when you feel exhausted from doing research and are confused about the trend, try changing your posture; perhaps this passive wealth is more suitable for you!

SoSoValue MAG7.ssi:

https://sosovalue.com/tc/assets/cryptoindex/ssimag7?tab=1

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。