After years of caution and anticipation, cryptocurrency has finally reached a milestone moment. The Trump administration has continuously brought positive policy news to the market since taking office, leaving a distinct mark at the start of the president's second term.

Although Trump did not mention cryptocurrency in his inaugural speech, which left the community somewhat disappointed, a series of very direct and precise executive orders quickly made up for it. Below is a brief summary of the executive orders related to cryptocurrency:

Trump established a working group composed of AI and cryptocurrency overseer David Sacks, SEC official Hester Pierce, the Treasury Secretary, and other senior members, which is considered a very supportive team for cryptocurrency.

The working group has the authority to lead discussions and propose regulatory policy recommendations that go beyond the federal government's expertise.

The order aims to support the growth of digital assets, allow blockchain to be used for legitimate purposes, and require relevant agencies to maintain neutrality towards technology in regulation.

The working group will assess the feasibility of establishing a national digital asset reserve.

The order requires opening banking services to legitimate cryptocurrency participants.

The order supports the issuance of dollar stablecoins by the private sector but prohibits the issuance or promotion of CBDCs (central bank digital currencies).

The order effectively repeals the previous digital asset framework established by the Biden administration.

Overall, compared to the situation in recent years, this is a quite comprehensive and impressive executive order.

In addition, shortly after the executive order was issued, some industry details gradually emerged, showing significant progress in institutional participation:

- The SEC overturned the controversial accounting rule "SAB 121," which will allow banking institutions to begin holding cryptocurrency assets on their balance sheets in the future. Existing rules require that held cryptocurrencies be marked as liabilities, significantly worsening corporate debt/equity ratios and making the cost of holding cryptocurrencies prohibitively high.

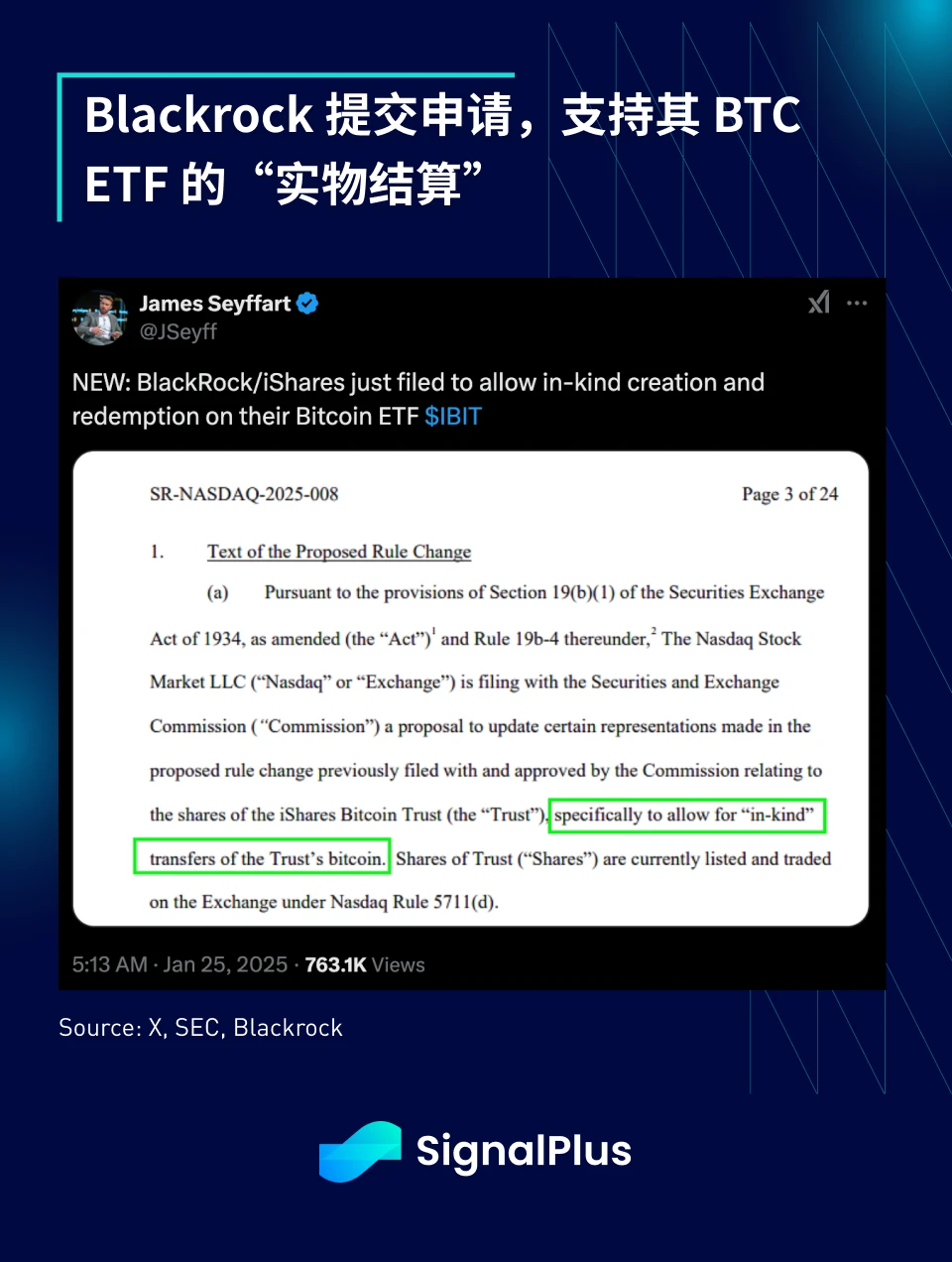

- Blackrock applied to amend its $IBIT BTC ETF filing to allow "physical settlement," meaning investors can choose to receive ETF returns in BTC rather than US dollars, indicating that Wall Street is preparing to support BTC settlement.

- In terms of blockchain applications, it is reported that Elon Musk is exploring the use of blockchain technology to track government spending and efficiency, very DOGE style.

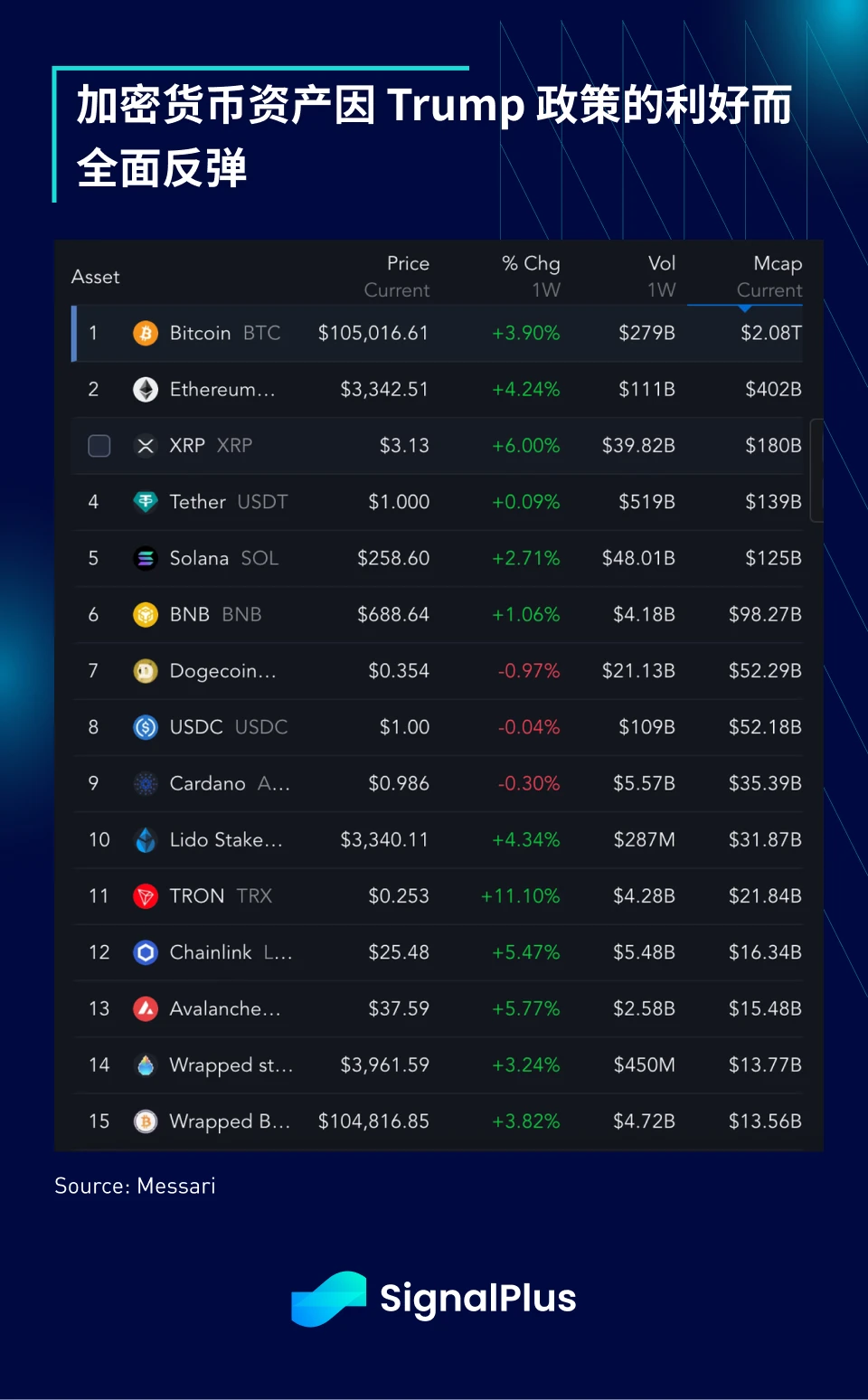

Over the weekend, Eric Trump "confirmed" plans to implement a 0% capital gains tax for domestic cryptocurrency projects (such as XRP), while all other offshore projects would face a 30% tax.

Additionally, Senator Ted Cruz pledged to introduce a new resolution to overturn the IRS rule requiring DeFi brokers to report total income and user data, arguing that the rule undermines the spirit of decentralization and hinders cryptocurrency innovation.

- Although the market did not reach a historical high, cryptocurrency rebounded strongly from last week's sharp decline, with BTC rising 4% and XRP increasing 6% due to being considered for inclusion in strategic cryptocurrency asset reserves.

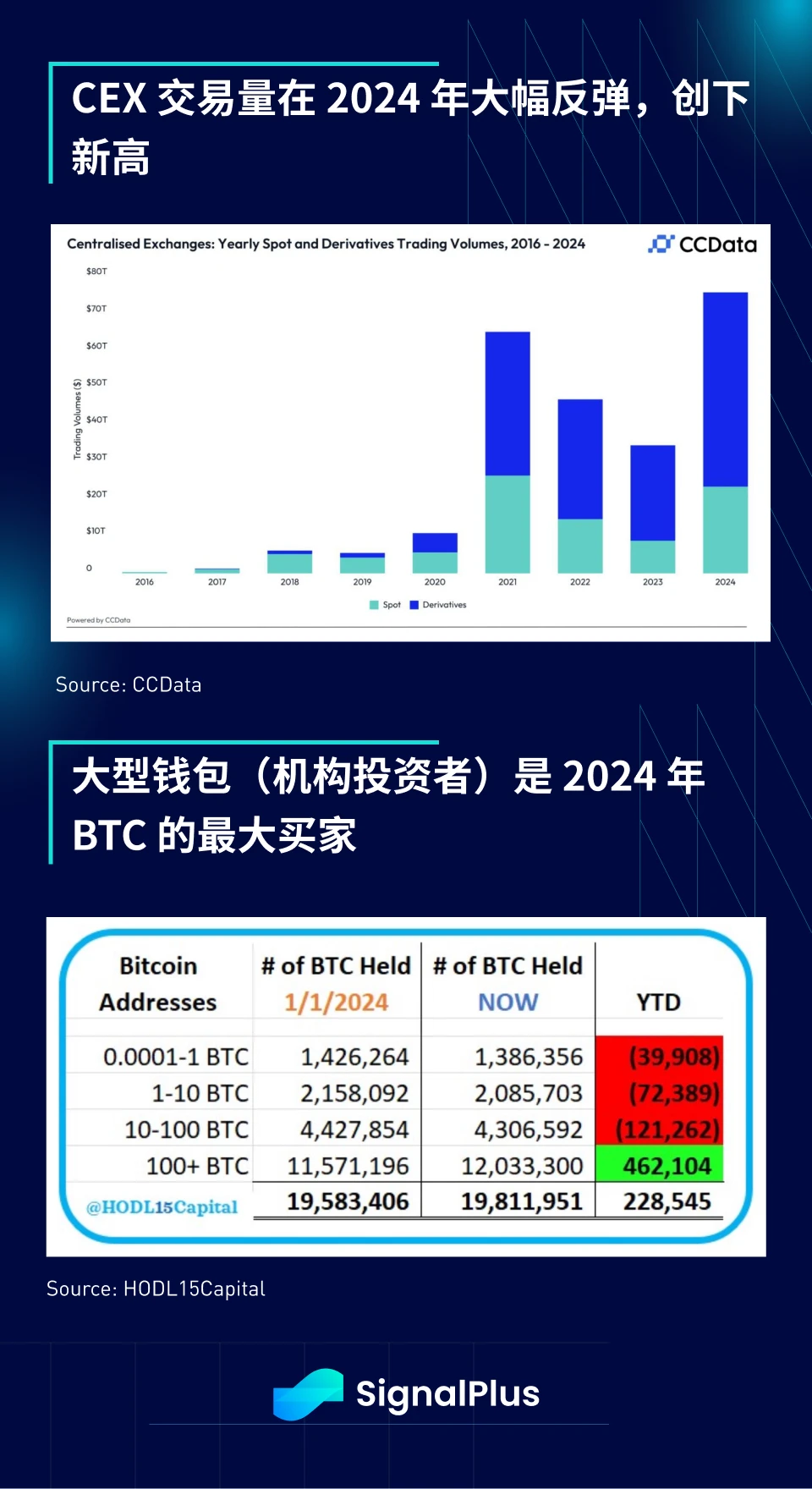

The underlying data is also favorable. According to a report by CCData, the trading volume of spot and derivatives on centralized exchanges reached a historical high in 2024, surpassing the peak before the FTX incident. Meanwhile, on-chain data shows that large wallet addresses (such as institutional investors and ETF buyers) have been net buyers of BTC, offsetting the sell-off from smaller addresses. This is a "position exchange" that typically occurs when mainstream institutions begin to accumulate BTC, which is a positive signal for sustained capital inflow and accumulation in the current political context.

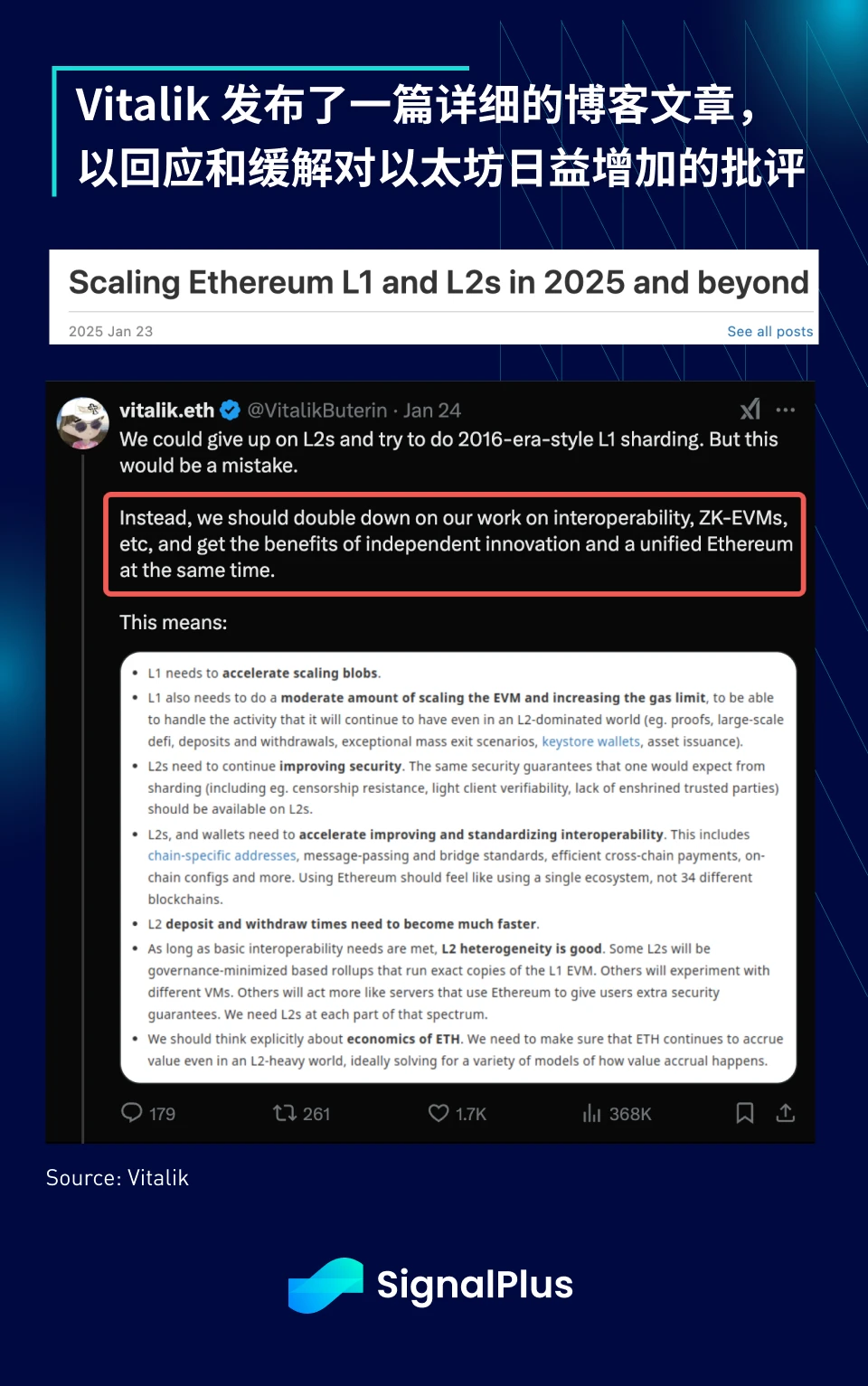

Last week, market sentiment was so optimistic that even the struggling ETH saw a rebound. Vitalik published a detailed blog post responding to community criticisms regarding the handling of Layer 2 growth. In short, he believes that Layer 2 will continue to exist but will also strive to improve the user experience of Layer 1 to reduce excessively high gas fees. While not everyone agrees, Vitalik's detailed explanation this time was more accepted than before, at least showing that he is informed and concerned about the complaints regarding Ethereum's current state. We hope this can mark the beginning of a rebound in Ethereum sentiment, especially considering its potential as a settlement layer for future financial institutions.

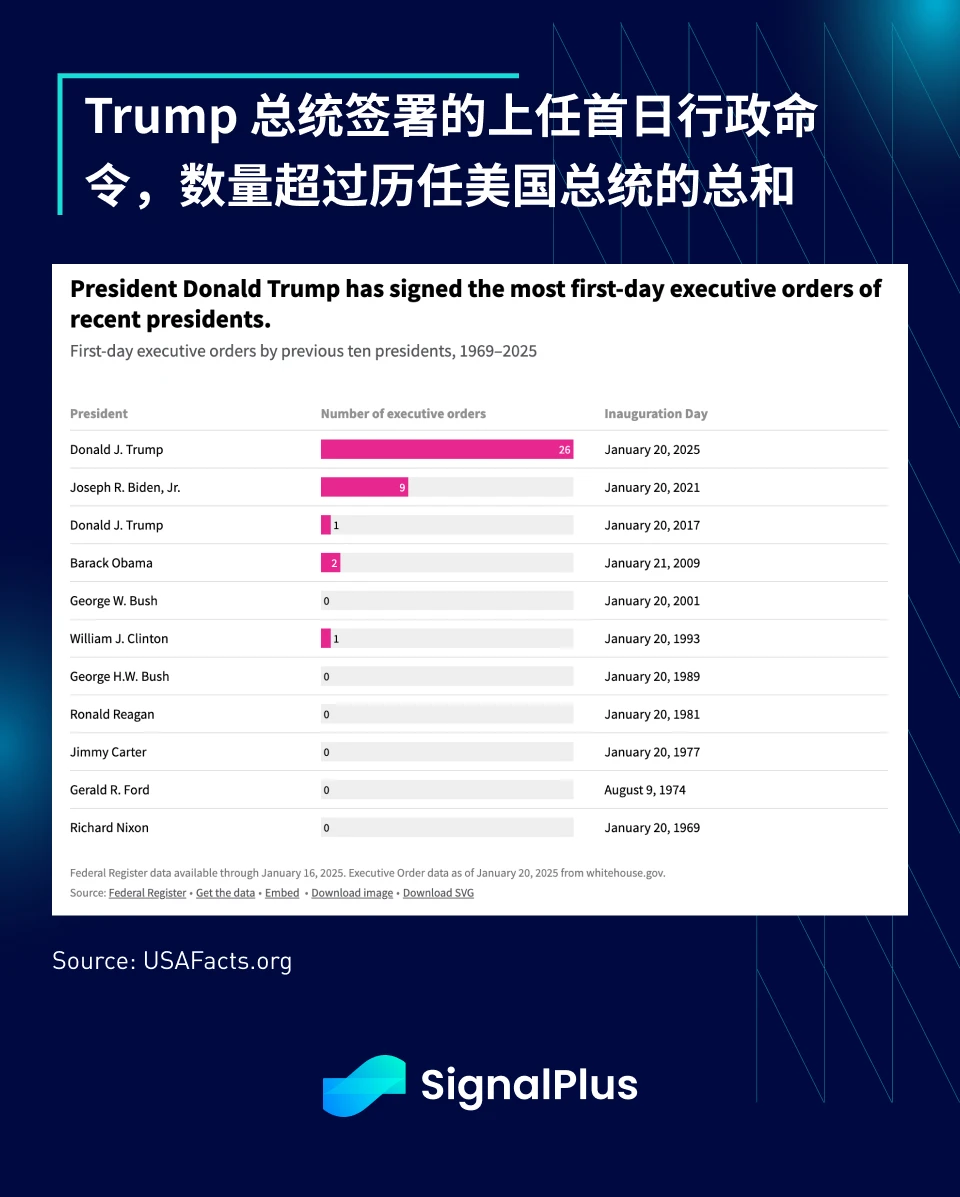

Returning to the traditional financial macro field, several executive orders from President Trump provide a wealth of content worth in-depth analysis. He signed 26 executive orders on his first day in office, breaking all records and far exceeding the total of all previous U.S. presidents.

In summary, here are some key policy highlights from Trump's new term:

Trade Policy:

"Produce in the U.S. or pay tariffs."

Trade with China:

The attitude is milder than expected, stating that U.S.-China relations are "very good," and trade needs to be "fair," but not necessarily "excellent."

Chinese Tariffs:

"China has already paid a lot of tariffs because of me."

"I would rather not have to use [tariffs], but it is a huge bargaining chip against China."

Geopolitics:

"Ukraine is ready to reach an agreement to end the war."

Threatening to impose taxes and sanctions on Russia if a peace agreement is not reached soon.

Energy:

Hopes OPEC will lower oil prices.

Needs to double U.S. energy production to "scale AI to what [the U.S.] wants."

Monetary Policy:

"I will call for an immediate interest rate cut."

With only 3 days until the next Federal Reserve meeting, market pricing shows almost no possibility of a rate cut.

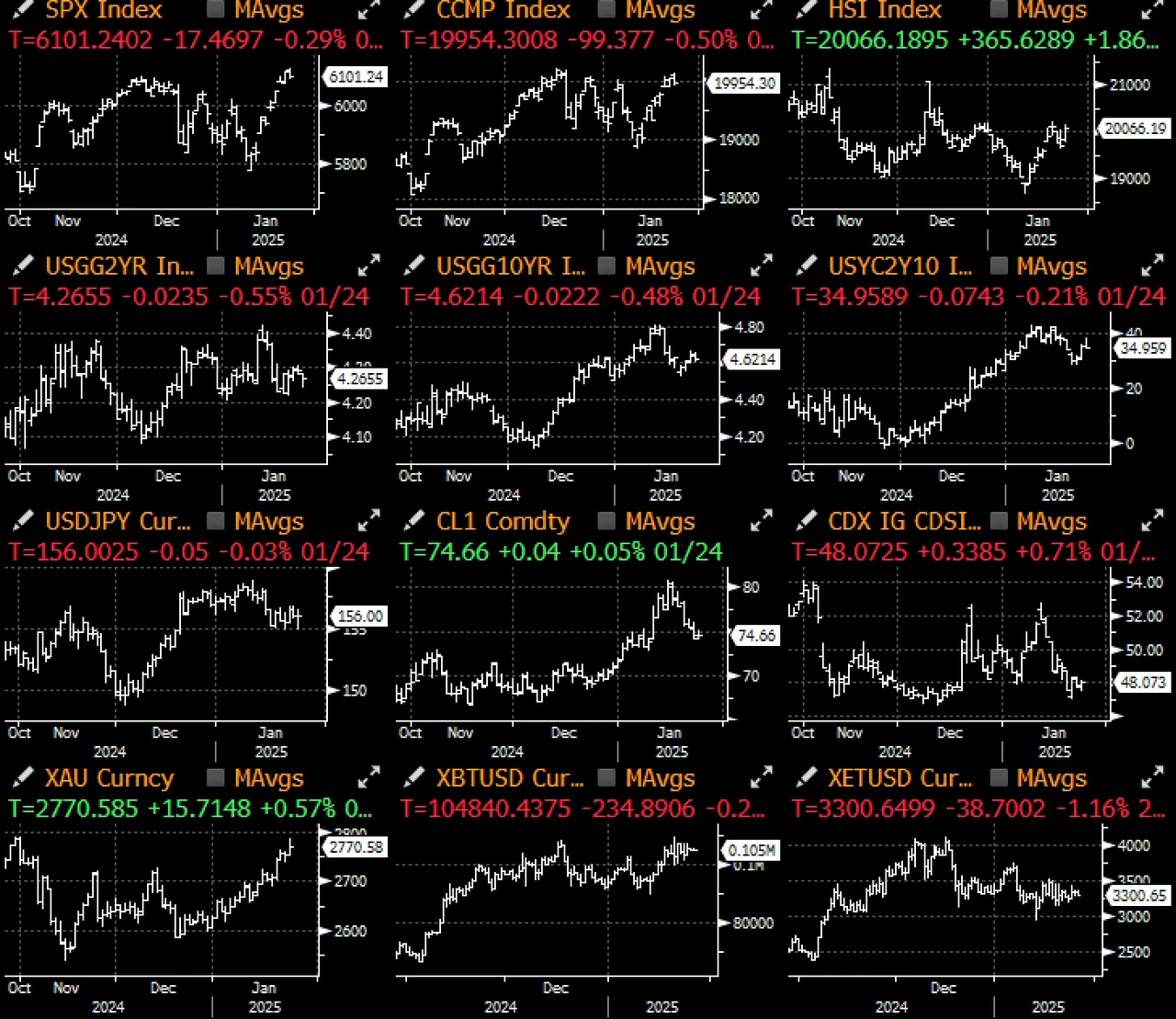

Macroeconomic market participants often feel confused by the market's response. The general trading consensus before Trump's inauguration was to go long on both the dollar and U.S. stocks, expecting that the general tariff policy would boost the dollar, while if tariffs were not implemented, the stock market might rise. The final outcome was closer to the latter, with weakened enforcement of tariffs (especially against China), leading to a general rise in risk assets and a weakening dollar.

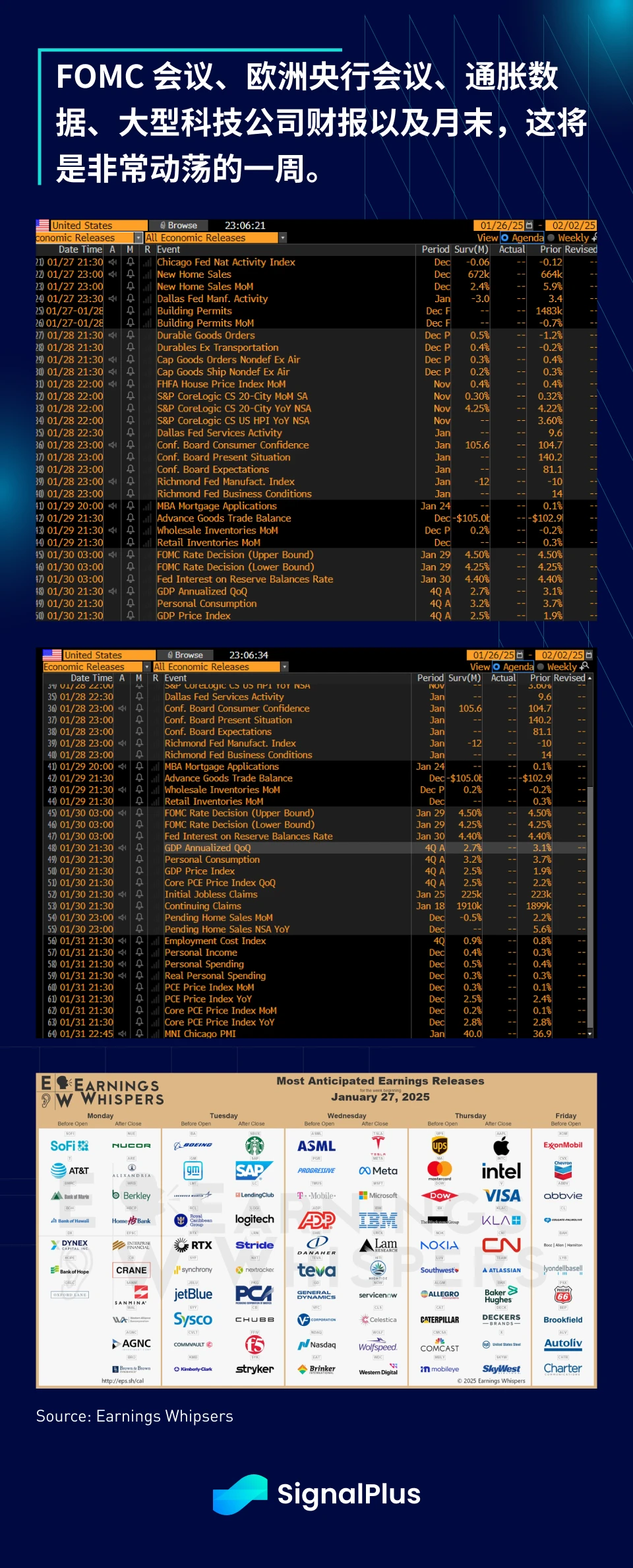

In terms of economic data, this week will see many important data releases and schedules, including consumer confidence data on Tuesday, the FOMC meeting on Wednesday, the European Central Bank meeting and U.S. GDP data on Thursday, and core PCE data on Friday. Additionally, this week will bring a series of important earnings reports, including from Apple, Tesla, Microsoft, Meta, ASML, UPS, Caterpillar, Visa, and Mastercard.

Considering the various heavyweight news from Trump 2.0 policies over the past week, the numerous macroeconomic schedules this week, and the earnings reports from major tech companies, along with the month-end effect, we advise readers to watch and wait this week. It is expected that this week will be filled with turbulence, noise, and uncertainty, and the trading for the new year has only just begun.

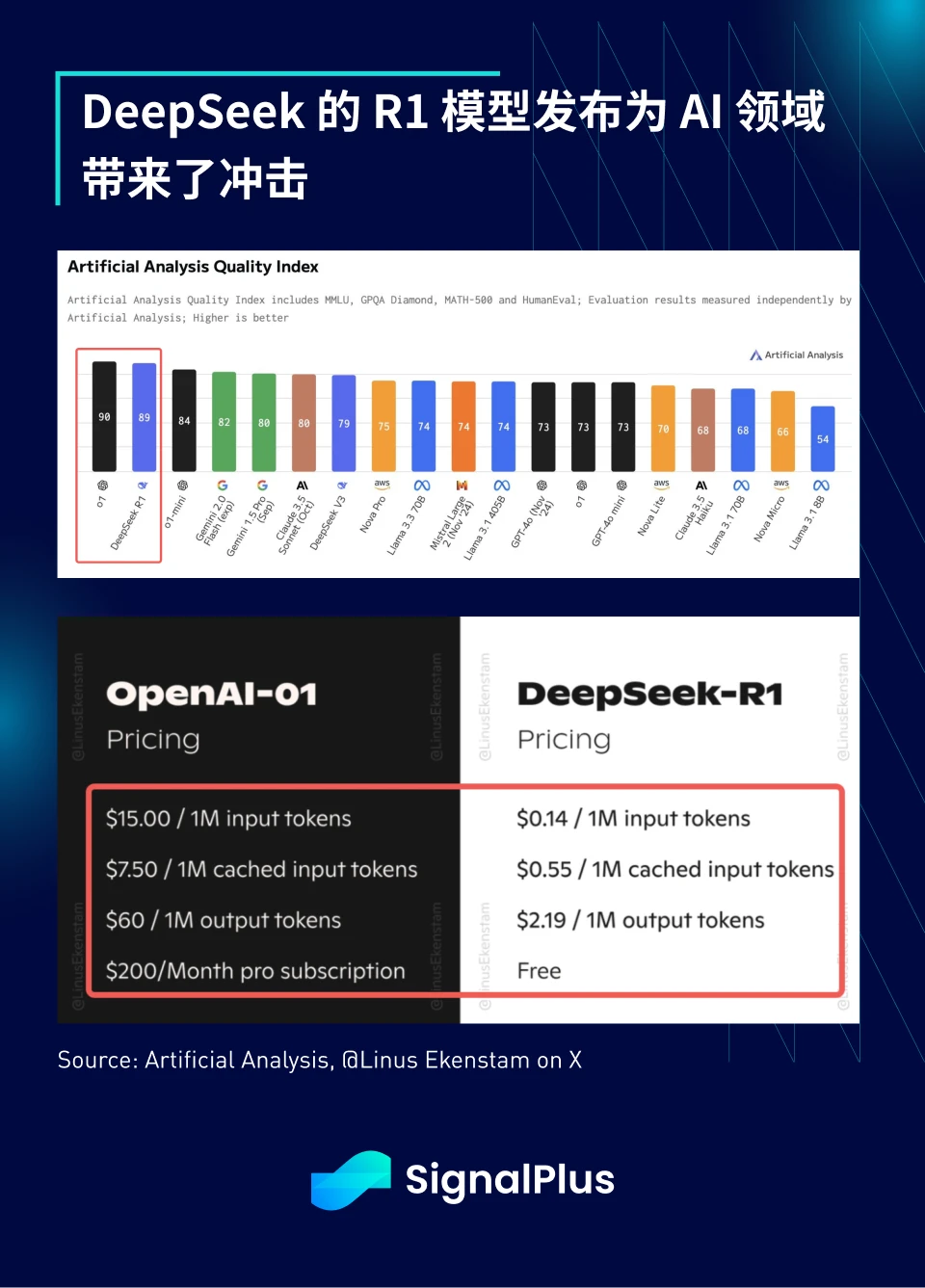

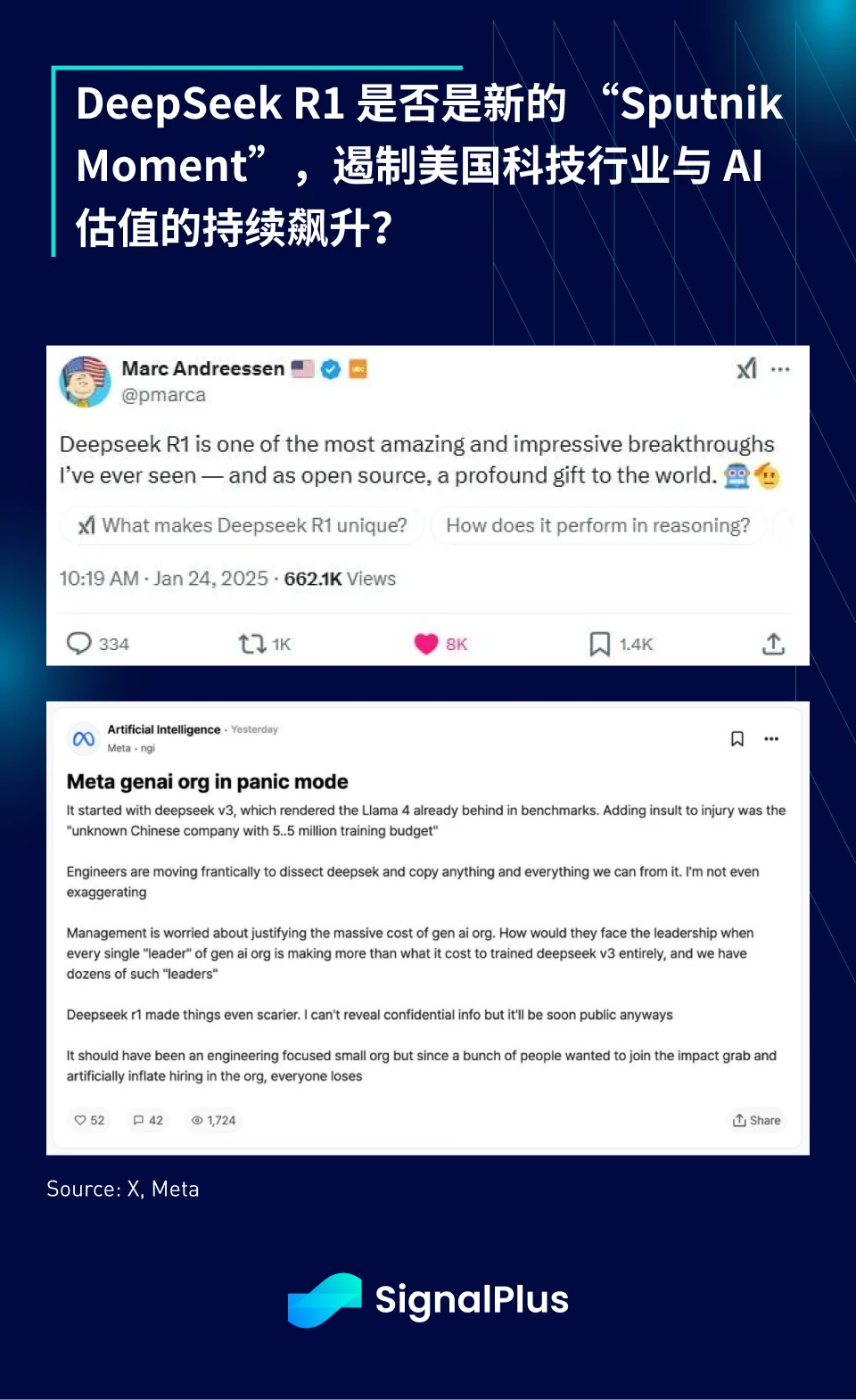

The cryptocurrency market is not the only area witnessing a critical turning point. With the simultaneous release of DeepSeek's R1 and ByteDance's Doubao 1.5 training models, generative AI (Gen-AI) may be experiencing its "Sputnik Moment."

Despite reportedly limited operating budgets constrained by chip supply, DeepSeek's R1 open-source model has achieved performance levels comparable to OpenAI's o1 model, with extremely low operating costs. Notable venture capitalists and practitioners have praised this as an incredible engineering breakthrough and a significant victory for open-source models, contrasting sharply with OpenAI's announcement of its $500 billion "Stargate" capital expenditure plan.

Of course, there remains much uncertainty regarding whether AI models are being commoditized and what this means for the high valuations of AI companies and their expensive infrastructure expenditures. More critically, is it finally time to sell Nvidia / Nasdaq / AI VC? This is undoubtedly a trillion-dollar question that exceeds our expertise but is certainly worth close attention from macro investors in the future.

The SignalPlus team will pause our market commentary during the Lunar New Year holiday next week. We thank everyone for their steadfast support over the past year and wish our readers good health, smooth sailing, and prosperity in the Year of the Snake!

You can use the SignalPlus trading indicator feature at t.signalplus.com to get more real-time cryptocurrency information. If you want to receive our updates instantly, feel free to follow our Twitter account @SignalPlusCN, or join our WeChat group (add the assistant WeChat: SignalPlus123), Telegram group, and Discord community to interact and communicate with more friends.

SignalPlus Official Website: https://www.signalplus.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。