This article aims to analyze the financing needs in global trade supply chains and explore how blockchain and tokenization technologies can address these challenges.

Global trade is a key driver of the modern economy, propelling globalization and technological advancement. Standard Chartered Bank predicts that global trade will grow by 55% over the next decade, reaching $32.6 trillion by 2030. However, there is a significant gap in the availability of trade financing, particularly for small and medium-sized enterprises (SMEs) in developing countries.

This article aims to analyze the financing needs in global trade supply chains and explore how blockchain and tokenization technologies can address these challenges. By observing the practical application of PolyFlow in supply chain finance, we can see how innovative PayFi scenarios further enhance supply chain finance solutions.

- What is Supply Chain Finance

The supply chain is a global, integrated, and efficient organizational structure involving buyers, suppliers, manufacturers, distributors, retailers, and end-users from different countries, centered around core products or services. Supply chain finance is a financial service model based on the credit of core enterprises within the supply chain. It integrates data such as logistics, cash flow, and information flow, as well as upstream and downstream enterprises.

Currently, the global supply chain finance market has exceeded $1 trillion and is expected to reach $3 trillion by 2025. Asia holds the largest share of this market, accounting for over 60%, while the market shares in Europe and the United States are also steadily growing. The market for products and services such as accounts receivable factoring, supply chain loans, and warehouse financing is expanding, showing trends of diversification and personalization.

Transforming Supply Chain Finance with Blockchain

The supply chain finance market has immense value; however, the complexity of its value chain makes it difficult for parties to synchronize information needs in a timely manner, leading to inefficiencies. Most critically, this financing model heavily relies on the credit of core enterprises in the supply chain, making it challenging for SMEs to participate.

Ironically, these SMEs are the ones that need financing the most. According to the International Finance Corporation (IFC), there are 65 million SMEs in developing countries with unmet financing needs. Despite the widespread recognition of this important market segment, it has not received sufficient attention.

As blockchain and tokenization technologies mature, more projects are proposing innovative solutions targeting this overlooked market segment. Blockchain technology has the potential to transform the current landscape of supply chain finance by enhancing market access and providing liquidity, transparency, and accessibility. Additionally, it can simplify trade complexities, improve transaction process efficiency, and reduce information asymmetry.

Real Case of PolyFlow

Let’s delve into a supply chain finance scenario involving PolyFlow:

Buyer: Roam is a decentralized telecom operator focused on building a global open wireless network infrastructure using Web3 and Open Roaming technologies. It encourages users to participate in network development and data sharing through incentive mechanisms and innovative technologies. Roam provides users with various high-performance DePIN router devices to facilitate network participation.

Supplier: The DePIN device supplier manages inventory based on Roam's orders and plans the production of DePIN devices, typically with a production cycle of three months. In this scenario, Roam's $1 million order is not fully prepaid. Usually, 30% of the order amount is paid as an initial payment.

Financing Needs: The DePIN device supplier must start production upon receiving the order. However, the initial payment is often insufficient to cover the costs of raw materials, production line setup, and completing production. Therefore, the supplier needs to seek financing from the bank using Roam's order as collateral.

Real Dilemma: The challenge is that Web3 projects like Roam often struggle to obtain bank credit or do not meet the credit qualifications of banks, unlike traditional core enterprises.

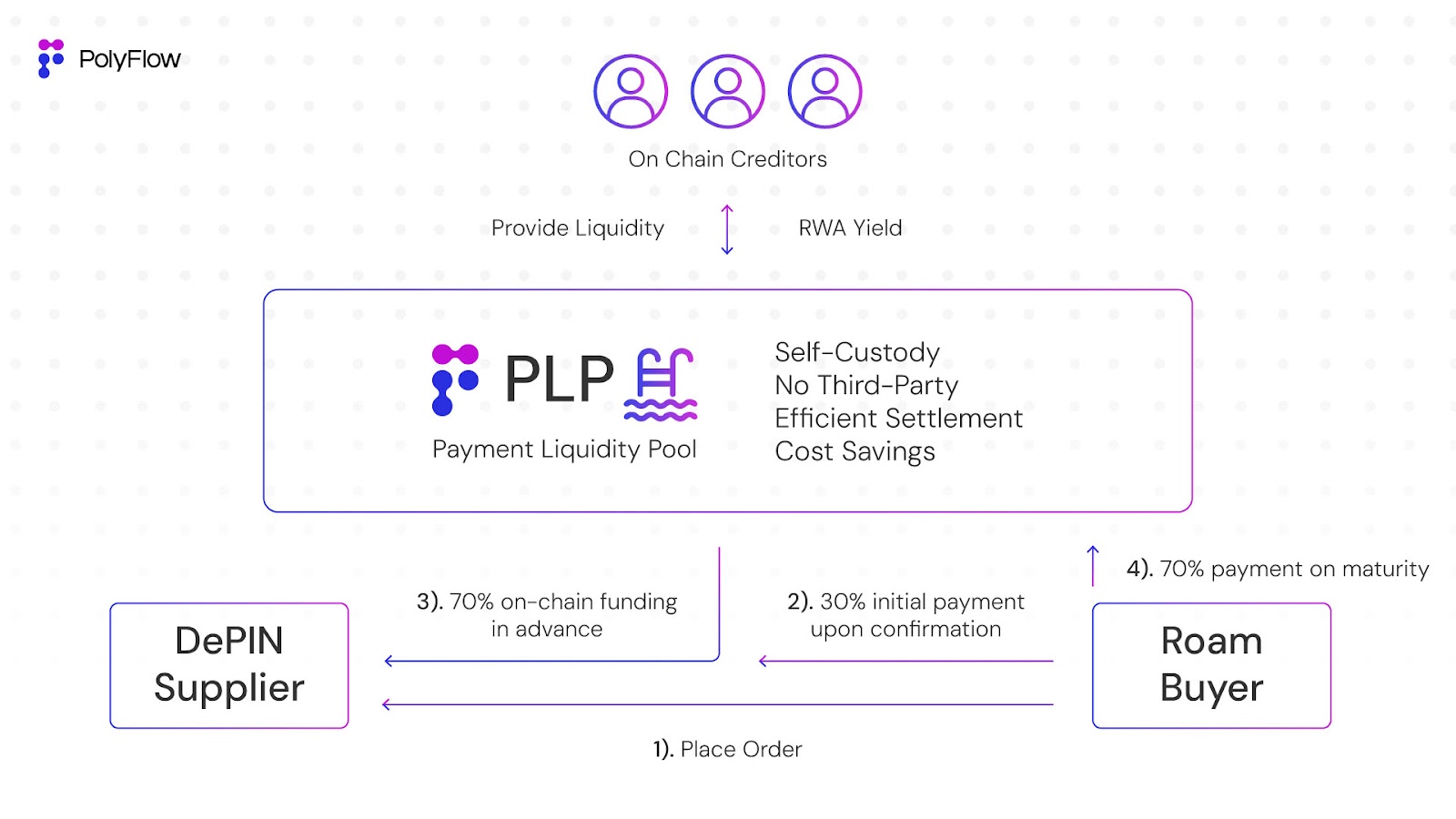

Solution: PolyFlow tokenizes Roam's order on the blockchain through its supported tokenized supply chain finance platform. This approach leverages on-chain liquidity to raise funds for the supplier based on Roam's order, meeting their financing needs.

Thus, this case creates a win-win situation for multiple parties. Roam can place an order by only paying the initial amount; by tokenizing Roam's accounts payable, the DePIN supplier can immediately access on-chain financing to support production; on-chain liquidity providers can participate in the tokenized assets of supply chain finance to earn returns. Ultimately, this innovative combination of supply chain finance and blockchain technology realizes the vision of PayFi.

Core Role of PolyFlow

PolyFlow plays a key role in this supply chain finance scenario:

Creating Liquidity: Traditional supply chain finance primarily involves financial institutions like banks. To increase liquidity and improve operational efficiency, financing parties need more diversified financing channels. Through PolyFlow's tokenization platform, suppliers' accounts receivable can be tokenized, allowing them to obtain liquidity through PolyFlow's payment liquidity pool. This method meets the financing needs of suppliers while facilitating efficient value transfer and capturing on-chain liquidity.

Credit Transmission: Typically, supply chain finance is only open to core enterprises in the value chain, often excluding smaller SMEs. PolyFlow's payment ID can help SMEs anchor the credit rating of buyers, enhancing the overall resilience and liquidity of the entire supply chain while assisting SMEs in establishing a credit system on the blockchain.

Supply chain finance assets are classified as private credit, traditionally only accessible to large institutional investors and high-net-worth individuals. Through PolyFlow's supply chain finance use case, liquidity providers can participate on-chain, incentivized by market-leading returns. Tokenization expands the investor base, heralding a new era of growth and efficiency. Ultimately, it promotes global economic development and contributes to a more sustainable and equitable financial landscape.

Looking ahead, the tokenization of trade assets offers multiple advantages for various participants and processes in the complex scenarios of global trade, including 1) facilitating cross-border trade payments, 2) addressing the financing needs between trade participants, and 3) utilizing smart contracts to improve trade efficiency, reduce complexity, and enhance transparency.

PolyFlow is gradually realizing these advancements.

Social Media

To learn more about PolyFlow and keep up with our latest updates, please follow our official channels.

📣Mirror| 💬Global Community| 👾Discord| 🐦Twitter/X| 🌐Website

Contact Us

support@polyflow.tech

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。