PolyFlow represents the next evolution in cross-border payments.

Imagine a Brazilian bank with numerous local merchants needing to make regular payments to suppliers in China. Currently, their payment channels rely on traditional banking networks or high-cost crypto payment solutions, leading to high transaction fees, delayed settlement periods, and insufficient control over cash flow. These issues hinder the value flow in global supply chains.

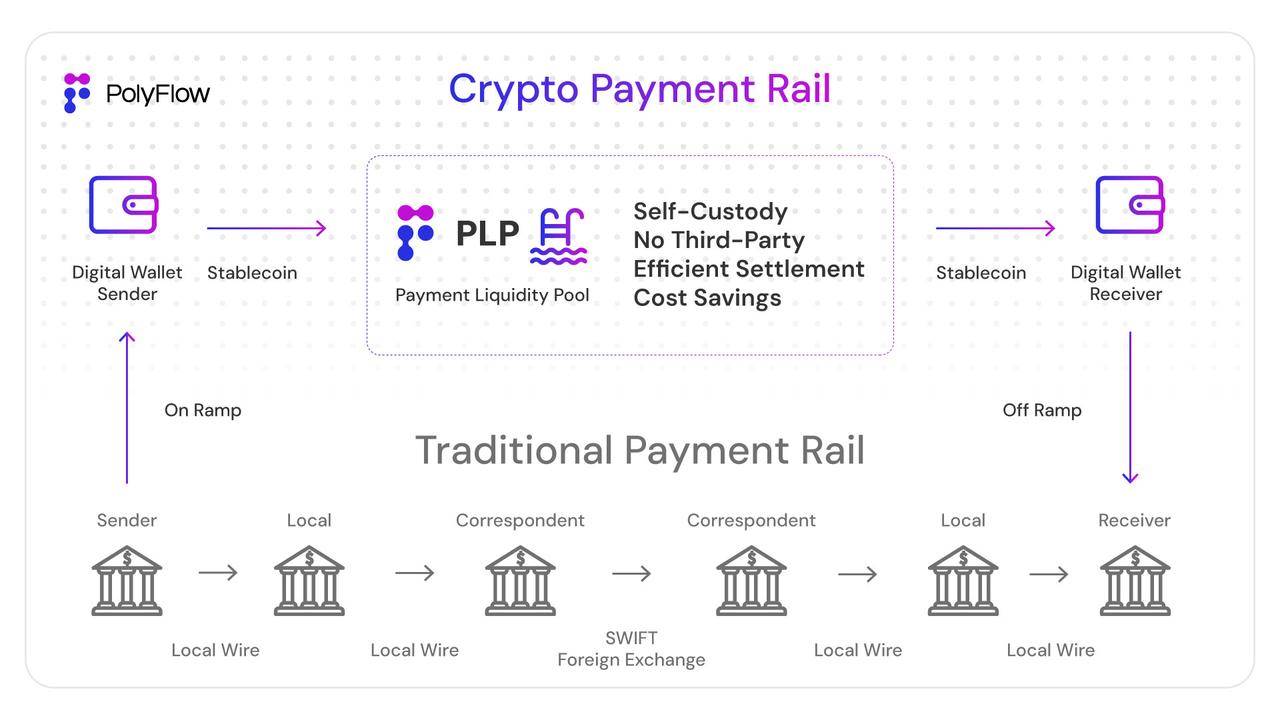

PolyFlow's revolutionary cross-border payment solution is powered by the PolyFlow Liquidity Pool (PLP), disrupting the complex status quo mentioned above. By utilizing blockchain technology, self-custody protocols, and on-chain settlement systems, PolyFlow eliminates the inefficiencies of traditional payment systems and significantly reduces the high costs associated with existing crypto payment networks. Here’s how we operate.

Pain Points of Traditional Cross-Border Payments

For decades, global businesses have relied on traditional banking systems like SWIFT for cross-border payments. However, these systems have significant drawbacks:

Multiple intermediaries: Payments often require passing through several intermediary banks, each charging fees and potentially causing delays.

High costs: Banks impose high transaction fees, foreign exchange rate spreads, and compliance-related additional costs.

Slow settlement: Payments can take days or even weeks to clear, especially when intermediary banks are in different time zones or involve compliance checks.

Lack of transparency: Businesses find it difficult to track the status of funds during the settlement process in real-time.

Even crypto solutions, touted as the future of payments, have not fully resolved these issues. Many platforms rely on centralized third-party custodians like Fireblocks or Blockdaemon to manage wallets and liquidity, which purchase expensive block addresses for each transaction, leading to increased costs and undermining the convenience and efficiency promised by blockchain technology.

The Solution of PolyFlow Liquidity Pool (PLP)

PolyFlow leverages blockchain and smart contract technology to bypass the pain points of traditional banks and third-party custodians, achieving unparalleled efficiency, transparency, and cost savings. Here’s how PLP works:

Self-custody and smart contracts

Unlike third-party custodial solutions, PolyFlow ensures that funds are always under the control of the client during the transaction process. We create automatically executed programmable agreements between the sender and receiver using smart contracts. Funds do not leave the client's control until the transaction is complete, minimizing counterparty risk and ensuring complete transparency.No need for third-party custody

By eliminating reliance on intermediaries like Fireblocks, PLP avoids the high processing fees associated with purchasing custodial addresses. Transactions are conducted directly through the PLP liquidity pool, enabling seamless value transfer.Efficient settlement

Once a transaction is initiated, our system accesses liquidity in real-time to execute payments. When currency conversion is needed off-chain, it is processed through our fully licensed banking partners in key regions such as the US, Europe, the UK, and Asia-Pacific, ensuring compliance and rapid settlement.Cost savings

PLP significantly reduces transaction fees compared to traditional banks or third-party custodians, with no intermediary cuts, allowing businesses to retain more funds while enjoying faster settlement speeds.

Real-World Scenario Example: Brazilian Merchant Paying Chinese Supplier

Returning to our Brazilian bank case. Today, Brazilian merchants paying Chinese suppliers may face:

High fees of 6%-8%: Including foreign exchange spreads and intermediary bank fees.

Delays of 3-5 business days or longer: Due to time zone differences and compliance checks.

Lack of control over cash flow: Funds are held by intermediary banks, leaving merchants with no control.

Using PolyFlow:

Fees reduced to below 2%: Thanks to our direct wallet-to-wallet transactions and liquidity model.

Settlement completed almost in real-time: Typically within minutes, without the multi-day delays of traditional systems.

Fully self-custodied: Ensuring funds only leave the merchant's wallet when ready to settle with the Chinese supplier in fiat currency.

Why Self-Custody is Crucial

A key highlight of PolyFlow is its self-custody model, driven by smart contracts. In traditional systems, funds are often held in custodial accounts, which brings the following risks:

Counterparty delays: If an intermediary encounters technical or compliance issues, funds may be blocked.

Transparency gaps: Clients find it difficult to understand the progress of transactions.

Security risks: Custodial wallets are prime targets for cyberattacks.

With PolyFlow, businesses always maintain control over their funds. Our self-custody model eliminates counterparty risk, ensuring funds are secure before settlement and providing complete transparency throughout the transaction process.

Legally Compliant Global Solution

PolyFlow is not only fast and cost-effective but also fully compliant with regulatory requirements. Our network of partner banks is fully licensed across the US, Canada, the UK, the EU, Africa, China, and the Asia-Pacific region, providing assurance that payments are processed within a robust regulatory framework. This ensures smooth cross-border transactions without concerns about regulatory issues that may arise from unlicensed systems.

The Future of Cross-Border Payments

PolyFlow represents the next evolution in cross-border payments. By eliminating intermediaries, leveraging blockchain technology for transparency, and returning control to clients through self-custody, we are creating a faster, cheaper, and more reliable payment infrastructure.

For banks, fintech companies, and businesses looking to optimize global payment processes, PolyFlow is the partner you have been searching for. Say goodbye to the inefficiencies of traditional banks and third-party intermediary networks, and embrace an innovative paradigm of rapid global capital flow.

Ready to change the way you handle cross-border payments? Contact us to learn more about PolyFlow.

Social Media

To learn more about PolyFlow and keep up with our latest updates, follow our official channels.

📣Mirror| 💬Global Community| 👾Discord| 🐦Twitter/X| 🌐Website

Contact Us

support@polyflow.tech

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。