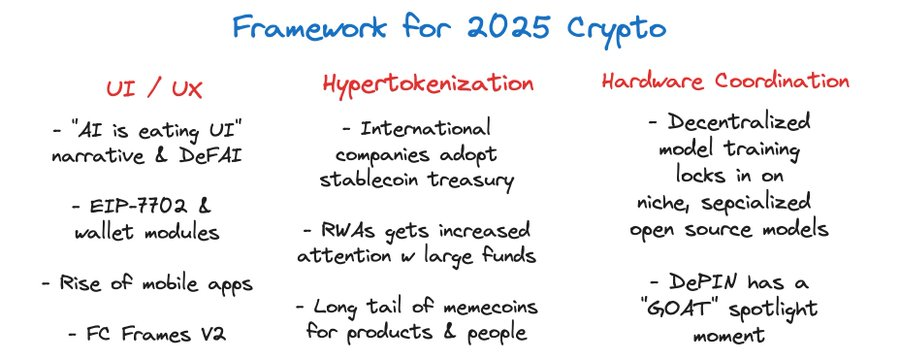

This article builds a framework through three major areas: user experience optimization, hypertokenization, and hardware coordination, looking ahead to the core trends and transformative opportunities in the future of the crypto economy.

Author: @yb_effect

Translation: Baihua Chocolate

Today, I hope we can all take a step back and establish a framework to think about how we should view this field in the next 6 to 12 months.

Have you ever felt that even though you have tried your best to pay attention, you still can't keep up? Don't worry, you are not alone.

In fact, it is indeed difficult to keep up when the metagame is constantly rotating. It's not just the short-term bull and bear markets; the actual topics and narratives are also changing continuously.

So, I thought we shouldn't see the "metagame rotation" as something to blindly chase after, but rather understand how it fits into the larger picture.

Thus, whenever we see a new trend or phenomenon, the first reaction should be: "Okay, what is its position on the crypto map?"

Of course, the framework itself will change, and we need to update it regularly. But today, let's establish a starting point for 2025.

I want to clarify that there is no such thing as a "correct framework." Everyone has their own perspective; you may agree or disagree. The "trinity" model I will discuss next is what I currently consider a reasonable structure, and I will try to explain my logic clearly.

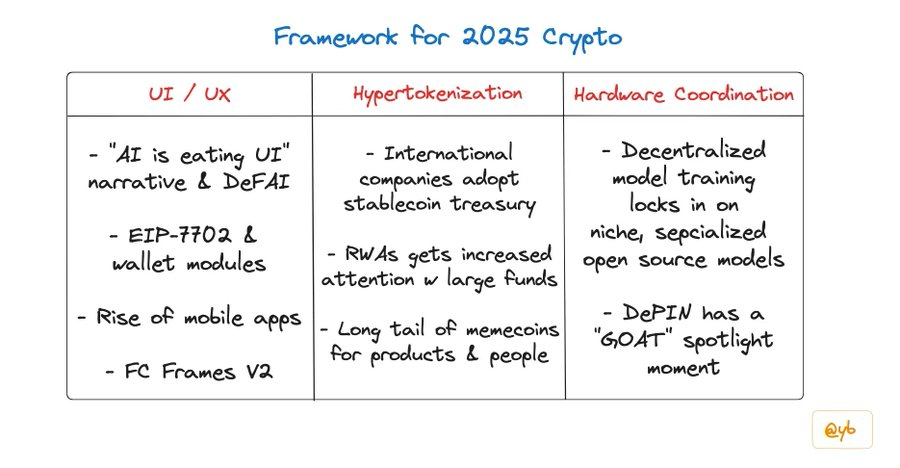

1. Three Important Categories:

1) User Interface and User Experience (UI/UX)

- Smart Agents / DeFAI (Decentralized Smart Agents)

- EIP-7702 and Wallet Modules

- Mobile Optimization

2) Hypertokenization- Exponential growth of stablecoins

- Tokenization of real-world assets (RWAs) is no longer a joke

- The rise of long-tail tokens

3) Hardware Coordination- The combination of AI and the infrastructure layer of crypto

- The highlight moment of DePin (Decentralized IoT)

Next, we will delve into each one.

2. User Interface and User Experience (UI/UX)

1) Smart Agents and DeFAI

I know that much of what we currently see in the field of crypto smart agents may seem exaggerated due to price fluctuations, but I can confidently say that not all of it is "vaporware."

Over the past few months, I have mentioned multiple times: Although most projects in the smart agent space may fail, those that endure will have a significant impact on the crypto industry. This is no different from the development history of DeFi and NFT projects.

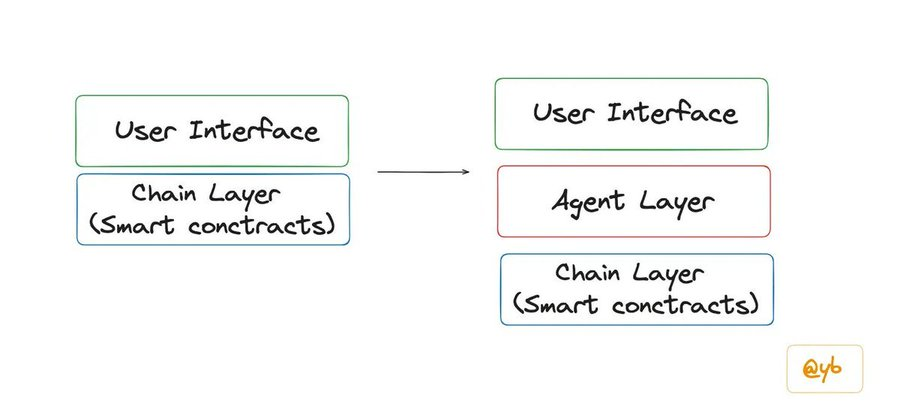

From my perspective, the biggest bullish reason is that the smart agent layer will position itself between the chain layer and the interface layer. In other words, the way that OG (veteran) crypto users used to interact through smart contracts will soon seem outdated.

As I mentioned in a previous article:

As the on-chain AI infrastructure continues to improve, we will be amazed by this mode of interaction—typing anything in the operation bar will yield a receipt showing that task X has been completed, along with a proof link (e.g., transaction record).

In summary: The on-chain interaction interface we will become accustomed to will be realized through smart agents.

It is worth noting that this is not a "brand new discovery." People have been discussing this since the day after ChatGPT was launched in 2022. However, like any new technology, finding the right timing requires years of experimentation. This is a point made by my friend Salvino, who said the exact same thing, just about 1.5 years earlier.

Another point I want to highlight is that I believe people still underestimate the tremendous advantage of "crypto smart agents" having autonomous control over wallets and using the chain for transactions.

A few months ago, when I first mentioned the rise of smart agents, I noted:

Now, the key point to understand is that the vision of the "smart internet" can only be efficiently realized through crypto rails.

Smart agents need to be able to use the social layer's APIs without permission, own funds, conduct transactions, demonstrate proof of work for tasks, and collaborate efficiently with other agents. This requires the integration of elements like smart wallets, stablecoins, decentralized social, and tokenization. If we use traditional Web2 infrastructure, the capabilities of these agents will be severely limited.

This won't happen quickly, but ultimately I believe the capabilities of on-chain smart agents will far exceed those of traditional smart agents because on-chain infrastructure provides more powerful functionalities.

At the same time, I partially agree with @notthreadguy's view. The crypto space is indeed often ridiculed, but I really don't think we will "fall behind" those in the AI field who mock and ignore us in the realm of on-chain smart agents.

2) Wallet Modules and EIP-7702

I mentioned the importance of this development in my previous article, but I am increasingly clear that EIP-7702 will become one of the biggest transformations in the Ethereum ecosystem since EIP-4844 (data blobs).

In simple terms, most wallets currently are not scalable. EIP-4337 attempted to change this, but it requires users to switch to smart wallets, which is difficult for users to accept.

Now, with EIP-7702, we essentially have created a functionality for wallets similar to the Chrome extension store.

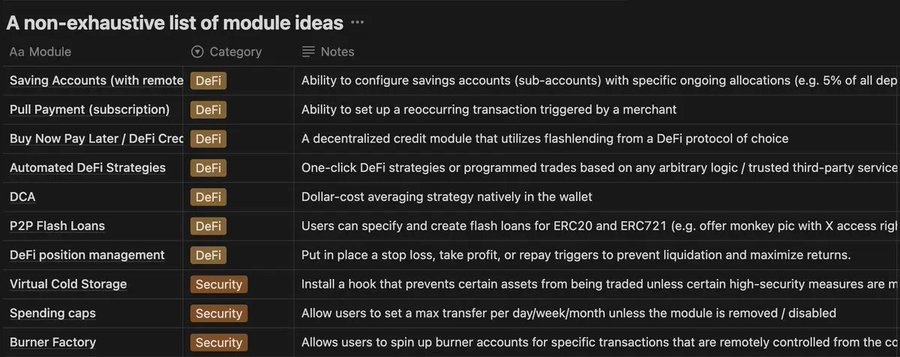

Here are some module examples compiled by the Rhinestone team. Note that this looks almost identical to browsing different Chrome extensions. I believe that once certain modules start to attract attention, developers will quickly flock to this new "gold rush" opportunity.

We will delve into the technical specifications of EIP-7702 in subsequent articles, but if you're interested, you can check out more module examples in @gakonst's AMA.

3) Mobile

Last week, I used two fantastic crypto mobile applications. If you haven't experienced them yet, I highly recommend you try Yapster and Clout. I currently don't have any extra Yapster invites, but you can follow their official Twitter account; you might be able to snag one.

I actually wrote about Yapster on Tuesday as well. Be sure to read the tweet below because I really think everyone needs to try this app! In fact, I can almost say with ninety-nine percent certainty that it was my tweet that brought a lot of attention to this app. So I really want to make sure that all TOC subscribers don't miss this opportunity.

I believe we will see more serious mobile innovations in 2025.

The two examples I mentioned above are leading a new wave of metagame, with these crypto products being well-designed and polished. If you look at my previous two tweets, you will notice a point I mentioned: the attention to detail in Yapster and Clout is impressive. They make users completely forget they are using crypto applications, which, in my view, is the North Star metric of success.

I have no doubt that a mobile application in the future will inevitably attract a large number of ordinary users simply because it has effectively borrowed the strengths of Web2 consumer applications in terms of gamification and virality.

Finally, as a supplement to this section, I want to specifically mention Farcaster. Most people have not yet realized the transformative significance of Frames v2 on the crypto user experience (UX). Currently, it is still relatively low-key, but the core developer ecosystem is building many interesting applications with great potential. Additionally, it is worth mentioning that the Merkle team is actively promoting tokenization and the "money-making" metagame. By sticking with this "purple application" (Farcaster) for a few months, it is possible to gain unexpected rewards in various ways (e.g., degen, higher, clanker coins, etc.).

In my view, as the Farcaster community gradually evolves more towards the "degen" direction in the crypto space, more and more people will realize why Frames v2 is a revolutionary breakthrough in quickly executing on-chain operations directly from dynamics.

3. Hypertokenization

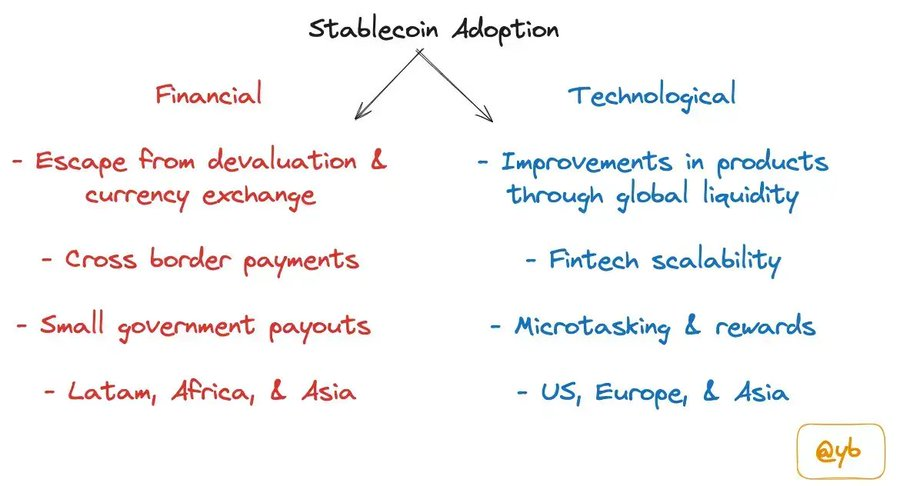

Before discussing hypertokenization in detail, I want to talk about the obvious issue at hand: the trading volume and usage of stablecoins will inevitably see explosive growth this year. The growth in 2024 has already reached levels that seemed almost impossible a few years ago. But that is just the prelude; I believe the real frenzy of stablecoins is just beginning.

By the way, following @peterschroederr is a good choice, as the stablecoin metrics he shares are very valuable references.

This is not just about USDC or USDT; more importantly, it concerns the companies in the entire ecosystem that are filling the gaps in stablecoin infrastructure. Additionally, I expect we will gradually get used to hearing news about large international companies like SpaceX announcing the adoption of stablecoins.

Of course, it’s not just crypto-native companies; many traditional financial giants are also rapidly seeking entry points and doubling down on the stablecoin space.

I explored this topic in detail in my article "The Stablecoin Barbell Strategy After the Bridge Acquisition." But I will soon publish follow-up content—keeping a close eye on stablecoin metrics and related announcements in corporate finance will be crucial this year.

Now, having discussed stablecoins, I believe the best way to organize the category of "hypertokenization" is to adopt a dual approach.

Essentially, the idea of hypertokenization is that any content, product, or idea that can attract attention can be assigned financial value. There are many advantages to this, of course, but there are also quite a few drawbacks. The key point here is: the door has been opened. Whether you like it or not, we are entering a hypertokenized world. Just look at the growth trend of tokens in the chart created by @jconorgrogan.

The two sides of this coin are:

- Institutional adoption of real-world asset tokenization (RWAs)

- The long-tail effect of "Memecoins"

Regarding the first point, take a look at this headline from a few days ago.

This is actually quite intuitive. More and more large institutional investors and funds worth trillions of dollars are eager to put their assets on-chain, hoping to optimize systems and improve profit margins in this way.

Why? I think @iamDCinvestor's explanation is the best:

To reiterate why BlackRock wants to put all securities on-chain: BlackRock is the world's largest asset management company and a leader in the ETF space. They want you to buy these ETFs and hold them long-term, and the best way to make you willing to do that is to allow you to use these securities as collateral for borrowing.

There is a lot of untapped collateral value in stocks and other securities. Yes, you can get margin loans on these assets through brokers, but the terms are often not favorable, and intermediaries are making money off you.

Now imagine what would happen if all securities were on-chain, connecting to the world's largest peer-to-peer borrowing market?

Does that sound appealing? Larry Fink (CEO of BlackRock) clearly thinks so.

To be honest, my current understanding of the RWA (real-world asset tokenization) space is still quite limited. But the developments this week have convinced me that I need to spend more time understanding the progress in this area.

Regarding the second point: the long-tail effect of Memecoins I believe the launch of Trump coin last Friday marks a paradigm shift—now, as long as a concept or topic resonates enough, it can capture its value through token issuance.

We are currently in the early stages of this trend, and both individuals and companies may issue their own tokens for various purposes in the future. For example, just a few days ago, Vine's co-founder Rus launched the $vine token and plans to relaunch the app in some form.

@lmrankhan's perspective is very accurate—it aligns with the views I expressed in my previous article "The Crypto-Driven Accelerationist Bubble." I believe this trend will become increasingly clear as the year progresses.

This is expected to become the norm. What’s more interesting is not the number of token issuances, but how people find interesting ways to utilize token crowdfunding to quickly elevate their projects without worrying about the delays of traditional venture capital.

To summarize this section:

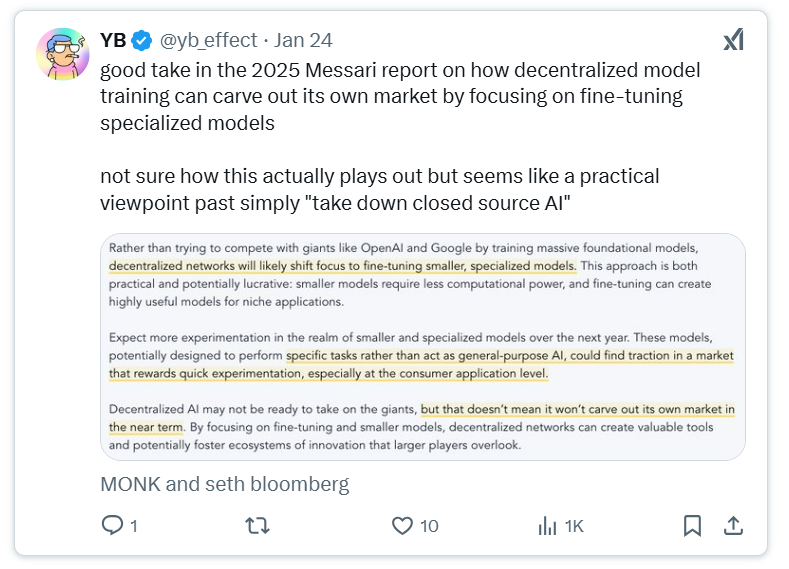

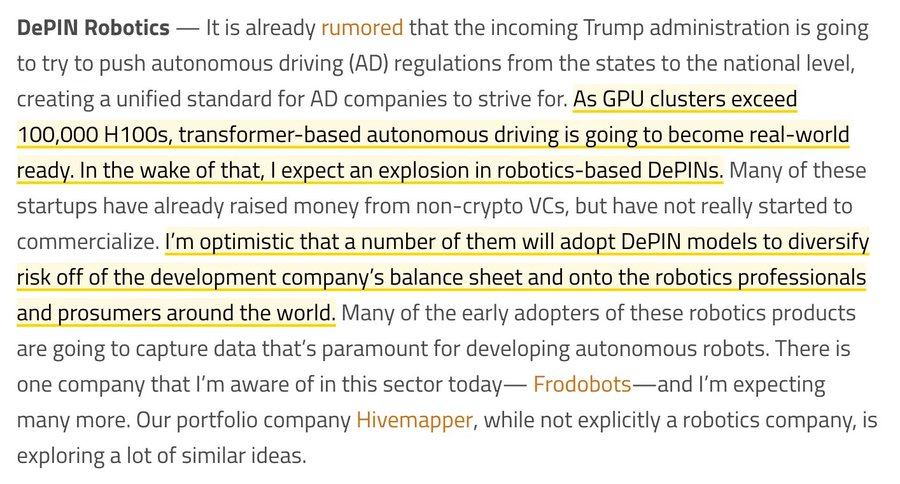

Hardware Coordination

-------------------------------------------------------------------------------------------------I will keep this section simple and clear. **Among the three areas, this may be the least conspicuous one, but I believe it will become one of the most influential application scenarios in the crypto space over the next seven years. The main reason is that hardware collaboration is like deep technology in the crypto field.** The core of **AI** **x Crypto** and **DePIN** lies in efficiently allocating physical infrastructure and its economic benefits in a way that can effectively compete with centralized clusters. For example, GPUs, internet bandwidth, energy networks, etc. **Addressing these issues requires a significant amount of time, but once a product breaks through the inflection point, it will irreversibly move towards broader development.** The fact is that companies in this ecosystem have not yet received the attention they deserve. You may have heard of **Grass**, **Daylight**, **Hivemapper**, and **Bittensor**, but perhaps that’s about it. Some projects attempt to completely rebuild from scratch, while others try to leverage existing physical infrastructure. A part of the **Messari** report that I found very practical is the realization that decentralized model training can focus on specific long-tail projects rather than directly competing with general models (like GPT, Claude). This seems more realistic because, for **Crypto x Hardware** projects, finding a niche that does not have to compete directly with the optimizations and resources of big tech companies (or large energy and utility companies) would be more advantageous.  I also find **@KyleSamani**'s perspective interesting. For me, just seeing the term "DePIN Robotics" feels fresh, which makes me realize that I indeed have a significant cognitive blind spot in this area.  It is still unclear which strategies will ultimately be the most effective, but my view is that we are actually very close to seeing one of these projects truly attract broader attention. If you ask me for predictions about **Crypto x Hardware**, based on my limited understanding, I would say... In 2025, after the Trump frenzy subsides slightly, we may experience a period of market volatility, at which point people's attention may turn to this field, as its emerging interesting practicality is surfacing at an increasingly rapid pace. At that time, a large **DePIN** or **DeAI** company may experience a breakthrough "legendary moment," and everyone will start to dissect the entire ecosystem, trying to understand its core logic and competing to drive up the prices of tokens like **$GRASS**. But my TOC friends... I assure you, we will be ahead of the curve. That’s all for my article today. I hope this framework helps you better organize some thoughts on the development of the on-chain economy.  Article link: https://www.hellobtc.com/kp/du/01/5656.html Source: https://x.com/yb_effect/status/1883235246818328964

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。