Shocking, this time the #AI bubble may once again be echoed by Howard Marks! This does not mean we are pessimistic about #AI, but allowing #AI's valuation to return to rationality and health is key to #AI's long-term stable development. If an AI Agent project fails to effectively enhance social productivity, its existence is worth reconsidering.

At the beginning of 2025, Howard Marks, founder of Oaktree Capital, published an investment memo titled "Revisiting the Bubble." His investment memos are treasures that even Buffett reads repeatedly and are highly regarded.

A brief introduction: Howard Marks, co-founder of Oaktree Capital Management, is considered one of the most influential figures in the investment world. His investment memos are known for their profound insights and market analysis, often regarded as must-reads by investors. In the early days of the 2000 internet bubble, he published a classic memo on the internet market bubble, and two months later, the internet bubble burst, earning him the title of investment prophet. This time (early 2025), he discusses bubbles again, exploring potential risks in the current market.

The memo "Revisiting the Bubble" discusses three core parts (original link in the comments):

🎯 How do bubbles form?

1️⃣ Howard Marks' definition of "bubble"

• A bubble is not just a state of overvalued stock prices; more accurately, it is a temporary state of investor psychological euphoria.

• The core characteristics of this psychology include:

- Irrational exuberance: Investors' excessive optimism about the continuous rise in asset prices.

- Blind worship of assets: Certain assets or companies are given overly high expectations.

- Fear of missing out: The fear of missing opportunities leads to blind following.

- Acceptance of high valuations: The belief that higher prices are more reasonable.

2️⃣ Causes of bubbles: New things

The allure of new things:

• Historical data serves as a "constraint" for traditional industries, but for new things (like new technologies and new markets), the lack of reference makes it easier for investors' enthusiasm to turn into frenzy.

• New things often come with "story-driven" investment models, such as: internet, AI, semiconductors, etc.

Historical cases:

• The 2000 internet bubble: Investors firmly believed that the internet would change the world, leading to many companies going public at high valuations, and subsequently, the vast majority of these companies went bankrupt, with only a few surviving.

• The "Nifty Fifty" stocks (1960s): Despite the companies performing well, their price-to-earnings ratios were excessively high (60-90 times), leading to a market decline and investors losing 90%.

3️⃣ Misconceptions in investor psychology

• Blindly chasing innovation: Unreasonably amplifying the rationality of innovation while ignoring potential business risks.

• Overestimating future growth: For example, being overly optimistic about sustained growth over the next few decades while neglecting market competition risks.

• Ignoring historical lessons: Bubbles often occur in situations where bubbles have not appeared for a long time, as investors' memories of risks become blurred.

📝 Why are bubbles most likely to occur in the AI semiconductor field?

1️⃣ The current state of tech stocks

• The semiconductor field represents the forefront of current technological development, especially with leading companies like NVIDIA.

• Valuation levels: Currently, NVIDIA's forward price-to-earnings ratio is 30 times, lower than the levels during the 2000 internet bubble, but investors have extremely high expectations for its sustained growth over the next few decades.

2️⃣ "Story-driven" in the semiconductor field

• AI and computing power revolution: The market unanimously believes that the development of semiconductors (especially GPUs) will drive a comprehensive upgrade of artificial intelligence and technology.

• The moat hypothesis: Investors believe that leading companies (like NVIDIA) will maintain their leading position for a long time due to their technological advantages.

• Scarcity of new things: Similar to historical bubbles, investors believe that the growth potential of the semiconductor industry is limitless.

3️⃣ Potential risks in the semiconductor industry

• Technological iteration: Rapid technological development may lead to new competitors disrupting existing industry leaders.

• Risks of overvaluation: Although the semiconductor industry has enormous growth potential, whether the current high valuations can be supported by sustained growth remains uncertain.

Historical lessons:

• The demise of the Nifty Fifty: The "growth stocks" of that time ultimately fell due to the bursting of the valuation bubble.

• The internet bubble: Although the internet changed the world, most startups disappeared after the bubble burst.

📊 How to respond to bubbles?

1️⃣ Understand valuation

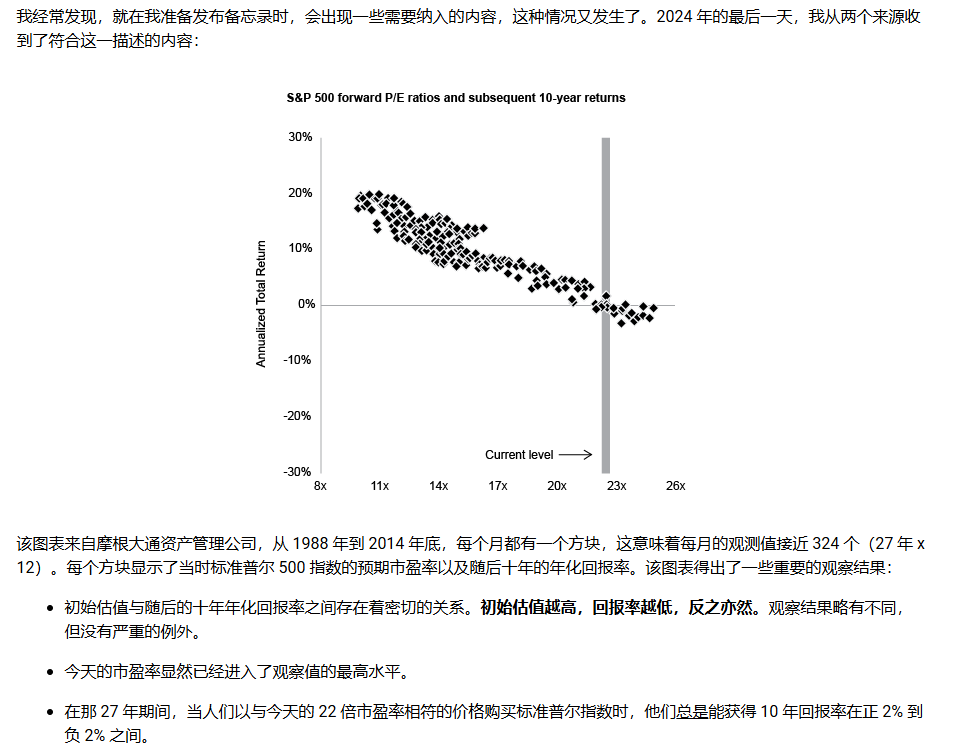

• The essence of valuation is paying for a company's future profitability. For example, the historical average price-to-earnings ratio of the S&P 500 is 16 times, meaning investors pay a premium for profits over the next 16 years.

• For high-valuation companies (like NVIDIA), investors are essentially paying for decades of profit growth, but this growth is not guaranteed.

2️⃣ Respect the market

• Marks points out: "The biggest risk is thinking there is no risk." High valuations often lead to lower long-term returns, and sudden changes in market sentiment can cause price-to-earnings ratios to quickly adjust, triggering market declines.

3️⃣ Avoid excessive optimism

• For the semiconductor industry or other high-growth areas, investors need to remain vigilant and avoid being misled by the mentality of "this time is different."

• Marks emphasizes: "There is nothing new under the sun." The generation and bursting of bubbles are part of market rules.

4️⃣ Long-term perspective

• Short-term markets are unpredictable, but long-term prices will fluctuate around the intrinsic value of companies. Investors should adhere to rational investment principles and avoid chasing highs and lows in emotional markets.

In summary: Marks' core viewpoint is that the essence of bubbles stems from human nature and psychology, rather than the market itself. Although the semiconductor field may currently be on the edge of a bubble, this does not mean the bubble will burst immediately. However, he reminds investors that short-term market trends are often driven by emotions, while long-term returns depend on the true value of companies. Investors need to base their decisions on common sense, avoid blindly chasing high-valuation assets, and maintain respect and vigilance towards the market. This memo is worth careful reading for every investor in U.S. stocks and cryptocurrencies today. 🧐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。