I. Introduction

Recently, the crypto market has frequently focused on the combination of AI and blockchain. Following AI Meme, AI Agent, and AI frameworks, DeFAI projects such as HeyAnon, Griffain, and AIXBT, which incorporate the AI+DeFi concept, have attracted investors' attention and prompted the market to reassess the immense potential of the integration of AI and DeFi.

At the same time, the development of AI technology has injected new vitality into the crypto field. From Generative AI to Large Language Models (LLM), breakthroughs in these technologies have further lowered the operational threshold of the DeFi ecosystem. Traditional DeFi users often face complex on-chain interactions, smart contract calls, and fund management issues, but with the support of AI agents, these problems are gradually being transformed into simple and intuitive natural language commands.

As a frontier of the fusion of finance and technology, DeFAI not only represents a technological upgrade of the DeFi ecosystem but also has the potential to redefine the future of financial interactions. In this article, we will focus on the emerging track of DeFAI, exploring its definition and significance, core classifications, and representative projects, while analyzing its development opportunities and challenges to reveal the future potential and possible directions of this emerging track.

II. Definition and Significance of DeFAI

2.1 Definition of DeFAI

DeFAI, which stands for DeFi+AI, is a new financial paradigm that deeply integrates artificial intelligence (AI) technology into the decentralized finance (DeFi) ecosystem. It combines the intelligent analysis and automation capabilities of AI with the decentralized attributes of DeFi, aiming to simplify user interactions, optimize investment decisions, and enhance the efficiency of on-chain operations.

In traditional DeFi, users need to be familiar with complex operational processes such as smart contracts, cross-chain bridging, and liquidity mining, and may even need to track market dynamics in real-time and execute trades manually. DeFAI simplifies all of this through the introduction of AI agents, allowing users to issue natural language commands. For example, a user can simply input "Invest my 100 USDC into the pool with the highest yield," and the AI will automatically analyze on-chain data, select the best investment strategy, and complete the relevant operations.

Core technologies include:

Natural Language Processing (NLP): Supports users in completing transactions through voice or text commands.

Large Language Models (LLM): Helps parse complex user needs and translate them into specific blockchain operations.

On-chain Data Analysis: Monitors fund flows, trading depth, and price fluctuations in real-time to support decision-making.

Intelligent Automated Execution: Automatically completes trading operations through seamless collaboration with smart contracts.

The core goal of DeFAI is to lower the usage threshold of DeFi through intelligent means, enabling more ordinary users to easily participate in the decentralized financial ecosystem while empowering professional users to achieve more efficient investment management and operations.

2.2 Importance of DeFAI

The importance of DeFAI is reflected in several aspects:

2.2.1 Lowering the Usage Threshold and Promoting DeFi Popularization

By introducing AI technology, DeFAI simplifies complex on-chain operations into a user-friendly experience. For example, users do not need to understand the technical details of cross-chain bridging or liquidity mining; they can complete complex operations with simple commands. This approach lowers technical barriers and attracts more non-professional users into the DeFi ecosystem.

2.2.2 Enhancing Financial Efficiency and Achieving Better Decisions

DeFAI not only optimizes user experience but also significantly improves the efficiency of on-chain operations. For instance, in yield optimization, DeFAI agents can quickly capture arbitrage opportunities and automatically adjust investment strategies by monitoring on-chain data in real-time. This dynamic adjustment capability far surpasses manual operations, allowing users to achieve higher capital utilization and returns.

2.2.3 Data-Driven Financial Decisions

Traditional DeFi users often rely on personal experience or spend a lot of time researching market data. DeFAI utilizes AI models to process vast amounts of on-chain data and market sentiment, providing real-time and accurate analysis. For example, by monitoring market trends and social data, DeFAI can help users identify potential investment opportunities and respond promptly.

2.2.4 Empowering Developers and Project Teams

For developers and project teams, DeFAI provides new tools for building innovative products. Through AI agents, developers can design automated trading strategies, build efficient on-chain protocols, and bring products to market more quickly. For example, HeyAnon allows developers to quickly integrate multi-chain functionality and optimize user experience through its AUTOMATE framework.

As the intersection of AI and DeFi, DeFAI not only injects new vitality into decentralized finance but also demonstrates immense potential in user experience, financial efficiency, and decision optimization. It represents both a technological fusion and breakthrough, as well as a new financial paradigm, marking a key step for DeFi from complexity to intelligence and user-friendliness.

III. Types of DeFAI Projects

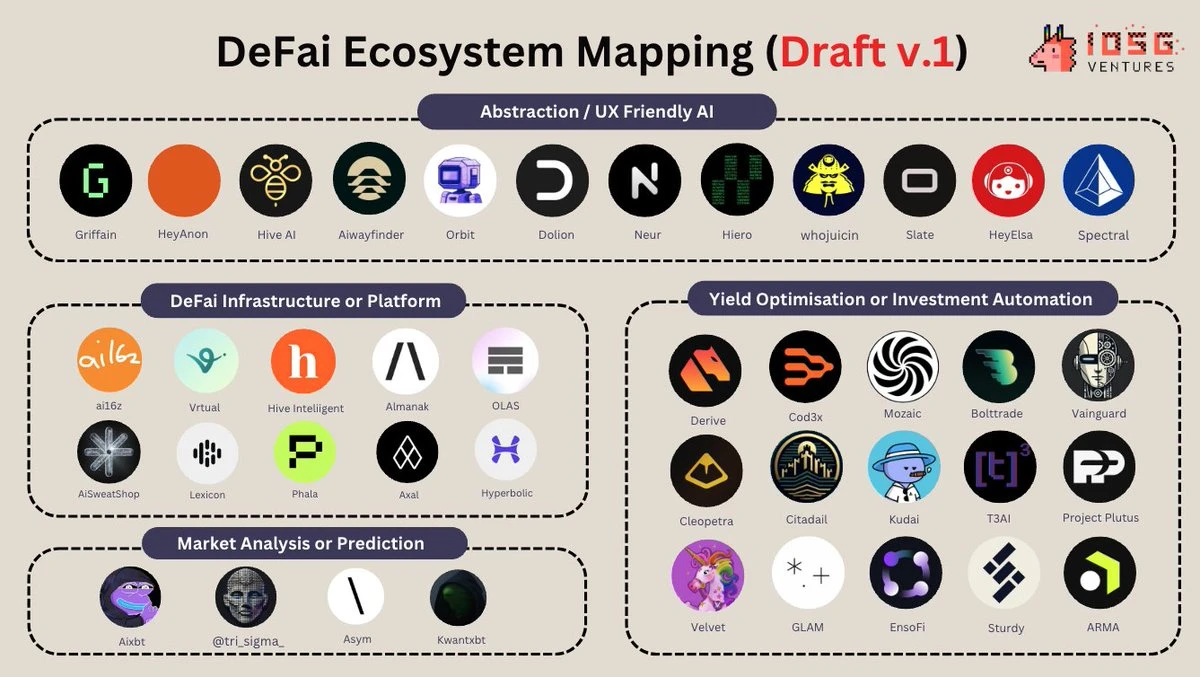

The rapid rise of DeFAI is attributed to its wide range of application scenarios and strong technical capabilities. Currently, the DeFAI track is mainly divided into four types, each corresponding to different user needs and market pain points.

Source: https://x.com/poopmandefi

3.1 User Experience Optimization

User experience has always been a significant barrier to the popularization of DeFi. Traditional DeFi operations require users to frequently switch platforms, call smart contracts, and manage wallets, which is not only cumbersome but also prone to errors. DeFAI introduces AI agents to abstract complex processes, making operations simpler and more intuitive.

Natural Language Interaction: Users can directly input commands through voice or text, and the AI completes transactions based on their needs. For example, "Convert 100 USDC to ETH and transfer it to my wallet."

Multi-Step Automated Operations: For example, cross-chain bridging and liquidity mining, where the AI can execute complex multi-step transactions from start to finish.

Personalized Interfaces: Adjusts interaction processes based on user habits, making DeFi more aligned with popular demands.

Representative Projects:

HeyAnon: Supports DeFi operations through natural language, allowing users to complete on-chain transactions simply by inputting commands without needing to understand complex smart contract calls.

Griffain: Provides a natural language trading interface on the Solana chain, supporting multi-chain operations and personalized task customization.

3.2 Yield Optimization and Investment Management

Yield optimization has always been a core goal pursued by DeFi users, but the efficiency and accuracy of traditional manual operations are often limited. DeFAI can dynamically adjust investment portfolios through on-chain data analysis and intelligent strategy design, providing users with the best yield paths.

Real-Time On-Chain Data Analysis: Monitors fund flows, price fluctuations, and changes in APY (Annual Percentage Yield).

Dynamic Yield Optimization: Automatically adjusts fund allocation and liquidity mining strategies based on market conditions.

Risk Control: AI can warn of liquidation risks based on market fluctuations and automatically implement hedging strategies.

Representative Projects:

Orbit: Utilizes AI to optimize cross-chain liquidity mining, helping users improve asset returns.

Mode Network: Builds yield optimization AI agents based on Ethereum Layer 2, supporting multi-chain asset management.

3.3 Market Analysis and Forecasting

The volatility and information density of the crypto market place high demands on investors. DeFAI provides users with clearer market insights and investment decision support through AI's analysis and forecasting capabilities.

Market Sentiment Monitoring: AI predicts market trends by analyzing social media data (such as Twitter, Telegram) and on-chain trading behavior.

Customized Reports: Provides personalized analysis of token trends and potential investment opportunities.

Automated Responses: Triggers trades or fund reallocations based on analysis results.

Representative Projects:

AIXBT: Captures investment opportunities in real-time by tracking market sentiment and providing users with trading strategies.

BUZZ: Integrates various AI models for real-time market forecasting and analysis.

3.4 Infrastructure and Platforms

Infrastructure is a crucial support for the DeFAI track, providing the underlying support for the operation of agents, data processing, and multi-chain interactions. By building efficient and secure infrastructure, DeFAI can attract more developers to participate, thereby promoting ecosystem expansion.

Data Processing and Analysis Platforms: Provide capabilities for collecting, cleaning, and analyzing on-chain data.

Multi-Chain Support: Helps AI agents achieve seamless interactions across different blockchains.

Developer Tools: Offers APIs and SDKs, allowing developers to quickly build AI-driven DeFi applications.

Representative Projects:

Mode Network: An Ethereum Layer 2 platform that supports the creation and management of AI agents.

Hive: A DeFi tool based on Solana that provides data analysis and trading execution support.

IV. Current Development Status and Representative Projects of the DeFAI Track

The main types of the DeFAI track cover multiple levels, from user experience to technical infrastructure, providing rich functions and services for users at different levels. Whether attracting new users through simplified interactions or optimizing investment returns to meet the needs of professional users, DeFAI is gradually expanding its influence in the DeFi ecosystem, with several milestone representative projects emerging.

4.1 Current Development Status

The attention on the DeFAI track has been steadily rising recently, with a batch of emerging projects. For example, the tokens of HeyAnon and AIXBT have achieved significant growth in a short period, and the market size of AI-driven decentralized application platforms is also rapidly expanding.

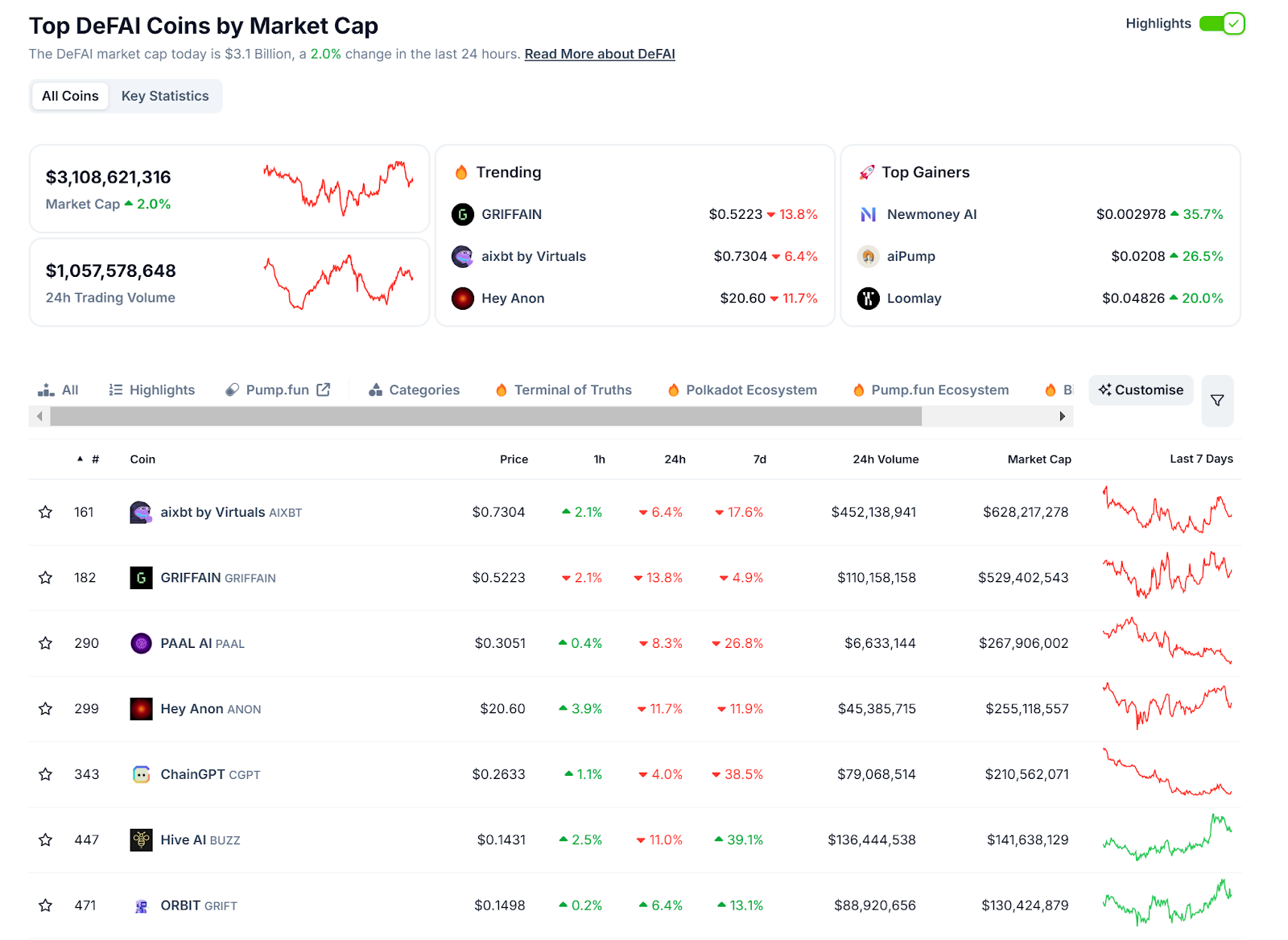

According to CoinGecko data, as of January 23, 2025, the overall market capitalization of the DeFAI track has surpassed $3.1 billion, with seven projects entering the top 500 crypto projects by market capitalization. This not only indicates investors' optimism about DeFAI but also proves the rapid maturity of this field in terms of technology and application.

Source: https://www.coingecko.com/en/categories/defai

4.2 Analysis of Representative Projects

4.2.1 AIXBT by Virtuals ($AIXBT)

AIXBT focuses on market sentiment tracking and trading strategy provision, offering users real-time trading advice by integrating on-chain and social data. $AIXBT is currently the highest market cap token in the DeFAI market, with a market cap exceeding $600 million.

Core Features:

Analyzes market trends and investor behavior.

Provides token price predictions and arbitrage suggestions.

Automates trade execution.

4.2.2 Griffain ($GRIFFAIN)

Griffain is dedicated to creating a DeFi abstraction platform based on the Solana chain, allowing users to complete multi-step transactions through natural language interaction. $Griffain has reached a market cap of $500 million.

Core Features:

Intelligent task scheduling.

Supports NFT minting and airdrop tasks.

Achieves high security in wallet management through Privy technology.

4.2.3 PAAL ($PAAL)

PAAL focuses on building a platform for "Agents-as-a-Service" (AaaS), providing users with various AI agents, including enterprise process automation and autonomous trading execution. Its current market cap is approximately $270 million.

Core Features:

Paal Bot: Answers user questions and provides real-time market intelligence.

Enterprise Agent: Used for process automation and operational optimization.

Autonomous Trading Agent: Executes on-chain trades based on user-defined rules.

Revenue Sharing: $PAAL holders can participate in platform profit sharing.

4.2.4 HeyAnon ($ANON)

HeyAnon focuses on abstracting DeFi operations through natural language processing (NLP). Users can complete tasks such as trading, asset management, and market analysis with simple commands. The price of $ANON has increased over 20 times in the past three weeks, with a market cap exceeding $250 million.

Core Features:

Multi-chain cross-chain bridging and trading.

Data-driven market sentiment analysis.

Automated portfolio management.

4.2.5 ChainGPT ($CGPT)

ChainGPT is an AI intelligence platform designed for blockchain developers and users, providing a variety of on-chain services by combining generative AI technology with the blockchain ecosystem. The current market cap of the $CGPT token is $210 million.

Core Features:

Code generation and smart contract analysis: Helps developers quickly write compliant smart contracts and detect potential vulnerabilities.

Market forecasting and investment analysis: Provides market insights using on-chain data and social sentiment.

On-chain interaction and operation optimization: Simplifies user interactions with blockchain protocols.

4.2.6 Hive ($BUZZ)

Hive is a decentralized financial tool built on Solana, focusing on providing users with a multifunctional integrated trading terminal that incorporates AI technology to simplify DeFi operations. With its powerful toolkit and user-friendly design, Hive has performed significantly in the market at the beginning of 2025, with its token $BUZZ surpassing a market cap of $140 million.

Core Features:

Natural language trade execution: Users can complete complex on-chain operations such as trading, staking, and lending with simple commands.

Yield optimization agent: Helps users identify the best yield opportunities for idle assets.

Integrates various AI models: Including OpenAI and Anthropic, to enhance the accuracy of market predictions.

Payment support: Further lowers the entry barrier for users into DeFi through Apple Pay and Google Pay.

4.2.7 Orbit ($GRIFT)

Orbit is a DeFi assistant that supports natural language interaction, aiming to simplify user DeFi operations across multiple blockchains through automation technology. It lowers the technical threshold for users to participate in multi-chain DeFi activities without requiring specialized knowledge or manual operations. Orbit has integrated over 100 blockchains and more than 200 protocols, with its token $GRIFT reaching a market cap of $130 million.

Core Features:

Cross-chain USDC integration and payment.

Automated trading and task execution.

4.2.8 Mode Network ($MODE)

Mode Network is an Ethereum Layer 2 platform focused on supporting the creation and management of AI agents. Mode Network has recorded over 1,600 AI agent transactions, and its ecosystem is rapidly expanding.

Core Features:

Provides yield optimization tools.

Supports multi-chain operations and user-customized agent development.

V. Opportunities and Challenges in the DeFAI Track

The rapid rise of the DeFAI track reflects the immense potential of the integration of blockchain and artificial intelligence technologies. However, as an emerging field, DeFAI faces significant development opportunities as well as multiple challenges.

5.1 Development Opportunities in the DeFAI Track

5.1.1 Lowering User Barriers and Promoting DeFi Popularization

The DeFi ecosystem has deterred many ordinary users due to its technical complexity, while DeFAI significantly lowers the entry barriers to DeFi through AI agents and natural language interaction. The simple and user-friendly operation model allows more non-technical users to seamlessly participate in the decentralized financial ecosystem, thereby expanding the potential user base of DeFi. For example, the natural language processing capabilities of HeyAnon and Griffain have enabled non-professional users to complete complex transactions with simple commands.

5.1.2 Enhancing On-Chain Efficiency and User Experience

The introduction of AI has led to a qualitative leap in the efficiency and experience of DeFi. For instance, AI agents can analyze market data in real-time, optimize trading paths, and dynamically adjust liquidity mining strategies, helping users achieve higher returns. Additionally, AI can monitor trading risks based on on-chain data, providing more personalized portfolio management solutions.

5.1.3 Emergence of New Business Models

The development of the DeFAI track has brought new business models to the market, such as:

Agents-as-a-Service (AaaS): PAAL provides a one-stop service from data analysis to automated trading through multifunctional AI agents.

Yield optimization and revenue sharing: AI agents help users achieve higher returns while the platform profits through service fees and revenue sharing.

Multi-chain interaction tools: Such as Hive, which provides users with more diverse options by supporting multi-chain operations.

5.1.4 Technology-Driven Ecological Synergy

The construction of the DeFAI ecosystem not only promotes the integration of AI and blockchain technologies but also attracts a large number of developers and capital into the field. The realization of multi-chain compatibility, along with open APIs and SDK tools, provides a foundation for the birth of more innovative applications.

5.1.5 Globalization and Diversification Opportunities

DeFAI does not rely on specific regional financial institutions or currency systems, giving it a natural characteristic of globalization. By supporting multi-language interaction and multi-chain asset management, DeFAI is expected to become an important entry point for global users to participate in decentralized finance.

5.2 Challenges Facing the DeFAI Track

5.2.1 Technical Complexity

The DeFAI track requires a high degree of integration between AI technology and blockchain technology, which poses high demands on developers. For example, building AI agents that support multi-chain operations not only requires processing large amounts of data but also needs to address issues of real-time performance and execution efficiency. Additionally, the complexity of smart contracts may also become a technical bottleneck for achieving high levels of automation.

5.2.2 Security and Trust Issues

"Security" of the agents: AI agents executing on-chain transactions may face hacking attacks or code vulnerabilities.

Data privacy and security: How to protect user privacy data and balance the transparency and privacy of on-chain data remains urgent issues to be resolved.

Decentralization assurance: Some AI services may rely on centralized models, which could undermine the core value of decentralized finance.

5.2.3 Intensifying Market Competition

The DeFAI track is currently in a phase of rapid development, but the functionalities of different projects are becoming increasingly homogenized. For example, multiple projects are focused on natural language interaction, yield optimization, and cross-chain operations, and how to form differentiated competition in the market is a challenge all projects must face.

5.2.4 User Trust and Education

Although DeFAI has lowered the technical barriers through simplified operations, ordinary users still need to accumulate a certain level of trust to accept AI-driven financial decisions. Furthermore, users' lack of understanding of the AI execution mechanisms and smart contract logic may affect their experience and trust.

5.2.5 Regulatory and Compliance Risks

The decentralized nature of DeFAI may trigger more regulatory scrutiny. For example:

Fund flows and transparency: Whether the cross-chain operations of agents comply with Anti-Money Laundering (AML) and Know Your Customer (KYC) rules.

Data security and liability: How to determine responsibility for trading errors or fund losses caused by AI agents.

VI. Outlook and Conclusion of the DeFAI Track

As an innovative track that integrates two cutting-edge technologies, DeFAI represents the next technological revolution in the decentralized finance field. By combining artificial intelligence and blockchain technology, it is redefining the operational methods of DeFi. Although this field is still in its early stages of development, several representative projects have already demonstrated DeFAI's potential in enhancing user experience, optimizing returns, and promoting ecological synergy.

Continuous technological evolution driving intelligent upgrades: With further advancements in Large Language Models (LLM), Natural Language Processing (NLP), and on-chain data analysis capabilities, the level of intelligence in the DeFAI track will significantly increase.

Broader user base and market participation: The user base of DeFAI will expand from current technology enthusiasts and professional investors to ordinary users, as natural language interaction and user-friendly interfaces further lower operational barriers, enabling more users to easily use DeFAI.

Synergistic effects of a multi-chain ecosystem: With the development of cross-chain technology, the multi-chain compatibility of DeFAI will be further enhanced, allowing users to operate freely across multiple chains. By seamlessly integrating multi-chain resources, DeFAI can provide users with richer asset choices and more efficient trading experiences.

Emergence of new business models: The future DeFAI track may give rise to on-chain agent economies, data-driven prediction markets, and decentralized governance and collaboration, empowering communities to achieve transparent and efficient ecological decision-making.

In summary, DeFAI, as a convergence point of artificial intelligence and decentralized finance, is on the brink of transformation. Its intelligent, automated, and user-friendly characteristics will not only reshape the landscape of decentralized finance but also provide global users with fairer and more efficient financial services. Through the joint efforts of technology, ecology, and the market, DeFAI is expected to become a core driving force in the fintech sector in the coming years, pushing the integration of blockchain and artificial intelligence to new heights.

About Us

Hotcoin Research, as the core investment research department of Hotcoin, is dedicated to providing detailed and professional analysis for the cryptocurrency market. Our goal is to offer clear market insights and practical operational guidance for investors at different levels. Our professional content includes the "Play to Earn Web3" tutorial series, in-depth analysis of cryptocurrency industry trends, detailed breakdowns of potential projects, and real-time market observations. Whether you are a newcomer exploring the crypto space for the first time or a seasoned investor seeking deeper insights, Hotcoin will be your reliable partner in understanding and seizing market opportunities.

Risk Warning

The cryptocurrency market is highly volatile, and investing carries risks. We strongly recommend that investors conduct their investments based on a full understanding of these risks and within a strict risk management framework to ensure the safety of their funds.

Website: https://www.hotcoin.com/

Medium: medium.com/@hotcoinglobalofficial

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。