Original Author: Deep Tide TechFlow

In the turbulent crypto market, projects within the Solana ecosystem are shining brightly.

For example, Jupiter. When everyone recently received their airdrops and happily exclaimed how delicious the pork rice is, did they also catch a whiff of Jupiter's financial prowess?

Sometimes, a project's generosity towards you stems from the strategic alliances and careful planning behind the scenes.

Jupiter, the hottest DEX protocol in the Solana ecosystem, has quietly initiated a wave of acquisitions over the past 1-2 years, incorporating multiple projects into its territory.

For instance, a recent news highlight is that Jupiter has acquired a majority stake in Moonshot.

But its actions go far beyond this. Through a series of precise acquisitions, Jupiter is weaving an ecological network that covers multiple dimensions such as trading, data, and wallets.

From initially focusing on token swaps as a DEX aggregator to now comprehensively laying out ecological infrastructure, Jupiter's ambitions have long surpassed the simple realm of decentralized trading.

Why has this DEX, once focused on providing optimal slippage, suddenly transformed into an "infrastructure fanatic"?

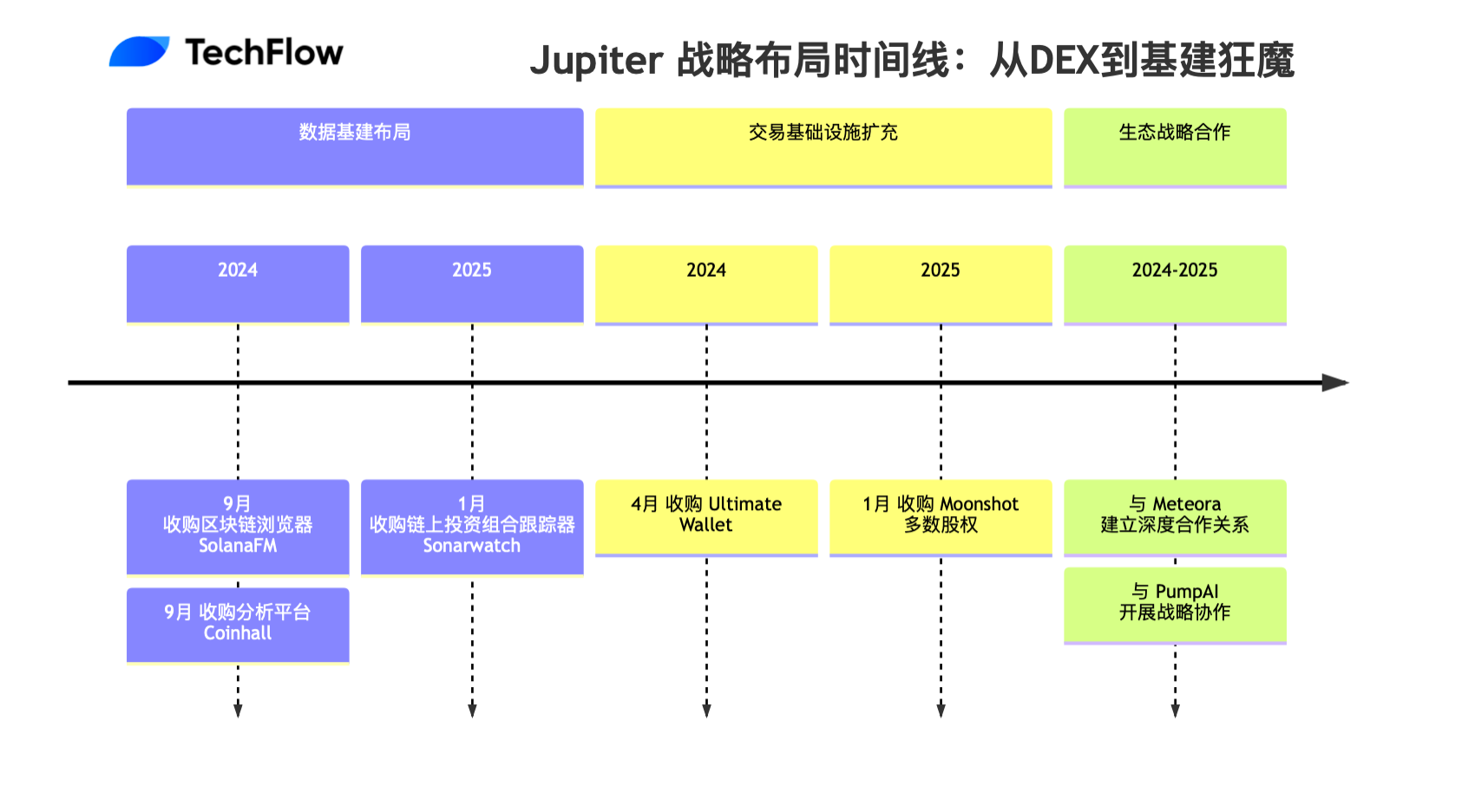

Deep Tide TechFlow has reviewed Jupiter's development and acquisition timeline, and combined it with its recent collaboration dynamics, attempting to restore the strategic layout behind these scattered acquisitions.

Starting from DEX: The Origin of Jupiter

In the thriving Solana ecosystem of 2021, a project named Jupiter quietly emerged. Initially, it was just a new face among many DEX aggregators, but its inherent technical genes quickly allowed it to stand out in the fiercely competitive DeFi arena.

Jupiter's first breakthrough was addressing a common pain point in the DeFi world: slippage. Through innovative routing algorithms, Jupiter can find the optimal trading path within complex liquidity pools, saving users a significant amount in trading costs.

The project's development speed is remarkable; by 2023, public data shows it has become the largest DEX aggregator in the Solana ecosystem, capturing over 50% of the on-chain token swap market share.

With a simple interface design, convenient cross-chain support, and a precise grasp of institutional trading needs, Jupiter quickly became the platform of choice for professional players.

However, what truly sets Jupiter apart in the competition may be its forward-thinking approach to ecological construction.

In today's fiercely competitive and homogenized crypto landscape, you can clearly feel:

A successful DEX must not only provide quality trading services but also become a hub connecting the entire ecosystem.

Thus, the acquisition drama belonging to Jupiter began.

Ongoing Acquisitions: Expansion of Infrastructure Territory

Jupiter's founder, Meow, previously stated in a podcast interview, "Our vision is not just to build a DEX, but to establish a complete DeFi infrastructure ecosystem."

So, what else does a complete ecosystem need?

If I were a user, the answer is obvious — it would be best to have everything I need for my DeFi activities in one place, from data analysis to trade execution to asset management, forming a closed loop.

Of course, these things cannot be accomplished by a single DEX. Thus, acquisitions and collaborations have become a viable path.

Looking at some of Jupiter's recent acquisition moves together, everything revolves around this closed loop.

Data Infrastructure: Acquisitions of SolanaFM, Sonarwatch, and Coinhall

Before making trades, users need accurate market data, on-chain activity analysis, and real-time price monitoring to assist their decision-making. Perhaps based on such strategic considerations, Jupiter has initiated its data segment layout over the past two years.

- September 2024: Acquisition of Blockchain Explorer SolanaFM

SolanaFM was previously one of the more distinctive blockchain explorers in the Solana ecosystem, providing users with fast, simple, and user-friendly access to on-chain data. The most important effect is simplifying trading information and reducing the complexity of capital flow visualization.

As early as 2022, SolanaFM completed a $4.5 million seed round of financing, with participation from VCs like Spartan Group; public data shows that Jupiter itself was also one of the investors in this project, laying the groundwork for the subsequent acquisition.

This acquisition not only enhanced Jupiter's data analysis capabilities but also provided users with more transparent on-chain activity tracking services. Besides a mature data analysis engine, more importantly, it acquired a technically experienced team in on-chain data processing.

- September 2024: Acquisition of Analysis Platform Coinhall

At the 2024 Solana Breakpoint conference, Jupiter announced the acquisition of the well-known trading analysis platform Coinhall. As a platform focused on trading data analysis, Coinhall is renowned for its powerful market data analysis capabilities and user-friendly interface, providing traders with real-time market trends, price movements, and trading volume analysis.

This acquisition holds significant strategic importance for Jupiter: first, by integrating Coinhall's analytical tools, Jupiter significantly enhanced its capabilities in market data analysis; additionally, Coinhall's one-click trading feature and intuitive data visualization tools will be fully integrated into Jupiter's trading platform, further optimizing the user trading experience.

- January 2025: Acquisition of On-chain Portfolio Tracker Sonarwatch

Just yesterday (25th), Jupiter DAO's official Twitter announced this acquisition.

From a business perspective, the integration with Sonarwatch will clearly strengthen Jupiter's portfolio tracking capabilities. Sonarwatch's portfolio tracking tools will be fully integrated into Jupiter's web and mobile platforms, providing users with comprehensive asset monitoring services.

The significance of this collaboration lies in its complementing Jupiter's shortcomings in real-time market monitoring.

Notably, SonarWatch positions itself as a "multi-chain" open-source tracking tool, facilitating DeFi adoption across different chains. This business positioning may align with Jupiter's recently announced Omnichain Network — Jupnet.

Expansion of Trading Infrastructure: Acquisition of Ultimate Wallet and Stake in Moonshot

In the DeFi ecosystem, trading infrastructure is the key link connecting users and trading platforms.

As a DEX aggregator, Jupiter must also streamline the complete link from user entry to trade execution, prompting it to initiate a series of strategic layouts at the infrastructure level.

- April 2024: Acquisition of Ultimate Wallet, Launch of Jupiter Mobile Plan

When acquiring this wallet last year, Jupiter had already stated on X that its "mobile plan attracting tens of millions of users is underway" and would "prepare for testing in May."

Moving towards mobile, the idea of having its own front-end app has emerged.

Jupiter has also indicated that acquiring Ultimate Wallet aligns with its mobile strategy, intending to leverage their technology and team to enhance Jupiter Mobile's performance.

While wallets like Phantom and other dApps are currently popular tools, a DEX can clearly also venture downstream, building its own front-end trading capabilities to control user entry and seek more traffic and trading revenue.

- January 2025: Acquisition of Majority Stake in Moonshot

In recent days, Jupiter further expanded its ecological territory by acquiring a majority stake in Moonshot, which has been regarded as "Meme Select" with the rise of meme coins.

The value of Moonshot itself needs little introduction. This meme trading platform, launched in July 2024, achieved nearly $400 million in trading volume when Trump launched the TRUMP coin this month, topping the regional app download charts.

More importantly, it provides a fiat entry point for direct meme purchases, which is an irresistible temptation for projects related to trading in the circle.

Acquiring a majority stake in Moonshot also means strengthened control over Moonshot. Through this acquisition, Jupiter is not just an aggregator but also controls part of the underlying liquidity sources.

Other Collaborative Layouts

In addition to the aforementioned acquisitions, projects related to Jupiter also involve Meteora and PumpAI.

- Yield Optimization: Synergistic Development with Meteora

Meteora, as an important infrastructure within the Solana ecosystem, has a close yet independent relationship with Jupiter. As a project transformed from the original Mercurial team, Meteora's development within the ecosystem is noteworthy.

Its TVL reached a new high of $1.3 billion in January 2024, briefly becoming the DEX with the highest daily trading volume in the ecosystem. This rapid growth is attributed to its innovative liquidity management mechanism and its close collaboration with Jupiter.

As a project developed by the original Jupiter team, Meteora focuses on building a sustainable yield layer for the Solana ecosystem. Through integration with Jupiter, users can earn additional yields while trading, significantly enhancing capital efficiency. Notably, this collaborative model has been validated in recent market hotspots — for example, during the trading of the official TRUMP coin, the combination of Jupiter and Meteora provided users with an optimal trading experience.

- Innovative Ecosystem: Strategic Collaboration with PumpAI

Additionally, PumpAI is an AI launch platform on Meteora that utilizes tools to help users create tokens. This includes descriptions, images, tokens, and mining pools, all processed by artificial intelligence.

The project has established liquidity pool collaborations with other protocols, such as Raydium and Jupiter.

Where is the Endpoint?

Jupiter's recent series of acquisitions outlines a grand blueprint that far exceeds a single DEX platform.

Through an in-depth analysis of its acquisition strategy, we can clearly see that this star project in the Solana ecosystem is playing a larger game: transitioning from a single point to a comprehensive ecological layout.

Jupiter's acquisition map spans multiple strategic areas. From the user entry point of Ultimate Wallet to the data analysis tool Coinhall, and the blockchain explorer SolanaFM, each acquisition fills an important piece of the ecological puzzle.

Especially through the acquisition of a majority stake in Moonshot, Jupiter not only strengthened its advantages in the liquidity aggregation field but also built a complete DeFi service closed loop.

By integrating core infrastructures such as wallets, data, and trading, Jupiter is constructing a self-contained collection of DeFi services. Users can complete the entire process from fiat entry, trading, to yield optimization within this ecosystem, and the convenience of this experience may be the key to competitive success.

It is particularly noteworthy that the Jupnet project (an omnichain network) that Jupiter is developing demonstrates its ongoing investment in technological innovation. This not only complements existing businesses but also represents a forward-looking layout for the future of cross-chain DeFi development.

Looking ahead, Jupiter's ambitions may extend beyond this.

Its ongoing layout of fiat entry and launch platform businesses indicates its aim to create an ecosystem that covers the entire lifecycle of projects. From project incubation, trading liquidity to user services, Jupiter is gradually establishing its position as the "infrastructure fanatic" of the Solana ecosystem through this series of strategic layouts.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。