I have been thinking recently about what kind of investment strategy to adopt in anticipation of the upcoming year 2025. We know that 2025 is the year of Trump, a year of complete right-wing uncertainty. As I write this investment essay, he has not yet taken office but is already eyeing Greenland, the Panama Canal, and ideas about Canada. Additionally, the crypto market is likely to transition from a bull to a bear market around Q2 of 2025. With Trump's tariffs and immigration policies in 2025, inflation and interest rate cuts will become points of contradiction, and the high interest rate era is likely to continue (although he may call for rate cuts after taking office, everything still depends on actual economic data). Therefore, how to manage asset investment effectively in such a turbulent year, especially how to ensure the safety and stable appreciation of LP investors' funds in our funds, is the key point we are considering.

When we revisited the strategies of Bridgewater Associates, it provided us with great inspiration. The world-renowned hedge fund, Bridgewater, was founded in 1975 and has stood strong for 50 years, which is quite rare in American financial history. It has two most well-known investment strategies: one is the "All Weather Strategy," and the other is the "Pure Alpha Strategy."

During the economic expansion cycle from 2023 to 2025, commonly referred to as a bull market, our strategy reference is the "Pure Alpha Strategy," which successfully captured assets like #RNDR at around $0.5, #KAS at around $0.002, #SOL at $40, and #SUI at around $0.5, etc. However, this strategy will be ineffective during a bear market. Therefore, to maintain steady appreciation during a bear market, we must learn from the "All Weather Strategy."

The All Weather Strategy is Bridgewater's proud strategy for navigating both bull and bear markets, developed over 25 years. Learning this strategy is akin to mastering martial arts, remaining resilient through all seasons and impervious to attacks. Bridgewater's thought process was simple: what kind of investment portfolio should one hold to perform well in various environments, whether in the face of currency devaluation or global political turmoil, and still achieve stable growth?

First, we need to understand that the ROI of financial investment products is determined by the following factors: 1️⃣ Cash returns 2️⃣ The volatility or risk level of the asset relative to the overall market (Beta) 3️⃣ The portion of returns that exceed market benchmark expectations (Alpha). In short: ROI = Cash + Beta + Alpha.

For most investors, the key is to determine their Beta asset allocation rather than excelling in trading within the market. The trick lies in determining the proportion of stocks, bonds, and commodities held, and here, crypto assets can be added, as Bridgewater's research era did not include them, ultimately making static investment portfolios reliable.

In 1990, Bridgewater's founder Dalio wrote in a memo: "During deflationary recessions, bonds perform best; during economic growth periods, stocks perform best; during monetary tightening, cash is most attractive" (this is the Merrill Lynch Clock proposed in 2004). This means that all asset classes have environmental biases. They perform well in certain environments and poorly in others. Therefore, holding a traditional stock-heavy investment portfolio is akin to making a massive bet on stocks, fundamentally betting that economic growth will exceed expectations.

By holding stocks, one faces the risk of economic growth falling below market expectations. To "hedge" this risk, stocks need to be paired with another asset class that also has positive expected returns (i.e., Beta) and will rise when stocks fall, with the rise roughly matching the decline in stocks. Bridgewater's memo suggests using long-term bonds with a risk profile similar to that of stocks to hedge this risk. It states: "Low-risk, low-return assets can be converted into high-risk/high-return assets." This means that, from the perspective of unit risk-return, all assets are roughly equivalent.

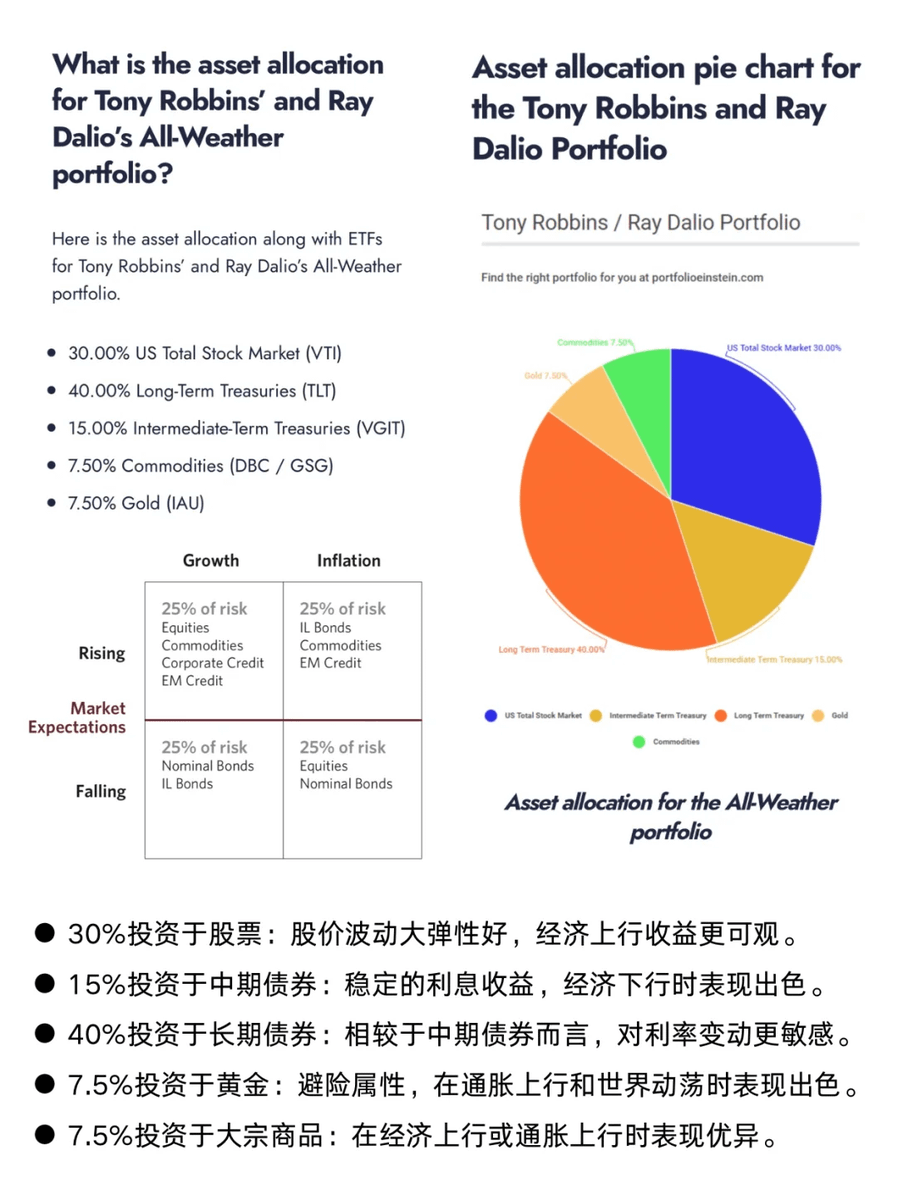

Thus, in Dalio's "All Weather Strategy," he created a four-quadrant chart to describe the range of economic environments that investors may face in the past or future. The key is to take on the same level of risk in each case to achieve balance. Investors are always discounting future scenarios, and their probability of being correct in any given situation is equal.

By using risk allocation as an alternative, the risk contribution of bonds will rise to be on par with that of stocks, leading to a balanced exposure to the risks of both stocks and bonds. For the All Weather Strategy, it is about maintaining balanced risk exposure for each economic environment. Moreover, the major asset classes held in each economic environment also maintain a consistent risk contribution.

The economic cycle can be divided into four macro states based on the relative size relationship between actual values of economic growth (Growth) and inflation levels (Inflation) and market expectations (Market Expectation):

📝 Economic expansion, economic contraction, rising inflation, falling inflation.

Assets suitable for different macroeconomic states:

Economic expansion: Stocks, commodities, corporate credit bonds, emerging market debt.

Economic contraction: Nominal bonds, inflation-linked bonds, government bonds, etc.

Rising inflation: Inflation-linked bonds, commodities, emerging market debt.

Falling inflation: Stocks, nominal bonds.

In response to Dalio's "All Weather Investment" strategy, we have created a general version of the allocation plan for 2025 (using $1 million as an example). The actual situation needs to be optimized in more detail based on your risk preferences and capital size. Partners in need can DM me on Twitter for discussion.

$1 million plan:

· Long-term government bonds: 32%

· US stock assets: 18%

· Cash or cash equivalents (short-term government bonds): 18%

· Crypto assets: 12%

· Commodities: 12%

· Gold: 8%

Through backtesting with Python data + AI, this strategy is relatively balanced:

1️⃣ Benchmark scenario (high probability): Moderate recovery, declining interest rates

Assumption: The global economy gradually recovers from a high inflation environment, interest rates gradually decline, and market risk appetite increases.

Expected returns:

Government bonds: Price increase, yield about 4%-6%.

US stocks: Steady growth, yield about 8%-12%.

Crypto assets: Improved liquidity, potential rebound, yield about 20%-40%.

Commodities: Stable demand, yield about 5%-8%.

Gold: Decreased safe-haven demand, yield about 3%-5%.

Overall annual return: about 7%-10%.

2️⃣ Pessimistic scenario: Economic recession, liquidity crisis

Assumption: Economic recession, corporate profits decline, market risk aversion increases.

Expected returns:

Government bonds: Safe-haven assets perform well, yield about 5%-7%.

US stocks: Decline, yield about -10%.

Crypto assets: High volatility, potential decline, yield about -20%-40%.

Commodities: Decreased demand, yield about -5%.

Gold: Increased safe-haven demand, yield about 10%-20%.

Overall annual return: about 3%-4%.

3️⃣ Optimistic scenario: Technology-driven bull market, strong global economic growth

Assumption: Stable economic growth, technological innovation drives the market, inflation is controllable.

Expected returns:

Government bonds: Average performance, yield about 3%.

US stocks: Strong performance, yield about 15%-30%.

Crypto assets: Bull market explosion, yield about 40%-60%.

Commodities: Price increase, yield about 15%.

Gold: Stable performance, yield about 4%.

Overall annual return: about 20%-30%.

In summary: Whether in the benchmark scenario or the most pessimistic scenario, this investment strategy is expected to achieve relatively stable investment returns in 2025 while effectively avoiding uncontrollable risks. US stock assets and crypto assets may provide higher growth potential, while long-term government bonds, cash or cash equivalents, and gold may offer stability and inflation hedging capabilities. Commodities are expected to perform well under economic recovery and inflationary pressures. Although the specific macro environment of 2025 is unpredictable, from the perspective of the continuity of the overall economy and the pendulum of the economic cycle, 2025 is likely to be a peak turning point of a large cycle nested within a small cycle. As the saying goes: "It is easy to conquer a territory, but difficult to maintain it." I hope all fans and partners can firmly hold onto the fruitful results of the bull market from 2023 to 2025 in 2025! 🧐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。