Author: Frank, PANews

Recently, the Trump family's crypto project World Liberty has significantly increased its holdings in Ethereum and other assets, with almost all operations conducted through the CoW Protocol, indicating a particular affinity for this aggregator. Additionally, Ethereum founder Vitalik and the Ethereum Foundation frequently use CoW Protocol for asset transfers and transactions. However, for ordinary users, the CoW Protocol is clearly less well-known than DEX products like Uniswap and 1inch. It was only recently, due to the Trump family's usage, that attention towards CoW Protocol has risen, with its token COW surging by up to 392% from November 6 to December 25 after Trump's election.

DEX's "OTC Market" Favored by Large Players

CoW Protocol was created in 2020, incubated by the Gnosis team, which builds Ethereum infrastructure. Its founder, Anna George, is also the business director of Gnosis. From 2016 to 2017, Anna George served as a monitoring and evaluation expert for the United Nations.

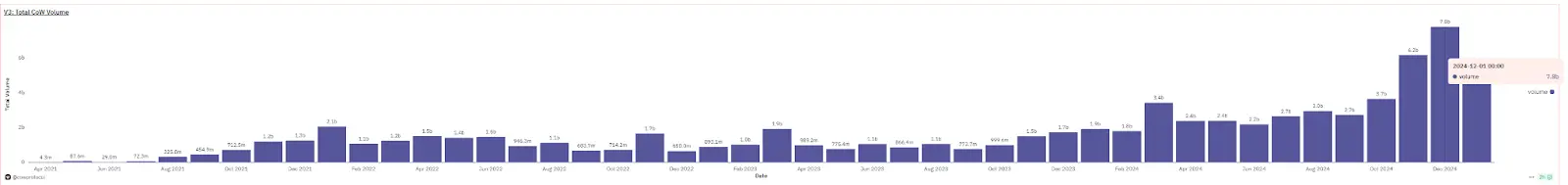

As of January 23, data shows that the daily active users of CoW Protocol, even after a noticeable increase, have only reached over 1,000. Previously, the daily user count was only a few hundred. However, in terms of cumulative trading volume, the project has reached $77 billion, ranking seventh in the Ethereum ecosystem. In December 2024, CoW set a record with a trading volume of $7.8 billion, and with approximately 1,600 daily active users in December, the average transaction volume per user on CoW reached $4.87 million per month. This indicates that CoW serves as a dedicated trading pool for large players.

CoW Protocol has several technical features, primarily aimed at eliminating MEV and reducing trading friction. The most distinctive core technology principle employed is the "demand matching" mechanism. Without going into too much technical detail, this mechanism resembles an on-chain OTC market, bypassing AMM liquidity pools to directly match large players with the same demand for pricing transactions. This effectively reduces on-chain MEV and trading friction to nearly zero.

For users making transactions worth millions or even tens of millions of dollars, this mechanism addresses key pain points while minimizing market price impact. This explains why the Trump family project World Liberty chose to allocate assets through CoW Protocol. At the same time, the Ethereum Foundation and Vitalik are also keen on using this project, with the Foundation frequently selling tokens through CoW.

On the other hand, ordinary users may prioritize aspects such as transaction speed, variety of trading pairs, and flexible trading pools. In comparison, CoW Protocol's matching mechanism does not lead in these areas. However, this is not significant; it seems that CoW Protocol was initially designed specifically for large players.

Data Shows Improvement, Aiming to Increase Revenue Levels

Recently, CoW Protocol has benefited from the World Liberty project, with its governance token COW starting to soar in price from November 6, rising from a low of $0.25 to a high of $1.23, with a maximum increase of 392%.

The COW token was launched back in 2022, with an initial opening price of about $0.80. Over the following year, the price fell significantly, reaching a low of $0.062, and it wasn't until 2023 that it began to recover, mostly hovering below $0.40. In September 2024, Coinbase announced the introduction of CoW Protocol to its listing roadmap. On November 6, multiple exchanges, including Binance and Bybit, listed COW. Interestingly, this day coincided with Trump's victory in the 2024 U.S. election. It is evident that various exchanges have included COW as part of Trump's related assets, and the election result immediately triggered market enthusiasm.

However, after Christmas, the price of the COW token began to decline. As of January 23, its price had dropped to around $0.63, representing an overall correction of nearly 50% from its peak.

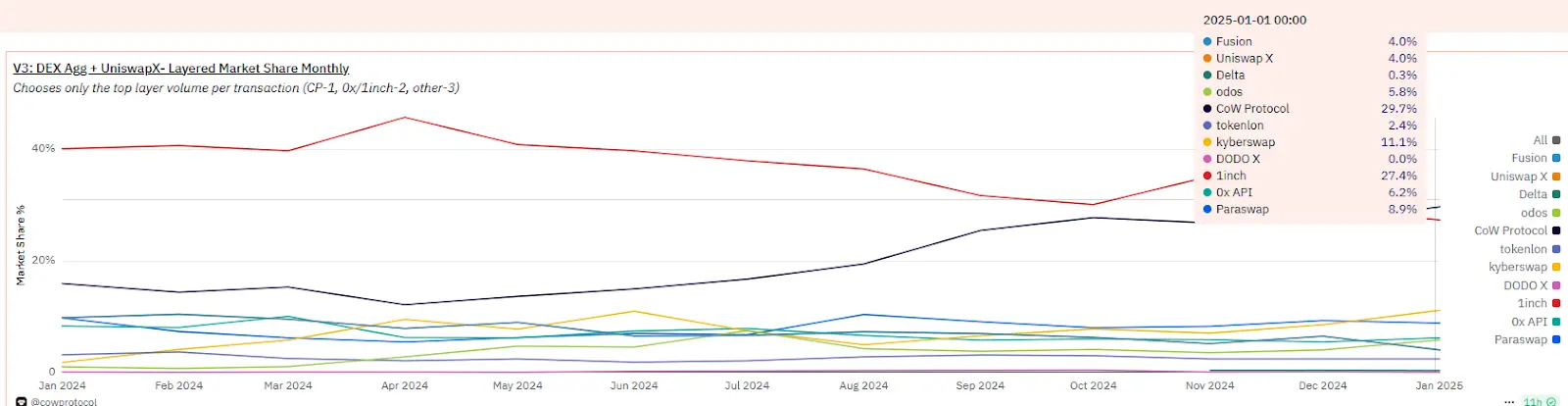

Aside from the traffic effects brought by the hype, CoW Protocol's data performance has shown significant growth in recent months. The most notable aspect is trading volume, which has remained in the range of $2 billion to $3 billion per month since the beginning of 2024. Starting in November, this figure surged to $6.2 billion, reaching a historical high of $7.8 billion in December. Throughout 2024, CoW Protocol's market share among Ethereum ecosystem aggregators has consistently ranked below 1inch, placing it second. However, on January 23, 2025, its monthly data performance surpassed 1inch for the first time, ranking first. The final rankings for both may not be clear until early next month.

On January 22, Cow DAO released the CIP-61 proposal on Snapshot, attempting to further regulate CoW Protocol's fee model and ratios to achieve better revenue levels. According to the proposal, CoW Protocol generated approximately $6 million in revenue in 2024 but still failed to break even, with development costs ($4.4 million), grants ($700,000), and solver rewards ($5.2 million) for the year. Therefore, Cow DAO hopes that this proposal can optimize users' transaction execution prices and create more additional value to reach breakeven sooner, reducing reliance on external funding.

According to CoW's official dashboard, Cow DAO's cumulative revenue amounts to 3,648 Ethereum, which, at an Ethereum price of $3,300, totals approximately $12 million. In the Ethereum ecosystem, CoW Protocol's revenue level ranks around 50th, which is relatively low for an aggregator that has been operating for four years and ranks among the top in trading volume.

With the recent overall data improvement, the CoW team clearly hopes to seize the current market opportunity to achieve new milestones. Currently, the proposal has passed smoothly, but the discussion heat on social media is not high. The token market has not shown significant price fluctuations as a result. Perhaps for the CoW team, capturing large players only requires targeted products and designs, but winning over the general public seems much more challenging. For ordinary users and token investors, the complex proposal expressions appear far less appealing than a simple airdrop.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。