# 1. Risks of Revenue Loss Due to Stablecoin Legislation

As of November 28, 2024, the market capitalization of USDT is approximately $132.3 billion, and it is expected that the stablecoin market will exceed $2.8 trillion by 2028. The regulatory dynamics surrounding stablecoins are of great concern to the market. The market capitalization of USDT is shown in the figure below:

On June 7, 2022, U.S. Senators Cynthia Lummis (Republican, Wyoming) and Kirsten Gillibrand (Democrat, New York) introduced a payment stablecoin bill. Gillibrand referred to it as "landmark bipartisan legislation that creates a clear regulatory framework for payment stablecoins, which will protect consumers, promote innovation, and bolster the dollar's dominant position while maintaining a dual banking system." The L-G bill may be one of the most significant regulatory measures introduced regarding USDT in recent years.

The bill would allow non-depository trust companies (non-banks) to issue stablecoins through their own channels as long as the nominal value of all their tokens is below $10 billion. The Lummis-Gillibrand bill stipulates that stablecoin issuers with a scale exceeding $10 billion must be "depository institutions authorized as national stablecoin issuers" to be allowed to operate legally. According to the Lummis-Gillibrand bill, centralized stablecoin companies like Circle (USDC, issuing $33 billion) or Paxos (PAXD) will have two options: either operate through state-level non-bank financial institutions or become depository institutions authorized as national payment stablecoin providers at the federal or state level, similar to money market funds or primary dealers in traditional financial institutions. In the L-G bill, only stablecoins that can be redeemed for sovereign fiat currency at any time, with non-crypto assets as the underlying anchor, used for MoE, are defined as payment stablecoins. Only payment stablecoins like USDT (depository institution type) and USDC (non-depository institution type) fall under the jurisdiction of the L-G bill, while algorithmic stablecoins and over-collateralized crypto-backed stablecoins (like DAI) are excluded.

Additionally, the L-G bill includes long-arm jurisdiction clauses, meaning these laws will apply to companies outside the U.S. Although Tether is registered in the BVI, it is expected to be subject to this bill's jurisdiction because USDT is widely circulated among U.S. investors and exchanges. The bill directly identifies Tether and USDT as being within its scope. Tether claims it does not provide services to U.S. customers because it does not directly issue tokens to these companies and individuals, but U.S. policymakers are unlikely to accept this regulatory evasion.

Therefore, Tether faces the risk of being issued a prohibition order by the U.S. Treasury or SEC. The L-G bill requires depository institutions to obtain prior approval from federal or state banking regulators before issuing and redeeming payment stablecoins, and they must be collateralized by high-quality liquid assets worth no less than 100% of the issued nominal value (such as U.S. dollars or U.S. Treasury bonds). They must publicly disclose the number of outstanding payment stablecoins and detailed information about the assets supporting these stablecoins and their values monthly, and they are obligated to redeem all outstanding payment stablecoins at face value in fiat currency upon customer request. If Tether triggers such potential obligations or fails to fulfill redemption and disclosure obligations, leading to a prohibition on conducting dollar-related business (Tether has no legal license in the U.S., making its U.S. business effectively illegal), it could result in severe fluctuations in the value of USDT, causing it to decouple from the dollar and enter a death spiral similar to UST.

Moreover, the SEC's attitude towards Tether is also ambiguous. Gary Gensler has publicly stated that he believes "only BTC is a commodity, and all other cryptocurrencies are securities," and he has repeatedly expressed serious concerns that stablecoins could disrupt the U.S. financial market. If Tether is classified as a security and brought under regulation, it would undoubtedly deal a heavy blow to USDT, which is significantly composed of gray market circulation, and this news could become an opportunity for a run on USDT and its decoupling from fiat currency.

# 2. Regulatory Risks Related to U.S. Treasury Collateral

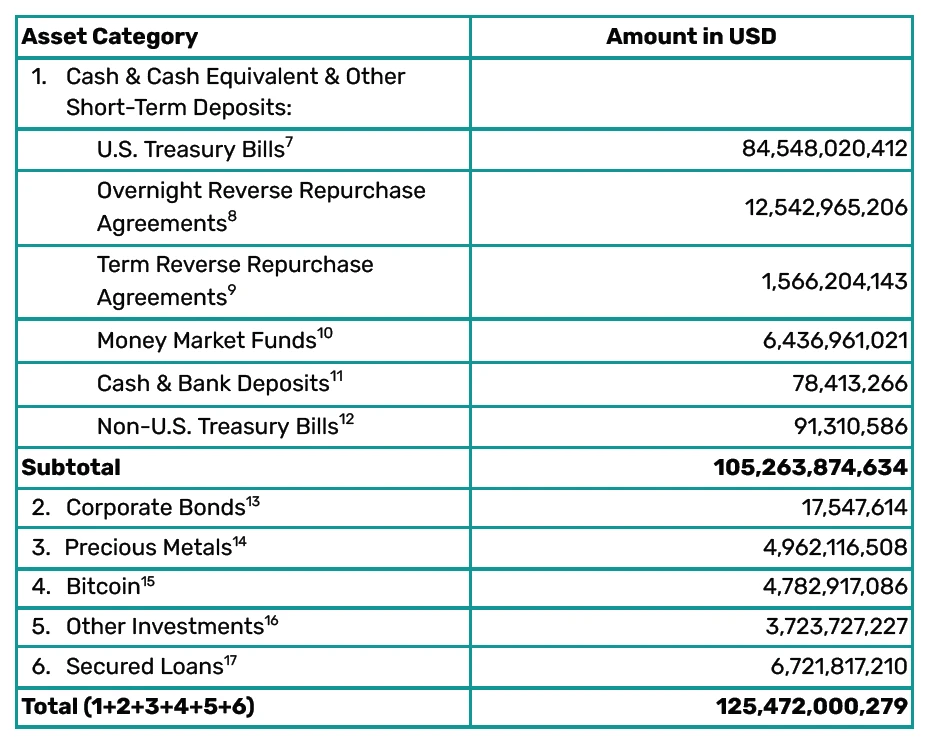

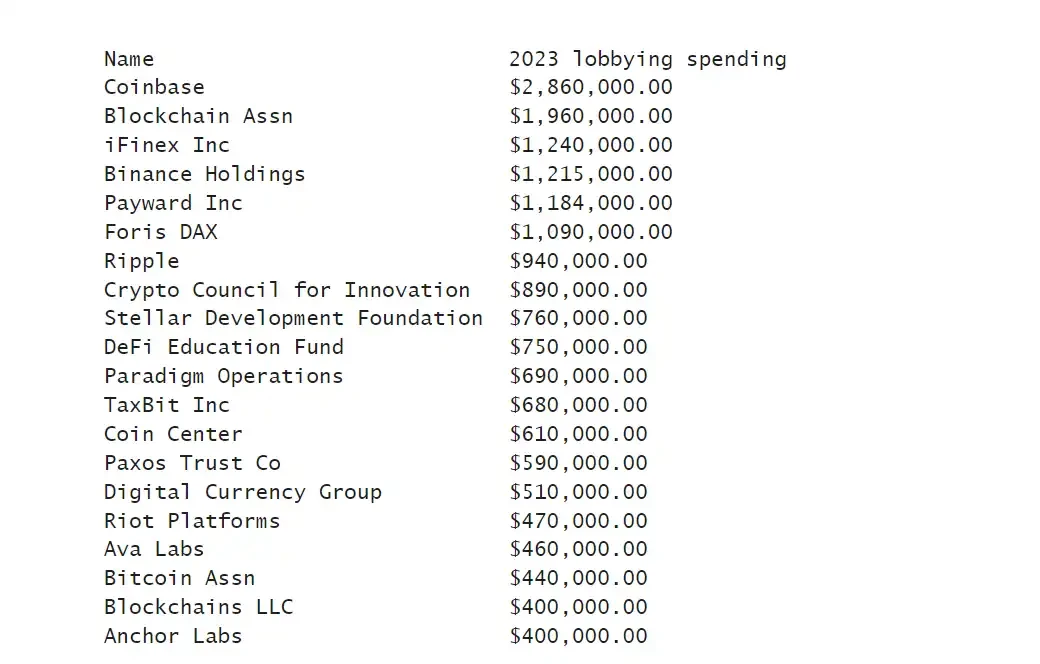

Currently, the anchoring mechanism of USDT to the dollar can be described as an "excess reserve mechanism," meaning that each USDT is backed by low-risk underlying assets worth more than $1, with the excess portion being Tether's net assets (Tether's asset side consists of U.S. Treasury bonds and other collateralized assets, while the liability side consists of the USDT it issues). Additionally, due to the widespread use of USDT, many arbitrage traders actively engage in arbitrage when the USDT price deviates slightly, effectively maintaining the price stability of USDT. Tether publishes quarterly reserve asset audit reports, and their scale and composition are shown in the figure below:

However, Tether holds a large amount of U.S. Treasury bonds and derivatives, which, while granting it a "central bank status" in the crypto world, has also raised numerous questions about whether it threatens the effectiveness of the traditional monetary policy transmission chain, even attracting the attention of U.S. financial regulators. Although the U.S. interest rate corridor system has evolved from a scarce reserve logic to an excess reserve logic post-QE, the current ONRRP serves as the most important buffer for the Federal Reserve to absorb TGA and other excess liquidity, establishing a solid floor for the interest rate corridor. After further issuance of T-bills, interest rate hikes, QE tapering, and QT, the current balance is gradually declining. In the second quarter of 2024, the ONRRP balance quickly dropped from a historical high of $2 trillion in 2022 to around $600 billion. With the deepening of QT, the depletion of ONRRP has become a high-probability event. In this context, even while still in the zero elasticity range of the curve, Tether's holdings of over $10 billion in ONRRP agreements and over $100 billion in U.S. Treasury bonds and MMF balances can already be considered to have a meaningful scale for the stable operation of U.S. monetary policy. Tether, being a company registered in the BVI that nominally refuses to engage in U.S. related business and is not subject to U.S. legal regulation, has led traditional regulatory bodies and media to view it as a potential threat to the order of the U.S. interest rate corridor system, considering it an ant hole in the long dam of U.S. monetary policy, which is not unfounded.

Regarding the quality of Tether's underlying assets, the proportion of cash and cash equivalents has slightly increased in recent years, but only 80% of it consists of highly liquid U.S. Treasury bonds, and the overall liquidity level is relatively average, which is one of the reasons for the frequent doubts about USDT's stability in recent years.

# 3. Competition Risks from PayPal and Traditional Financial Institutions (such as Banks) Issuing Stablecoins

Stablecoins can effectively capture value and have unique advantages in mobile payments and cross-border payments, including anonymity, speed, decentralization, universality, and value stability. As a pioneer in collateralized stablecoins that bridge different trading pairs, Tether has not only captured the incremental value and user demand but has also addressed the severe slippage issues caused by using only BTC as an intermediary in exchanges, even laying the groundwork for the introduction of smart contracts, becoming an indispensable infrastructure in the crypto world. Due to its anonymity and high universality, USDT has inevitably become one of the most important mediums of exchange (MoE) in the black market. However, in contrast to the industry dividends enjoyed by Tether as a market leader, there is also a strong desire among companies capable of crossing this industry barrier to enter the collateralized stablecoin space and share in the profits. Tether's net profit reached $2.2 billion in the third quarter of 2024, and for traditional internet payment giants like PayPal and traditional commercial banks, the lucrative prospects of payment stablecoin business itself, along with the seamless integration of payment stablecoins with their core payment operations, can create extremely powerful synergies.

Currently, Tether's most significant moat in the collateralized centralized stablecoin industry is its substantial "reserves," achieving over-collateralization while ensuring that its underlying assets are all highly liquid, low-risk U.S. Treasury bonds, Treasury derivatives on the Federal Reserve's liability side (MMF), and a small portion of Bitcoin. However, as discussed above, central banks (issuing digital currencies) and commercial banks have capital adequacy far exceeding that of Tether. As a purely collateralized stablecoin, Tether's business model does not impose very high requirements on the issuer's crypto-native business thinking; it only needs to utilize its capital resources to subsidize and attract on-chain users, subsequently entering on-chain asset trading pairs, and through cooperation with exchanges (such as fee discounts) to attract centralized exchange users to use stablecoins (similar to Binance promoting XUSD and FDUSD), thus being able to capture at least a portion of the market share from Tether. The potential competition Tether faces (more from non-crypto-native players) poses a significant challenge to its business.

# 4. Litigation Risks

In addition to the aforementioned risks, Tether also faces multiple potential litigation and investigation risks. In 2021, the U.S. Department of Justice intervened in the investigation of Tether, and in 2022, the Tether case was handed over to prosecutor Darmian William of the Southern District of New York, who specializes in high-profile cases in the crypto field (such as SBF, FTX, etc.). The primary reason for the DOJ's investigation into Bitfinex and Tether is that they are suspected of violating sanctions and anti-money laundering regulations, as well as issues related to Bitfinex misappropriating Tether funds. Specifically, the DOJ is investigating whether Tether has been used by third parties to fund illegal activities such as drug trafficking, terrorism, and hacking, or to launder the proceeds of these activities. Additionally, the U.S. Treasury is also considering imposing sanctions on Tether, as USDT is widely used by individuals and groups sanctioned by the U.S., including Hamas and Russian arms dealers. Furthermore, Tether's transparency issues have also been questioned, as it has long been accused of money laundering and lacking audit transparency. The focus of the investigation is on whether Tether's financial operations are legal and whether it has appropriately reported the liquidity of its assets and the underlying supporting assets. Due to these reasons, Bitfinex and Tether have long used some gray shadow banking services like Crypto Capital for savings and custody, resulting in a vicious cycle of compliance risks.

In addition, Tether faces multiple lawsuits, including several crypto traders suing Tether, accusing it of colluding to manipulate cryptocurrency market prices, in violation of the Commodity Exchange Act (CEA) and the Sherman Antitrust Act. The plaintiffs allege in their complaint that Tether and Bitfinex pushed USDT into the market through "large and carefully orchestrated buying and promotional activities," creating a false appearance of strong demand to drive up cryptocurrency prices. This also includes a lawsuit from the well-known crypto lending company Celsius against Tether, claiming that Tether improperly liquidated approximately $2.4 billion worth of Bitcoin before its bankruptcy. Tether responded by calling the lawsuit extortion and stated that its actions were in accordance with the terms of the agreement, as Celsius failed to provide the required collateral before liquidation. These lawsuits are likely to have adverse effects on Tether.

# 5. Alternatives: USDC and Other Stablecoins

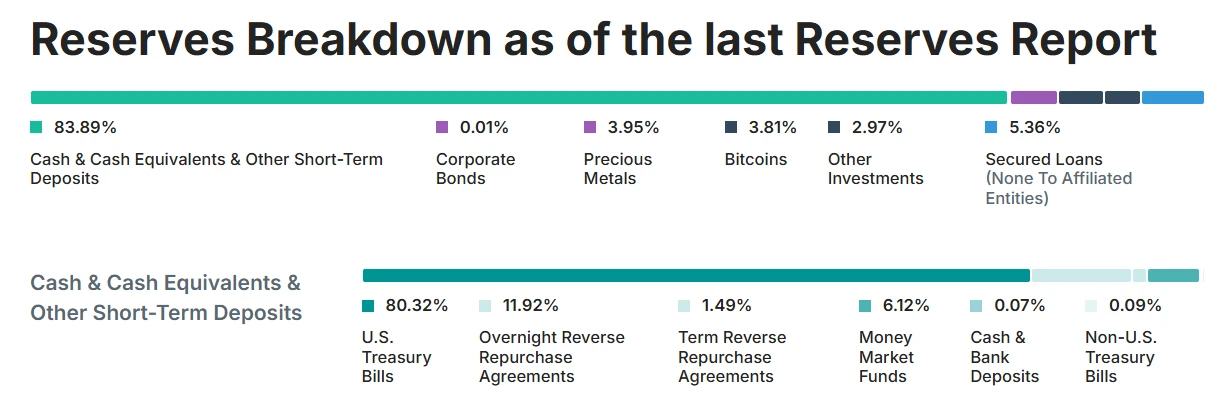

It is noteworthy that despite the aforementioned adverse factors, USDT still occupies the vast majority of the stablecoin market capitalization, being the most widely circulated and utilized stablecoin. The probability of it encountering significant issues in the short term is relatively low, and Tether and its parent company Bitfinex have invested substantial funds in out-of-court lobbying in recent years (as shown in the figure below).

At the same time, after Trump's election, he clearly expressed dissatisfaction with anti-cryptocurrency policymakers like Gary Gensler and nominated Howard Lutnick, who has close ties to Tether, as the candidate for Secretary of Commerce. Lutnick's financial company, Cantor Fitzgerald, is Tether's custodian and has also engaged in a $2 billion lending project with Tether. Therefore, it can be considered that the risk of Tether being shut down by U.S. policy authorities has further decreased after Trump's election.

However, assuming that due to U.S. regulatory policies and other reasons, Tether suffers a significant blow and a black swan scenario occurs where USDT decouples from the dollar, other stablecoins represented by USDC would be the primary choice to fill the important ecological niche of USDT in terms of deposits, withdrawals, and trading pair anchoring.

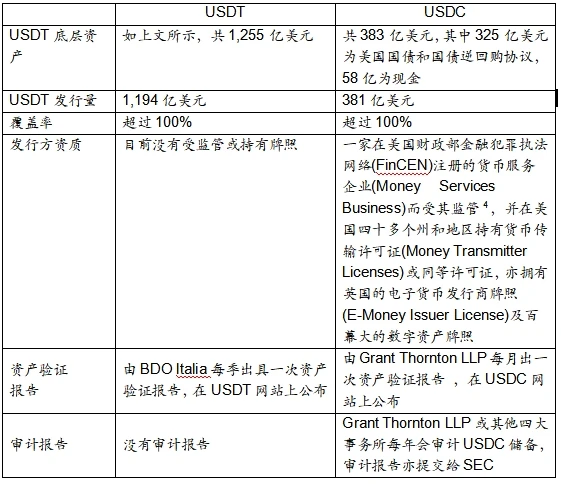

Overall, USDC strictly adheres to U.S. regulatory rules and has superior transparency, while its weaknesses are that its liquidity and acceptance are clearly inferior to USDT. USDC complies with SEC requirements to follow public company standards for third-party annual audits and discloses its underlying asset status weekly, with monthly audits conducted by the Big Four. In contrast, USDT does not have a strict audit in the conventional sense, and its supporting asset status is disclosed monthly. The comparison between USDT and USDC is shown in the table below:

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。