I didn't expect it to be beyond my expectations. Last night, I was still saying that during the most FUD period for ETH, ETF investors were actively buying ETH. However, after a series of positive news yesterday, the selling of #ETH surged. The same situation occurred with #BTC, but at least BTC had a net inflow, while ETH experienced a net outflow.

It's not hard to understand; it's all a Sell The News behavior. In fact, it wasn't until near the close of the US stock market yesterday that market sentiment gradually shifted from selling back to buying. The US National Reserve yesterday reached a psychological threshold for some investors, who believed that with the positive news materializing, it should turn bearish, leading to significant selling volume, which is very normal. The selling volume in the spot market yesterday was even exaggerated.

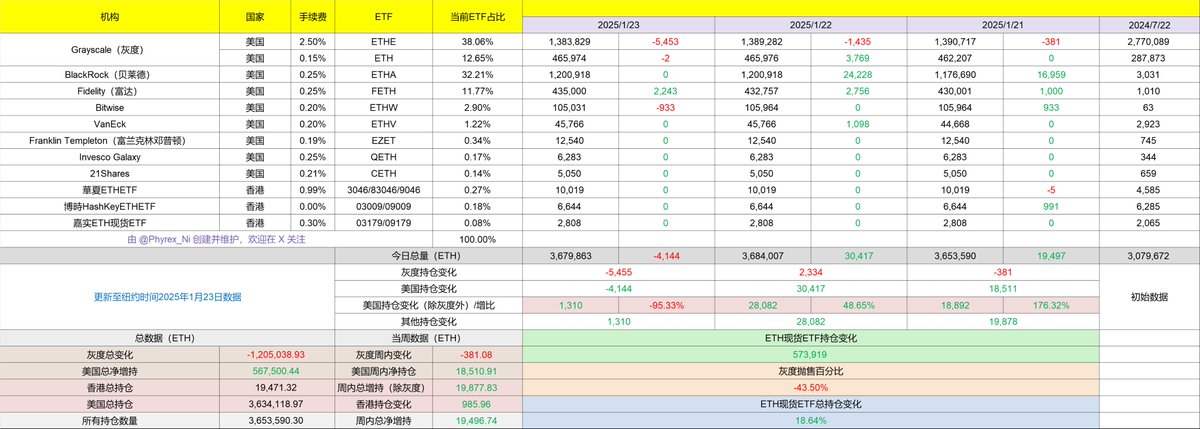

In the data from the past 24 hours, although selling was predominant, it can still be seen that most investors have strong expectations for the future. The most sold was Grayscale's $ETHE, which only sold a little over 5,000 ETH, a volume that is still less than what Trump's WLFI bought. Bitwise also sold less than 1,000 ETH, which isn't much either.

On the net inflow side, BlackRock had zero yesterday, while Fidelity continued to buy over 2,200 ETH. Overall, even with the Sell The News behavior, these sell-offs aren't significant. I expect that buying volume will increase after the market opens today, especially since small V has made some changes.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1W7JJ8lMQiUUlBb9U-BvFoq2H-2o5CpUuPO4D_KK3Ubw/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。