Organized by: Fairy, ChainCatcher

Important News:

- Trump Signs Executive Order to Establish Cryptocurrency Task Force: Assessing Creation of National Reserve, Banning CBDC

- Sun Yuchen: XCN is Currently Undergoing Severe Market Manipulation, Using High Leverage and Contracts

- Binance Alpha Adds ALON

- BIGBANG Member X Account “TOP 최승현” Issuing Meme Coin is a Fake Account

- New York Department of Financial Services Issues Consumer Warning on Meme Coins, Emphasizing High Volatility and Fraud Risks

- Vitalik: Political Tokens are “Tools for Unlimited Political Bribery”

- U.S. SEC Officially Withdraws Cryptocurrency Accounting Policy SAB 121

- Public Company Semler Scientific to Raise $75 Million to Purchase More Bitcoin

“What Important Events Happened in the Last 24 Hours”

Sun Yuchen: XCN is Currently Undergoing Severe Market Manipulation, Using High Leverage and Contracts

TRON founder Sun Yuchen posted on X stating: “XCN (Chain) is currently undergoing severe market manipulation. They are using high leverage and contracts, which could seriously harm many exchange users. I advise exchanges to closely monitor this risk. We will report their illegal activities to the U.S. Securities and Exchange Commission (SEC) and the Department of Justice (DOJ) for further investigation.”

Binance Alpha Adds ALON

According to the official page, Binance Alpha has added ALON.

BIGBANG Member X Account “TOP 최승현” Issuing Meme Coin is a Fake Account

The X platform account @choiseungttt is suspected of impersonating former BIGBANG member T.O.P to engage in activities related to the issuance of Meme coins.

Currently, there is no conclusive evidence indicating a direct connection between this account and T.O.P. It is essential to remain highly vigilant regarding investment projects involving celebrities or public figures.

U.S. Congress Members: Concerned About Foreign Individuals and Governments Using TRUMP or MELANIA to Influence President Trump and His Family

Two senior Democratic Congress members from Massachusetts, Elizabeth Warren and Representative Jacob Auchincloss, warned that the Meme coins issued by the Trump couple pose not only financial risks but also national security concerns, as the global and largely anonymous cryptocurrency market may allow foreign actors to purchase large amounts of TRUMP or MELANIA tokens to influence the U.S. government.

Moreover, the issuance of Meme coins by the Trump couple may violate the constitutional compensation clause, which prohibits government officials from accepting payments or gifts from foreign entities without congressional approval. Elizabeth Warren and Jacob Auchincloss wrote in a letter, “Almost anyone in the world can purchase these tokens, raising concerns about foreign individuals and governments using these tokens to influence President Trump and his family.”

Zhao Changpeng: I Have Never Purchased Meme Tokens or NFTs, but That Doesn’t Mean I Oppose Them

Zhao Changpeng tweeted, “I can see both sides of the argument. But I can’t say I know which side is right and which side is wrong. I think the bottom line is that in a decentralized world, no one is forcing anyone to buy (or not buy) Meme tokens (or any cryptocurrency). If you don’t want to, you don’t have to participate. But others should also have their own choices. I am a builder myself. I have never purchased Meme coins (or NFTs). But just because I don’t understand how to appreciate something doesn’t mean I oppose them.”

New York Department of Financial Services Issues Consumer Warning on Meme Coins, Emphasizing High Volatility and Fraud Risks

The New York Department of Financial Services issued a consumer warning, cautioning against “emotion-based virtual currencies,” namely Meme coins, emphasizing their extreme volatility, lack of regulation, and high fraud risks, including sudden price manipulation schemes.

The department warned that these tokens are often controlled by a small group of insiders, created on unlicensed platforms, and are susceptible to severe price manipulation. The New York Department of Financial Services also stated that it has begun closely monitoring Meme coins, as part of scams, where creators or insiders may engage in manipulative “wash trading” to create the illusion of market activity and price increases.

The public often finds it challenging to discern which Meme coins are manipulated, and consumers should be particularly wary of the recent surge in emotion-based currencies created through unlicensed platforms, which allow individuals without technical expertise to create currencies with just a few clicks. Even on regulated platforms, the prices of Meme coins are unstable and unpredictable, and they may drop significantly in a short period.

Market News: THORChain in Debt Crisis, Validator Nodes Have Paused Network Operations and Are Voting on Restructuring Plan

According to X user TCB, THORChain is currently in a state of insolvency. Data shows that THORChain's current liabilities include $97 million in loans (ETH and BTC) and approximately $102 million in savings and synthetic assets, while available assets are only $107 million in external liquidity.

TCB stated that THORChain's borrowing obligations are fulfilled by minting and selling RUNE tokens, a design that has led to high reflexivity, exacerbating the problem. After repaying $4 million in RUNE debt yesterday, the protocol has incurred additional millions in RUNE. Validator nodes have paused network operations and are voting on a restructuring plan.

THORChain faces two options: one is to maintain the status quo, where about 5-7% of the value will be withdrawn by the first exiters, and RUNE will continue to decline; the other is to declare debt default, retain valuable parts through bankruptcy restructuring, and gradually repay creditors without affecting the protocol's viability. TCB recommends adopting the second option to protect the rights of liquidity providers, maintain network value, and achieve long-term development.

Vitalik: Political Tokens are “Tools for Unlimited Political Bribery”

According to The Block, Ethereum co-founder Vitalik Buterin stated on social media on Thursday that political tokens could lead to “unlimited” bribery. Vitalik's comments are part of a broader discussion on the trends in the cryptocurrency industry, especially in the context of political leaders like President Trump embracing cryptocurrency. Vitalik pointed out that certain parts of the industry conflict with each other due to their short-term and long-term values, comparing it to “highly addictive mobile games” and chess.

Vitalik wrote on X: “In the past year, we are entering a new order, and now the most powerful people in the world are cheering for the idea of creating tokens for anyone, at any scale, for anything. Therefore, it is time to discuss the difference between the short-term ‘sugar high’ fun that is not recommended for newcomers and the long-term sense of achievement and wealth accumulation. This is not to say that ‘fun is bad,’ but rather the distinction between modern highly addictive mobile games and chess or World of Warcraft. It is time to discuss the fact that large-scale political tokens cross another line: they are not just sources of fun, whose harms are limited to mistakes made by voluntary participants; they are tools for unlimited political bribery, including bribery from foreign governments.”

The recently launched large-scale political tokens are TRUMP and MELANIA, both related to President Trump and First Lady Melania Trump. These tokens were launched before Trump took office as the 47th President of the United States on January 20 and experienced significant price drops shortly thereafter.

Public Company Semler Scientific to Raise $75 Million to Purchase More Bitcoin

Public company Semler Scientific will raise $75 million to purchase more Bitcoin.

U.S. SEC Officially Withdraws Cryptocurrency Accounting Policy SAB 121

According to official news, the U.S. Securities and Exchange Commission (SEC) announced the withdrawal of the cryptocurrency accounting policy SAB 121 in its latest employee accounting announcement No. 122.

The document rescinds the interpretive guidance contained in Topic 5.FF, titled “Accounting for an Entity’s Obligation to Safeguard Cryptographic Assets Held for Its Platform Users.” Entities should fully retroactively withdraw Topic 5.FF starting from the annual period beginning after December 15, 2024.

Additionally, the SEC emphasized that entities are still obligated to disclose risks related to the custody of cryptographic assets in accordance with existing regulations.

Trump Signs Executive Order to Establish Cryptocurrency Task Force: Assessing Creation of National Reserve, Banning CBDC

Trump has signed an executive order to establish a Presidential Task Force on Digital Asset Markets, tasked with developing a federal regulatory framework for managing digital assets (including stablecoins) and assessing the creation of a strategic national digital asset reserve. The task force will be chaired by the White House's "AI and Cryptocurrency Czar" David Sacks, with members including the Secretary of the Treasury, the SEC Chair, and heads of other relevant departments and agencies. The executive order directs departments to propose recommendations to the task force regarding any regulations and other agency actions that should be rescinded or modified affecting the digital asset sector.

Additionally, the executive order prohibits agencies from taking any action to establish, issue, or promote central bank digital currencies (CBDCs). The order also rescinds the previous administration's "Digital Asset Executive Order" and the Treasury's "Framework for International Engagement on Digital Assets," stating that these two executive orders stifled innovation and harmed America's economic freedom and global leadership in the digital finance space.

Previously, it was reported that President Trump was signing executive orders related to AI and cryptocurrency.

“What Exciting Articles Are Worth Reading in the Last 24 Hours”

Who Are the Primary "Beneficiaries" and Potential "Manipulators" Behind Trump's Epic Coin Launch?

Although Trump stated that he "doesn't know much" about his namesake Meme coin TRUMP, the entire crypto layout of the Trump family undoubtedly has strong "manipulators."

The seemingly casual launch of TRUMP coin is actually the result of clear prior collaborations with multiple projects such as Moonshot and Jupiter/Meteora, which are the biggest beneficiaries behind Trump's epic coin launch, aside from Solana.

For example, Moonshot, which supports fiat purchases of memes, quickly added 400,000 users, becoming a strong new challenger in the CEX space. Meteora, from the same team as Jupiter, is the fastest-growing project in the Solana ecosystem benefiting from Trump's coin launch… As a carefully selected partner of Trump, they are worth long-term attention.

Full Text of Trump's Davos 2025 Speech and Overview of Financial Giants Q&A

President Donald Trump delivered a speech at the World Economic Forum in Davos, Switzerland, on Thursday, marking his first appearance at an international event since returning to the White House earlier this week.

In a 45-minute speech, Trump criticized European regulators for being too harsh on American tech companies, oil producers for keeping oil prices too high, and large banks for refusing to serve conservatives.

He also called on countries around the world to invest in the U.S. and promised to provide low tax rates and a more relaxed regulatory framework.

Domestically, Trump expressed pressure on the Federal Reserve regarding interest rates.

“I will ask for an immediate reduction in interest rates,” Trump said. “Similarly, interest rates around the world should also go down. Interest rates should follow our lead down.”

There is widespread belief that Trump's remarks are an opening statement for his upcoming lobbying campaign against Federal Reserve Chairman Powell.

Under Public Pressure, Vitalik Calls on L2: Come Back and Support ETH

Recently, Ethereum's performance in this cycle has sparked widespread dissatisfaction, with community members expressing disappointment over the Ethereum Foundation's (EF) inaction. Even some leading projects within the Ethereum ecosystem have begun to question the EF, seemingly hinting at a "palace coup."

Founders of several well-known projects have voiced their concerns about Ethereum's future direction:

The founders of Synthetix and Infinex believe that the EF should require L2 (Layer 2 networks) to use their revenue to buy back ETH, thereby increasing demand for ETH and enhancing its value.

The founder of Curve believes that the EF should immediately abandon the L2 strategy.

The founder of Aave has released "12 Measures to Save the EF," calling for the foundation to take swift action to address the current predicament.

More intense voices come from the founder of Wintermute, who believes that Ethereum faces the possibility of a "death spiral."

In response to the strong questioning from cornerstone projects in the ecosystem, Ethereum founder Vitalik Buterin finally spoke today, announcing that a "toll" will be imposed on L2 networks.

Meme Popularity Rankings

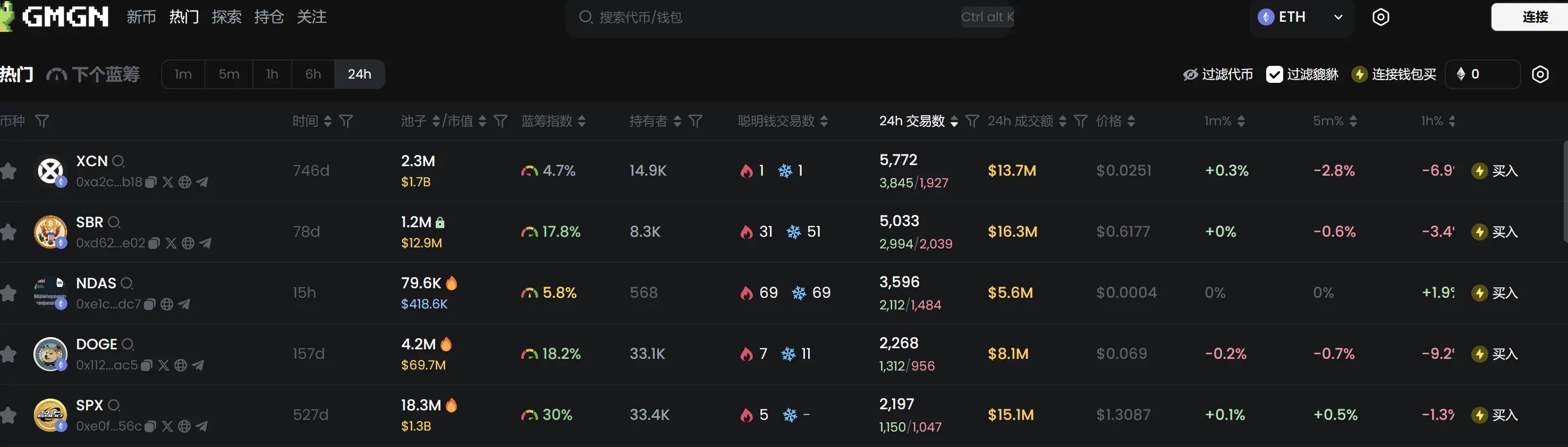

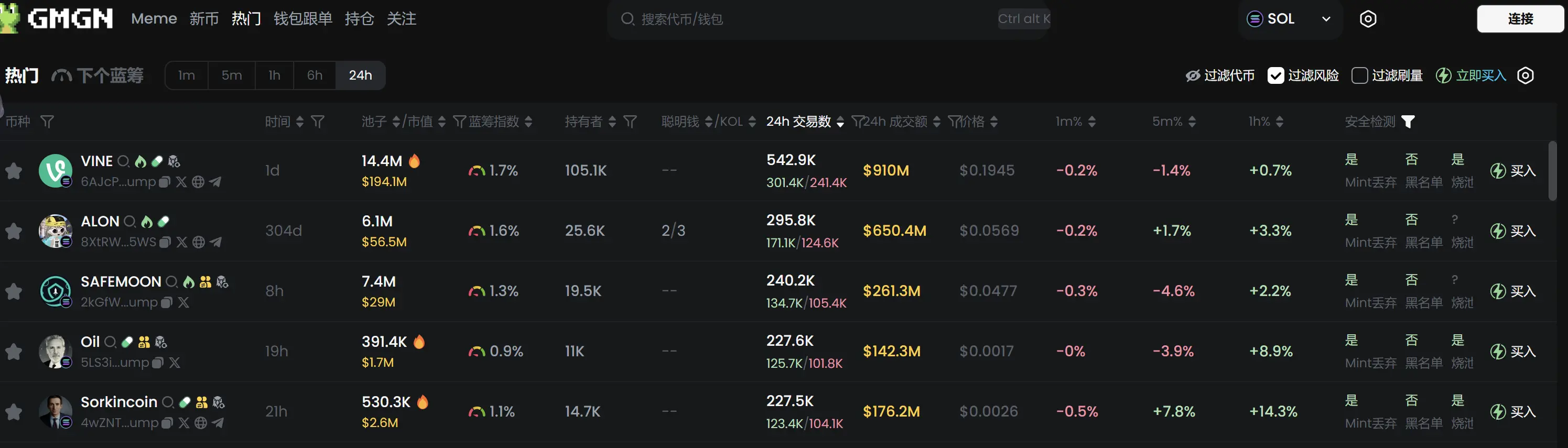

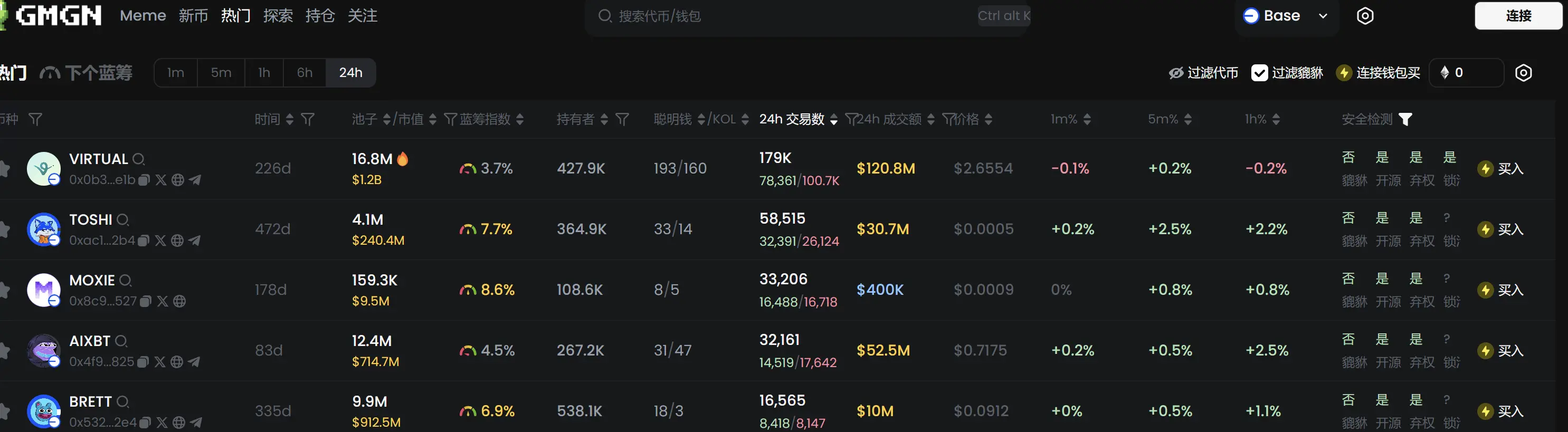

According to the meme token tracking and analysis platform GMGN, as of January 24, 19:50:

In the past 24 hours, the top five popular Ethereum tokens are: XCN, SBR, NDAS, DOGE, SPX

In the past 24 hours, the top five popular Solana tokens are: VINE, ALON, SAFEMOON, Oil, Sorkincoin

In the past 24 hours, the top five popular Base tokens are: VIRTUAL, TOSHI, MOXIE, AIXBT, BRETT

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。