Macroeconomic Interpretation: Today, U.S. President Trump signed a landmark executive order aimed at strengthening America's leadership in the digital financial technology sector. This order establishes a Presidential Digital Asset Market Working Group to develop a federal regulatory framework while exploring the possibility of creating a national digital asset reserve. The release of this executive order has undoubtedly sparked widespread attention and discussion within the cryptocurrency sector, and its impact on the crypto market, especially BTC, is worth exploring in depth.

The executive order signed by Trump clearly outlines several key points aimed at protecting and promoting access to and use of open public blockchain networks for American citizens and the private sector. This initiative not only ensures citizens' freedom in developing and deploying software, participating in mining and validation, conducting transactions, and self-custody of digital assets, but also emphasizes the importance of dollar sovereignty, encouraging the development and growth of dollar-backed stablecoins. These measures undoubtedly provide strong policy support for the healthy development of the cryptocurrency market, enhancing investor confidence in the crypto market.

On the regulatory front, the executive order requires the Presidential Digital Asset Market Working Group to propose a comprehensive federal regulatory framework to manage the issuance and operation of digital assets in the U.S. (including stablecoins). The development of this framework will consider various factors such as market structure, oversight, consumer protection, and risk management, aiming to provide a clear and certain regulatory environment that reduces market uncertainty. For the cryptocurrency market, the clarity of the regulatory framework helps enhance market transparency and standardization, thereby attracting more investor participation.

It is noteworthy that the executive order also explicitly prohibits the establishment, issuance, circulation, and use of central bank digital currencies (CBDCs) within the jurisdiction of the United States. This decision reflects the Trump administration's cautious attitude towards CBDCs, believing that they may pose a threat to economic freedom and financial stability in the U.S. In contrast, cryptocurrencies, as a form of decentralized currency, align more closely with the Trump administration's pursuit of financial autonomy. Therefore, this decision is expected to further solidify the position of cryptocurrencies within the U.S. financial system.

In exploring the establishment of a national digital asset reserve, the executive order requires the working group to assess its feasibility and propose standards for its creation. This initiative indicates that the Trump administration is considering incorporating cryptocurrencies into the national reserve system to enhance the flexibility and stability of the national financial system. If this plan is implemented, it would signify a further elevation of the official recognition of cryptocurrencies, potentially bringing greater development space to the cryptocurrency market.

Additionally, the executive order rescinds two related executive orders from the previous administration, deeming them as stifling innovation and harming economic freedom in the U.S. This decision undoubtedly provides a more relaxed policy environment for the innovative development of the cryptocurrency market, helping to stimulate market vitality and promote continuous progress and application expansion of cryptocurrency technology.

From the market response, Trump's executive order on cryptocurrencies has had a positive impact on the cryptocurrency market. Investor confidence in cryptocurrencies has been strengthened, and market activity has increased. Particularly, Bitcoin (BTC), as the leader of the cryptocurrency market, has seen its price buoyed to some extent by the executive order. However, it is also important to note that the cryptocurrency market is highly volatile and influenced by various factors, so the long-term impact of the executive order on the market still needs further observation.

In summary, the executive order signed by Trump brings positive policy signals to the cryptocurrency market, helping to enhance market transparency and standardization while boosting investor confidence. At the same time, the prohibition of CBDCs and the exploration of a national digital asset reserve reflect the U.S. government's recognition and importance of cryptocurrencies. However, the future development of the cryptocurrency market still faces many challenges and uncertainties, and investors should remain rational and invest cautiously. With the guidance and support of policy, we have reason to believe that the cryptocurrency market will usher in a broader development prospect.

BTC Data Analysis:

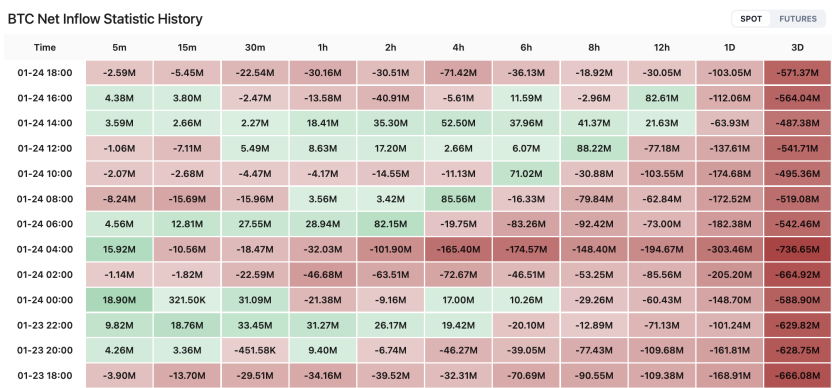

According to coinank data, in the past 24 hours, the net inflow and outflow of BTC funds are shown in the chart. Overall, the outflow of funds is greater than the inflow, which is also the reason for the market correction.

The market has been eagerly anticipating the potential benefits that #Trump could bring to the cryptocurrency sector, and the good news has arrived, such as today’s announcement that “Trump has established a cryptocurrency working group to explore the creation of a national digital asset reserve,” along with “Trump's first cryptocurrency executive order: proposing a federal regulatory framework and assessing the establishment of a national digital asset reserve.”

However, the #BTC market did not react significantly in the short term. I think there may be several factors:

First, there was actually news from a cryptocurrency-enthusiast congressman last night that significant news was about to be released, which led to a preemptive rise in the market, and when the news was announced, it was a case of good news being priced in.

Second, Trump's executive order on cryptocurrencies does not establish a #Bitcoin strategic reserve as the market had anticipated, but merely assesses the possibility.

Third, the U.S. stock market is currently closed, and #ETFs cannot be traded. Coupled with the time difference and rest, there may be some reaction when the U.S. stock market opens in the evening.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。