Author: Biteye Core Contributor viee

Editor: Biteye Core Contributor viee

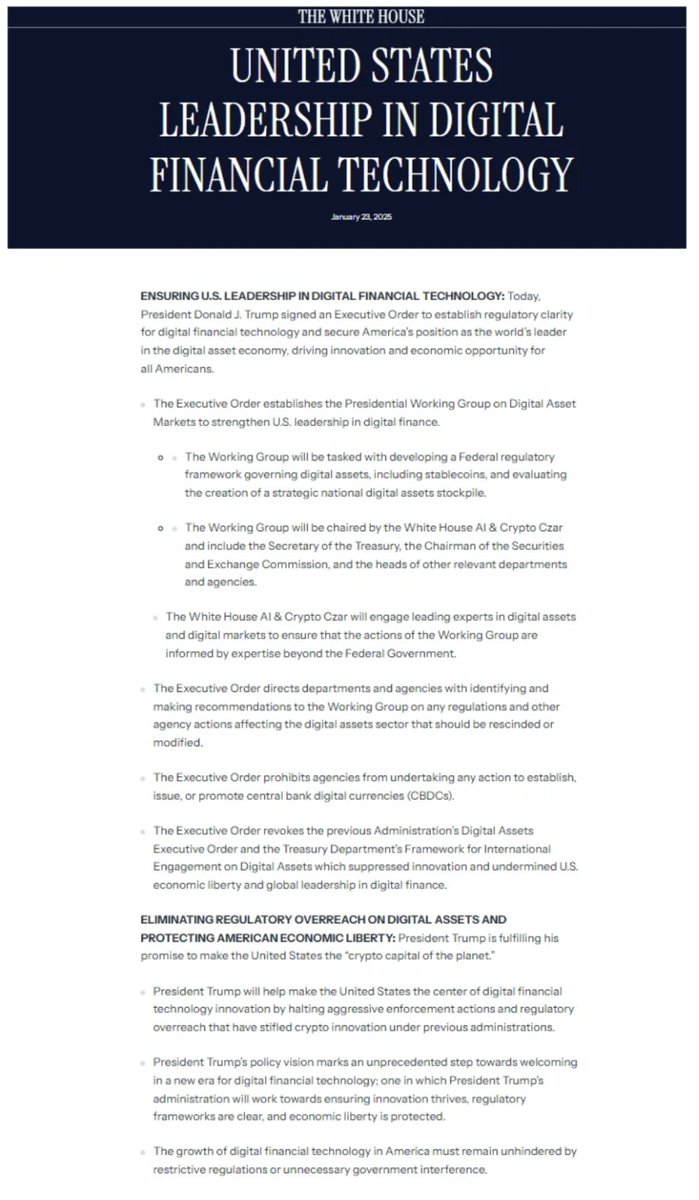

Yesterday (January 23, 2025), Trump signed a highly anticipated executive order at the White House, officially announcing that the United States will increase policy support in the fields of artificial intelligence (AI) and digital cryptocurrencies. This not only indicates Trump's intention to push the U.S. to take a leading position in the global AI race but also releases a positive signal for the cryptocurrency sector.

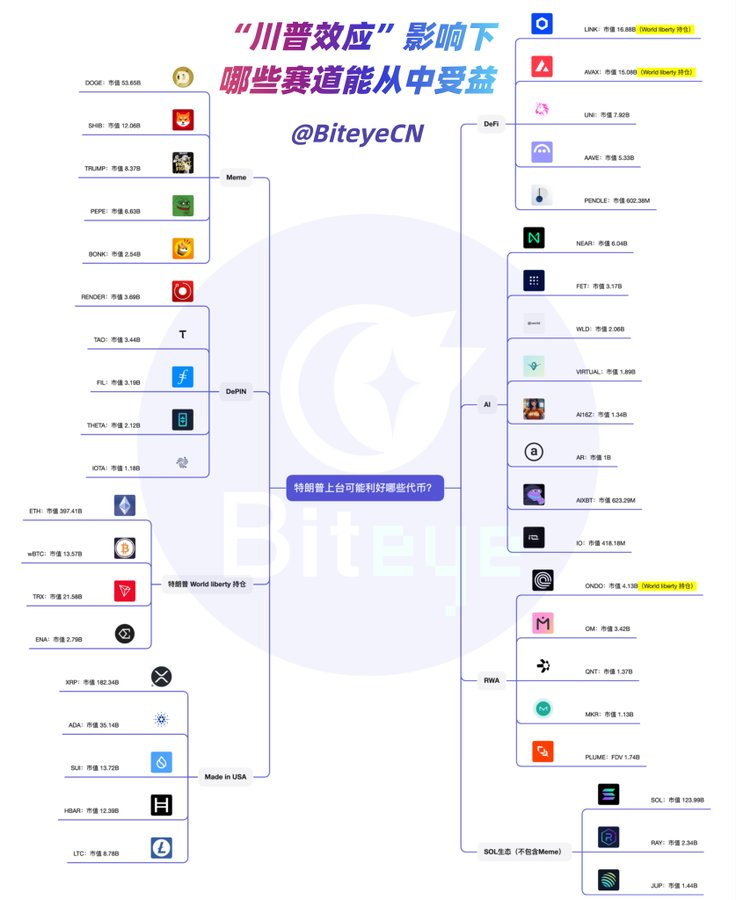

Compared to the regulatory approach of the Biden administration, Trump's policies are bold and sweeping, potentially allowing projects that have been overshadowed by regulatory concerns to experience a long-awaited revival. From DeFi to AI, and MEME coins, will these sectors see a new wave of growth driven by the "Trump Effect"? Can he, like last time when he led the "$Trump Coin Boom," catch the market off guard again?

In this article, Biteye outlines several key sectors and related tokens that may benefit from this situation.

1. DeFi: Accelerating Compliance and Mainstream Adoption

The DeFi project World Liberty Financial launched by the Trump family undoubtedly injects a strong boost into the DeFi sector. The WLFI project is not a hasty endeavor but operates within a regulatory framework after thorough legal compliance preparations, especially in terms of compliance. This means that, in addition to showing a high level of optimism for DeFi, WLFI may signal a more lenient regulatory environment for the cryptocurrency industry under Trump's administration.

Moreover, based on the new DeFi tax regulations proposed by the IRS in December 2024, it can be speculated that more systematic DeFi regulatory laws may be introduced in 2025, making compliance in the DeFi industry a potential trend for cryptocurrency development in 2025. The establishment of a compliance framework to promote the development of the DeFi industry, combined with Trump's lenient stance on cryptocurrency regulation, may encourage more traditional financial institutions to enter the DeFi space. Currently, $LINK and $AVAX are the two highest market cap tokens in the DeFi sector and are also held by WLFI, which may find new opportunities in this wave of policy adjustments.

2. AI: Trump Vows to Make the U.S. the World Capital of Artificial Intelligence

In his inaugural speech, Trump mentioned increasing investment and development in the field of artificial intelligence (AI), particularly in decentralized AI infrastructure. On Tuesday, the White House announced a collaboration with tech giants like Oracle, OpenAI, and SoftBank to launch a $500 billion AI infrastructure project. On Thursday, Trump signed an executive order related to the cryptocurrency industry and artificial intelligence, setting a 180-day deadline to formulate an "Artificial Intelligence Action Plan" and a federal regulatory framework for managing digital assets (including stablecoins), as well as assessing the creation of a strategic national digital asset reserve. The executive order also prohibited central bank digital currencies (CBDCs), as Trump believes they would "threaten the stability of the financial system, personal privacy, and U.S. sovereignty."

Against this backdrop, the potential for the combination of AI and cryptocurrency is particularly noteworthy, especially in the DeFi x AI (DeFAI) sector, where decentralized AI applications and algorithmic trading may receive more support.

3. RWA & DePIN: Tokenization of Real-World Assets

The Trump family's World Liberty Financial is not only involved in the DeFi sector but also in RWA (Real-World Assets) related tokens, such as $ENA and $ONDO. Robinhood CEO Vlad Tenev and well-known cryptocurrency trader Andrew Kang have both expressed optimism that Trump’s administration will accelerate the transfer of stocks, private companies, and real-world assets (RWA) onto the blockchain through tokenization. The recently launched RWAFi concept project Plume Network was also publicly invited to Trump's inaugural ball.

In addition to RWA, last month Trump spoke at the Blockchain Association's annual gala, stating that real use cases like DePIN legitimize cryptocurrencies and are a legislative priority.

This information inevitably raises questions about the impact of Trump's administration on the RWA and DePIN sectors. In a lenient policy environment, these sectors may experience a golden development period.

4. Meme Coins and the SOL Ecosystem: Reassessing the Potential of "Altcoin Season"

The Trump Meme coin launched by Trump created a market cap of $24 billion on its first day, bringing a new wave of attention to the Meme coin sector, with Web2 speculators rushing in overnight. The popularity of $TRUMP is a rare combination of politics and finance in cryptocurrency history, and "presidential coin issuance" undoubtedly has far-reaching market implications.

Additionally, the decision to deploy the $TRUMP token on the Solana chain further strengthens the market recognition of the Solana ecosystem and may become a catalyst for Solana's future development, potentially impacting the following areas:

Increased Capital Inflow into the Solana Ecosystem: Due to the high market cap of $TRUMP and the influence of the Trump family, Meme coin projects on the Solana chain have attracted significant capital and market attention. This capital inflow may not be limited to Meme coins themselves but could also encourage more developers and project teams to choose Solana as their issuance and operating platform.

Potentially Accelerating the Approval of Solana ETFs: As a representative of high-performance blockchains, Solana has a foundation for market acceptance. Trump's involvement not only increases Solana's market exposure but also helps its recognition in traditional financial markets, thereby accelerating the approval process for Solana ETFs.

Possibly Laying the Groundwork for "Altcoin Season": Meme coins driven by celebrity and political power may trigger the emergence of more similar projects, absorbing most of the liquidity on-chain and potentially driving the next "altcoin season."

5. World Liberty Holdings & U.S. Native Coins: Strongest Connection to Trump

These two sectors have a relatively strong connection to Trump and do not require further elaboration. Currently, the top ten tokens held by World Liberty are: $ETH, $wBTC, $STETH, $USDC, $TRX, $USDT, $AAVE, $LINK, $ENA, $ONDO. Additionally, projects sponsoring Trump's inauguration and cryptocurrency gala can be noted, including TRON, Ripple, Anchorage, Kraken, Sui, MetaMask, Galaxy, Ondo (ONDO), Solana, Etoro, Uniswap, and cryptocurrency public companies Coinbase, MicroStrategy, Marathon Digital, Nano Labs, Exodus, Metaplanet, etc.

6. Conclusion

From DeFi to AI, from RWA tokenization to Meme coins, as the "crypto president," every move Trump makes challenges the traditional industry landscape. His cryptocurrency policies may drive the industry towards a more compliant and mature direction in the coming years.

However, the true future of the cryptocurrency industry relies not only on short-term policy dividends but also on continuous innovation in its underlying technology and ongoing compliance efforts. Will Solana seize this opportunity to break through its bottleneck? Can sectors like DeFi and RWA rejuvenate within a compliant framework? At the intersection of policy relaxation and technological innovation, how will crypto assets dance with the traditional financial system? We can foresee that the coming years will be a critical period for all these transformations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。