Author: flowie, ChainCatcher

Despite Trump stating that he "doesn't know much" about his namesake meme coin TRUMP, the Trump family's entire crypto layout undoubtedly has a strong "operator" behind it.

The seemingly casual launch of the TRUMP coin is actually the result of clear pre-established collaborations with multiple project parties such as Moonshot, Jupiter/Meteora, making them the biggest beneficiaries behind Trump's epic coin issuance, aside from Solana.

For instance, Moonshot, which supports meme coin purchases, quickly added 400,000 users, becoming a strong new challenger in the CEX space. Meteora, from the same team as Jupiter, is the fastest-growing project in the Solana ecosystem benefiting from this Trump coin issuance… As a carefully selected partner of Trump, they are worth long-term attention.

Primary Supporters/Beneficiaries of Trump's Coin Issuance

Moonshot——Added 400,000 users, CEX* challenger*

After the issuance of Trump's coin (TRUMP), Moonshot, as the official purchasing channel recommended by Trump, added over 400,000 new users within 24 hours, processing nearly $400 million in transaction volume. Due to the trading frenzy surrounding the TRUMP token, Moonshot briefly rose to the top of the free finance apps on the US Apple App Store, surpassing Coinbase, PayPal, and Robinhood.

According to statistics from @sliceanalytics on Dune, Moonshot gained 187,400 new on-chain users solely through TRUMP, while the previously popular TikTok meme Chillguy only brought in over 7,200 new users.

Currently, the cumulative trading volume of TRUMP on Moonshot has also reached nearly $750 million.

After the issuance of Trump's coin, Robinhood also collaborated with Moonshot, allowing over 20 million users on Robinhood to seamlessly deposit into Moonshot, opening up more traffic for Moonshot.

Moonshot is not a meme launch platform launched by DEXScreener, but rather comes from the same lineage as Pump.fun, both incubated by Alliance DAO.

Shortly after its launch in July last year, Moonshot was recommended by meme super influencer Murad. Its feature is the support for fiat currency to purchase meme coins. Users can quickly fund their accounts through common payment methods like Apple Pay, credit cards, and PayPal, without the need to manage complex blockchain wallets or pay gas fees.

Moonshot has gathered a large number of popular meme coins, including many tokens that have not yet launched on secondary or top exchanges.

Around October last year, Moonshot truly gained popularity due to the "listing effect" presented by the early listings of major tokens like MOODENG, SPX6900, Chillguy, and GOAT, earning it the title of the Binance of the meme world, a small Binance on-chain.

Because it allows for quick fiat deposits, Moonshot is more likely to attract users from outside the crypto space, with MOODENG and Chillguy being concept coins from TikTok.

The rapid launch of the $30 billion presidential meme TRUMP is expected to become the best showcase of Moonshot's "listing effect," and the platform's listing effect and carefully selected tokens are worth ongoing attention.

Moonshot allows a massive number of users to participate directly, bypassing CEX, which poses a significant threat to CEX.

Currently, Moonshot has not disclosed any coin issuance plans.

Jupiter/Meteora——Shaking up the Solana DeFi landscape

Jupiter, as the largest DEX aggregator on Solana, is a well-known star project in the crypto community. Many users may not be familiar with Meteora, a liquidity platform for stable assets on Solana. In fact, Meteora and Jupiter share the same founding team; the Jupiter team founded Meteora before establishing Jupiter.

Meteora was originally named Mercurial Finance and issued the token MER in 2022, but due to the fallout from the FTX incident, it rebranded to Meteora and abandoned the MER token. The new token MET that Meteora originally planned to issue has also not been released.

Jupiter and Meteora provided LFG tech stack and liquidity support for Trump's coin issuance.

After the issuance of Trump's coin, Jupiter mentioned on the X platform that the issuance of TRUMP used the same LFG tech stack as JUP, including DLMM pools, ILM design, and tight integration with Jupiter.

Jupiter stated that close collaboration with the Meteora team ensured the smooth issuance of TRUMP, not only on Jupiter but throughout the entire ecosystem using the Jupiter API (including applications like Moonshot).

On Meteora, it can be seen that the TRUMP team injected 10% of the initial liquidity into the TRUMP/USDC trading pair through Meteora, using the DLMM mechanism to smoothly sell over $500 million worth of tokens to the market.

Both Jupiter and Meteora benefited greatly from this epic coin issuance collaboration with Trump, especially the previously obscure Meteora.

On the day of Trump's coin issuance (January 18), Jupiter's daily trading volume surged to $16.8 billion, setting a historical record of $20.6 billion the next day, more than three times its usual daily trading volume of around $6 billion.

Meteora's growth was even more dramatic, with trading volumes breaking new highs of $3.99 billion, $6.1 billion, and $4.7 billion from January 18 to January 20, which is about 8-10 times its usual trading volume of $500-600 million.

Meteora also became one of the most profitable protocols in the Trump effect. According to monitoring by @ai_9684xtpa, around 5 hours after Trump's coin issuance, TRUMP's mainstream liquidity pool protocol income on Meteora ranked second across the entire network in the past 24 hours, only behind Tether, with LP income reaching $12.2 million. If estimated based on average hourly fee income, it could reach as high as $58.08 million in 24 hours.

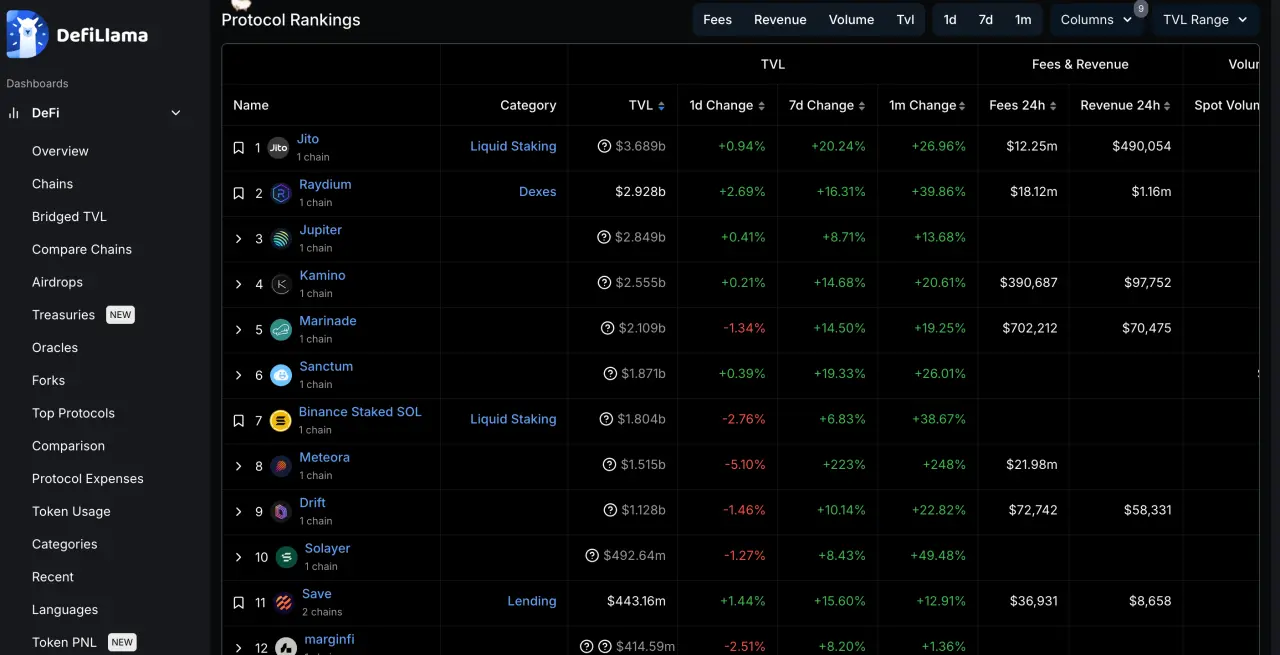

On January 21, according to DefiLlama data, Meteora's fees within 24 hours reached $111.93 million, surpassing Solana to rank first.

Meteora also ate into Raydium's market share, shaking up the DeFi landscape on Solana. According to Blockwork data, Raydium was previously the largest meme trading revenue generator on Solana, with a market share of around 90%. After the issuance of the TRUMP token, it dropped to 30%, while Meteora's share of meme coin trading on Solana rose from less than 10% to 60%.

Recommended reading: “Trump's Coin Issuance Shakes Up the Solana DeFi Landscape: Meteora's Daily Trading Volume Soars 8 Times, Raydium's Market Share Drops Below 30%”

Wintermute——Market-making Project as a Trendsetter

Wintermute quickly supported OTC trading of the TRUMP token after its issuance and further announced support for trading TRUMP tokens via API, providing streaming and RFQ pricing.

Previously, on-chain analysis indicated that the largest holding address for TRUMP was suspected to be Wintermute, suggesting that Wintermute may have previously collaborated to provide market-making services for the TRUMP token.

With the recent popularity of meme and AI agents, Wintermute's market-making projects, holdings, and trading dynamics have become a trend indicator for many players.

At the end of November, according to analysis by @ai_9684xtpa, 64% of the top 25 meme coins that Wintermute was market-making for had already launched on Binance, with 6 tokens simultaneously listed for both spot and perpetual contracts.

Crypto KOL @NFTbigbanana also analyzed Wintermute's market-making path, where a clear signal comes from the official Twitter account; before market-making, @wintermute_t may have interacted with or followed related meme Twitter accounts, or small tokens were transferred to Wintermute's wallet; then there is the accumulation phase, characterized by a long duration (6 months+) but not a significant pullback; finally, a large price surge.

Players can observe Wintermute's trading movements and associated addresses through platforms like arkm.

Other Meme Infrastructure in the Solana Ecosystem

In addition to Moonshot, Jupiter/Meteora, and Wintermute as the supporting teams behind Trump's coin issuance, other meme infrastructures in the Solana ecosystem have also benefited from a significant influx of traffic. DefiLlama data shows that the TVL of Solana ecosystem projects has generally risen over the past 7 days.

In the past 7 days, more than half of the projects that entered the top 20 in revenue came from the Solana ecosystem. Besides Solana, the main tools for meme trading and trading bots, as well as DEXs, ranked by revenue from high to low are: Photon, Pump, Moonshot, MEVX, Phantom, BullX, BONKbot, Raydium, Trojan, DEX Screener, GMGN.

Why are Polychain and Sun Yuchen rumored to be the leaders behind Trump's Coin Issuance?

It is currently difficult to definitively identify the exact operators behind Trump's coin issuance. However, key team members from various crypto projects associated with the Trump family, especially those from WLFI, as well as pro-crypto officials in Trump's new government, have participated to some extent.

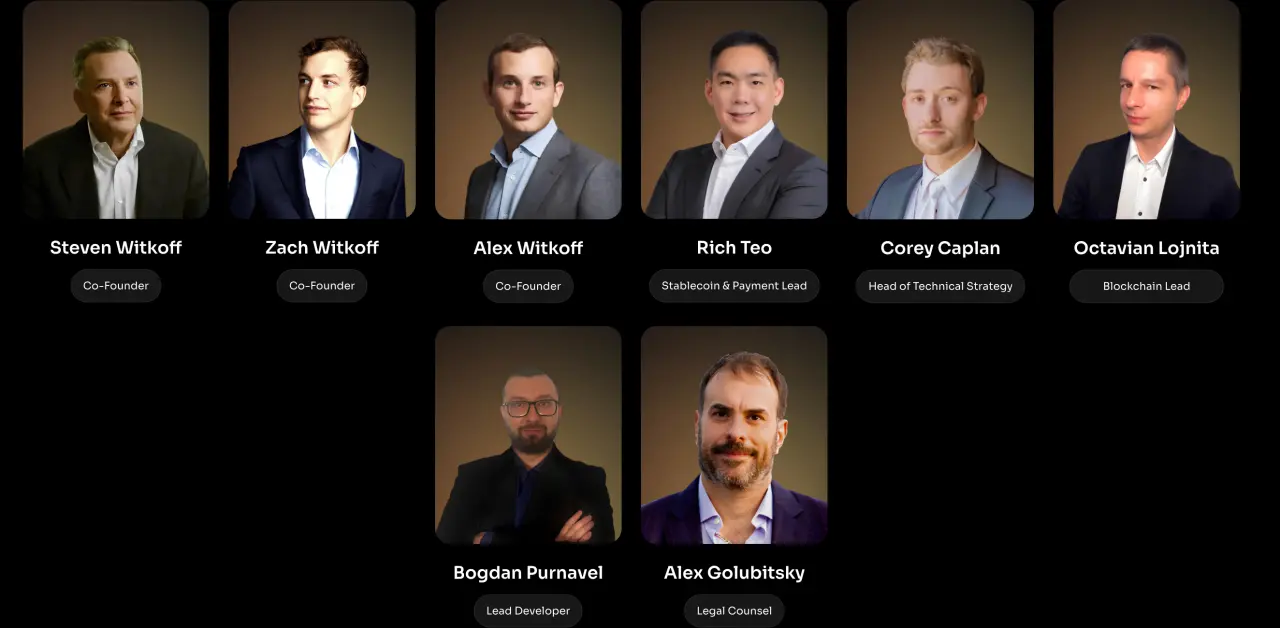

In addition to Trump and his family members, the five co-founders of WLFI are Chase Herro, Zak Folkman, Steven Witkoff, Zach Witkoff, and Alex Witkoff.

However, the crypto backgrounds of these five co-founders are not very deep, but they do have some connections to the crypto space. Chase Herro has been involved in businesses such as cannabis sales and weight loss products, with a complex background, and he previously collaborated with Zak Folkman on the DeFi project Dough Finance. Zak Folkman also runs a service called "Date Hotter Girls," which teaches how to approach women, making his background somewhat controversial.

Steven Witkoff is a real estate developer and a friend of Trump, having donated $2 million to Trump's campaign and being appointed as a special envoy to the Middle East. Zach Witkoff and Alex Witkoff are both sons of Steven Witkoff.

The other five specific business leaders and advisory members of WLFI are closely related to crypto.

Corey Caplan, the head of technology strategy at WLFI, is a co-founder of the DeFi project Dolomite.

WLFI's chief developer Bogdan Purnavel and blockchain head Octavian Lojnita both worked at Dough Finance in development-related roles. Coindesk also reported that WLFI allegedly obtained code directly from Dough Finance in its early stages.

Rich Teo, the head of stablecoins and payments, is the CEO of Paxos Asia.

In the advisory team, Sandy Peng is a co-founder of the Ethereum Layer 2 blockchain Scroll, Luke Pearson is a general partner at Polychain Capital, and Alexei Dulub is the founder of Web3 Antivirus and PixelPlex.

It is worth mentioning that ****Scroll in the advisory team is also one of the Layer 2 projects led by Polychain. Additionally, the prediction platform **Polymarket, which Trump has frequently retweeted this year, is also a project led by Polychain.

As a leading VC in the U.S., Polychain has significant connections with Trump and WLFI, and it has been speculated to be the most critical guiding force behind Trump's crypto layout.

Sun Yuchen's close interactions with Trump's crypto project WLFI and meme coins before and after the issuance of Trump's coin have also sparked market speculation that he is a key guiding figure behind this issuance.

Looking at Sun Yuchen's recent actions related to Trump, on November 24, 2024, he invested $30 million in WLFI and became an investment advisor for the project.

On January 19, 2025, Sun Yuchen invested another $45 million, bringing his total investment to $75 million.

On the day of the TRUMP coin issuance, January 18, Sun Yuchen quickly facilitated its listing on the HTX platform, with Huobi seeing over 100,000 new registered users in a single day, also gaining significant traffic benefits. Following that, starting January 20, WLFI increased its holdings of TRX twice, with a cumulative value exceeding $7 million. In the future, WLFI tokens will also be issued on the Tron network and will be listed on HTX at the earliest opportunity.

In addition to projects related to Trump's crypto initiatives like WLFI, some key pro-crypto officials in the Trump administration may also be involved, such as Vice President Vance, SEC Chairman Paul Atkins, and David Sacks, the White House director of AI and cryptocurrency affairs.

David Sacks has previously revealed his holdings in Sol, being a long-time supporter of Solana. The choice to issue Trump's coin on Solana may have also been influenced by David Sacks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。