At the end of 2024, the cryptocurrency market experienced an unprecedented rapid bull market, with Bitcoin's price soaring to over $100,000 shortly after Trump won the U.S. election, marking the beginning of Bitcoin's journey to $100,000. This wave of market activity not only propelled Bitcoin's rise but also led to the prosperity of the entire cryptocurrency market. Data shows that the total market capitalization of the global cryptocurrency market increased by approximately $1.8 trillion in 2024, with $1 trillion of that increase occurring after the election. However, this market frenzy became even more intense with Trump's official inauguration in January 2025, as his team launched a series of aggressive initiatives, including the introduction of his MEME coin, TRUMP, which saw its market capitalization exceed $160 billion within just two days. The celebrity effect in the crypto space, from Musk to Trump, shows that the sensitivity to information here far exceeds that of other industries. NX.one Research Institute will conduct an in-depth analysis of the Trump effect and the investment opportunities that can be seized in the Trump 2.0 era.

Review of How Trump's Election Victory Ignited Bitcoin

Let’s first review the initial Trump effect. After Trump won the U.S. election, Bitcoin's market performance can be divided into three breakthrough phases:

The first phase began on November 5, when Trump won the U.S. election, and Bitcoin's price started to rise rapidly. On November 10, Bitcoin's price broke the $80,000 mark, and just three days later, on November 13, it surged past $90,000, showing extremely strong market performance.

The second phase occurred on November 20, when news emerged that Trump's team was considering establishing a new position in the White House specifically responsible for cryptocurrency policy. This would be the first such position in White House history, reflecting the growing influence of the cryptocurrency industry on the new government. The day after this news broke, Bitcoin's price further climbed, breaking through $98,000.

The third phase was on December 5, when Trump officially nominated the pro-cryptocurrency official Atkins to be the new chairman of the U.S. Securities and Exchange Commission. According to insiders, Atkins plans to reduce regulatory restrictions on cryptocurrencies and ease penalties for related violations after taking office. Following this personnel announcement, Bitcoin's price soared again, successfully breaking through the $100,000 mark.

NX.one Research Institute believes that Trump's victory not only ignited Bitcoin but also initiated a new round of bull market for the entire cryptocurrency sector. The total market capitalization of the cryptocurrency market grew by 39.9% that month, rising from $2.48 trillion at the beginning of the month to $3.47 trillion. Ethereum also performed well, increasing by 47.8% that month, climbing from $2,511 to $3,711. Additionally, the altcoin market saw a revival, with XRP leading the market with a 362.3% increase, while MEME coins like DOGE and SHIB rose by 160.4% and 70.7%, respectively.

While the market was optimistic and advancing rapidly, the Federal Reserve lowered interest rates to 4.5%-4.75% on November 7, further boosting the rise of risk assets. At the same time, the resignation of SEC Chairman Gary Gensler sparked optimistic expectations for an improved regulatory environment. However, there is no doubt that the core driving force behind this bull market is the Trump effect.

Trump Officially Takes Office, Family Fully Engaged in the Crypto Industry

In January 2025, before Trump officially took office, he and his family members made a high-profile entry into the cryptocurrency industry, causing significant market fluctuations, starting with Trump and First Lady Melania issuing their personal MEME coins.

Trump Issues TRUMP Token:

On January 18, Trump announced on social media the launch of his personal MEME token, TRUMP (OFFICIAL TRUMP), marking the first time a U.S. president has issued a cryptocurrency. The issuance price of the TRUMP token was $0.1824, and within 12 hours of its launch, it surged over 15,000%, reaching a price of $82 and a market capitalization exceeding $82 billion.

The token was issued on the Solana blockchain, which was a crucial decision. NX.one Research Institute predicted in 2024 that there would be a competition between the Ethereum and Solana chains this year. The issuance of TRUMP sparked a frenzy in the market, with a large influx of investors trading on the Solana chain. Data shows that after the TRUMP token went live, trading volume on the Solana chain increased by 1,200% in a short period, benefiting several decentralized trading platforms (such as Jupiter, Raydium, and Meteora). The native token of Solana, SOL, broke through $290 on January 19, setting a new historical high, and Solana's market capitalization exceeded $159.2 billion.

In addition to strongly empowering the Solana chain, it also stimulated and encouraged the MEME coin sector. The successful issuance of the TRUMP token ignited broader market interest in MEME coins, leading to price increases for other MEME coins. Subsequently, Melania Trump announced the issuance of MELANIA on January 19, with its market capitalization quickly surpassing $10 billion. Trump's youngest son also launched a Meme coin named BARRON, which has now been listed on mainstream exchanges, with a market capitalization soaring to approximately $400 million in less than 24 hours.

Trump's two sons, Eric Trump and Donald Trump Jr., are also actively involved in the crypto space. Eric Trump promoted the TRUMP token on the X platform, calling it "the family's move into emerging business sectors." Additionally, the Trump family is deeply involved in the World Liberty Financial project, where Donald Trump Jr. is not only a promoter of WLFI but is also reported to be one of the project's leaders, participating in strategic decision-making. NX.one Research Institute will share updates on WLFI's recent developments later.

It is evident that the entire Trump family is now engaged in the cryptocurrency industry, and their ties are continuously deepening. However, the celebrity effect in the crypto space can be volatile, and market reactions cannot be predicted with 100% accuracy by oligarchs. For instance, while the issuance of the TRUMP token sparked a market frenzy and a large influx of funds into the crypto market, the launch of MELANIA surprisingly triggered a siphoning effect, causing the TRUMP token's price to plummet by 60%, indicating the market's heightened sensitivity to the Trump family's dynamics.

Volatility in the Crypto Market After Trump's Inauguration:

Despite Trump's repeated expressions of support for cryptocurrencies during his campaign, he did not mention cryptocurrencies in his inauguration speech on January 20. This unexpected omission led to significant volatility in the crypto market:

On January 20, as market funds entered in anticipation of potential positive information from the inauguration speech, the cryptocurrency market experienced a rollercoaster-like trend. Bitcoin's price soared from $99,600 to $109,200, only to experience a sharp drop afterward. In the early hours of January 21, Bitcoin hit a low of $100,200. By the afternoon of January 21, Bitcoin was fluctuating around $102,000, down 5.6% within 24 hours.

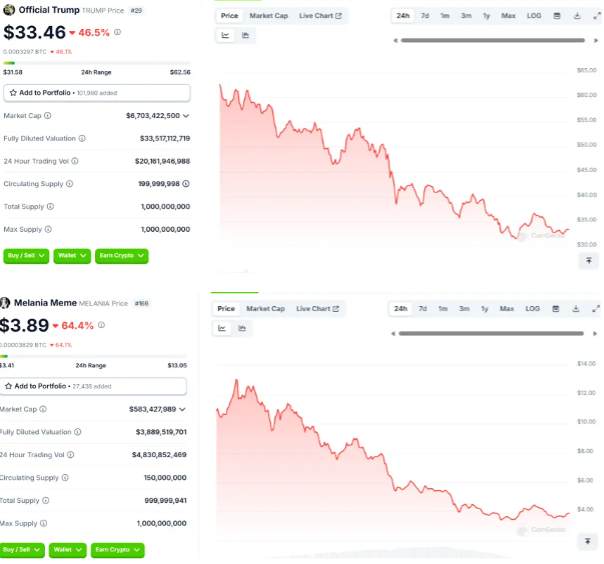

The volatility of MEME coins was even more pronounced, with the TRUMP coin dropping over 46% within 24 hours, reducing its market capitalization to $6.7 billion. The MELANIA coin saw an even steeper decline of 64% within 24 hours, with its market capitalization shrinking to $583 million. According to Coinglass data, over 250,000 people were liquidated across the cryptocurrency market in the past 24 hours, with liquidation amounts exceeding $750 million.

NX.one Research Institute believes that this phenomenon indicates the market's extreme sensitivity to Trump's words and actions, with his policy expectations having a significant impact on the crypto market. The Trump effect cannot only lead to endless price increases; if market expectations are not met, or if they fall short, the prices of tokens, especially MEME coins, can collapse like a mirage, posing significant risks.

Seizing Investment Trends in the Trump 2.0 Era

Although Trump did not mention cryptocurrencies in his inauguration speech or when signing executive orders, a series of recent actions by the DeFi project World Liberty Financial, supported by his family, indirectly demonstrate Trump's emphasis on the cryptocurrency sector. Here is a detailed analysis of WLFI's recent actions:

- Increased Holdings on Inauguration Day

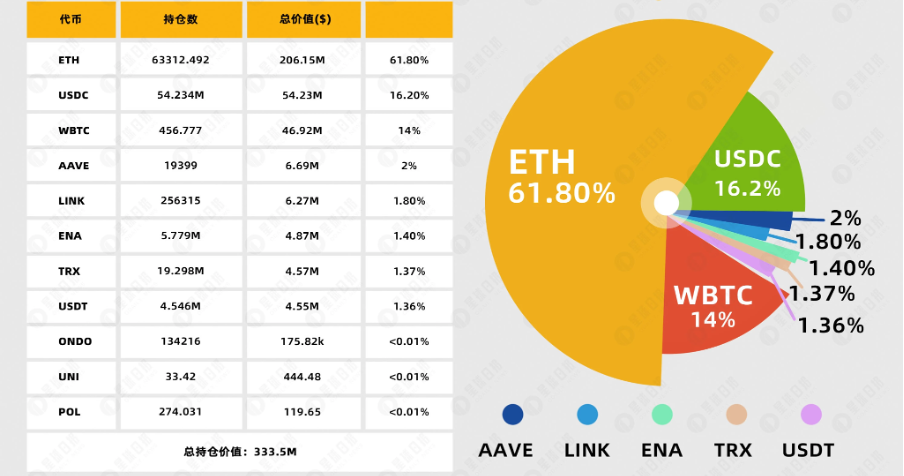

On January 20, the day Trump was inaugurated, WLFI announced it had increased its holdings of WBTC worth $32.81 million, ETH worth $37.47 million, TRX worth $4.7 million, and other cryptocurrencies, totaling over $88 million. This move not only showcases WLFI's long-term optimism towards crypto assets but also indicates its active positioning in the global crypto financial market.

- First Investment in Chinese Projects

In this increase, WLFI made its first investment in TRX, amounting to $4.7 million. TRON, founded by Justin Sun, is one of the leading projects in the blockchain space. This investment not only marks WLFI's strategic expansion into the Chinese blockchain community but also opens the door for deep cooperation in the crypto ecosystem.

- Collaboration with Ethena Labs

On December 18, WLFI announced a partnership with Ethena Labs to implement sUSDe in DeFi collaboration. This partnership will utilize Aave's lending infrastructure to further enhance WLFI's total value locked and attract more users.

- Other Holdings and Market Impact

According to a chart created by ODAILY showing WLFI's main holdings, ETH accounts for the highest proportion at 61%. Additionally, WLFI holds WBTC, AAVE, LINK, ENA, and other tokens. These holdings are seen as potential positives, bringing a "U.S. attribute" label to the related tokens.

Conclusion

The Trump effect has brought new development opportunities to the cryptocurrency industry while also triggering heightened market sensitivity and potential risks. NX.one Research Institute believes that although Trump did not mention cryptocurrencies in his inauguration speech, the market remains confident in his policy expectations. David Bailey, CEO of Bitcoin Magazine, stated that executive orders related to cryptocurrencies may be included among the first 200 executive orders after Trump's inauguration. Furthermore, the recent frequent increases in holdings and collaborations by WLFI, supported by the Trump family, also demonstrate their clear support for the cryptocurrency sector. These signs indicate that cryptocurrencies may still hold an important position in Trump's future policy planning. Investors should closely monitor subsequent policy developments and WLFI's further actions to seize the trends in the cryptocurrency market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。