Master Discusses Hot Topics:

At noon, the Bank of Japan raised interest rates by 25 basis points as expected, yet the market remained calm. I saw someone ask, "Isn't this interest rate hike a negative signal?" In fact, the financial market is never about the interest rate hike itself, but rather about expectations.

As long as it doesn't exceed expectations, it's considered good news. After all, the financial market is always most afraid of the unknown. Once you understand this logic, your trading mindset will also become clear. Looking back, the VIX index (fear index) of the US stock market is the most intuitive barometer. When VIX rises, the market tends to fall; when VIX falls, market sentiment naturally stabilizes.

This time, the interest rate hike in Japan didn't stir much of a wave, and the reason is simple: this was something the market had already anticipated. In contrast to Japan's interest rate hike, Trump's recent actions have become the hot topic in the crypto circle.

In the early hours, Trump announced a series of policies regarding cryptocurrencies, including the establishment of a national digital asset reserve and the formation of a cryptocurrency working group, also mentioning that the US aims to become the "global capital of AI and crypto." This is clearly a boost for Bitcoin! However, the market's reaction was somewhat strange: Bitcoin didn't rise but instead fell?

This is actually the main strategy of the big players. All publicly announced positive news, such as ETF listings, new cryptocurrency regulations, and national reserve plans, may excite retail investors in the short term, but the big players won't easily lift the market. Once retail investors rush in, the market is likely to correct.

Real upward movements often happen quietly. When all the news cools down, Bitcoin will finally experience a breakthrough after consolidation. Therefore, as long as it doesn't drop below 99.5k, short-term consolidation is actually an opportunity. Once the market's hype passes, the big players will truly exert their strength. By the time you notice, the price will have already soared.

This is Japan's third interest rate hike this year. The first time, the market indeed experienced a "circuit breaker panic," but the last two times? They were uneventful; everyone has gotten used to it. With the interest rate hike implemented, the market is just as it is. Instead, Trump's series of cryptocurrency policies, which bring long-term benefits, are more worthy of attention.

From the federal regulatory framework to the national reserve plan, once these things are implemented, Bitcoin's position will be further elevated. More importantly, traditional institutional money will gradually enter the market, pushing up the bottom price, and the future volatility will slowly decrease.

Speaking of this, I want to share a logic: relying on following others won't earn long-term money; trading is about logic and systems. Regardless of how it drops in the short term, Trump's policies still provide strong support for Bitcoin in the long run.

Looking at Japan, when the negative news landed, the market didn't even create a ripple, which indicates that the real big funds had already made their plans. Additionally, next Tuesday is our New Year's Eve, and the A-shares will be closed. A portion of the hot money during the Spring Festival will inevitably flow into the crypto circle.

Looking back at every Spring Festival, the gains in the crypto circle have been like a money-printing machine. So relax, the market still has a long way to go. With Trump making announcements, Bitcoin is riding the wave of national reserves. Japan's passive interest rate hike has left the market unfazed.

Consider this carefully; which one is more powerful? Investment is not about blind impulse but about direction. As long as the trend remains unchanged, maintain your confidence, buy on dips, and leave the rest to time.

Master Looks at Trends:

Resistance Level Reference:

First Resistance Level: 106000

Second Resistance Level: 105000

Support Level Reference:

First Support Level: 103600

Second Support Level: 102700

Today's Suggestions:

Currently, the first resistance is in the upper range of a short-term converging pattern, and a brief adjustment may occur. If the price rebounds to this area, considering it's close to the high point, it is recommended to adopt a short-term bearish trading strategy with a risk-reward ratio.

The second resistance belongs to a strong resistance area and needs to be observed further after breaking the first resistance. If accompanied by significant upward momentum, further breakout trends may be anticipated.

If the first support can stabilize in the short term, it can be seen as a rebound support area within the triangular convergence pattern, potentially pushing the price further up. Even if the first support is broken, it does not mean an immediate shift to bearish.

At this time, it is crucial to focus on the second support level and observe whether the price can close above the previous low point. If so, consider attempting to establish long positions from that level.

Currently, this can be seen as testing yesterday's short-term low point. Since the current low point has already risen, the rebound view can be maintained. However, maintaining a rebound view does not mean expecting a continuous rebound; rather, it involves taking planned strategic actions based on real-time trends. It is essential to analyze the adjustment range and set reasonable target profit prices.

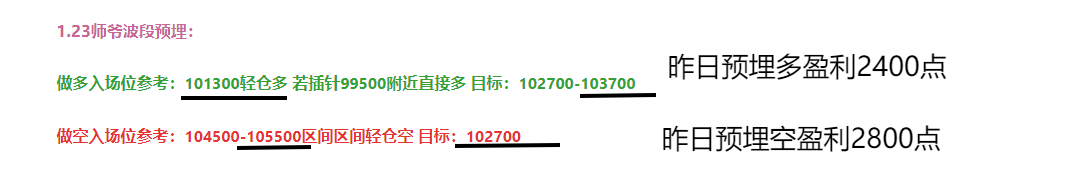

1.24 Master’s Band Strategy:

Long Entry Reference: Light long near 102700; if it dips to around 101500, go long directly. Target: 105000

Short Entry Reference: Light short in the 105000-106000 range. Target: 103600-102700

This article is exclusively planned and published by Master Chen (public account: Coin God Master Chen). Master Chen is the same name across the internet. For more real-time investment strategies, solutions, spot trading, short, medium, and long-term contract trading techniques, operational skills, and knowledge about candlesticks, you can join Master Chen for learning and communication. A free experience group for fans and community live broadcasts are now available!

Warm reminder: This article is only written by Master Chen on the official account (as shown above). Other advertisements at the end of the article and in the comments section are unrelated to the author! Please be cautious in distinguishing authenticity. Thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。