I waited until 4 AM and still didn't see any new bills signed by Trump, so I plan to submit my homework first. As time goes on, the price of BTC has also started to pull back. It seems that today's FOMO sentiment is somewhat disappointing, but from a medium to long-term perspective, today indeed marks the beginning of a new trend, although this is a long and drawn-out trend that may only belong to #Bitcoin.

Senator Cynthia Lummis, a strong advocate for cryptocurrency, has become the chair of the Digital Assets Banking Subcommittee. Lummis is also the first U.S. senator to submit a #BTC strategic reserve proposal. Her appointment essentially represents that the U.S. will go far in the field of cryptocurrency and BTC, especially as the connection between banks and cryptocurrencies becomes tighter.

Another piece of information is that the repeal of SAB121 is waiting for the new SEC chair, Paul Atkins, to take office and start pushing it forward. However, the timing of Paul Atkins' appointment is still uncertain, as his nomination requires Senate confirmation, but it shouldn't take too long. The current acting chair, Mark Uyeda, has also been doing well, initiating reforms in the SEC's approach to cryptocurrency on his first day in office. Overall, Trump's administration is favorable for cryptocurrency; although there hasn't been news of a BTC strategic reserve, it is still a good development, just a bit slower than many expected.

As of 4 AM Beijing time, there were fewer than 60 presidential orders signed by Trump, with many more to come. They may not arrive quickly, but there should be some content related to cryptocurrency. The current price pullback likely reflects a cooling of investor sentiment and a risk-off approach ahead of Japan's interest rate hike at 2:30 PM on the 24th Beijing time. However, it doesn't seem to be a big issue, as investors continue to bet on Trump.

Looking back at BTC's data, there isn't much to say. The price fluctuations are still evident, and the short-term investors' games are very obvious. However, many short-term investors seem to be interpreting Trump's favorable news, unfortunately, they have been let down twice. There is a strong exchange of chips between profit and loss among short-term investors, which also reflects market sentiment.

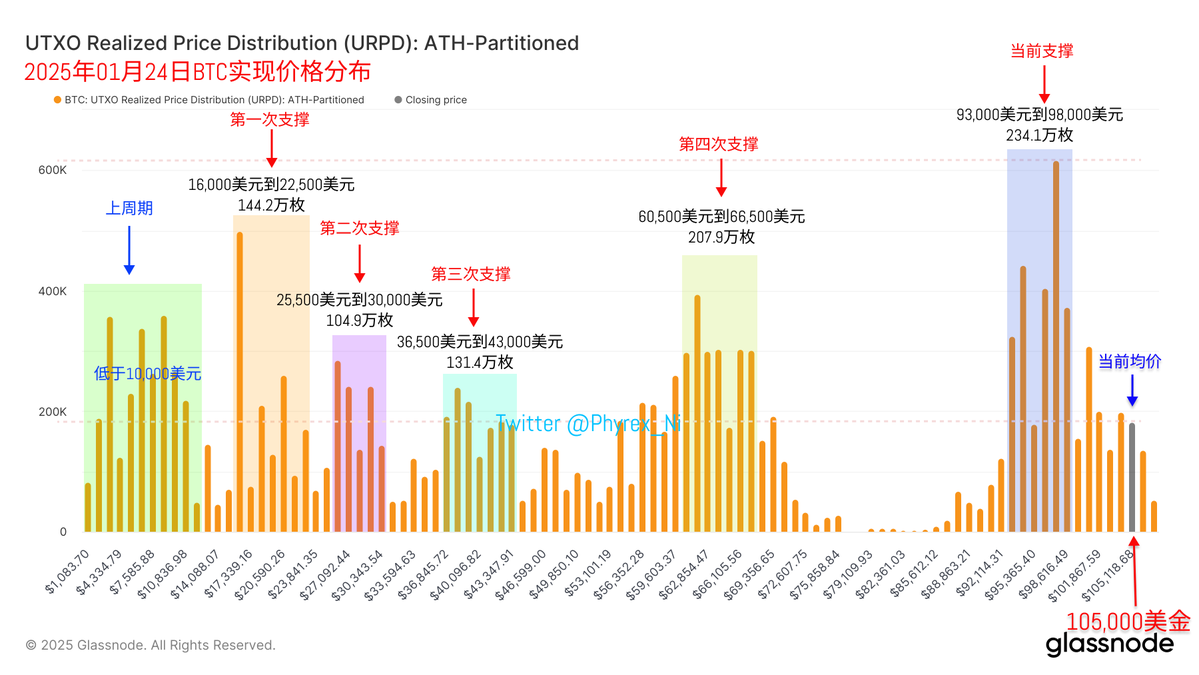

Although there has been a lot of turnover, support remains very stable. Even with two good expectations today, the price of BTC was nearly $107,000, but investors with holding prices below $92,000 have not changed much, and those with profits over $10,000 remain very indifferent.

The stability of support indicates that investor sentiment is currently very stable, and there are no signs of a large-scale price drop. The remaining factor is to see the situation with the yen's interest rate hike. Tomorrow is Friday, and I hope to offset the negative sentiment from the yen's interest rate hike before the weekend, so we can enjoy a good weekend.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。