Author: Li Dan

Source: Wall Street Journal

After Trump took office, he took action on cryptocurrencies by signing a presidential executive order aimed at promoting the development of the cryptocurrency industry. Additionally, there was good news from the U.S. Congress for the crypto community: a congressman who first proposed establishing a Bitcoin strategic reserve in the U.S. last year has been promoted.

On Thursday, January 23, Eastern Time, the White House announced that President Trump signed an executive order titled "Strengthening America's Leadership in Digital Financial Technology." The order mandates the establishment of a presidential "Working Group on Digital Asset Markets" within the National Economic Council, which advises the president.

The working group will be led by David Sacks, the White House's first AI and cryptocurrency special advisor, who has been dubbed the "AI and cryptocurrency czar." Members of the working group will also include the U.S. Secretary of the Treasury, Attorney General, Secretary of Commerce, Chairman of the Securities and Exchange Commission (SEC), Chairman of the Commodity Futures Trading Commission (CFTC), and other heads or designated personnel from government departments and regulatory bodies.

The executive order also explicitly mentions that the Trump administration is considering whether to adopt Bitcoin as a national reserve for the U.S. The order states that the working group will submit a report to Trump within 180 days of the order's issuance, providing regulatory and legislative recommendations. The report should focus on: managing a federal regulatory framework for the issuance and operation of U.S. digital assets, including stablecoins, and considering regulations on market structure, oversight, consumer protection, and risk management.

The working group "should assess the feasibility of establishing and maintaining a national digital asset reserve and propose standards for such a reserve, which may include cryptocurrencies lawfully seized by the federal government through enforcement actions."

However, amidst the market excitement, there remains a key question: whether the executive order is merely about establishing a national Bitcoin reserve based on existing funds seized from criminal activities over the years, or if it aims to create a larger reserve that can purchase more Bitcoin over time.

The executive order also explicitly prohibits central bank digital currencies (CBDCs). The order states:

"Except as required by law, all (federal government) agencies are hereby prohibited from taking any action to establish, issue, or promote CBDCs within or outside the United States."

The order requires that any government agency currently planning or undertaking initiatives related to establishing a CBDC in the U.S. must immediately terminate such plans and take no further action to develop or implement such initiatives.

Sacks stated that the new working group will "make America the world capital of cryptocurrency" under Trump's leadership, and actions in AI will ensure that the U.S. "dominates and leads the world in the AI field." Trump mentioned that these actions "will earn a lot of money for America."

U.S. Senate Banking Committee Establishes New Digital Asset Subcommittee Focused on Strategic Bitcoin Reserve Legislation

Earlier on Thursday, Tim Scott, chairman of the U.S. Senate Banking Committee, appointed Wyoming Senator Cynthia Lummis as the chair of the newly established subcommittee on digital assets. Lummis subsequently released a statement announcing that this new committee dedicated to digital assets will focus on two areas:

- Promoting responsible innovation and protecting consumers through bipartisan digital asset legislation, including legislation on market structure, stablecoins, and strategic Bitcoin reserves;

- Conducting strict oversight of federal financial regulatory agencies to ensure compliance with the law, including preventing the recurrence of Operation Chokepoint 2.0.

Operation Chokepoint 2.0 is reportedly a collaborative action taken by U.S. federal government agencies aimed at excluding cryptocurrency companies from the traditional banking system, and no formal documents have confirmed its existence to date.

In July of last year, Trump promised at the Bitcoin 2024 conference to classify Bitcoin as a strategic reserve asset for the U.S. Lummis, as an ally of Trump in the Senate, first proposed the Strategic Bitcoin Reserve Act that month, which calls for selling a portion of the Federal Reserve's gold reserves to purchase 1 million Bitcoins to establish the "strategic Bitcoin reserve" proposed by Trump. Based on the then-current price of Bitcoin, this would cost approximately $90 billion.

In Thursday's statement, Lummis again mentioned legislation related to the Bitcoin strategic reserve. She stated:

"Digital assets represent the future, and if the U.S. wants to maintain its leading position in global financial innovation, Congress urgently needs to pass bipartisan legislation to establish a comprehensive legal framework for digital assets and strengthen the dollar through a strategic Bitcoin reserve. … I look forward to submitting bipartisan legislation to President Trump this year to ensure our financial future."

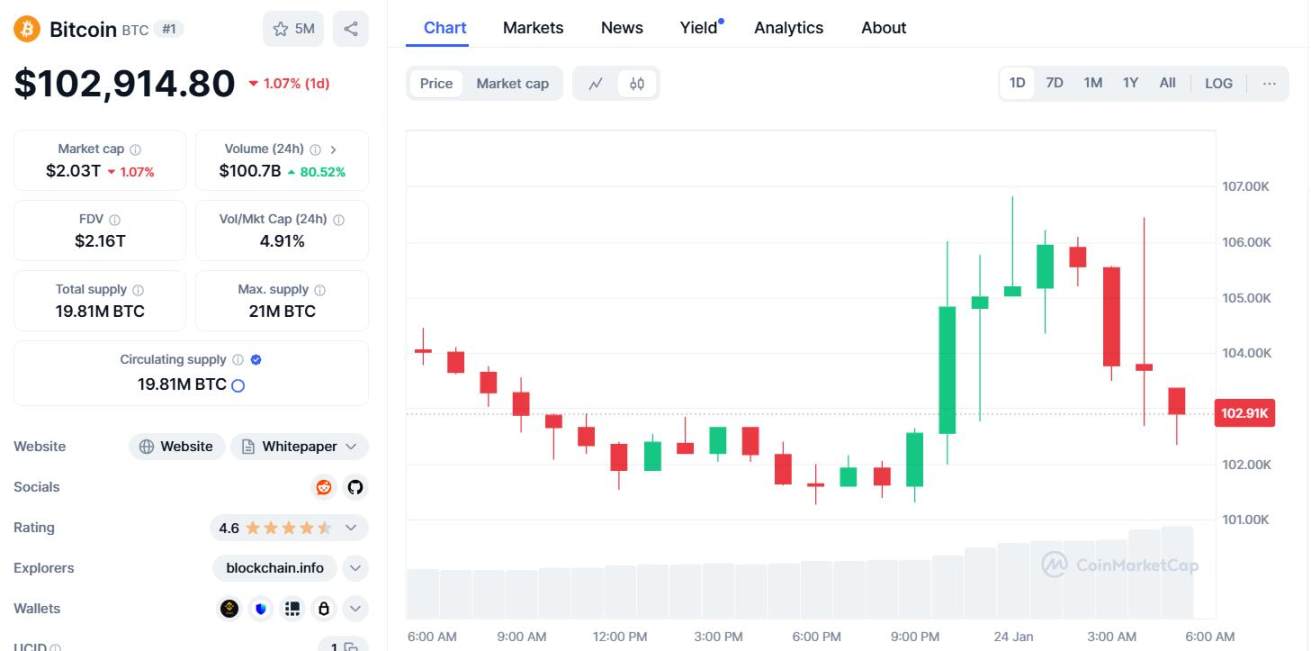

The news of Lummis's appointment quickly ignited the cryptocurrency market. On Thursday, the trading price of Bitcoin (BTC) against the U.S. dollar surged during the session.

According to CoinMarketCap, the spot trading price of Bitcoin against the U.S. dollar first fell below $101,300 during European trading hours, hitting a daily low, but accelerated its rebound after the U.S. stock market opened, rising above $106,800 towards the end of the morning session, an increase of over $5,000 or more than 5% from the daily low, approaching the intraday record high of over $109,000 set on Monday. However, the U.S. stock market fell back towards the end of the session, and after the market closed, it dropped below $103,000, down over 1% in the last 24 hours.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。