Great products are all similar.

Author: Deep Tide TechFlow

The new world comes like a dream, Bitget BGB!

Humans are creatures that need a sense of ritual, always turning a certain date into something special to say goodbye to the past. As the world becomes increasingly turbulent in 2024, there may always be a ticker that brings you to tears. Apart from the soaring Bitcoin, few have provided ordinary people with as many opportunities as BGB; memes are too volatile, and VCs are too inefficient.

However, BGB allows you to share in profits of a 1400% increase, as well as the secondary dividends of 15 tokens that first go on BG before hitting BN, along with countless financial benefits, clearly resembling a frontrunner.

A year-long period, BGB delivers a perfect score

The mindset of a problem-solver is well-suited for the on-chain games of Crypto, while the imagination of a dreamer is the valuation logic of platform tokens, from BNB's $800 to the DEX miracle of Hyperliquid, and BGB's more than tenfold increase in a year.

The underlying logic of the crypto world has always been trading, and trading platforms occupy the center of interaction between all project parties and retail investors. Whether D/C EX, the market always favors platforms with the best trading experience, and the tokens of exchanges and public chains are also the strongest value targets.

BGB as Bitget's platform token, an Alpha opportunity for ordinary people in 2024

Everyone in the crypto space dreams of becoming a whale.

For individuals, the greatest difficulty in the journey from 0 to 1 in capital accumulation is finding low-volatility, stable public chains, Super Apps, and exchange platform tokens as the most stable investment strategy, after which one can wait for the non-linear growth phase of wealth.

At the beginning of 2024, many believed that BGB at $0.5 was overvalued, but by the end of 2024, BGB had reached nearly $8.5, achieving an ATH, and the bull market has just begun. There is reason to believe this is just a local optimum, and the market will give BGB a fairer pricing.

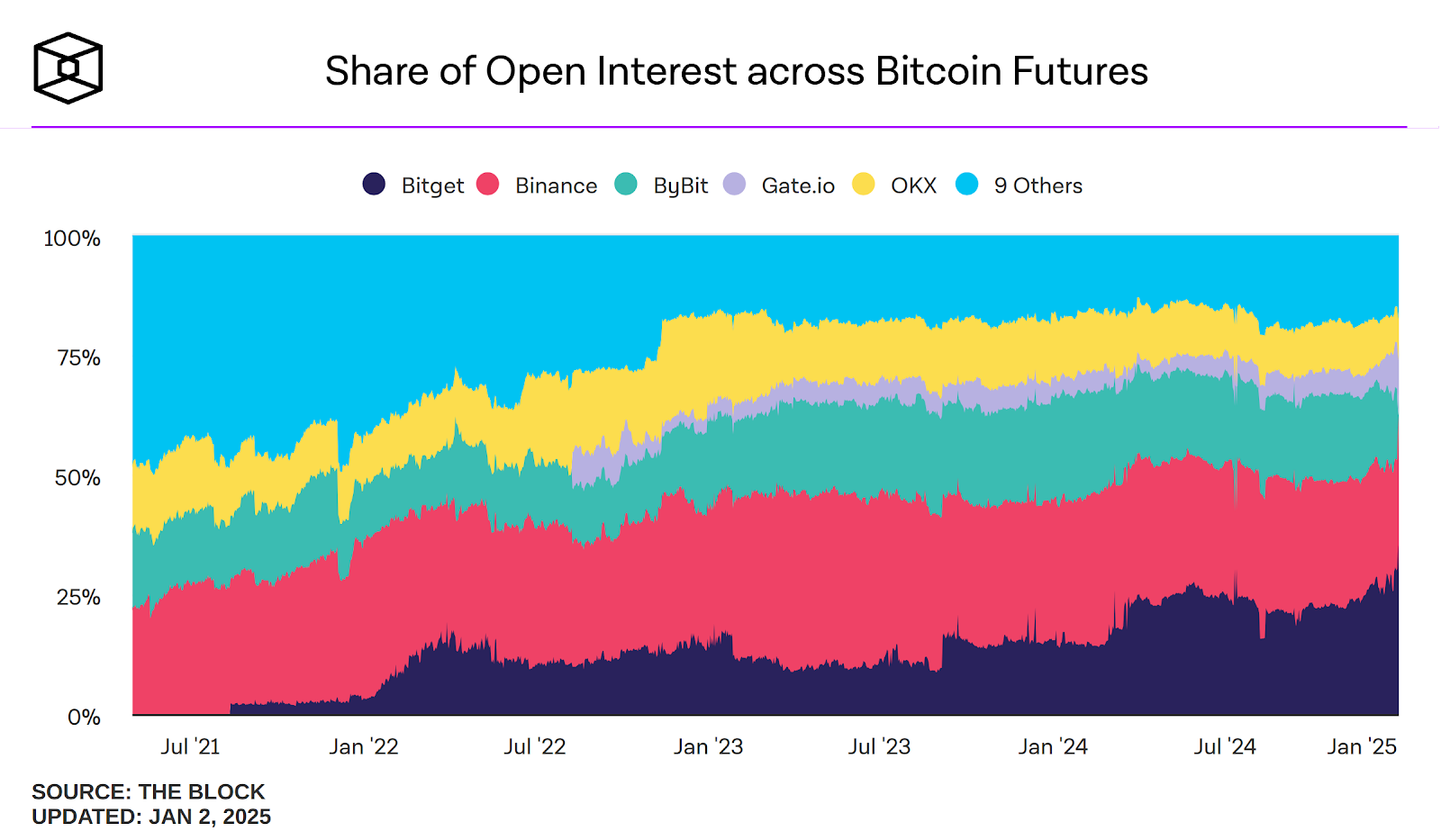

According to data from Defillama, Bitget's monthly capital inflow reaches $1.6 billion, ranking first among all CEXs, and in BTC contract data, Bitget even holds a 35% share, dividing the market into three parts, a rising star in crypto exchanges.

After 6 years, Bitget has completed its positioning in 2024.

In the coming year of 2025, surpassing new business models will also be a rightful expectation.

BGB, a proactive choice, allows you to share in the efforts of Bitget's 1700+ employees, as Bitget enters its growth phase.

Bitget is an expert in asset discovery and issuance, whether linking with Hyperliquid or actively absorbing Bitget Wallet token BWB, focusing all efforts on empowering BGB is Bitget's consistent approach.

Traffic is king: The crypto world is driven by hot topics; the issuance of projects and memes relies on leveraging favorable winds to soar high. Bitget has registered users reaching 45 million, discovering 23 projects entering Launchpool last year, becoming the most frequently opened application in the crypto space, firmly occupying the traffic center;

Realizing profits: If the increase in token price is the only metric, it is clearly insufficient for a platform token. In fact, BGB is now the operational core of Bitget. Holding BGB allows for appreciation, wealth management, new token subscriptions, fee reductions, and profit sharing—all for the Holders, whether whales or retail investors, today everyone is part of the BGB family;

Supporting token price: The better the profits and traffic, the more they will ultimately reflect in the token price. The biggest surprise at the end of 2024 is not that BGB has increased tenfold, but that trading volume is already comparable to BNB, while the market caps still have a tenfold difference, leaving everything for 2025.

It can be understood that BGB occupies a central position in leveraging traffic—profits—token price, with stable low-volatility returns leading to a continuous rise in token price, ultimately laying the foundation for BG to surpass numerous CEX/DEX in 2024.

In addition to actively holding tokens, BGB Beta returns connect in a line, coming from Bitget's continuous empowerment

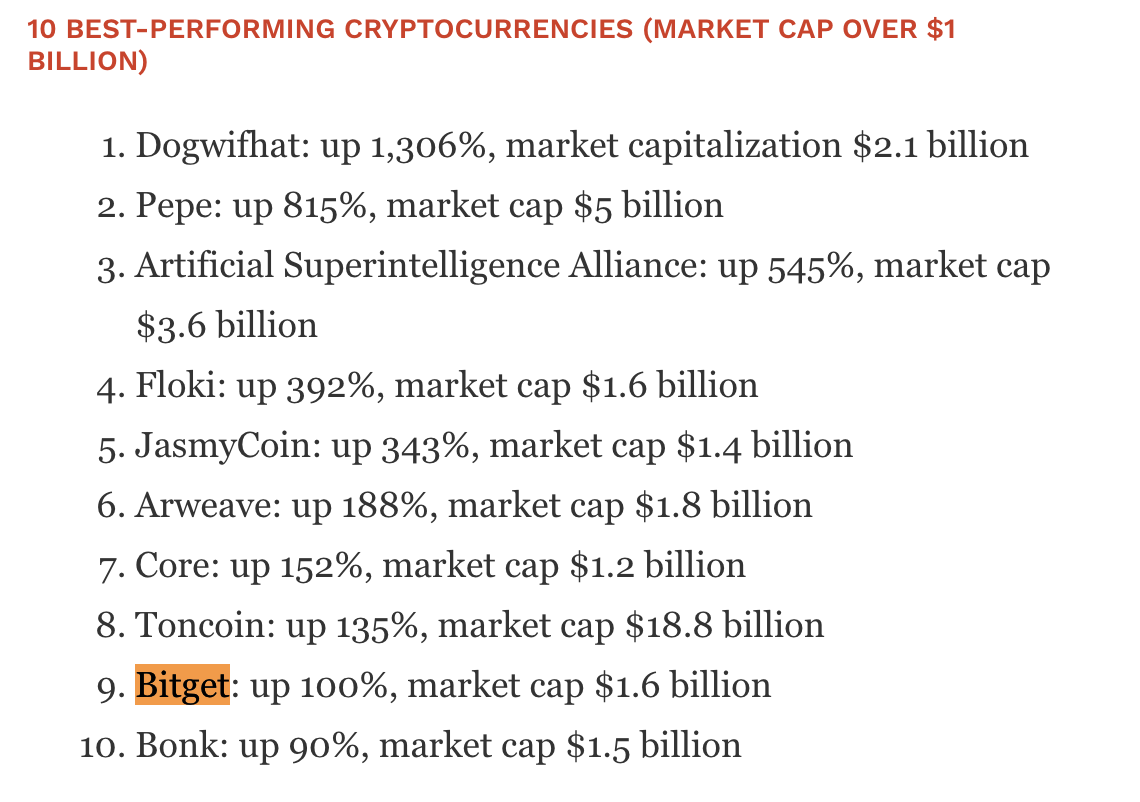

Every surge has its trace, and by mid-2024, Forbes listed BGB among the top ten tokens with the best performance at a $1 billion market cap, with four seats for MEME, three for Solana, and BGB being a rare exchange token, a true standout.

Compared to the emotional value of memes, BGB's value is tangible.

BGB has numerous rights, and we can only choose the most important ones to discuss, foremost being the new token subscription, with double happiness from Launchpad & Launchpool, allowing the use of BGB for early subscriptions of star tokens and sharing in star tokens through staking BGB.

Additionally, using BGB allows participation in a series of promotional activities, such as enjoying a 20% discount when paying with BGB. More creatively, holding BGB allows traders to share 10% of the profit from their trades.

There are also all-day mining rights in PoolX, along with wealth management, free withdrawals, VIP privileges, and many other benefits. In short, whatever others have, BGB has; whatever can be participated in on-chain, BGB can participate in, bridging the centralized and decentralized worlds to seize every hard-earned profit.

Of course, among all core rights, the most important is the ability to participate in new token subscriptions, reflecting Bitget's asset discovery capability.

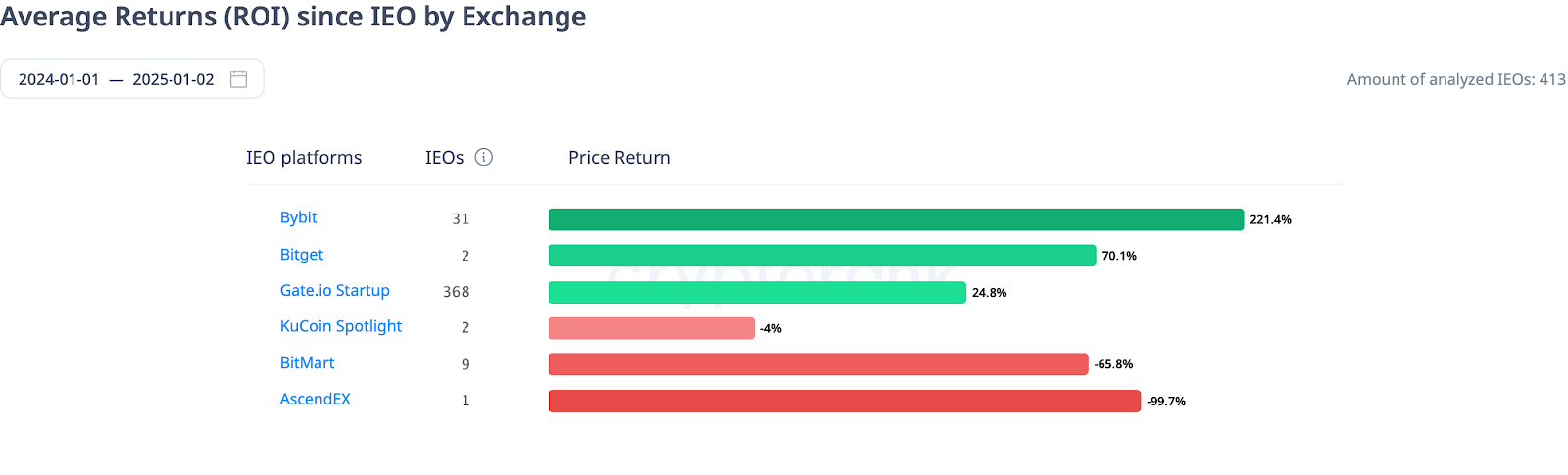

Contrary to what many imagine, Bitget once canceled spot trading to focus on building strength in contract trading, and when the time was right, spot operations were resumed, resulting in a miraculous ROI.

In 2024, BGB is focused on integrating various rights, while in the 2025 plan, BGB will break free from the constraints of platform tokens, truly becoming a real asset that flows seamlessly across on-chain, off-chain, Web2, and Web3.

Specializing in multiple capabilities, Bitget will deeply expand institutional and VIP services, creating a more diversified user structure;

Connecting with the BTC ecosystem, public chain ecosystem, and DeFi ecosystem, allowing more real trading links to become value transfer venues for BGB;

Breaking down barriers between Bitget U cards and merchants, allowing payments, stablecoins, and more crypto assets to become real consumption capabilities.

Ethereum is Money, while BGB is an asset, an asset that transcends the definitions of cryptocurrency and platform tokens. Let's witness it together in 2025!

Serving ordinary people, 2025 is the right time for a turnaround

The history of platform tokens is essentially the history of the iteration of trading venues. This is not just the history of CEX; even DEX can be included, as dYdX proved the feasibility of on-chain contracts, while Hyperliquid has taken it to the extreme. Similar to Bitget, Hyperliquid also developed the contract market first before moving to the spot market, placing Hype at the core of its ecosystem, without exception.

Great products are all similar, and Bitget has proven the reliability of its strategy six years ago.

In 2024, Hyperliquid and Bitget become twin stars of DEX and CEX. Hyperliquid's airdrop has created a group of retail investors who are neither poor nor rich but have expectations, and they will participate more actively in market liquidity. Hyperliquid's unique auction token model has also attracted more projects to launch on Hyperliquid.

A slight comparison shows that HyperLiquid benefits from decentralized technology and governance structure, achieving a daily income level of $50,000 with 300,000 users, while Bitget's team of over a thousand serves 45 million global users, with high-quality service yielding $3 million in daily income.

Different development philosophies represent the same path of progress; the core of exchanges is to enhance asset issuance and pricing capabilities. Hyperliquid can offer 50x leverage, while Bitget supports up to 125x. Despite various differences, Hyperliquid and Bitget share similarities in the wealth effect on their respective token-holding communities, and we can even quantify this wealth effect.

Assuming an ordinary friend, Xiao G, chooses to invest in crypto assets regularly, especially since the U.S. president openly supports Bitcoin. He looks at BTC/ETH, which are indeed good assets but too expensive, while BGB is more suitable for his situation.

Xiao G sets his investment amount at 100,000 RMB for the year, deciding to invest about 10,000 RMB each month.

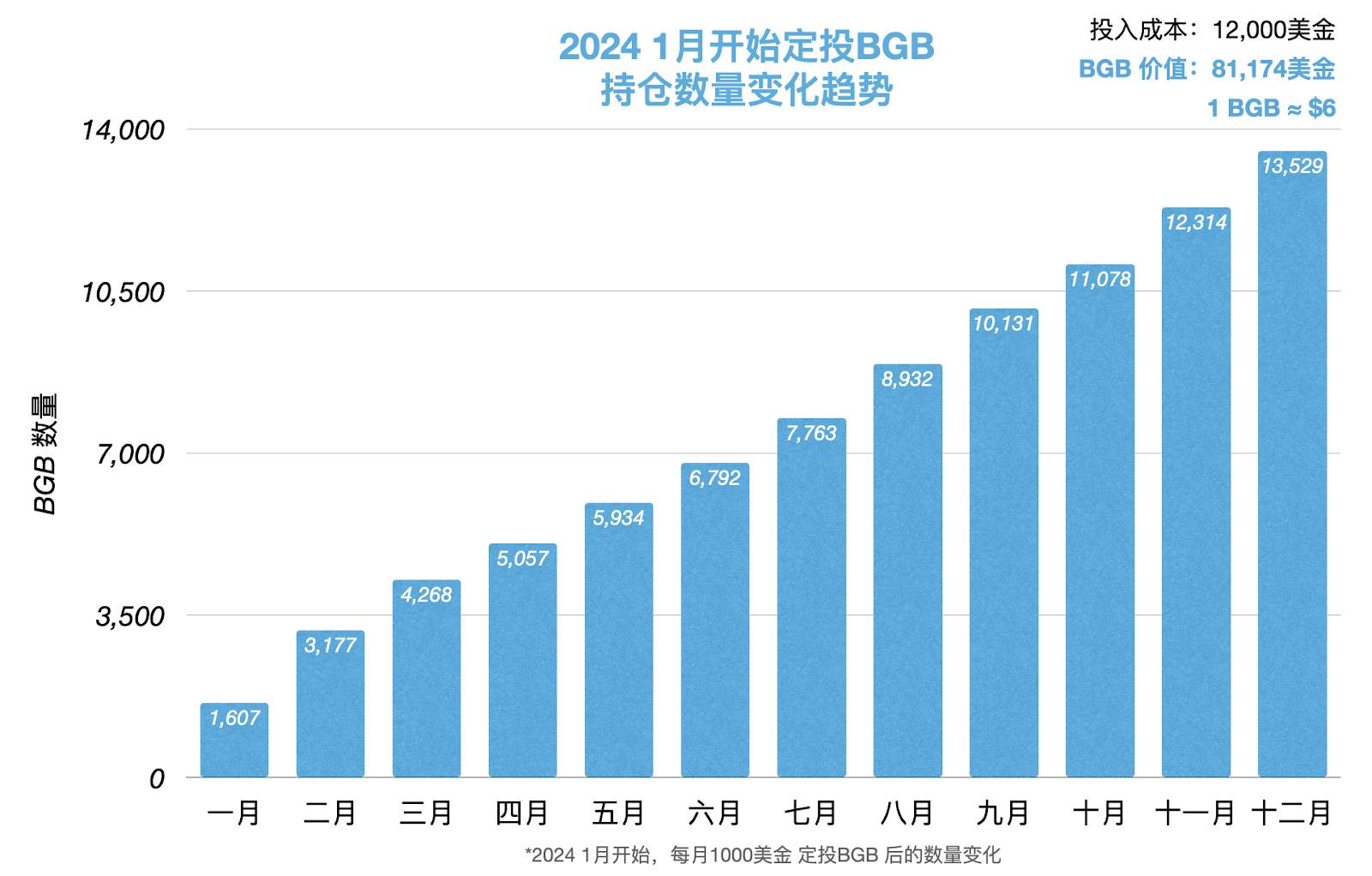

Assuming Xiao G invests $1,000 monthly at the beginning of the year, we can clearly see that as BGB's price increases, the amount of BGB he can buy with $1,000 each month decreases, but the dollar-based purchasing power continues to rise. Adding in launchpool returns, by the end of the year, he could obtain 13,529 BGB, with a total cost of only $12,000. At the closing price at the end of December, 1 BGB = $6, calculating the value at $81,174, yielding a 6.7x return.

Moreover, it is important to note that this does not include the 23 LaunchPools and one LaunchPad benefits that Bitget will launch in 2024. If we account for these returns and reinvest the profits each time, he could earn $10,565, which would be purely passive income.

Conclusion

In 2025, BGB dividends will continue to overflow.

How short the days are! In 2024, BGB embarked on the path of merging with BWB, but this is just an appetizer; the main event is the operation of BGB's buyback mechanism, which will destroy 800 million tokens at once, valued at $5 billion at market price, ensuring price stability. Bitget is serious about this.

A major trend in 2025 will be the integrated development of DEX and CEX. The next step for BGB must be to empower the on-chain ecosystem, stepping out of Bitget's own greenhouse to face greater waves of change.

For instance, after the merger news was made public, BGB's price quickly surged, ultimately breaking through the historical high of $8.5, with an increase of over 30%. The overall coordination within the internal ecosystem will also enhance market perception. With Bitget Wallet users reaching 60 million, a user base exceeding 100 million will open up more imaginative possibilities for BGB.

Of course, relying solely on buybacks will only temporarily boost the token price. For example, after the announcement of the token burn, the market cap exceeded $10 billion, ranking 16th, but it began to decline after the positive news. Ultimately, the long-term value of a token still needs real use cases to support it.

Currently, Bitget is undoubtedly one of the leading exchanges globally, and BGB has also reached a prominent position among platform tokens. As for Bitget's overall ranking in 2025, how much anticipation is there for the reveal?

Everything is in progress. In 2025, let us witness the intense development of more platforms.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。