Macroeconomic Interpretation: The current cryptocurrency market is undergoing a complex phase of tug-of-war between bulls and bears, with BTC prices fluctuating around $102,000. Although the news of the SEC forming a cryptocurrency regulatory task force triggered a brief decline, the market overall has shown resilience. Behind this phenomenon are signals of volatility compression from a technical perspective, as well as the interplay of multiple factors such as the deepening of regulatory frameworks, the expansion of the derivatives market, and the meme coin craze. The following analysis will explore three dimensions: market structure, regulatory dynamics, and emerging assets.

Recent data shows that Bitcoin's 60-day volatility range has significantly narrowed to below the current trading range, a phenomenon that historically usually indicates an impending volatility explosion. From market behavior, capital flows exhibit a divergent characteristic: on one hand, there is a surge in demand for put protection at a $95,000 strike price in the options market, reflecting some investors' concerns about a short-term pullback; on the other hand, on-chain indicators show that long-term holders are still in an accumulation phase, with no large-scale selling behavior observed. This divergence between technicals and sentiment may be brewing momentum for a price breakout. If we consider historical patterns, volatility expansion could be triggered in the coming weeks, with directional choices potentially depending on macroeconomic catalysts, such as the Federal Reserve's FOMC meeting next week regarding interest rate guidance.

Although the SEC's recent regulatory actions have caused temporary panic in the market, the long-term institutionalization trend of the cryptocurrency market remains unchanged. The unexpected leak of a test page from the Chicago Mercantile Exchange (CME) regarding the launch plans for XRP and SOL futures, although clarified by officials as a technical error, still propelled the prices of both assets up by 3.4% and 4.1%, respectively, indicating market expectations for the expansion of compliant derivatives. This phenomenon reflects two major trends: first, traditional financial institutions are accelerating the inclusion of crypto assets into their product matrices; if CME officially launches XRP and SOL futures, it will further attract hedge funds and asset management institutions; second, the gradual clarification of the regulatory framework may weaken the jurisdictional disputes of the SEC, paving the way for innovative products like spot ETFs. In the short term, policy uncertainty will continue to suppress market risk appetite, but in the medium to long term, regulatory compliance is a necessary prerequisite for large-scale capital inflows.

Speculative assets represented by the Trump meme coin (TRUMP) have recently surged, with total spot trading volume reaching $38 billion and prices rising 82% within three days from the closing price on the first day. Although the high volatility of such assets has sparked controversy, their liquidity diversion effect on the market cannot be ignored. TRUMP has rapidly risen based on political narratives and community consensus, reflecting a shift in crypto market culture from "technological faith" to "event-driven" dynamics. However, the explosive growth of meme coins may exacerbate market fragility: on one hand, the withdrawal of short-term speculative funds from mainstream assets (like BTC) may put downward pressure on prices; on the other hand, if regulatory agencies take targeted measures against meme coins, panic sentiment may spread throughout the market. Notably, TRUMP is issued on the Solana chain, and its popularity has indirectly pushed SOL prices above $270, highlighting the symbiotic relationship between public chain ecosystems and asset issuance.

Against the backdrop of rising expectations for a shift in the Federal Reserve's monetary policy, BTC's anti-inflation narrative is facing a test. Recently, some institutions have continued to increase their BTC holdings, attempting to shape it as an alternative to "digital gold," but high volatility in the short term still hinders mainstream enterprises from making large-scale allocations. It is worth noting that if crypto-friendly legislation is promoted in the future policy cycle, BTC may be embedded in the narrative of economic growth, becoming a tool to hedge against risks in traditional financial markets. This political-economic variable could provide a new valuation anchor for BTC, but its realization depends on the stability of the regulatory framework and the diversification of institutional products.

The current cryptocurrency market is in a transitional phase between old and new cycles: the coexistence of technical volatility compression, deepening regulatory frameworks, and meme coin speculation creates a complex environment that leads BTC's short-term trend to oscillate within a range. However, the expansion of the derivatives market, inflows into spot ETFs, and the reconstruction of political-economic narratives still provide support for medium to long-term upward trends. Investors need to be cautious of liquidity fluctuations caused by meme coins and regulatory black swans, while also paying attention to the direction of major capital flows after a volatility breakout. In the coming month, the FOMC meeting guidance and CME futures product developments may become key catalysts to break the balance.

Data Analysis:

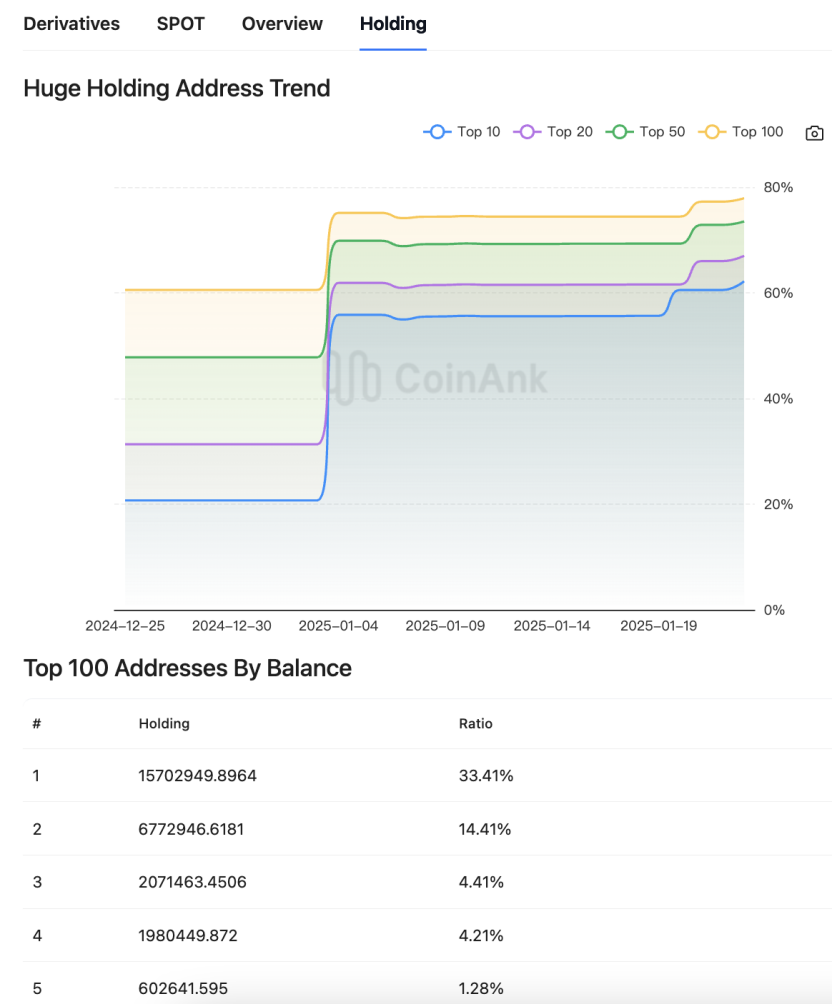

With the price correction of the Trump concept coin (#TRUMP), most TRUMP token holders are at breakeven or have profits/losses within $1,000. According to Coinank data, the trend of large TRUMP holders' addresses is shown in the figure. There are 424 addresses with profits between $1 million and $10 million, 16,791 addresses with profits between $10,000 and $1 million, and 50,636 addresses with profits between $1,000 and $10,000. The largest proportion of addresses are those with losses under $1,000, totaling about 486,421.

BTC Analysis:

Currently, BTC is showing a fluctuating pattern on the 4-hour level, having risen to our previously anticipated resistance level of $107,000 before pulling back and testing support near $100,000 again. Observing the CoinAnk super trend indicator, the bullish trend initiated from the previous low of $88,900 has not yet ended, but the price has tested the $100,000 support area three times in a row, forming significant technical resonance in that region—comprising both dynamic support from trend lines and a concentrated buy wall shown on the exchange order book (step=10 large order distribution), creating a key battleground for bulls and bears.

From a structural perspective, the "buy the expectation - sell the fact" market triggered by the Trump inauguration event has been largely digested. After the price retreated from the $110,000 high, it has been building a consolidation platform in the $100,000 to $101,000 range. Currently, two technical signals need to be closely monitored: first, the defensive strength of the super trend support line (around $100,000); if the 4-hour candlestick continues to hold above this level, it is likely to extend the upward channel, with short-term resistance to watch at $107,000 (Fibonacci 38.2% retracement level) and the psychological level of $110,000; second, if the $100,000 support is effectively broken, it may trigger programmatic selling, with downward targets pointing to $95,000 and the previous low of $90,000.

A notable marginal change is in the market liquidity structure: currently, the order depth below $100,000 has significantly increased, while there are dense take-profit sell orders in the $103,000 to $107,000 range. This order book distribution suggests that a stronger momentum is needed for a short-term upward breakout. Combined with the narrowing MACD histogram on the 1-hour level and the RSI indicator hovering in the neutral zone, it is expected that a directional choice will be made in the next 24 hours, and it is recommended to closely monitor the outcome of the bulls and bears contesting the $100,000 support area.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。