"If I knew where I would die, I would never go there." — Charlie Munger

Written by: kokii.eth

Recently, the market has been a bit crazy, with interest rate cuts, regulatory easing, Trump issuing coins, BTC hitting new highs, and Crypto once again proving to be one of the best choices in this polarized era. Yes, as long as we don't leave the table, we will all eventually get rich. — But the problem is, it's too easy to leave the table.

Half is fire, half is seawater. Every day in this industry, there are myths of sudden wealth, and every day there are people who fall into irretrievable situations. Before the raging bull market begins, let’s take a look at different stories of zeroing out from predecessors, hoping everyone can protect their precious capital before the next big opportunity arrives.

Wallet Security

Private Key Loss: Backup paper for private keys burned (Los Angeles fire), hard drive containing the wallet thrown away (a certain British guy is still searching for his BTC in the landfill), multi-signature threshold settings fail (a certain multi-signature address lost / suddenly passed away, permanently locked)

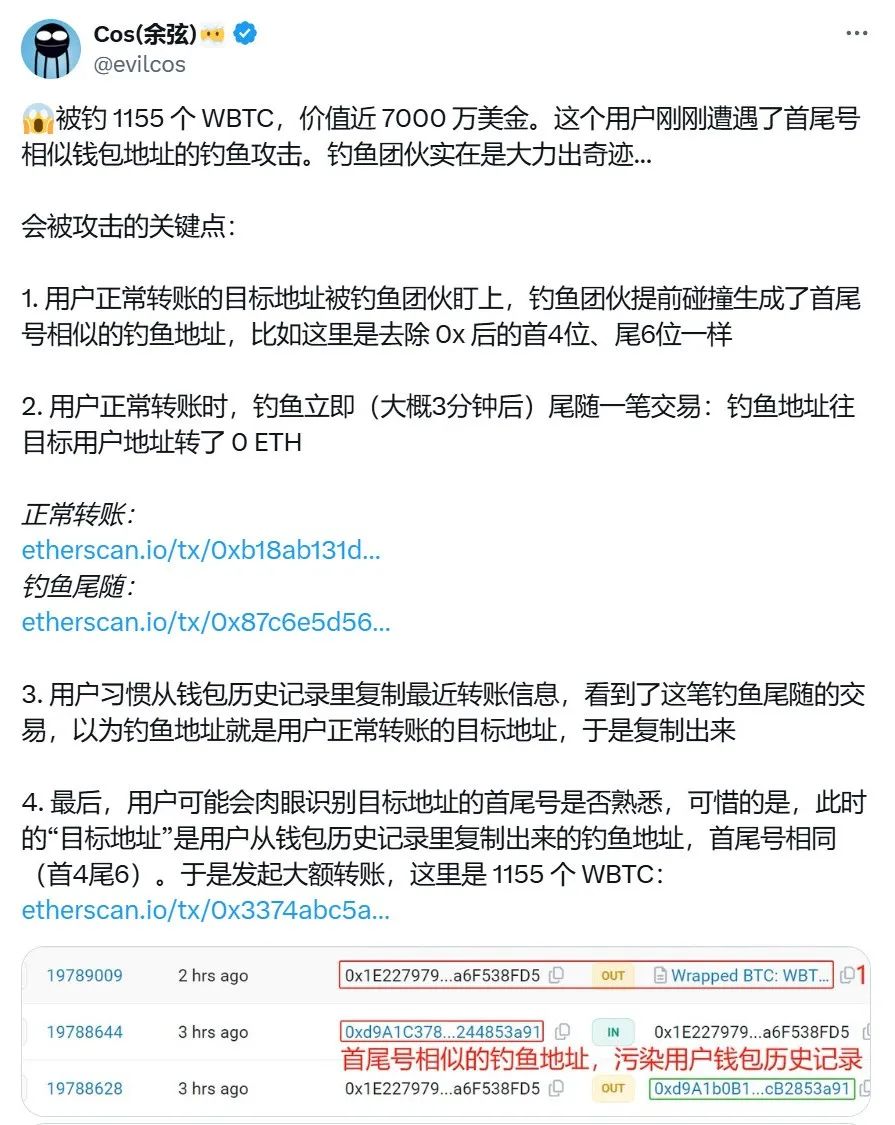

Wallet Theft: Private key leaked (stored in cloud storage and hacked, casually copied and pasted), connected to phishing websites, downloaded a virus-laden fake wallet app (Twitter, Telegram scams), subjected to social engineering attacks (be careful of those around you)

Operational Errors

Deposit/Withdrawal/Transfer Errors: Wrong coin type selected for deposit/withdrawal, wrong chain, wrong address, deposited to testnet, black hole address (even gods can't save you)

Market Order Shock: Accidental market order instantly executed at a shocking price (a needle stuck to the sky)

Personal Safety

Information Leakage: Leading to being tracked or threatened in real life (especially those who love to wear exchange T-shirts and carry exchange suitcases)

Emotional Loss of Control: Unable to control emotions after significant losses, making dangerous decisions (going downstairs to buy a pack of cigarettes, neither taking the elevator nor the stairs)

Overdrafting: Long-term staying up late + poor routine, leading to serious health issues or even sudden death (chasing profits, sitting idle)

Trading Investment

Contract Liquidation: High leverage + holding positions + unlimited margin calls, wiped out in a day (the ultimate fate of contract gamblers)

Gambler's Mentality: Treating trading as gambling, purely following trends and betting on low-quality coins, unwilling to cut losses and constantly fantasizing about bottom fishing after losses (shanzhai, meme)

Wrong All-in: Betting funds beyond one's capacity (borrowed money, house money, emergency funds) on a single coin or sector (Luna)

Falling into Scams: Being cut by air projects, ground promotion schemes, PiXiu schemes, insider trading, blindly trusting project parties (your opponent is the project party issuing coins, what do you have to compete with them?)

Exchanges

Exchange Collapse: Exchange runs away, unable to withdraw (FTX)

Withdrawal Locked: Triggering exchange risk control, account locked (even large exchanges can do this)

Withdrawal Card Frozen: Triggering anti-money laundering, bank card frozen (they say it's to protect you)

Unreliable U Merchant: Encountering unreliable U merchants who run away with funds (disappearing after transfer, many offline OTC as well)

On-chain Interaction

Contract Vulnerabilities: Interacting project contracts have vulnerabilities exploited (cross-chain bridges), attacked by flash loans, manipulated by oracles (lending), malicious authorization draining wallets

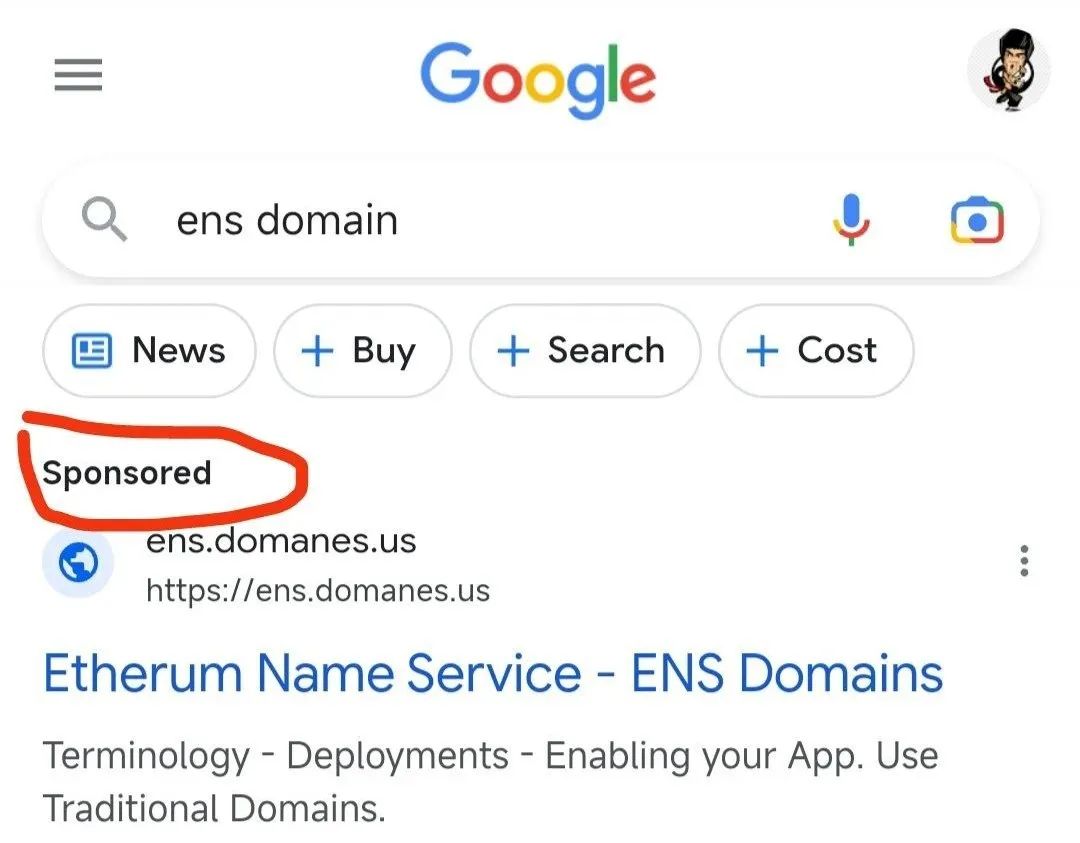

Clone Websites: Front-end fraud, paid search engine ads, fake domains, fake customer service (Discord, Telegram)

Rug Pull: Disappearing after raising funds in pre-sale, or immediately dumping after launch (the last words of the project party are "never rug")

MEV: Being front-run, sandwich attacks, arbitrage (humans can't compete with technology)

Launching Your Own Project

Wrong Direction: Investing a lot of manpower and resources to solve a false demand, project fails due to unsuccessful financing (metaverse, GameFi, Polkadot ecosystem)

Compliance Nightmare: Being troubled by regulatory agencies and law enforcement from different countries (Multichain, deep-sea fishing)

There are countless ways to die; have you heard any other versions of the story? Feel free to share. After the abyss, there is gold worth a fortune. I wish everyone to avoid pitfalls and not leave the table.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。