In 2024, Ethereum earns an average of $6.79 million in fee revenue daily, while Tron earns $5.89 million.

Written by: 1912212.eth, Foresight News

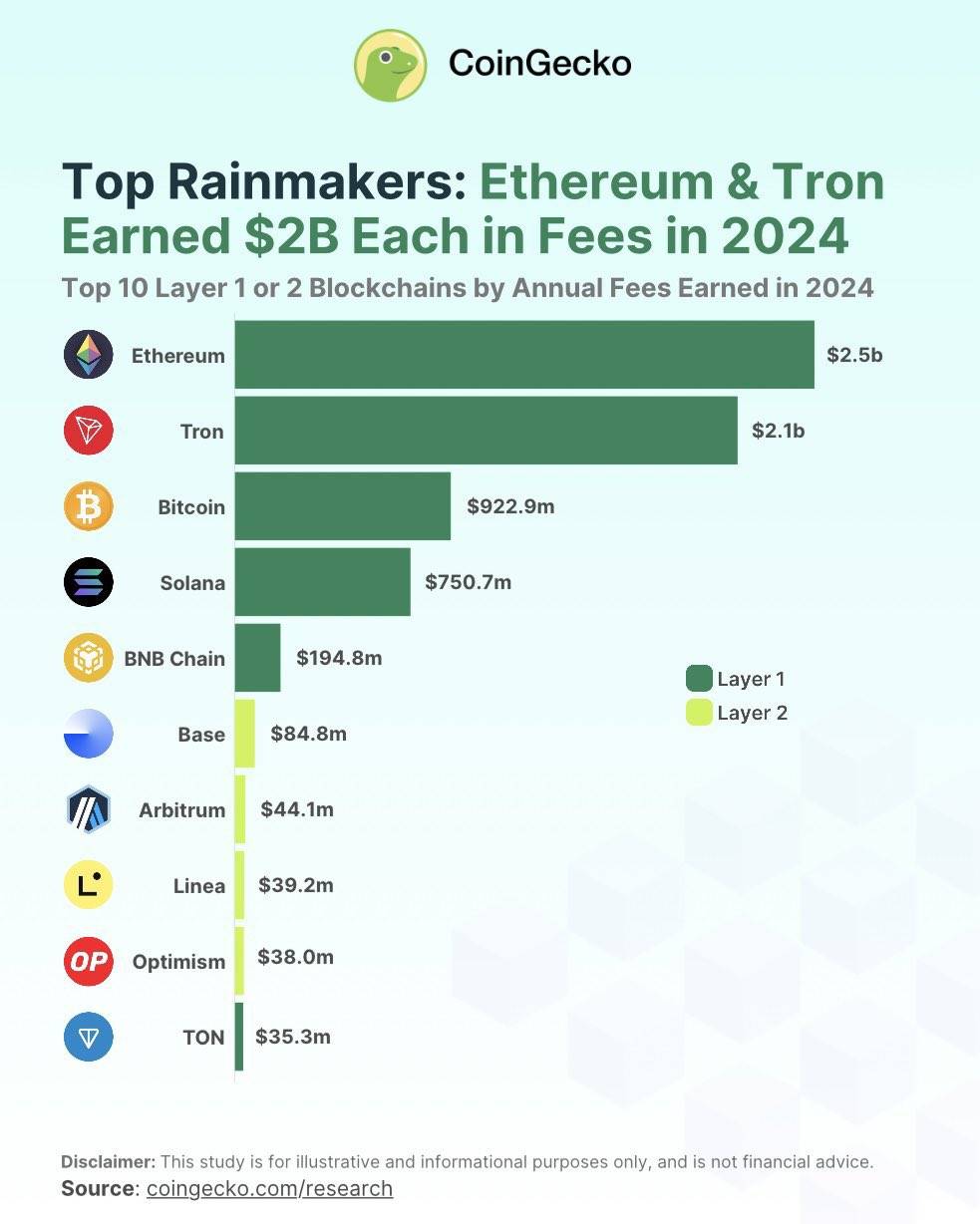

Protocol fee revenue remains one of the important data indicators for measuring the activity, value capture, and ecosystem of a blockchain. Recently, CoinGecko released the 2024 ranking of L1 and L2 protocol fee revenues, with Ethereum and Tron ranking first and second, respectively, each exceeding $2 billion. This data indicates that Ethereum earns an average of $6.79 million daily, while Tron earns $5.89 million daily.

Solana's fee revenue reached $700 million, while the once-popular TON has lost its momentum, earning only $35 million last year. BNB Chain performed modestly, with nearly $200 million in revenue. Bitcoin's fee revenue reached $920 million.

In terms of L2 data, Base leads significantly, with nearly $85 million in protocol fee revenue, even surpassing the combined data of Arbitrum and OP.

Ethereum Protocol Revenue Rises, But Coin Price Falls Short of Expectations

Chain fee revenue typically comes from multiple sources, such as transaction fees, smart contract execution fees, indirect income from block rewards, MEV-related income, cross-chain bridge and asset transfer fees, on-chain storage fees, burn mechanisms, governance fees, and more.

Since the Cancun upgrade, Ethereum has significantly reduced L2 transaction costs and promoted its development; however, this benefit has not translated into a noticeable improvement in revenue. It even has a flavor of "sacrificing the small self to achieve the greater self." In 2023, Ethereum's protocol revenue was $2.41 billion, with only a 3% increase in fee revenue for 2024. Ethereum primarily earned $1.17 billion in the first quarter of 2024, accounting for nearly half of its total fee revenue for the year. Although the data shows growth, given the market's upward momentum and high expectations, this fee revenue performance is still underwhelming.

The lackluster data has a direct mapping effect on the ETH coin price, which has fluctuated around $3,000 for most of the past year. The prolonged stagnation of the coin price has led to widespread dissatisfaction and skepticism within the community, putting Vitalik and the Ethereum Foundation in a public relations crisis.

The revenue performance of various Ethereum L2s is also relatively average, with Base emerging as one of the few bright spots among Ethereum L2s. This is attributed to its firm grasp of the meme wave, taking off in the process. In 2024, the Base chain saw the emergence of AI concept coins like VIRTUAL/AIXBT, as well as meme coins like DEGEN, with a wealth effect far exceeding that of Arbitrum and OP. Although there is still a significant gap compared to Solana, its potential should not be underestimated.

L2 protocols making money have not truly fed back into Ethereum. Taking Base as an example, most of the network fees last year turned into profits for CoinBase, with very little funding going to the Ethereum mainnet. If annualized, CoinBase's earnings from Base are close to $100 million.

With the L1 mainnet's profit effect waning, whether L2 can still become Ethereum's "supersonic missile" remains a question mark.

Tron and Solana's Breakthroughs Become Key to Explosive Growth

As a stablecoin public chain, Tron’s protocol fee revenue increased from $922.08 million in 2023 to $2.15 billion in 2024. As a major pillar contributing to protocol fees, its stablecoin revenue surged from $38.36 million in January 2023 to a high of $342.54 million in December 2024, achieving nearly a tenfold increase.

Solana's fee revenue also performed impressively, soaring from $25.55 million in 2023 to $750.65 million in 2024, a nearly 30-fold increase that far exceeds many competitors. The fees on the Solana chain mainly come from transaction fees and priority gas fees. The reason is clear: since last year, meme coins and AI concept coins on the Solana chain have experienced explosive growth, with exaggerated wealth effects attracting numerous users to chase after "dog coins."

For example, its launch platform Pump.fun has accumulated revenue exceeding $400 million to date. Another meme liquidity infrastructure, Raydium, has an annualized revenue of $363 million. In the past three months, fee growth has exceeded 370%, and revenue growth has surpassed 260%.

Thanks to the inscription boom in 2024, Bitcoin's annual fee revenue grew by 15.9%. Meanwhile, TON benefited from "play-to-earn games," experiencing its highlight moment in the first half of 2024.

Conclusion

Looking back at last year's fee revenues, it is not difficult to find that chains with larger increases often "ride the wave" and seize their opportunities. The silence of L2, DeFi, and NFTs did not provide Ethereum with a strong opportunity to take off, while the two major trends of memes and AI concept coins gave Solana a chance to shine in this cycle, and Tron benefited from the influx of stablecoin funds, leading to a significant increase in revenue.

However, some trends come quickly and leave just as fast, potentially undermining the sustainability of future fee revenues. For instance, after the 2024 inscription and the TON ecosystem games fell silent, there has been no further improvement. When this part of the revenue wave recedes, how to think about the next phase of development becomes crucial.

Seizing opportunities when they arise is key, and if preparation is insufficient during the preparatory phase, one may miss out on good opportunities. If Solana continues to experience frequent outages and poor user experiences with wallets, it may not find its own good fortune. If Ethereum's mainnet scalability is quickly resolved, perhaps the meme wave could also occur on it, leading to its own turnaround.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。