"If you are afraid of your currency devaluing, or you are afraid of the economic or political stability of your country, you can have an international tool called Bitcoin that will overcome those fears."

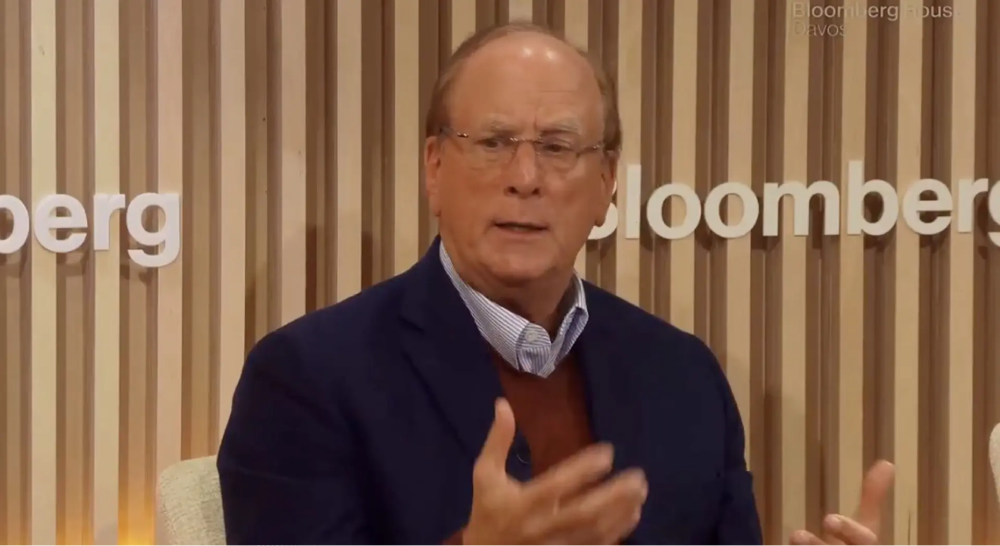

This was the latest comment on Bitcoin by Larry Fink, CEO of BlackRock, at the World Economic Forum in Davos in January 2025. He even predicted that if major global investors allocated 2% to 5% of their portfolios to Bitcoin, its price could soar to between $500,000 and $700,000.

This series of statements sharply contrasts with his earlier skepticism towards Bitcoin and reflects a significant shift in the attitude of the world's largest asset management company, BlackRock, towards Bitcoin. This article will deeply review BlackRock's investment journey into Bitcoin, analyze the underlying reasons for Larry Fink's change in attitude, and explore the potential impact of this change on the market.

1. Larry Fink's Latest Views: Endorsing Bitcoin

At the beginning of 2025, Larry Fink's public statements on Bitcoin reached unprecedented heights. He not only positioned Bitcoin as an "international tool" to hedge against currency devaluation and political uncertainty but also boldly predicted the potential price ceiling for Bitcoin at the Davos Forum.

- The Financial Democratization Potential of Bitcoin: Fink emphasized that Bitcoin has the potential to enhance financial security in economically unstable regions, especially in emerging markets, where Bitcoin can provide an effective financial inclusion solution for those unable to access traditional financial services.

- Attractiveness to Institutional Investors: Fink also highlighted that Bitcoin's scarcity and decentralized nature make it uniquely attractive to institutional investors. He believes that as more traditional financial institutions enter the Bitcoin market, its price and status could further increase.

- The $700,000 Price Prediction: Fink's prediction is not unfounded; it is based on discussions he had with sovereign wealth funds. He revealed that some funds are considering allocating 2% to 5% of their portfolios to Bitcoin. If this allocation strategy is widely accepted, market dynamics could drive Bitcoin to remarkable heights.

These statements mark Fink's comprehensive recognition of Bitcoin and set the tone for BlackRock's deep involvement in Bitcoin.

2. Early Skepticism and Criticism: Bitcoin as a "Money Laundering Tool"

To understand the shift in attitude of BlackRock and Fink, it is crucial to revisit their early views.

- Starting Point of Skepticism: Viewing Bitcoin as a "Money Laundering Tool": In the early stages of Bitcoin's development, Fink held a strong skeptical attitude towards it. In 2017, when Bitcoin's price fluctuated dramatically and was plagued by negative news, Fink openly stated that Bitcoin's anonymity and decentralization made it a "money laundering tool," questioning its legitimacy and potential threat to the traditional financial system.

- Vigilance Towards the Cryptocurrency Market: In 2018, Fink continued to express reservations about Bitcoin, believing it lacked stability and reliable intrinsic value, and stated that BlackRock had no intention of including Bitcoin or other digital assets in its investment products at that time. During this period, BlackRock mainly adopted a wait-and-see approach.

3. Key Turning Points in Attitude Change

What prompted such a significant change in Fink and BlackRock?

- Changes in the Global Economic Environment and the "Digital Gold" Narrative of Bitcoin: The global economic recession triggered by the COVID-19 pandemic led to a surge in demand for safe-haven assets. Bitcoin's limited supply and decentralized nature began to be viewed as tools to combat inflation and economic uncertainty, and the "digital gold" narrative gradually took hold. Fink began to reassess Bitcoin's potential and, by the end of 2020, acknowledged for the first time that Bitcoin could become a global asset and even pose a threat to the international status of the dollar.

- Increased Institutional Acceptance and Gradual Clarity in Regulatory Environment: As more institutional investors began to pay attention to and allocate Bitcoin, and as various countries gradually clarified their regulatory frameworks for cryptocurrencies, Fink's attitude softened accordingly. In 2021, he publicly stated that Bitcoin and other cryptocurrencies could become legitimate investment tools and emphasized that blockchain technology could bring revolutionary changes to the financial industry.

4. BlackRock's Bitcoin Investment Journey

BlackRock's investment actions are the best evidence of its change in attitude.

- Initial Involvement: Launching Bitcoin Futures Products: In 2021, BlackRock began to include Bitcoin futures trading in two of its funds, marking its first direct participation in the cryptocurrency market.

- Launch of Bitcoin ETF: Accelerating Entry into the Crypto Market: In 2024, BlackRock launched the iShares Bitcoin Trust (IBIT), directly investing in Bitcoin spot markets, providing institutional investors with a convenient investment channel.

- Rapid Expansion of Fund Size: After the launch of IBIT, it quickly gained market recognition, and its asset size expanded rapidly, surpassing BlackRock's gold ETF (IAU), fully reflecting the enormous demand for Bitcoin in the market. The successful operation of IBIT in early 2025 undoubtedly enhanced Fink's confidence in Bitcoin and laid the foundation for his bold predictions.

5. BlackRock and Bitcoin: Market Impact and Insights

BlackRock's participation has had a profound impact on the cryptocurrency market.

- Accelerating Institutional Investor Entry: As the world's largest asset management company, BlackRock's actions are a bellwether, undoubtedly attracting more institutional investors into the cryptocurrency market, bringing more funds and liquidity to the market.

- Accelerating the Integration of Traditional Finance and Cryptocurrency: BlackRock's involvement has accelerated the integration of traditional finance and cryptocurrency, promoting the improvement of market rules and regulatory frameworks, which is beneficial for the long-term healthy development of the cryptocurrency industry.

- Enhancing Bitcoin's Legitimacy and Mainstream Status: BlackRock's recognition of Bitcoin has enhanced its legitimacy and mainstream status in the traditional financial sector, breaking the long-standing stereotype of Bitcoin as an "alternative asset."

6. Conclusion and Outlook

BlackRock's change in attitude towards Bitcoin is an important milestone in the development of the cryptocurrency market. From initial skepticism to current embrace, BlackRock's transformation not only reflects changes in the market environment but also signals the important role cryptocurrencies will play in the future financial system. Larry Fink's latest remarks and BlackRock's actual actions indicate that Bitcoin is gradually being accepted by mainstream financial institutions, and its potential as a global asset is being gradually unleashed. However, investors must remain rational and recognize the high volatility and potential risks of the cryptocurrency market, while actively participating and managing risks. The story of BlackRock and Bitcoin continues to unfold, and its future development is worth our continued attention.

Disclaimer: The above content is for reference only and does not constitute investment advice.

If you have any questions, you can contact us through the following official channels:

AiCoin Official Website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AICoincom

Email: support@aicoin.com

Group Chat: Customer Service Yingying、Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。