This article will start with an interpretation of Trump's inaugural speech policies, combined with the background and market performance of the $TRUMP token and its counterpart $MELANIA, to deeply analyze the impacts behind them.

I. Introduction

On January 20, 2025, Donald Trump was sworn in as the 47th President of the United States, marking the beginning of his non-consecutive second presidential term. This moment is not only a significant milestone in American political history but also a focal point for global markets. On the same day, a token named $TRUMP quietly gained popularity, adding a unique financial color to this moment. This article will start with an interpretation of Trump's inaugural speech policies, combined with the background and market performance of the $TRUMP token and its counterpart $MELANIA, to deeply analyze the impacts behind them.

II. Interpretation of Trump's Inaugural Speech Policies

In his inaugural speech, Trump reiterated the "America First" policy and outlined a blueprint for a "golden age" through a series of new policy plans. Here are some key policy interpretations:

• Immigration Policy: Trump announced a national emergency at the southern border to strictly control illegal immigration. His "Remain in Mexico" policy was reactivated, and he aimed to combat foreign crime networks through the Alien Enemies Act of 1798. This strong policy aims to create a safer environment for the U.S. economy by strengthening border security and internal enforcement.

• Energy Policy: In the context of stock and energy crises, Trump declared a national energy emergency, ended the "Green New Deal," and re-promoted the development and utilization of traditional energy. He emphasized leveraging America's abundant oil and gas reserves to drive economic recovery while canceling the electric vehicle mandate to support the automotive industry.

• Trade and Economy: To protect domestic workers and businesses, Trump plans to establish an external tax bureau to impose tariffs on imported goods and use the tax revenue to fill the U.S. treasury. This move is seen as a strategy to enhance the competitiveness of domestic manufacturing through economic nationalism.

• Social and Cultural Policies: Trump introduced race and gender policies into social discussions, restoring gender definitions and ending social engineering interventions. He also plans to reform the education and public health systems, advocating for a culture of pride and freedom in America.

• International and National Security: Trump emphasized protecting national security through military reforms while positioning himself as a peacemaker, announcing the return of hostages from the Middle East to showcase diplomatic achievements.

These policies focus on restoring national confidence and strengthening American advantages, reflecting Trump's concern for economic revival and cultural reshaping. The lack of mention of cryptocurrency-related policies and benefits in his speech also led to significant market fluctuations.

III. $TRUMP Token: Background, Process, and Impact Analysis

Background of the $TRUMP Token

Two days before the inaugural speech, Trump announced the launch of the eponymous meme token $TRUMP via social media. This move is both an extension of personal branding and a response to the trend of digital economy, aiming to leverage his global fame and political stature to create a wave in the crypto market. As a former president, Trump's involvement tightens the connection between the crypto industry and mainstream politics, attracting attention from the political sphere and Trump supporters. This could stimulate discussions on crypto policies and influence government regulatory attitudes toward the crypto market.

$TRUMP Token Issuance and Market Performance

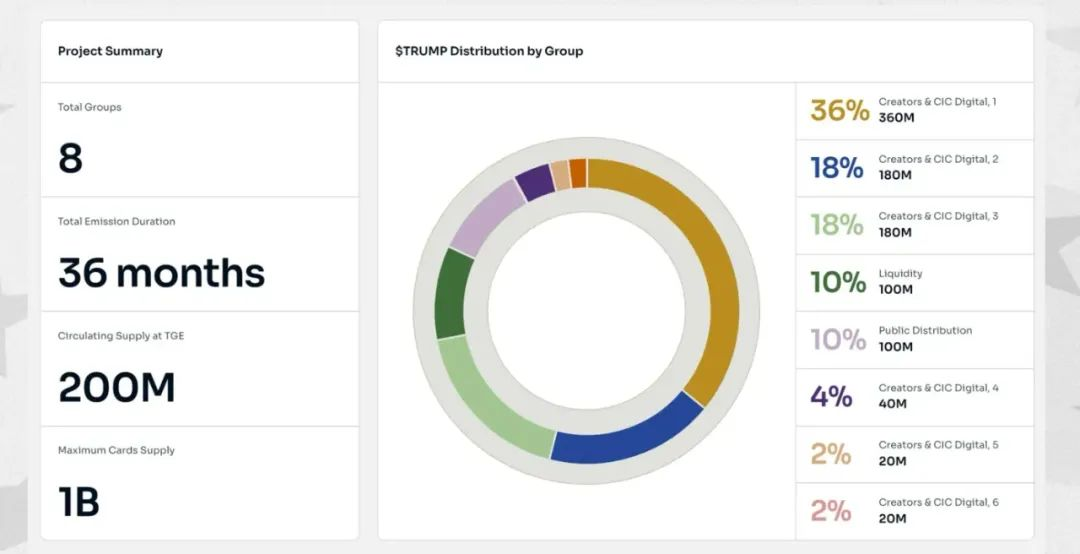

• Issuance Time and Method: $TRUMP went live on January 18, 2025, launched on the SOL chain, with an initial total supply set at 999,999,993.45 tokens. 20% of the tokens were immediately unlocked, while the remaining 80% will be unlocked linearly over three years.

• Market Reaction: The issuance of the TRUMP token sparked significant market attention and discussion. It achieved remarkable market performance in a short time. Within hours of its launch, the market cap of TRUMP surpassed $8 billion, peaking at $15 billion. This performance quickly placed it among the top 30 cryptocurrencies, currently ranked 24th with a market cap of $7.6 billion, making it the first token ever launched at such speed and scale.

• Community Activity: Due to the inherent traffic effect of the Trump brand, investors and cultural enthusiasts actively participated, and major exchanges rushed to list the token overnight.

Significance and Potential Impact of the $TRUMP Token

- A Model of Financial Innovation and Marketing Integration

The issuance of $TRUMP opens a new era of integrating cryptocurrency with political marketing. It not only showcases the market value of personal branding but also provides the public with a window to participate in financial innovation.

Market Risks and Regulatory Challenges

The short-term popularity may bring price volatility risks and trigger discussions on cryptocurrency regulation. Given the political background of its issuer, questions about whether the $TRUMP token complies with securities laws and the intended use of funds may prompt scrutiny from the U.S. Securities and Exchange Commission (SEC) and other financial regulatory bodies. Notably, this is the first time a token has been endorsed by a sitting president.Cultural and Social Impact

This is not merely a financial tool; it may also become a cultural phenomenon. Supporters view it as an endorsement of Trump's policies, while opponents may target it for criticism. This division could further exacerbate political polarization in society and reflect the trends of public opinion in the digital economy era.Insights for the Cryptocurrency Industry

The success of $TRUMP demonstrates the potential of celebrity brands in the cryptocurrency market, possibly encouraging more celebrities, businesses, and even government agencies to enter the market in similar ways. However, it also reminds industry participants that tokenization must be based on transparency and legality to avoid market bubbles and public trust crises due to excessive speculation.Subsequent Impact on Cryptocurrency

The launch of $TRUMP is seen as a significant endorsement of the SOL chain and may catalyze a season of altcoins. QCP Capital points out that the influence of $TRUMP could attract more retail funds, increasing attention on the crypto market. This phenomenon is reminiscent of the situation during Coinbase's listing in 2021, which could lead to a peak in market sentiment. Additionally, the launch of the $TRUMP token may impact Bitcoin ($BTC). As more people choose to buy $TRUMP, the status of $BTC as the preferred store of value may face some challenges, potentially leading to a decline in the value of its ecosystem projects. Therefore, the market's expectation for Bitcoin price increases may also be prolonged. Not only $BTC, but during the high market sentiment for $TRUMP, it is evident that liquidity is being drawn away, causing other tokens to experience a draining effect.

However, from a positive perspective, the $TRUMP token has made many people wealthy and attracted the attention of institutional investors, potentially sparking a wave of celebrity token launches. Nonetheless, some argue that Trump's brand endorsement may bring him moral pressure, although he seems unconcerned about this.

Trump's return to office and the issuance of the $TRUMP token are not just cryptocurrency events but also a political and economic intersection that could change the landscape of the crypto market. However, the market euphoria also carries significant potential risks. Whether regulatory challenges or social impacts, the future performance of the $TRUMP token deserves ongoing attention. This is not only about its price trends but also about the long-term implications of this phenomenon for the entire cryptocurrency industry and global market rules.

IV. $MELANIA Token: Background, Process, and Impact Analysis

Following the trading frenzy of $TRUMP, just a day later, First Lady Melania Trump also launched a meme token named after herself, $MELANIA. At 6 AM on January 20, Mrs. Trump announced the second token issued by the Trump family on her social media, which surged over 14,500% within 24 hours, reaching a peak market cap of nearly $15 billion, but subsequently experienced a significant pullback.

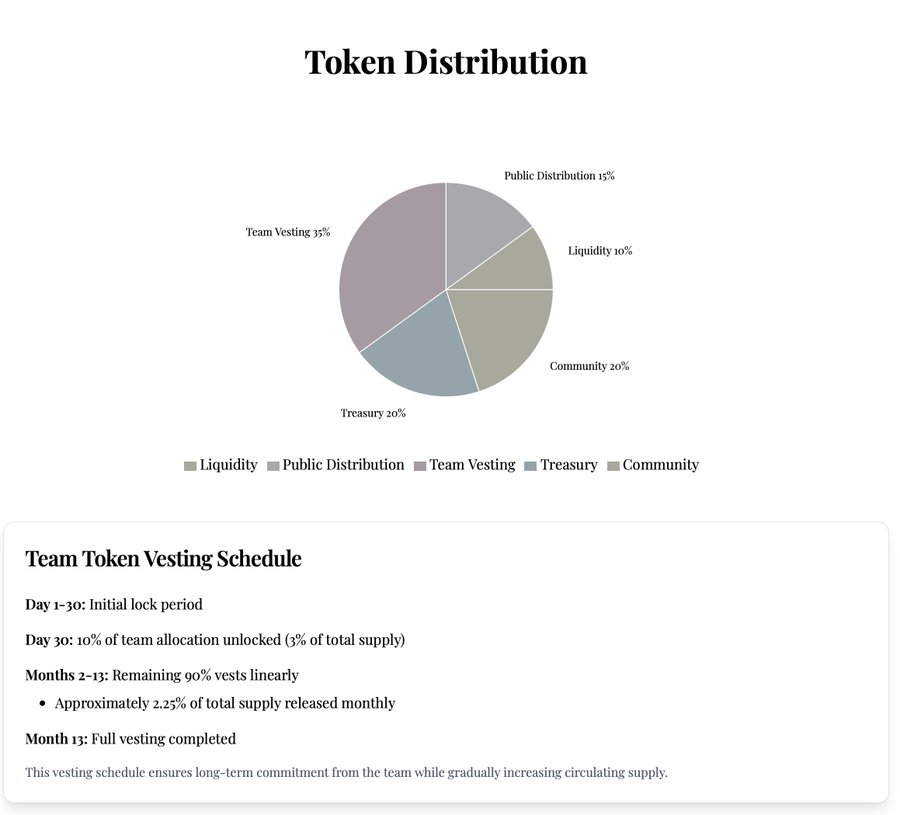

The economic model of the MELANIA token differs from that of the TRUMP token. Its distribution structure includes 35% for the team, 20% for the treasury, 20% for the community, 15% for public issuance, and 10% for liquidity. The team share has a 30-day lock-up period, while $TRUMP has a 3-year lock-up period.

Although $MELANIA generated a warm market response, it also raised some doubts. Some noticed that the official website for the Melania token was only launched for a day, suggesting that the token's release might be a temporary initiative to extend the attention drawn by TRUMP, lacking a substantial long-term plan and contribution. Investors are cautious, viewing it as a potential money-making tool. The launch of $MELANIA coincided with the anniversary of the Trump couple's wedding, leading some to believe it might be a gift from Melania to Trump.

Upon the announcement of $MELANIA, the market erupted with criticism, further solidifying the perception that the Trump family views the crypto market as a money-making tool. This led to angry and panic-driven sell-offs in the market, and with the subsequent lack of mention of cryptocurrency during the presidential inauguration, BTC briefly fell below $100,000, SOL dropped to $230, and $TRUMP plummeted from a high of $80 to $35, with various on-chain assets suffering significant losses. The extreme volatility of $MELANIA further highlights the high speculative nature of meme tokens; even with presidential endorsement, it remains a high-risk speculative asset.

V. Future Market Development

After Trump's official inauguration, policies may lead to a relaxation and clarification of U.S. cryptocurrency asset regulations, thereby promoting innovation and market capitalization growth in the crypto market in the following ways:

- Reducing Regulatory Pressure

The Trump administration may adopt more lenient regulatory policies, reducing restrictions on cryptocurrency assets and encouraging innovation and investment. For example, it may repeal some restrictive regulations like SAB 121, which would help traditional financial institutions better participate in the crypto market.

- Encouraging Participation from Traditional Financial Institutions

By guiding traditional financial institutions to participate in the crypto market, Trump's policies may bring more liquidity and stability to cryptocurrency assets. This participation could include allowing banks to provide custody and trading services for crypto assets.

- Support for Innovation

On January 21, Trump announced at the White House that three companies—SoftBank Group from Japan, the U.S. OpenAI Research Center, and Oracle Corporation—will invest $500 billion in AI infrastructure. This support will also help promote the growth of emerging projects that combine crypto and AI, potentially positioning the U.S. as a global innovation center for crypto assets.

- Enhancement of International Competitiveness

By implementing friendly crypto policies, the U.S. may restore its leadership in the global crypto asset space, attracting international investment and businesses, thereby enhancing national competitiveness. The issuance of the presidential meme coin is likely a trial run for a global asset tokenization movement led by Trump aimed at achieving digital dollar hegemony.

VI. Conclusion

Trump's personal involvement in launching the meme has dropped a bombshell in the crypto market, attracting global attention and promoting the development of the crypto market. It is foreseeable that well-known figures, idols, and IPs from various countries around the world could launch their own memes, raising the question of whether this segment of the market could become the next trillion-dollar opportunity. With Trump entering the arena, his goal should not merely be to profit from meme issuance; rather, it is to convert off-chain assets into on-chain assets and trade them with the digital dollar, thereby extending the hegemony of the digital dollar in the digital world. This aligns not only with Trump's personal interests but also with the fundamental interests of the United States, ultimately benefiting crypto investors.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。