Grid trading tools have become an essential "oscillation artifact" for investors today. It automatically sets buy and sell orders within a specific price range, helping investors capture market fluctuations to achieve the goal of buying low and selling high. However, despite the efficiency and convenience that grid trading brings, it also comes with risks and challenges. This article will delve into the pros and cons of grid trading, helping everyone use it more effectively while avoiding common pitfalls.

1. Pros and Cons of Grid Trading

(1) Pros

1. Automated Trading

Grid trading can operate 24/7, taking advantage of all volatility opportunities.

2. Buy Low, Sell High

The grid strategy automatically executes "buy low, sell high" operations by setting price ranges, fully utilizing the oscillation characteristics of the market, allowing you to steadily profit in a fluctuating market.

3. Low Maintenance Requirements

Once the grid strategy is set, it requires almost no manual intervention, saving you from the complicated task of market monitoring, allowing you to focus on other things.

4. Zero-Basis Operation

Even if you are a trading novice, you can start grid trading with simple parameter settings after investing funds, making it easy to participate in the market through automated operations.

(2) Cons

1. Large Drawdowns

In a highly volatile market, the grid strategy may lead to significant drawdowns, especially when the market breaks through the set highest or lowest grid, which can exacerbate losses.

Optimization Measures: Move the grid and flexibly adjust the grid range to adapt to market changes, reducing losses.

2. Low Capital Efficiency

Due to the large number of orders within the grid, some funds may be locked for extended periods, affecting liquidity and overall efficiency.

Optimization Measures: Adjust the number of active grids to improve capital utilization and avoid excessive capital occupation.

2. Methods for Setting Efficient Grids

1. Choose Suitable Cryptocurrencies

● Prefer mainstream cryptocurrencies, selecting those with good market depth and active trading to enhance liquidity in grid trading.

● Select those with obvious price oscillations and frequent fluctuations to increase the chances of grid profits.

2. Determine a Reasonable Grid Range

Choosing the right grid range is crucial. Here are several effective tools and methods to help you select an appropriate price range:

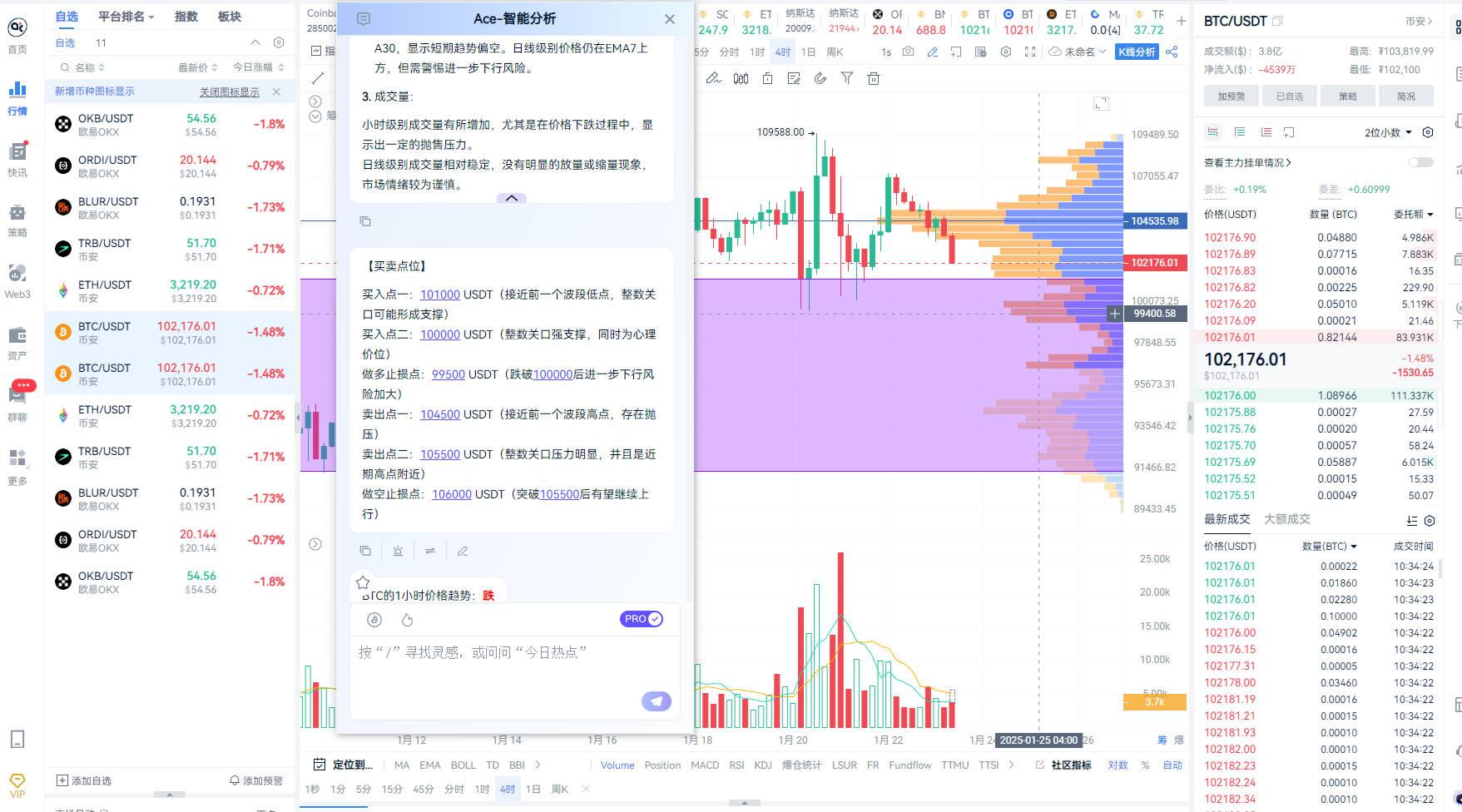

● Xiao A Analysis

You can obtain valuable short-term price ranges through Xiao A analysis.

● Support and Resistance Levels

Use tools like chip distribution, total depth, and Fibonacci retracement to determine important support and resistance lines. Typically, the price of a cryptocurrency will repeatedly test support and resistance levels, and the highs and lows that fail to break through represent significant psychological thresholds for buyers and sellers, which can be used as the price range for the grid.

For example, using chip distribution, select the price level where the chip peak is located as the grid range, as shown below:

● Historical Volatility Range

The highest and lowest points observed over a specific period can serve as potential ranges for setting grids.

● Candlestick Patterns

Identify specific patterns in the charts, such as rectangles, head and shoulders, double bottoms, etc., and select the highs and lows of these patterns as the operational range for the grid, which can be assisted by the AICoin drawing tool.

3. Set an Appropriate Number of Grids

Determine the number of grids (price intervals) based on market volatility and personal trading strategy. Generally, the more grids there are, the lower the profit per grid, and the more frequent the trades, which can lead to increased transaction fees; conversely, fewer grids result in higher profit per grid, lower trading frequency, and relatively reduced fees, but may lead to missed trading opportunities.

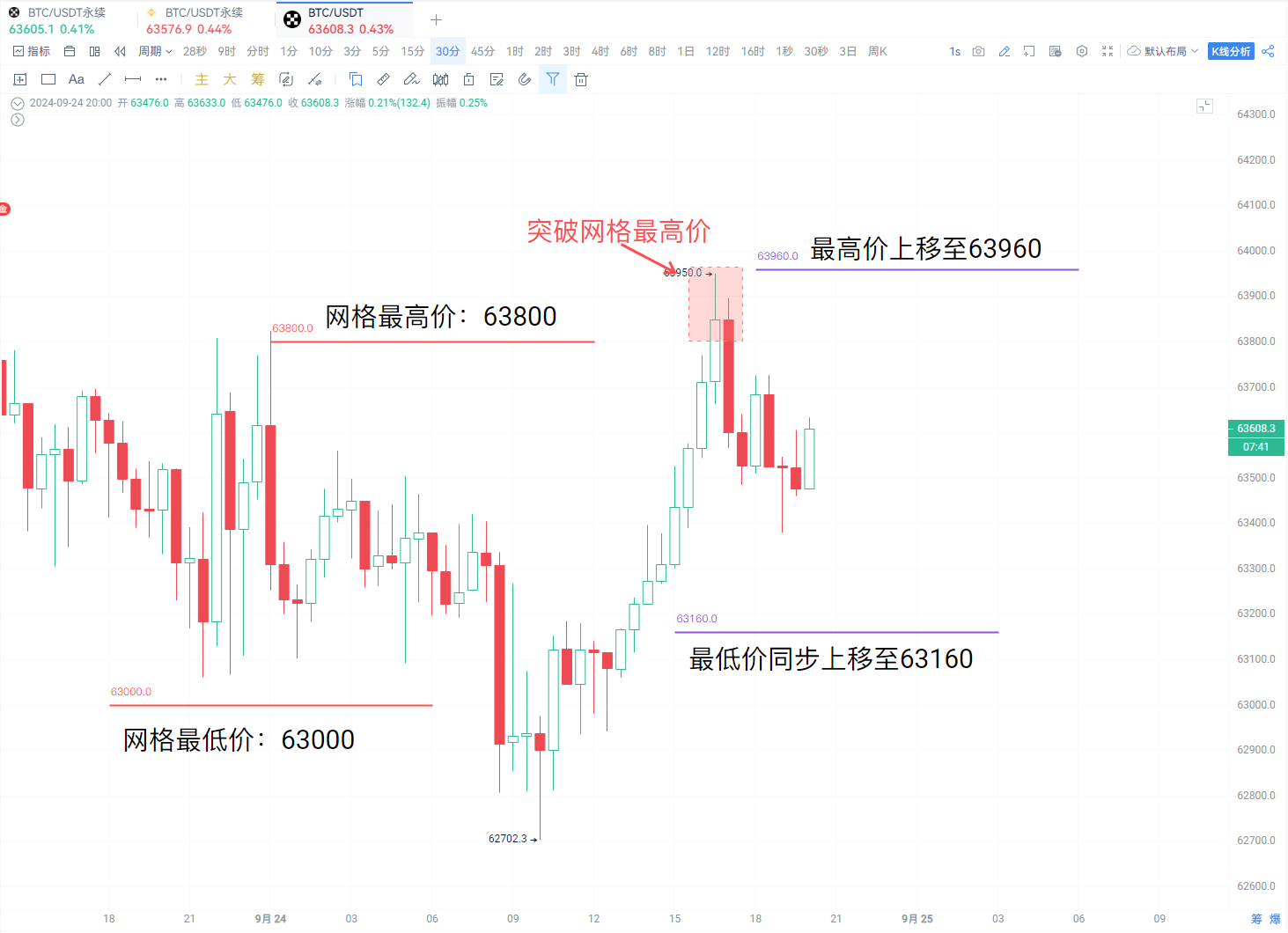

4. Use Mobile Grids

Mobile grids are an advanced tool that can effectively prevent grid-breaking risks and have the following advantages:

● Increase strategy flexibility: By automatically adjusting the grid, the strategy can better adapt to market changes rather than simply stopping when prices exceed the range;

● Improve capital utilization: Because the strategy can continue to operate at prices beyond the original range, it can better utilize capital and capture more trading opportunities;

● Seize opportunities in market volatility: Especially during rapid market rises or falls, mobile grids can help users avoid missing these important market opportunities.

After enabling mobile grids, when the cryptocurrency price exceeds the highest price of the grid, the grid will automatically cancel the lowest grid range and move to the grid range that includes the market price, becoming the highest grid. The advanced feature also allows the stop-loss price and the price at which the grid stops moving down to be proportionally adjusted upwards. Similarly, when the price falls below the lowest price of the grid, the lowest price of the range, stop-loss price, and the price at which the grid stops moving up will also be adjusted downwards.

3. Precautions for Running Grid Trading

1. Be Aware of Grid-Breaking Risks

Once the price exceeds the grid range, trading will stop. You can control losses by setting stop-loss orders while dynamically adjusting the grid (i.e., using mobile grids) to adapt to new market conditions.

2. Control Emotions

Avoid making decisions based on short-term losses or profits, maintain consistency in strategy and a long-term perspective.

3. Be Aware of Trading Fees

Trading fees can erode profits, especially in high-frequency trading grid strategies. It is advisable to choose trading platforms with lower fees and set reasonable grid ranges and quantities.

4. Common Questions and Answers about Grid Trading

1. Will the AI grid run normally if the computer is shut down or goes to sleep?

Shutting down or putting the computer to sleep can cause the grid to run abnormally. Ensure that the AICoin client is running properly and that the network remains stable.

2. Is the grid tool a market order or a limit order?

Grid orders are limit orders.

3. How many AI grids can be created at most?

There is no upper limit on the number of AI grid strategies; users can run multiple strategies simultaneously.

4. Is the new grid order in AI grid trading executed automatically, or does it require manual intervention?

If the program is not stopped, it will run automatically.

5. How to supplement funds for an ongoing grid strategy?

Currently not supported; you can open a new grid.

6. Will contract grids be liquidated?

If the cryptocurrency price suddenly fluctuates significantly and exceeds the range that the grid trading strategy can cover, it may lead to liquidation of the contract grid strategy. You can set stop-loss orders or use low leverage while maintaining sufficient margin to prevent liquidation risks.

7. How will trading profits be calculated after manually closing the grid trading strategy?

All profits will be settled at market price immediately, and the invested funds and profits will automatically transfer to the user's fund account.

8. If the market price exceeds the grid range, should the strategy be terminated?

The grid trading bot will only operate within the set price range. If it exceeds the range, trading will stop until the price returns to the grid range. Currently, when the grid strategy is running, users cannot modify grid parameters. It is recommended to set mobile grids, which will automatically move the upper and lower limits of the grid range upwards as the average price rises.

9. What is the difference between total profit, floating profit and loss, and grid profit?

● Total Profit: Net profit after deducting fees.

● Floating Profit and Loss: The unrealized loss of the latest position.

● Grid Profit: The cumulative profit generated from each buy and sell transaction in the strategy.

10. Why is grid profit positive, but total profit shows a loss?

Grid profit is the cumulative profit generated from each completed buy and sell order in the trading strategy, including the floating profit and loss of the latest position, while total profit is the realized profit after deducting fees.

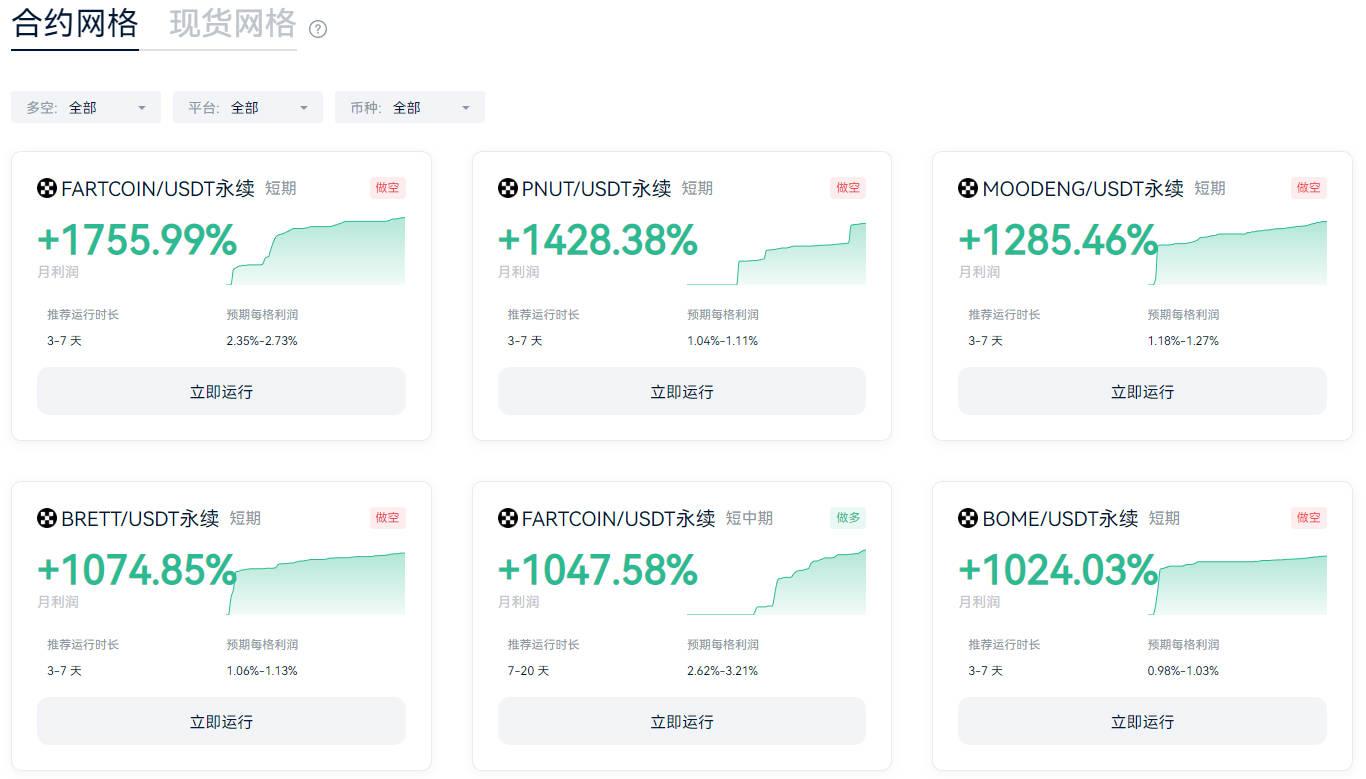

5. Recommended High-Win Rate Grid Strategy

Strategy: AI Neutral Grid

Introduction: The grid range is 50,000~65,000, shorting above the benchmark price and going long below the benchmark price, with a limit of 10 grids above and below (a total of 20 grids).

Usage: Go to the APP or PC version of [Community Indicators], search for [AI Neutral Grid], and click subscribe to use it, supporting real trading (program automatically places orders). Subscription link: https://www.aicoin.com/link/script-share/details?shareHash=JYrOv33K6JrrvdW1

Note: Backtested returns and win rates do not represent future returns; data is for reference only.

If you have any questions, you can contact us through the following official channels:

AiCoin Official Website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AICoincom

Email: support@aicoin.com

Group Chat: Customer Service Yingying, Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。