Macroeconomic Interpretation: The monetary policy direction of the Bank of Japan is attracting global financial market attention, with widespread market expectations that the Bank of Japan will further raise interest rates at the monetary policy meeting in January 2025, increasing the policy interest rate ceiling from 0.25% to 0.50%. This expectation not only reflects changes in Japan's domestic economic situation but also suggests that the global financial market, particularly the cryptocurrency market, may experience new volatility.

As one of the world's important central banks, the Bank of Japan's adjustments to its monetary policy have far-reaching implications for global financial markets. The expectation of this interest rate hike is not unfounded; it is based on statements made by the Bank of Japan's governor and deputy governor in public forums, as well as market expectations regarding Japan's economy and inflation. The Bank of Japan emphasizes the need for sufficient communication with the market to avoid unexpected changes in monetary policy, which has, to some extent, reduced market uncertainty.

Although the market has already priced in a significant expectation of an interest rate hike, the hike itself may still bring some volatility to the market. Looking back at the last interest rate hike by the Bank of Japan in July 2024, there was a noticeable volatility in global capital markets, including the cryptocurrency market. Therefore, investors need to closely monitor the market's reaction following this interest rate hike.

From the perspective of the direct impact of the interest rate hike on the cryptocurrency market, it may manifest in the following ways:

The interest rate hike may trigger an increase in market risk aversion. Under the expectation of an interest rate hike, investors may be more inclined to allocate funds to relatively safe assets, such as bonds and gold in traditional financial markets, while reducing investments in high-risk assets like cryptocurrencies. This could lead to capital outflows from the cryptocurrency market, resulting in price declines.

The interest rate hike may exacerbate volatility in the cryptocurrency market. The cryptocurrency market is inherently highly volatile, and macroeconomic events like interest rate hikes often act as catalysts for market fluctuations. With the expectation of an interest rate hike, investors may become more cautious, and market reactions could be more pronounced.

The interest rate hike may impact liquidity in the cryptocurrency market. An interest rate hike could lead to rising market interest rates, thereby increasing financing costs, which may put some pressure on liquidity in the cryptocurrency market. Insufficient liquidity could result in decreased trading volumes and increased price volatility.

It is worth noting that the impact of this interest rate hike on the cryptocurrency market may be relatively limited. On one hand, the market has already priced in a significant expectation of an interest rate hike, which has reduced market uncertainty to some extent. On the other hand, compared to July 2024, the current net short position in yen is not at an extreme level, so the likelihood of a reversal is not high. Additionally, the relative strength of the U.S. economy has also alleviated concerns about a global economic recession, which helps stabilize market sentiment.

In the long run, the Bank of Japan's interest rate hike policy may have more profound effects on the cryptocurrency market. As the Bank of Japan gradually tightens its monetary policy, global financial markets may gradually move towards normalization, which helps enhance the market's risk tolerance. At the same time, the interest rate hike may prompt investors to focus more on the long-term value of assets rather than short-term fluctuations. For the cryptocurrency market, this means that the market may gradually shift from being speculation-driven to value-driven, with high-quality projects and assets becoming more favored.

The Bank of Japan's interest rate hike policy may also influence global capital flows, indirectly affecting the cryptocurrency market. As the interest rate differential between the U.S. and Japan gradually narrows, carry trades may decrease, and the pressure on the yen to depreciate may ease. This helps enhance the competitiveness of the Japanese economy and may attract more international capital to the Japanese market. However, for the cryptocurrency market, changes in capital flows may bring more complex effects, requiring investors to closely monitor market dynamics.

In summary, the Bank of Japan's interest rate hike policy may have some impact on the cryptocurrency market, but the specific degree of impact depends on various factors such as market reactions, investor sentiment, and the global economic situation.

At the end of July last year, the yen's interest rate hike led to a significant drop in BTC, but will this trend continue to replicate? The impact of yen strength and weakness on Bitcoin is complex and variable, making it difficult to directly determine price movements. On one hand, the interest rate hike may enhance the yen's purchasing power, prompting investors to shift funds from high-risk assets like BTC to low-risk assets, while the previous low-interest-rate borrowing of yen to invest in U.S. assets may be disrupted, leading to a decline in BTC prices. On the other hand, the interest rate hike may also trigger changes in global capital flows; if investors seek higher returns, demand for assets like BTC may increase. Therefore, it cannot be generalized.

BTC Data Analysis:

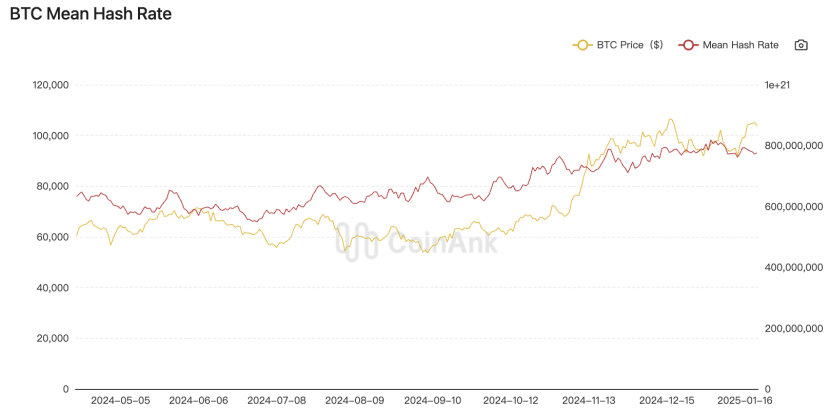

According to Coinank data, the current BTC network hash rate has retreated from its historical high, diverging from recent BTC price trends. This may be related to mining companies taking year-end breaks and the recent impact of Trump's return to power on rising coin prices. Historically, the overall trends of both have been consistent, so there are two possible outcomes: either the hash rate continues to rise, or the coin price follows the hash rate downwards.

A recent research report from financial services company Canaccord Genuity indicates that Bitcoin mining is expected to remain profitable in 2025, with major mining companies' mining costs ranging from approximately $26,000 to $28,000 per Bitcoin. Currently, the trading price of Bitcoin is about $105,000. The large-scale electricity supply from mining companies is increasingly attracting attention from artificial intelligence data center hosting businesses. Additionally, several large publicly listed mining companies are leveraging their capital advantages to upgrade their mining equipment following the halving event in April last year, thereby enhancing their competitive position and network hash rate share.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。