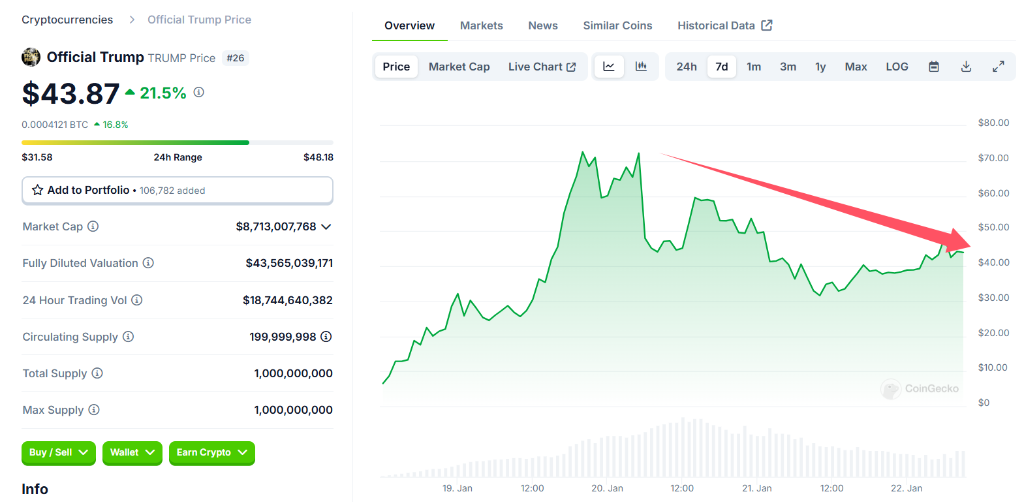

On the second day of Trump's presidency, the stock price of Trump Media & Technology Group (TMTG) plummeted by 11%, and the so-called "Trump Coin" crashed over 40% from its peak.

Written by: Bu Shuqing, Wall Street Insights

On the second day of Donald Trump's inauguration as the 47th President of the United States, related concept assets saw a significant decline. The stock price of Truth Social's parent company, Trump Media & Technology Group (TMTG), dropped 11% on Tuesday, while the so-called "Trump Coin" fell over 40% from its highest point.

However, when asked about it on Tuesday afternoon local time, Trump said, "I know very little about it other than that I issued it. I hear it's very successful, but I haven't looked at it." Following this statement, Trump Coin experienced a sharp drop but has since recovered some ground, still accumulating over 20% in the past 24 hours.

"Trump Coin" reached a historical high of $75.35 after its launch, while the MeMe Coin launched by First Lady Melania Trump also peaked at $13.73 on the same day. Despite both experiencing significant declines on Tuesday, early investors who bought in and sold near the peak still made considerable profits.

Early data from analysis firm Nansen indicated that as of noon on Monday, many of the largest Trump Coin holders (those who invested over $20 million) were selling off their holdings for profit. Among them, one investor holding over $52 million in Trump Coin sold off their entire position, achieving a 91% return on investment.

Among the 15 largest holders, about 33% had completely exited their positions as of noon on Monday. The remaining holders sold off most of their holdings, but with smaller positions. An exception was a major shareholder with a $32 million position who had not yet sold.

According to Nansen's data, investors with returns exceeding 10,000% had varying position sizes, with the smallest being $1,400 and the largest nearly $2.4 million. The highest returns reached almost 19,000%, with one holder maintaining a position worth $270,000, still holding 54% of it as of noon on Monday.

While some made substantial profits, others faced significant losses. One investor completely exited their position after a 36% loss, resulting in over $3.5 million in losses, while another wallet was sold off after a 41% loss, incurring nearly $2 million in losses.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。