Author: @arndxt_xo

Compiled by: Blockchain in Plain Language

Historically, Bitcoin tends to perform strongly in February of halving years.

1. Cycle Review and Predictions

1) Review of 2017 and 2021 Cycles

2017: Bitcoin experienced a pullback in January but resumed its upward trend in February.

2021: Similarly, BTC fell in January and regained momentum in February.

2) 2025 Predictions

If history repeats itself, February this year may also see a similar upward trend.

3) Market Rumors and Potential Drivers

Recently, speculation around executive orders related to Bitcoin has intensified.

Although unconfirmed, historical experience suggests that such events typically have a significant impact on the market.

Next, we will conduct an in-depth analysis of performance across various sectors.

2. Industry Overview

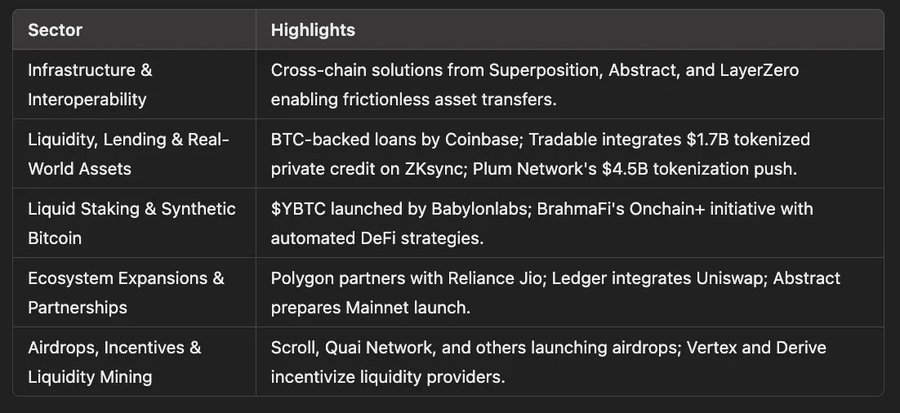

1) Infrastructure & Interoperability

Reducing network tribalism and achieving cross-chain connectivity.

Development Dynamics:

Superposition (Arbitrum L3) and Abstract (integrating Stargate's Hydra) are launching more efficient asset transfer and data sharing solutions.

LayerZero is expanding its influence, allowing applications on Superposition to access liquidity from over 100 connected chains.

Arcana Network is collaborating with Scroll to allow users to pay Gas fees with stablecoins (USDC/USDT) on any chain, significantly simplifying the onboarding process for users.

Perspective:

These advancements indicate a sustained momentum in promoting cross-chain interoperability. From L1 to L2 to L3, seamless movement of assets and data is gradually becoming a fundamental requirement in the industry.

Projects that can integrate user-friendly interfaces, Gas abstraction, and universal cross-chain bridges are expected to reduce the barriers that previously hindered the adoption of DeFi due to "network tribalism."

Looking ahead, we may see more customized L3s launched in vertical fields, such as gaming, RWA (real-world assets), and institutional-grade DeFi.

2) Liquidity, Borrowing, and Real-World Assets

The Holy Grail of Credit and Lending Ecosystems.

Development Dynamics:

Coinbase has launched BTC-collateralized loans for U.S. users, providing mainstream audiences with the ability to leverage Bitcoin assets.

Tradable has partnered with ZKsync to bring $1.7 billion of raised credit (RWA) on-chain, showcasing how institutional-grade products can further penetrate the DeFi space.

Plume Network has attracted over $4.5 billion in asset commitments for asset tokenization, achieving a TVL of $64 million before launch, while also launching a $25 million RWAfi ecosystem fund.

Perspective:

The lines between CeFi and DeFi are increasingly blurred, marking an important sign of industry maturity.

Coinbase's entry into the crypto lending market indicates that centralized exchanges are willing to offer products traditionally associated with DeFi platforms. This may divert DeFi users but simultaneously validates the importance of on-chain loans as a key financial tool.

The integration of RWA is seen as the "Holy Grail" connecting traditional finance and on-chain liquidity.

If this trend continues, DeFi may experience stronger yields, deeper liquidity, and higher institutional trust, but it may also come with increased regulatory scrutiny.

The development in these two areas reflects not only technological and ecological progress but also the industry's transformation from "novel technology" to mainstream financial tools.

3) Liquid Staking & Synthetic Bitcoin

Innovation in Staking Mechanisms.

Development Dynamics:

Babylon Labs has launched $YBTC, a liquid staking token backed 1:1 by BTC, integrated with pSTAKE.

BrahmaFi has introduced the Onchain+ program, combining multi-chain strategies and AI agents (ConsoleKit) for automated DeFi operations.

Perspective:

Liquid staking has proven to be a key means of unlocking additional yields for stakers without sacrificing liquidity. By tokenizing staked assets (like BTC, ETH, etc.), DeFi participants can use them as collateral or trade freely.

This "dual yield" model (earning staking rewards while potentially gaining DeFi yields) may further accelerate development.

However, there are inherent risks: the more times assets are "liquid staked," the deeper the complexity of the system. Protocols must maintain transparency and undergo thorough audits to prevent hidden leverage from eroding system stability.

4) Ecosystem Expansion and Strategic Partnerships

Mass user onboarding and corporate collaborations.

Development Dynamics:

Polygon Labs has partnered with India's largest telecom company, Reliance Jio (with over 450 million users), to integrate blockchain solutions into Jio's applications.

Ledger has integrated Uniswap into Ledger Live Desktop, providing a smoother experience for hardware wallet users.

Abstract is preparing for its mainnet launch, hinting at an upcoming wave of multi-chain product innovations.

Perspective:

Mass user onboarding and corporate partnerships are key to the blockchain industry's move towards mainstream adoption. This not only enhances the visibility of blockchain technology but also further validates its value through real-world applications.

Especially in high-growth markets like India, the collaboration between Polygon and Reliance Jio could become an important example of driving blockchain adoption.

5) Airdrops, Incentives, and Liquidity Mining

Intensifying User Competition.

Development Dynamics:

Several projects, including Scroll, Quai Network, Fuel, and Bubblemaps, are launching airdrop campaigns or extending reward seasons, each with different community participation standards.

Protocols like Vertex (rewarding $2.1 million in $SEIToken) and Derive (rewarding $2 million in $DRV to liquidity providers) continue to offer user incentives. Nodepay and Solayer provide early claiming processes or direct distribution during the TGE phase.

Perspective:

Airdrops have proven to be an effective way to kickstart initial user bases but are gradually becoming a "standard" in the competition among new protocols.

As more projects offer incentives, user fatigue may become an issue. The key for projects lies in attracting users through genuine utility rather than merely relying on "chasing incentives."

In the long run, protocols need to find a balance between incentive mechanisms and sustainable token economics. The best strategy is to design reward systems that attract new users and retain them through the actual value of products.

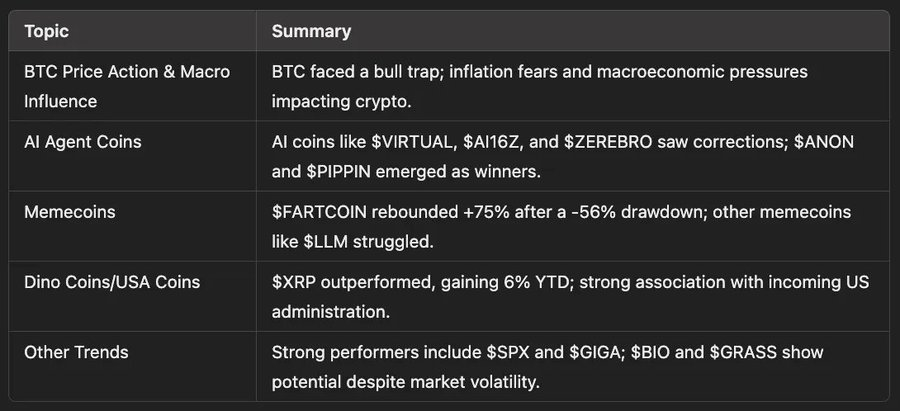

3. Narrative Overview

From liquid staking and ecosystem collaborations to user incentives, the current focus of the industry is on enhancing user experience and engagement through innovation and strategy. These developments not only drive the improvement of infrastructure but also signify that DeFi is gradually moving towards a more mature and efficient stage.

1) BTC Price Trends and Macro Impacts

Market Dynamics

On the first Monday of the new year, the market experienced a significant "bull trap." Bitcoin ($BTC) surged after the New York market opened, with Coinbase premiums attracting investors who believed a bull market was imminent. However, this signal proved to be false. The next day, Bitcoin's price quickly stagnated and fell sharply, leading to a weakening altcoin market.

2) Key Macro Factors Leading to Uncertainty

Inflation concerns: Strong employment market data (NFP report) released on January 10 indicates potential inflationary pressures, which may lead to fewer rate cuts, serving as a bearish signal for the stock and crypto markets.

Dollar Index (DXY): Reached a new high of 110.

10-Year Treasury Yield: Increased from 4.6% to 4.8% since the beginning of the year.

S&P 500 Index: Retraced to pre-election price levels.

3) AIToken Corrections and Opportunity Consolidation

$VIRTUAL: Fell 57% from a market cap of $5.2 billion.

$AI16Z: Fell 63% from a market cap of $2.5 billion.

$ZEREBRO: Fell 73% from a market cap of $820 million.

$FAI: Dropped from $650 million to $500 million.

$AIXBT: Despite market weakness, it remains close to historical highs.

$GOAT: Fell 55%, continuing to show weakness.

Emerging Winners

$ANON: Grew from $20 million to $240 million.

$AVA: Grew from $60 million to $300 million.

$PIPPIN: Grew from $15 million to $320 million.

4. Memecoins Dynamics

1) FARTCOIN

A meme coin loosely associated with the AI narrative, rebounded 75% after a 56% drop. The market speculates that its market cap may exceed $5 billion or even higher.

$$BUTTHOLE and $$LLM

$BUTTHOLE: Fell 70% after reaching a peak of $140 million.

$LLM: Related to the AI narrative, fell 75% after reaching $150 million.

2) Dino Coin and USA Coin (represented by $XRP)

$XRP: Up 6% year-to-date, outperforming the market.

The association of Ripple with the incoming U.S. government and CEO Brad Garlinghouse's relationships with key political figures boosted market sentiment.

3) Other Strongly Performing Tokens

$HBAR

$XLM

$ADA

5. Other Notable Trends and Strong Performances

$SPX: Surpassed a $1 billion market cap, reaching a peak of $1.6 billion, now down 30%.

$GIGA: Approaching $1 billion but faced resistance, down 30%.

$SUI: Reached a historical high FDV of $54 billion, only down 13%.

New Projects Launched

$BIO: Launched as the first major DeSci protocol, with an FDV of $3 billion, now down 55%.

$GRASS: Showed strong rebound after several weeks of sideways trading.

$USUAL: Sparked controversy due to changes in USD0++ redemption rules, down 66% from historical highs.

Tokens to Exercise Caution With

$FTM: Potential for a second spring due to trading contracts being delisted, but significant migration issues exist.

$RUNE: Faces risks related to ThorFi borrowing, being compared to LUNA.

Animal-themed meme coins: $POPCAT, $WIF, and $NEIRO performed the worst, with $POPCAT down 73% from historical highs.

6. Outlook for 2025

The market has opened a new chapter, but the macroeconomic environment and the diversity of the token market suggest we should remain cautious while seeking potential opportunities.

Looking forward to reaching new heights in 2025 with more market participants!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。