Solana's capital inflow reached approximately $300 million within a week, primarily from Ethereum, Base, and Arbitrum.

Author: Ignas | DeFi

Compiled by: Deep Tide TechFlow

Last weekend was dubbed one of the craziest weekends in the cryptocurrency space. The trading volume of decentralized exchanges (DEX) hit an all-time high, with Solana excelling on multiple fronts, while the capital flow indicated significant changes in the market.

Here’s a quick overview of the data and trends behind this phenomenon through 10 charts.

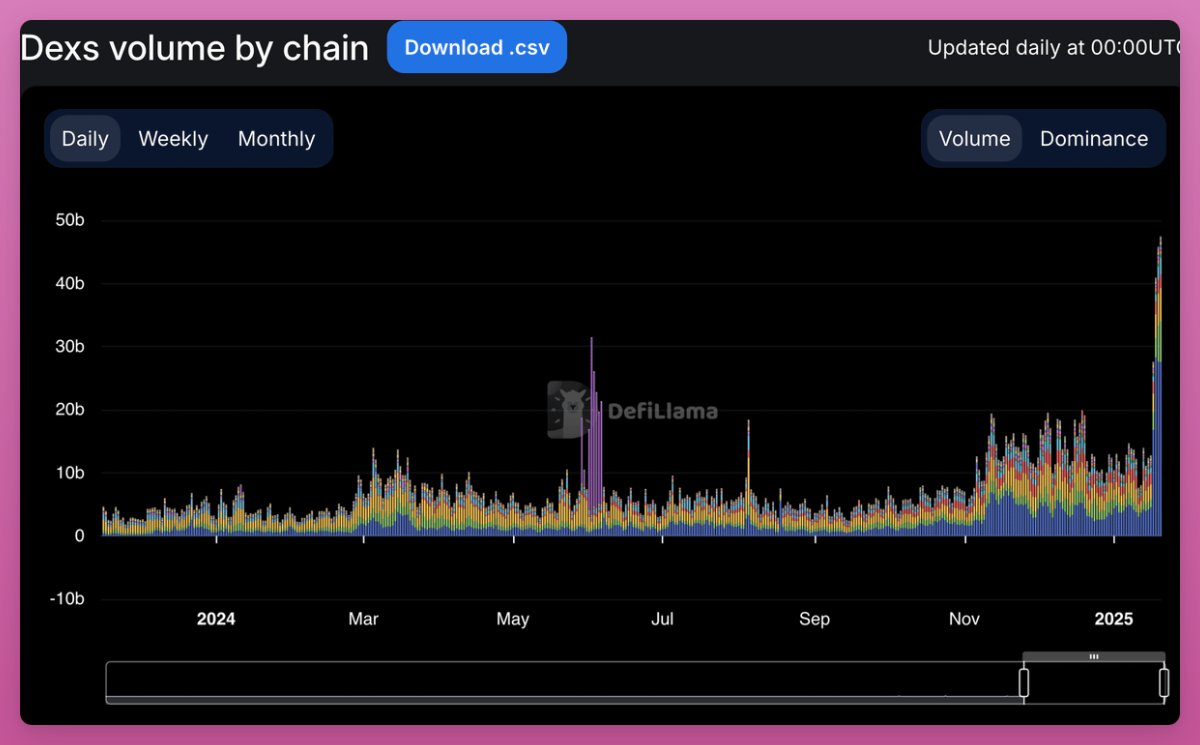

1. DEX Trading Volume Hits All-Time High

Solana's decentralized exchange (DEX) trading volume reached $27 billion, far surpassing Ethereum's $5 billion.

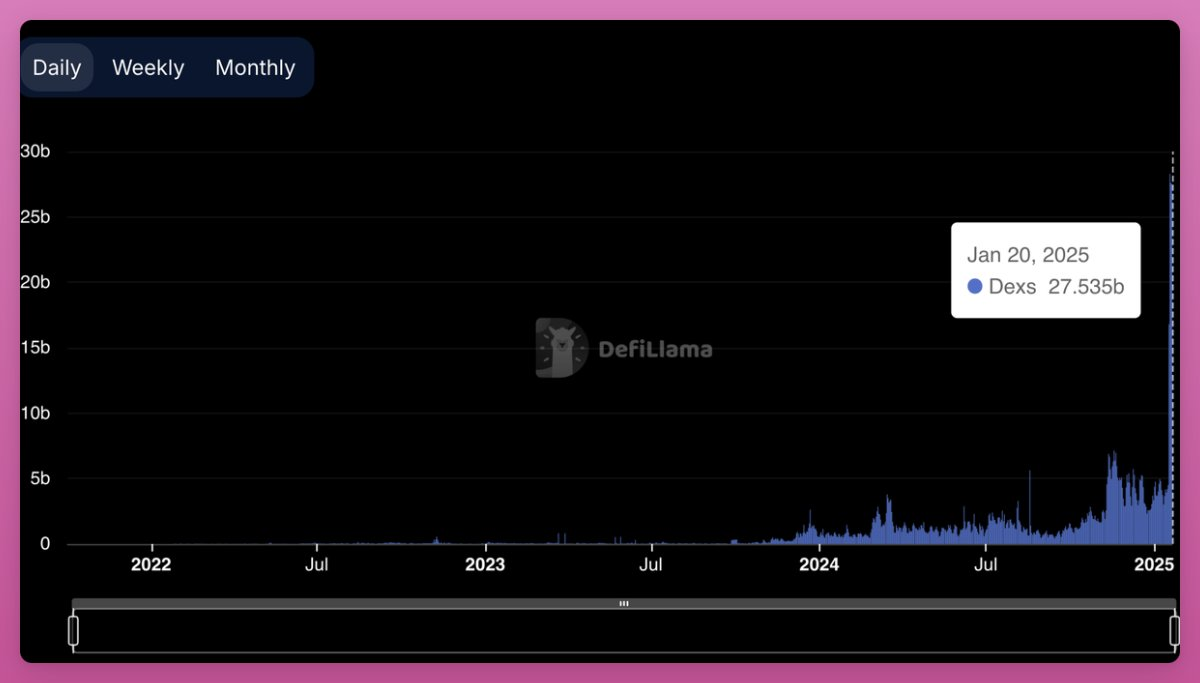

2. Solana DEX Trading Volume Soars

Solana's DEX trading volume skyrocketed from an average of about $5 billion to $27 billion, achieving a 5.4-fold increase.

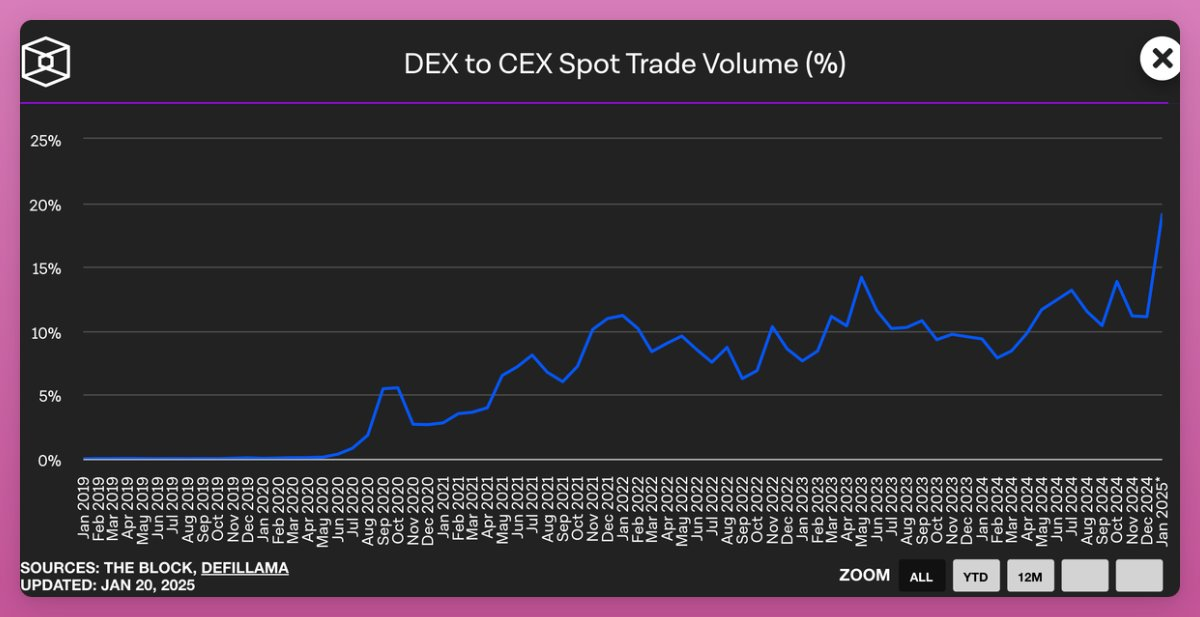

3. DEX to CEX Trading Volume Ratio Reaches All-Time High

Due to this phenomenon, the trading volume ratio of DEX to centralized exchanges (CEX) reached a historic peak of 19%.

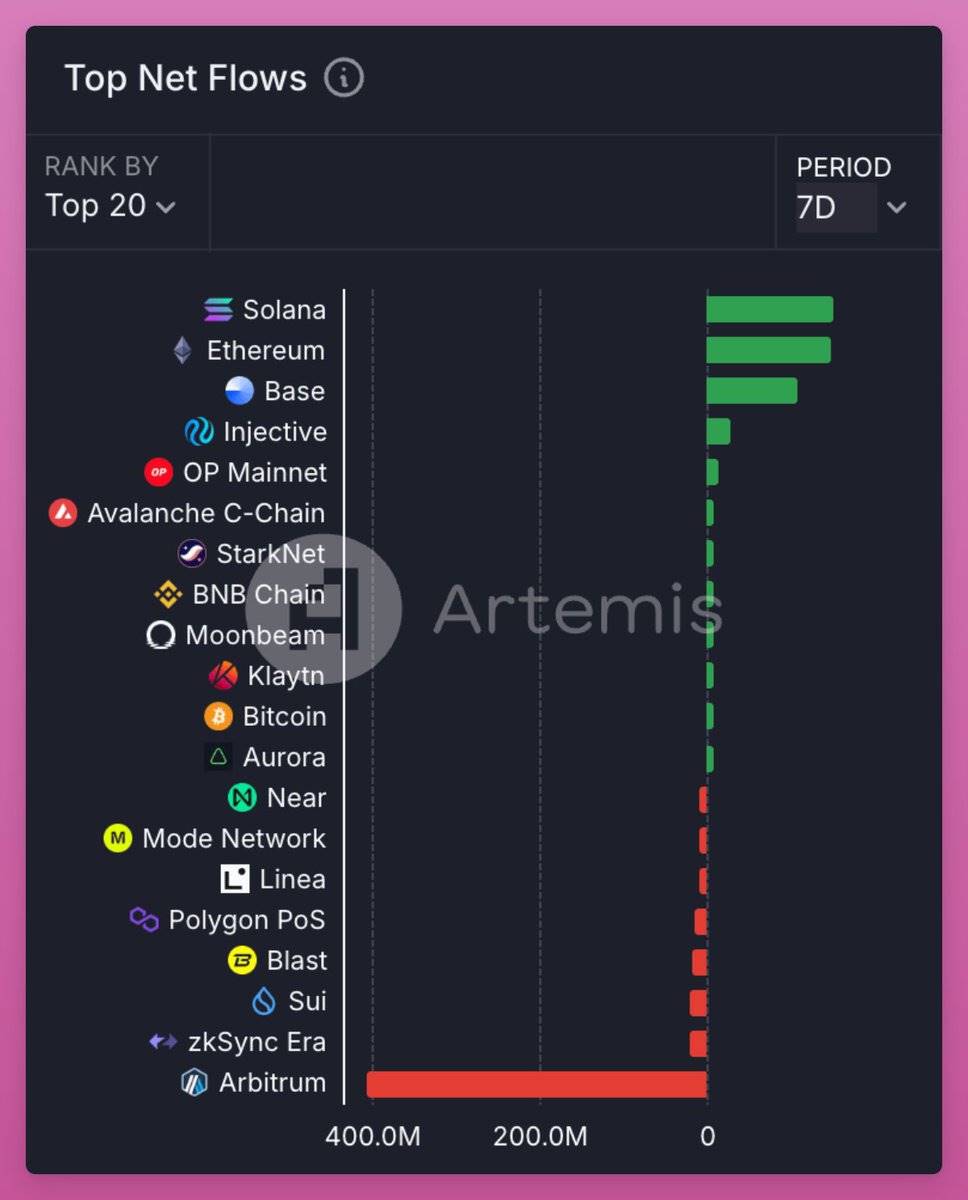

4. Capital Flows from Arbitrum to Solana, ETH, and Base

Data shows that Solana achieved a net inflow of $153 million within a week, while Arbitrum lost $405 million.

(Is this situation related to Hyperliquid's cross-chain bridge?)

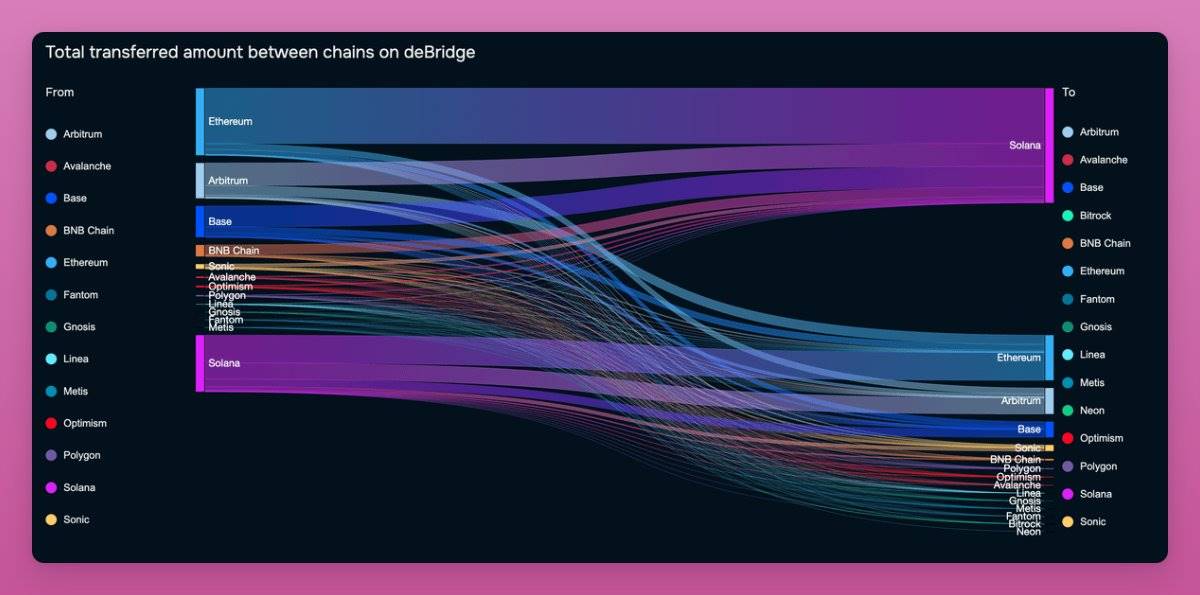

5. Visual Analysis of Capital Flow to Solana

According to data analysis from DeBridge, Solana's capital inflow reached approximately $300 million within a week, primarily from Ethereum, Base, and Arbitrum.

At the same time, Solana's capital outflow was about $140 million.

6. Phantom Activity Surges

Phantom reports show that its request volume exceeded 8 million per minute. The total trading volume through Phantom reached $1.25 billion, involving 10 million transactions.

Based on the current 0.85% fee, Phantom's fee revenue during this period reached approximately $10.6 million.

@phantom: “Trading has now resumed smoothly, and all systems are operating normally.

Despite facing numerous challenges, our users achieved over $1.25 billion in trading volume today and completed 10 million transactions, which is impressive!”

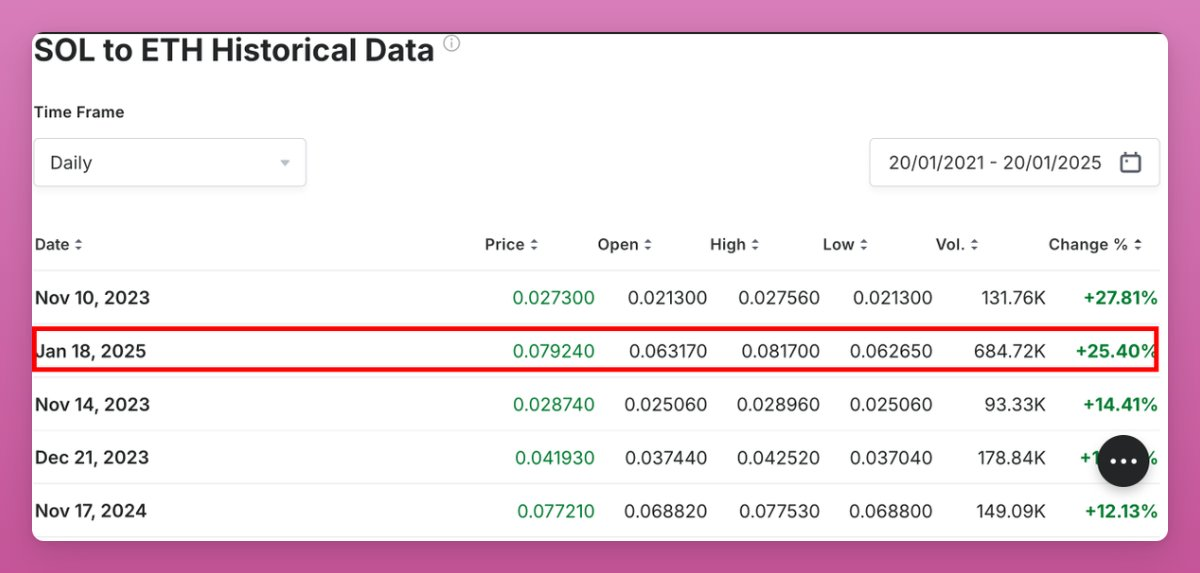

7. $TRUMP Launch Day Sees Strong SOL Performance

On the day of the $TRUMP token launch, the exchange rate of SOL to $ETH experienced its largest single-day increase since 2021, reaching as high as 25%.

This repricing further dampened the morale of the Ethereum community and intensified calls for reform within the Ethereum Foundation.

The possibility of SOL surpassing ETH has become a hot topic of discussion.

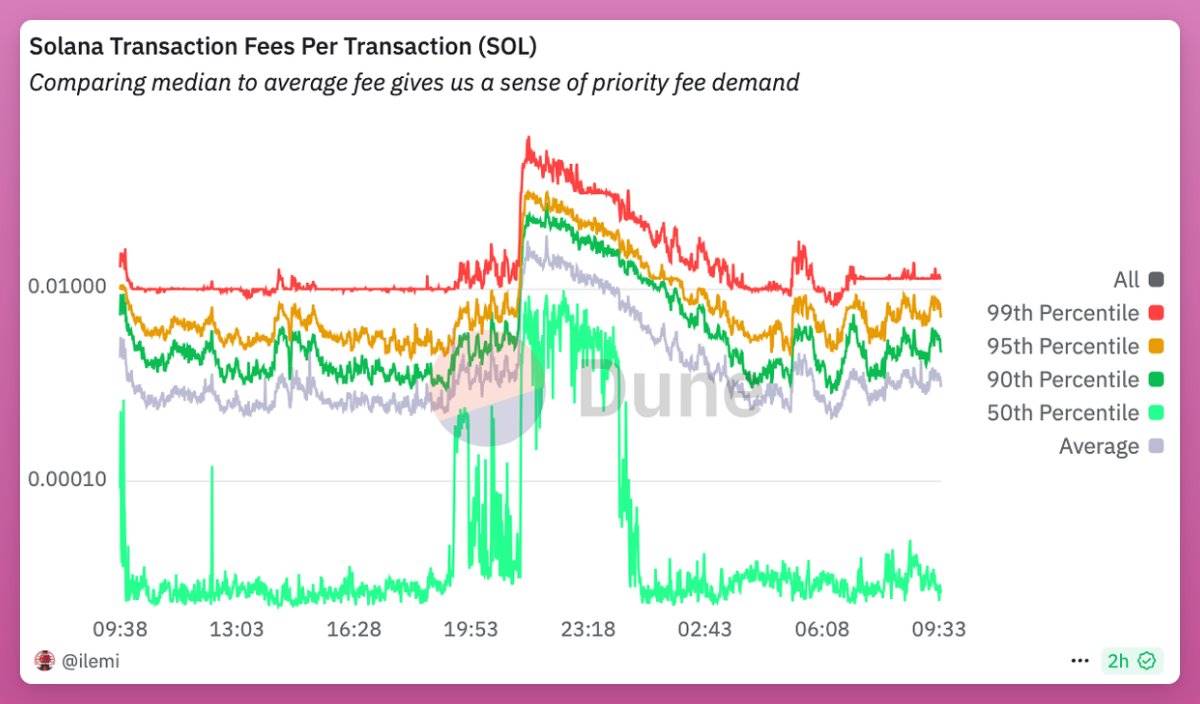

8. Solana's Challenge: Soaring Fees

Despite strong performance, Solana's fees averaged a 20-fold increase during this period, causing many users to be unable to complete transactions successfully.

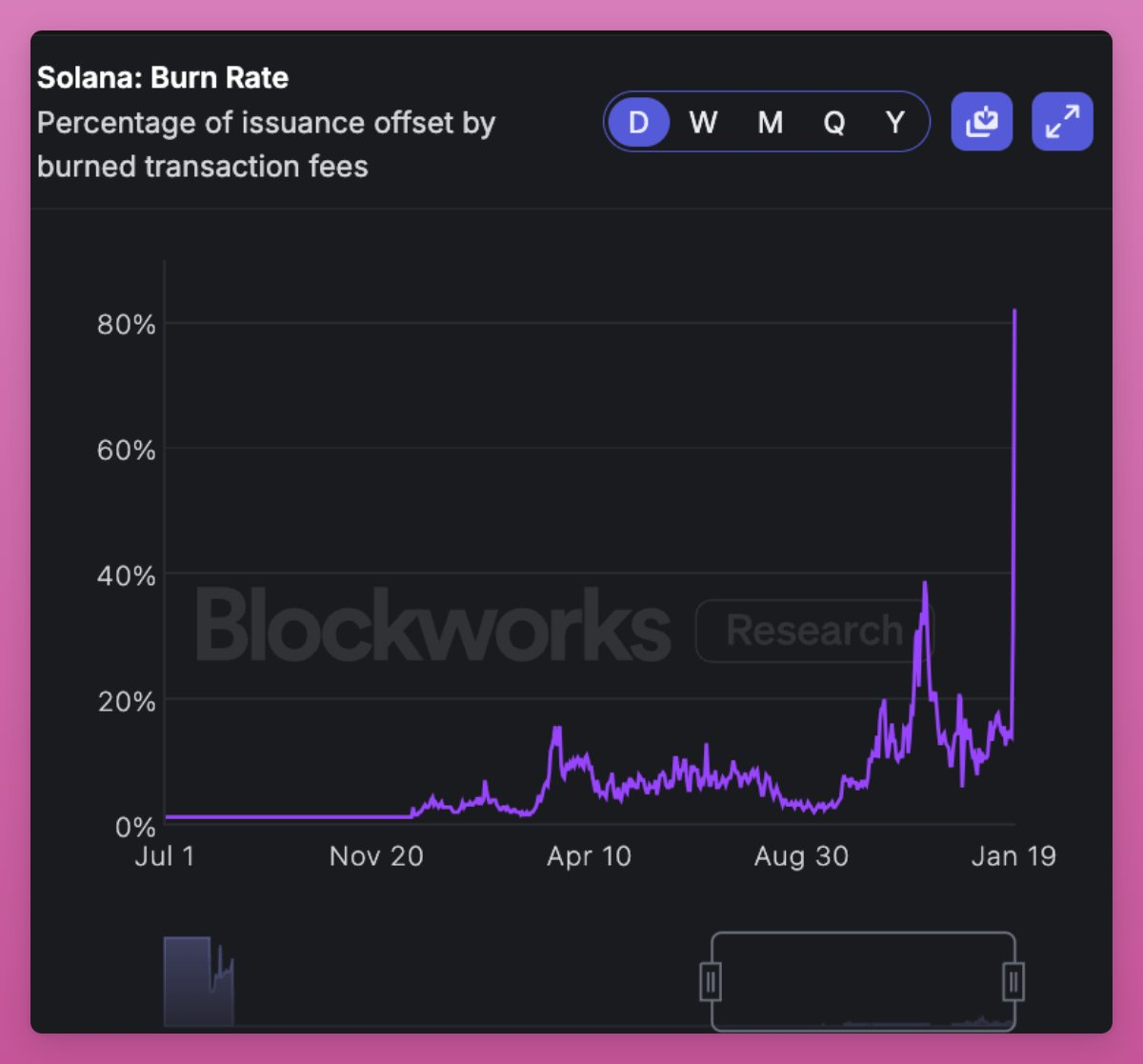

9. High Fees Benefit SOL Stakers

High fees brought profits to SOL stakers, with total fee revenue reaching $57 million. Of this, priority fees accounted for $33 million, and Jito Tips accounted for $23.5 million.

10. Additionally, the amount of $SOL burned reached a record $16.7 million.

However, don’t rush to promote the so-called "ultra-sound money" theory, as even the burn amount for this day only accounted for 81% of SOL's issuance for that day.

Summary: Solana's Weekend

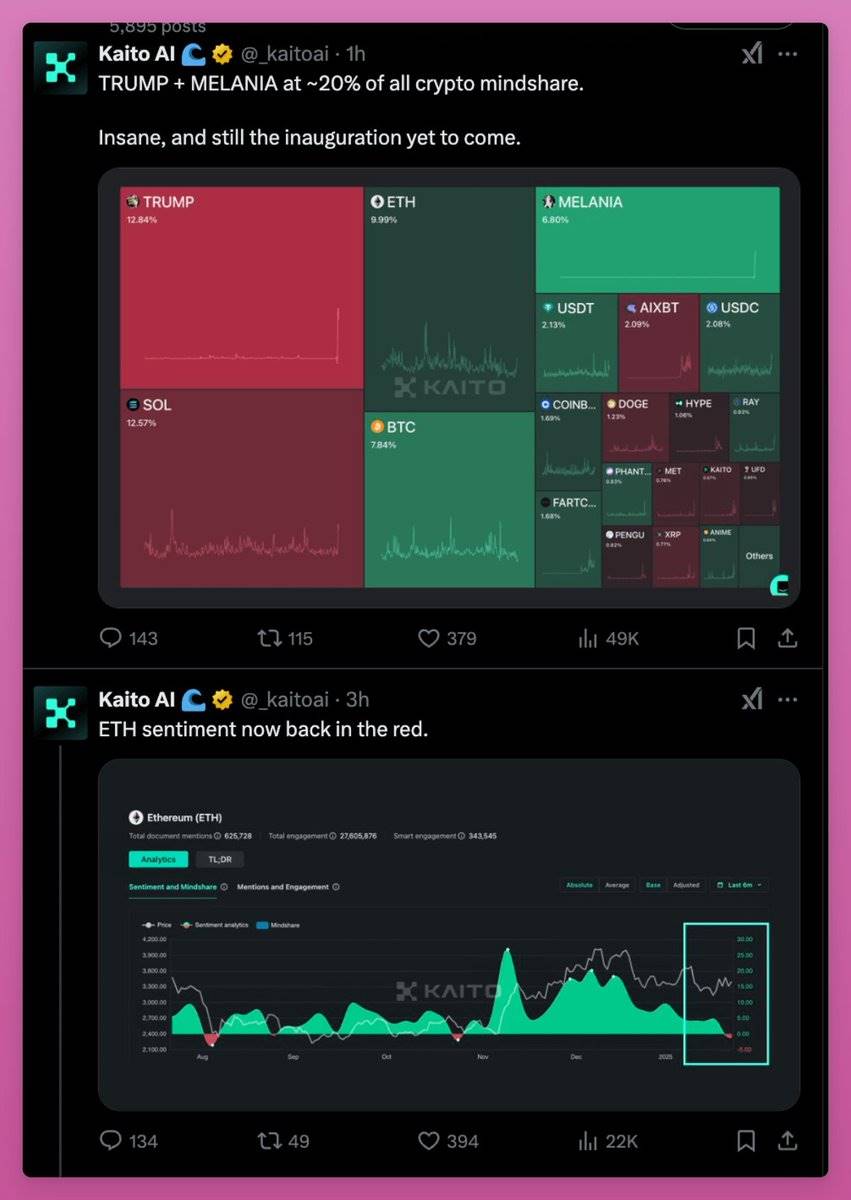

This weekend undoubtedly belonged to Solana: $TRUMP, MELANIA, and $SOL captured the market's main focus. Meanwhile, the market sentiment for ETH turned negative once again.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。