On January 30, 2025, the Federal Reserve is set to announce its latest benchmark interest rate decision. As global markets focus on this monetary policy milestone, it is particularly important to review the impact of previous benchmark rate adjustments by the Federal Reserve on the cryptocurrency market and to predict the direction of this decision in light of the current economic context. This not only relates to the trends in traditional financial markets but will also have a profound impact on the crypto asset ecosystem.

Historical Impact of Federal Reserve Benchmark Rate Adjustments

Low-Interest Rate Environment and the Prosperity of the Crypto Market

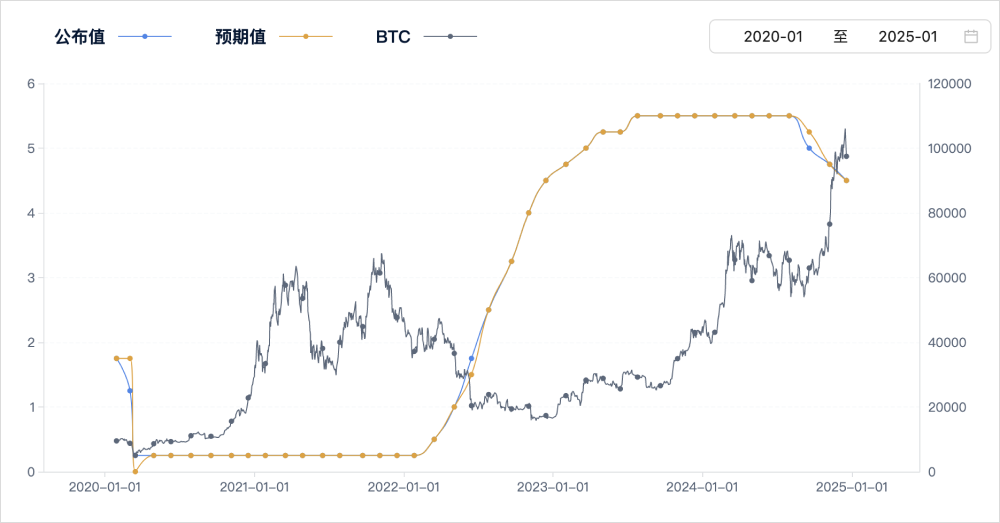

Between 2020 and 2022, the Federal Reserve's low-interest rate policy created excellent development conditions for the crypto market. With the implementation of quantitative easing (QE) policies globally, an influx of liquidity drove the prices of mainstream cryptocurrencies like Bitcoin and Ethereum to soar. For instance, Bitcoin's price rose from less than $8,000 at the beginning of 2020 to a historic high of $69,000 in November 2021.

During this period, cryptocurrencies were seen as "digital gold" in the fight against inflation, attracting significant attention from institutional investors. Institutions like Grayscale increased their purchases of Bitcoin, while companies like MicroStrategy directly incorporated Bitcoin into their balance sheets. Meanwhile, the decentralized finance (DeFi) ecosystem rapidly expanded in the low-interest rate environment, with platforms like Aave, Compound, and Uniswap's total value locked (TVL) surpassing $180 billion by the end of 2021.

Impact of the Rate Hike Cycle on the Crypto Market

Starting in 2022, the Federal Reserve began tightening monetary policy through consecutive rate hikes to curb high inflation. This move had a significant negative impact on the crypto market. Bitcoin's price fell below $16,000 in the second half of 2022, while Ethereum dropped from $3,800 at the beginning of the year to less than $1,200.

The high-interest rate environment significantly reduced the risk-return ratio of crypto assets, leading investors to shift towards traditional assets with higher returns and lower risks, such as government bonds and high-grade bonds. At the same time, the stablecoin market also faced indirect impacts from interest rate changes. The Fed's rate hikes increased the yields on dollar-denominated reserve assets, significantly boosting the income of stablecoin issuers, but this also exposed them to higher regulatory pressures and operational risks.

Investor Psychology Amid Market Volatility

During the rate hike cycle, the volatility of the crypto market significantly increased. In 2022, one of the largest cryptocurrency exchanges, FTX, went bankrupt due to liquidity issues, triggering broader market panic. This event exacerbated investors' risk-averse sentiment in a high-interest rate environment, further depressing market liquidity. Meanwhile, traditional financial institutions showed reduced interest in crypto assets, leading to a significant outflow of institutional funds.

Impact of the Federal Reserve's Rate Cuts in 2024 on the Market

Rate Cuts and Market Recovery

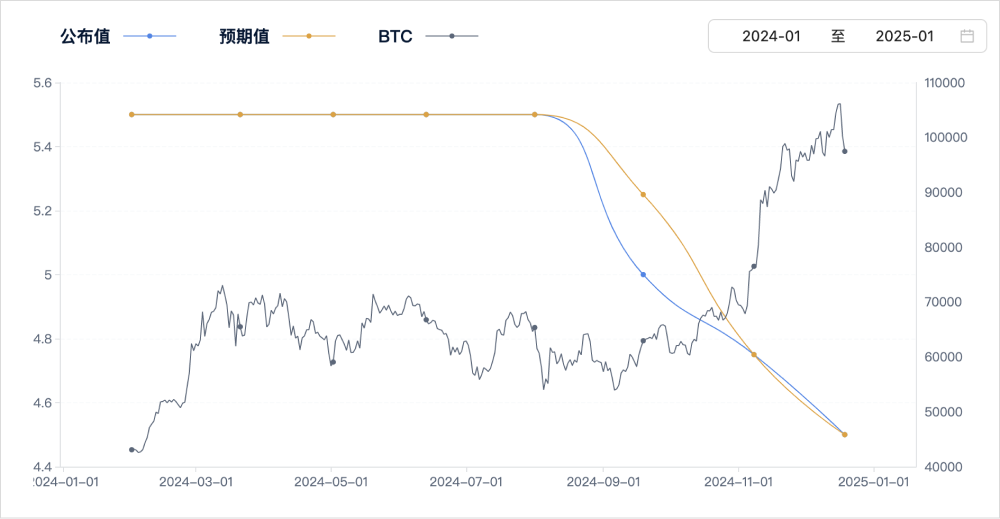

In 2024, the Federal Reserve cut rates twice in September and October, totaling a 75 basis point reduction in the benchmark rate. This move aimed to address potential economic slowdown and a weakening labor market. This policy shift directly propelled a short-term recovery in the crypto market.

Bitcoin's price surged rapidly following the rate cut announcement, approaching $61,000, while Ethereum also broke through $2,300. Additionally, the DeFi sector attracted a large influx of investors again, with a significant increase in platform locked value. Meanwhile, the NFT market and metaverse-related tokens also showed signs of activity.

Improvement in Market Sentiment and Capital Inflow

The low-interest rate environment enhanced the market's preference for high-risk assets. As institutional investors repositioned themselves, liquidity in the crypto market significantly improved. Particularly in the decentralized finance sector, the demand for borrowing surged, and protocol activity rebounded. According to DeFi Pulse data, by the end of 2024, the total value locked (TVL) in DeFi recovered to $140 billion, a growth of over 50% compared to the beginning of the year.

It is worth noting that the market's overinterpretation of the policy shift also led to short-term price volatility. Some analysts warned that while rate cuts injected liquidity into the market, the uncertainty of the global macroeconomic situation could still pose potential risks.

Outlook for the Federal Reserve's Decision on January 30, 2025

According to the CME "FedWatch" tool, as of January 2025, the market generally expects the Federal Reserve to maintain interest rates, although some opinions suggest a possible 25 basis point cut.

Economic Background

Recent data shows that the U.S. GDP growth rate slowed to an annualized 1.5% in the fourth quarter of 2024, while the core PCE (Personal Consumption Expenditures) price index rose 3.2% year-on-year, down from 4.8% in 2023. The unemployment rate slightly increased to 3.8%, indicating a gradual loosening of the labor market.

Goldman Sachs' latest report predicts that the Federal Reserve will cut rates by 25 basis points in the first quarter of 2025 and further reduce rates in the following two quarters, totaling a 100 basis point cut for the year. This forecast is based on a significant decline in U.S. inflation data and an increased risk of economic slowdown.

Meanwhile, Guggenheim Partners' Chief Investment Officer Anne Walsh noted that the Federal Reserve might cut rates once per quarter in 2025, totaling a reduction of 75 to 100 basis points. However, this rate-cutting path is slower than previously expected, reflecting policymakers' cautious approach in balancing economic growth and financial stability.

Key Opinion Leaders (KOL) Perspectives

Cathie Wood, founder of ARK Invest, stated that rate cuts could stimulate demand for cryptocurrencies, especially major assets like Bitcoin and Ethereum. She pointed out that the long-term potential of the crypto market remains strong, and rate cuts will lay the foundation for a new round of capital inflows.

However, JPMorgan strategist Nikolaos Panigirtzoglou warned that rate cuts could lead to increased market volatility in the short term, especially amid ongoing regulatory uncertainty. He advised investors to remain cautious when increasing their holdings in crypto assets.

Potential Impact on the Crypto Market

Impact of Rate Decisions on Capital Flows

The Federal Reserve's interest rate decisions will directly affect liquidity in the crypto market. In a low-interest rate environment, cryptocurrencies may continue to attract risk-tolerant investors. Particularly for mainstream assets like Bitcoin and Ethereum, their safe-haven and appreciation attributes may be favored amid market volatility.

Stablecoin issuers will also be significantly affected by interest rate changes. Each 25 basis point cut could reduce the annual interest income of stablecoin issuers by hundreds of millions of dollars. To compensate for the decline in income, these institutions may seek higher-yield investments, thereby increasing systemic risk.

Opportunities for DeFi Recovery

The low-interest rate environment may provide an opportunity for the recovery of the DeFi sector. The usage rates of lending protocols and locked value are expected to increase significantly. However, investors need to be cautious of potential regulatory risks and market volatility due to excessive leverage.

Long-Term Outlook and Risks

Although rate cuts may bring short-term benefits, the crypto market still faces multiple challenges in the long term, including regulatory pressures, technological iterations, and changes in the global macroeconomic landscape. Particularly in the context of the U.S. Securities and Exchange Commission (SEC) tightening its scrutiny of crypto assets, market participants need to be more cautious.

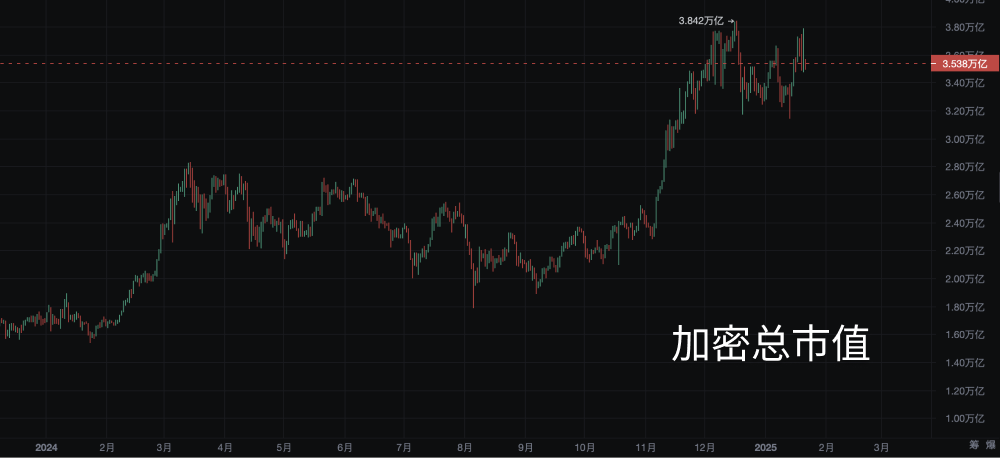

According to AiCoin data, the total market capitalization of the global crypto market at the beginning of January 2025 was $3.5 trillion, a 200% increase compared to the same period in 2024. This indicates that investors remain confident in the medium- to long-term prospects of the crypto market.

Conclusion: Policy Shift and Market Future

The Federal Reserve's benchmark interest rate decision is not only an important barometer for global financial markets but also a key variable for the cryptocurrency ecosystem. The outcome of the meeting on January 30, 2025, whether it maintains rates or further cuts them, will have a profound impact on market sentiment and asset prices.

For investors, staying attuned to macro policy trends and dynamically adjusting their portfolios based on economic data remains a core strategy for navigating market uncertainties. At this critical policy juncture, the future of the crypto market is filled with both opportunities and challenges.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。