On January 20, 2025, Gary Gensler officially resigned as the Chairman of the U.S. Securities and Exchange Commission (SEC), a change that has sparked widespread attention in the cryptocurrency market. He was succeeded by Mark Uyeda, who is considered to have a friendly attitude towards cryptocurrencies. Following this change, the market showed a relatively positive reaction in the short term, with many speculating on how the new leadership team will redefine the regulatory environment for the crypto market and whether this policy adjustment can reignite the market confidence that has long been overshadowed by a gloomy sentiment.

The Changing Winds of the SEC: From Gensler to Uyeda

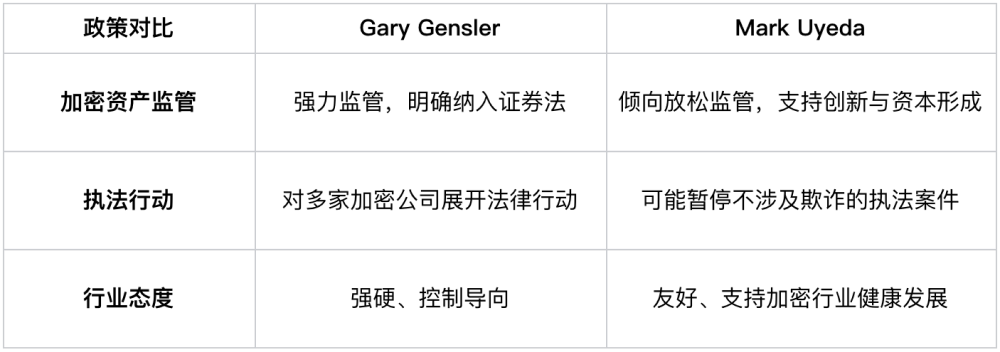

Gary Gensler's Iron-Fisted Policies

Since taking the helm of the SEC in 2021, Gary Gensler has advocated for stricter regulation of cryptocurrencies, particularly bringing major crypto assets like Bitcoin and Ethereum under the securities law framework. The core argument of this policy is that crypto assets exhibit characteristics of traditional securities and should be regulated under existing laws. As a result, Gensler led large-scale legal actions against crypto giants including Ripple, Coinbase, Binance, and Terraform Labs, aiming to ensure fairness and transparency in the market through regulation.

Although the intention behind this policy was to protect investors and combat market manipulation and fraud, its aggressive approach has faced widespread opposition. Many industry practitioners and some legislators believe that excessive regulation could stifle innovation in the industry and make the crypto market less competitive. Gensler's policies not only exacerbated uncertainty in the industry but also deepened the divide in the fintech sector.

Mark Uyeda's Friendly Signals

After Mark Uyeda took over from Gensler, the market generally believes that the SEC's cryptocurrency regulatory policy will undergo a transformation. Uyeda has been an SEC commissioner since 2022 and has consistently held a relatively moderate regulatory stance, particularly criticizing Gensler's aggressive policies. He believes that the current regulatory framework may not necessarily apply to crypto assets and suggests developing more flexible policies to promote innovation and capital formation.

As an SEC commissioner appointed by the Trump administration, Uyeda's stance is more amicable towards the crypto industry, arguing that cryptocurrencies should be viewed as an innovative asset class, and that moderate regulation can support their healthy development. His appointment is seen as a potential sign of changing the current regulatory model, especially in enhancing market transparency and protecting investor rights while promoting industry growth.

Looking Ahead: Uyeda's Regulatory Blueprint

Dawn of Regulatory Easing

Uyeda's appointment has brought some exciting signals to the market, particularly his clear stance on easing cryptocurrency regulation. He has publicly criticized Gensler's policies as overly strict, arguing that the innovative spirit of the crypto market should be respected and that the rapid development of the market should not be overly interfered with. Recently, Uyeda stated that he supports reducing legal restrictions on financial institutions holding digital assets, encouraging banks and other traditional financial institutions to more broadly participate in the holding and trading of crypto assets.

His attitude towards easing cryptocurrency regulation has not only garnered support from some Republican commissioners but has also sparked widespread discussion within the industry. SEC Commissioner Hester Peirce has strongly advocated for reducing the regulatory burden on the crypto market, arguing that the unique characteristics of digital assets compared to traditional financial markets require flexible regulatory measures.

Encouraging Innovation and Capital Formation

In addition to addressing the issue of excessive regulation, Uyeda's regulatory agenda also emphasizes innovation and capital formation. He pointed out that the potential of the crypto market is enormous, and only by relaxing regulations and reducing compliance costs for businesses can more funds flow into the industry, driving innovation in crypto technology and market development.

At the same time, Uyeda has stated that he will focus on protecting the interests of investors, particularly the elderly. Preventing financial fraud, increasing market transparency, and improving corporate governance are his policy priorities. This policy not only helps enhance the overall integrity of the crypto market but also effectively attracts more institutional investors to participate, thereby promoting the maturity and robust development of the market.

Suspension of Certain Legal Actions

Additionally, reports suggest that under Uyeda's leadership, the SEC may suspend legal actions against crypto companies that are not involved in fraud. This news immediately triggered a strong reaction in the market. Many crypto companies expressed that this policy could provide them with breathing room, alleviating the troubles caused by excessive regulatory pressure in recent months.

In this context, the market generally believes that with the relaxation of regulatory policies, more crypto projects may receive funding support, further driving the development of the industry.

How Will the Crypto Market Respond?

Restoration of Market Confidence

The market holds a generally optimistic view of the policy changes following Uyeda's appointment. Due to his friendly stance towards cryptocurrencies, the easing of regulations is likely to stimulate market confidence and attract more investors and institutions into the crypto market.

Reducing Compliance Costs, Stimulating Market Vitality

Easing regulations can not only promote the growth of the cryptocurrency market but also significantly reduce compliance costs for businesses. In the past, many crypto companies were unable to invest resources in innovation due to high compliance costs. By alleviating these burdens, Uyeda's policies are expected to encourage more financial institutions and businesses to enter this emerging field, thereby accelerating market development.

Long-Term Risks and Concerns

Despite the positive short-term market response, the long-term impact remains uncertain. Easing regulations may lead to increased market speculation and fraudulent activities, especially concerning emerging projects that lack transparency and security guarantees. The absence of investor protection mechanisms or lax regulation could exacerbate market volatility. Finding a balance between stimulating innovation and ensuring market order will be a significant challenge for the new regulatory team.

Moreover, as other countries around the world strengthen their regulation of cryptocurrencies, ensuring that the U.S. market remains competitive while effectively preventing the spread of market risks will be another major challenge facing the SEC in the future.

Conclusion: A New Era, New Challenges

The change in SEC chairmanship marks a potential significant turning point in U.S. cryptocurrency regulatory policy. Mark Uyeda's appointment undoubtedly brings more expectations for the crypto industry. His policy changes could ignite market vitality and promote sustained growth in the crypto market. However, ensuring investor protection and industry stability while fostering market development will be the core challenge of future regulation. The focus of all market participants will undoubtedly be on the policy direction in the coming months, and whether this new regulatory era can provide a broader space for the crypto market remains to be seen.

The above content does not constitute investment advice.

If you have any questions, you can contact us through the following official channels:

AiCoin Official Website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AICoincom

Email: support@aicoin.com

Group Chat: Customer Service Yingying、Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。