Table of Contents:

Large Token Unlock Data for This Week;

Overview of the Crypto Market, Quick Read on Weekly Popular Coins' Price Changes/Fund Flows;

Inflow and Outflow of Spot ETF Funds;

Solana's Daily Transaction Fees Hit All-Time High;

Key Macroeconomic Events and Financial Data Forecast for This Week.

1. Large Token Unlock Data for This Week;

Tokens such as FTN, MRS, IMX, ALT, APEX, and MURA will experience significant unlocks this week, including:

Fasttoken (FTN) will unlock 20 million tokens on January 21 at 8:00 AM, valued at $76.2 million, accounting for 4.67% of the circulating supply;

Metars Genesis (MRS) will unlock 10 million tokens on January 22 at 8:00 AM, valued at $31.4 million, accounting for 11.87% of the circulating supply;

Immutable (IMX) will unlock 24.52 million tokens on January 24 at 8:00 AM, valued at $29.9 million, accounting for 1.43% of the circulating supply;

AltLayer (ALT) will unlock 240 million tokens on January 25 at 6:00 PM, valued at $21.8 million, accounting for 10.39% of the circulating supply;

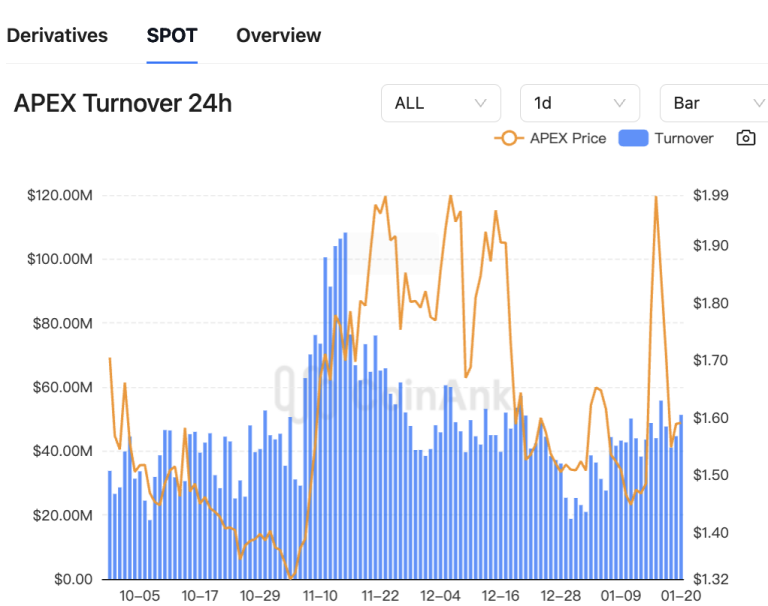

ApeX (APEX) will unlock 10 million tokens on January 20 at 8:00 AM, valued at $15.9 million, accounting for 18.71% of the circulating supply;

Murasaki (MURA) will unlock 20 million tokens on January 23 at 8:00 AM, valued at $13 million, accounting for 34.84% of the circulating supply;

Ethena (ENA) will unlock 12.86 million tokens on January 22 at 3:00 PM, valued at $10.8 million, accounting for 0.42%.

The above times are in UTC+8. This week, pay attention to the negative effects of these token unlocks, avoid spot trading, and seek shorting opportunities in contracts. Among them, MRS, ALT, APEX, and MURA have significant unlock ratios and scales, warranting extra attention.

2. Overview of the Crypto Market, Quick Read on Weekly Popular Coins' Price Changes/Fund Flows

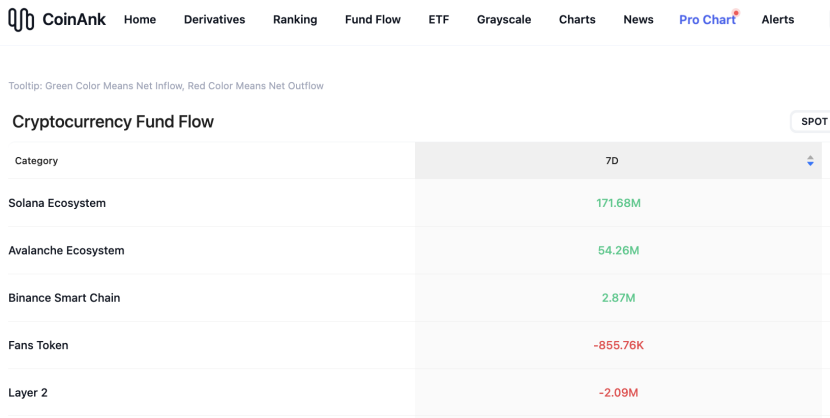

According to CoinAnk data, in the past week, the crypto market, categorized by concept sectors, saw the largest net inflows in the Solana ecosystem, Avalanche ecosystem, Binance Smart Chain, as well as in fan tokens and Layer 2 sectors, while the net outflows were relatively small. In the past week, many tokens have also experienced rotational increases. The top 500 by market capitalization are as follows: TRUMP, XCN, NEW, TOSHI, and ELON have shown relatively high increases and can continue to be prioritized for trading opportunities in strong tokens.

3. Inflow and Outflow of Spot ETF Funds.

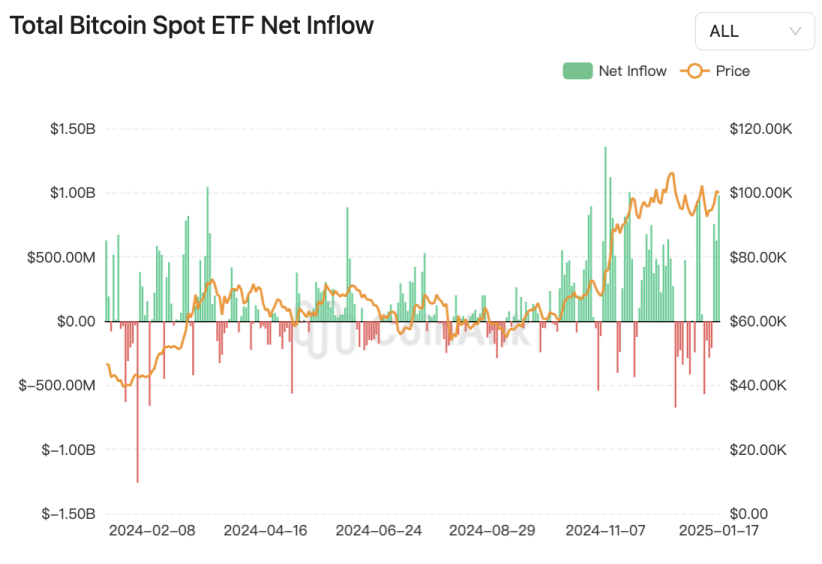

Data shows that the U.S. Bitcoin spot ETF had a cumulative net inflow of $1.8629 billion last week. The total on-chain holdings of the U.S. spot Bitcoin ETF have surpassed 1.14 million BTC, currently reaching about 1.146 million BTC, accounting for 5.78% of the current BTC supply, with the on-chain holding value reaching about $120.1 billion. Meanwhile, the BTC price has also hit a new all-time high today.

We believe that the cumulative net inflow of $1.8629 billion into the U.S. Bitcoin spot ETF last week indicates that market demand for Bitcoin remains strong. This inflow may reflect investors' confidence in Bitcoin as an asset class and interest in spot ETF products. The total on-chain holding data further demonstrates Bitcoin's importance in institutional investors' asset allocation.

Some large institutional investors are shifting their focus from AI chip manufacturer Nvidia to leading cryptocurrency ETFs, a shift that may be related to the growing recognition and acceptance of cryptocurrencies in the market. Data shows that Millennium Management's Israel Englander reduced his holdings in Nvidia by 12.5% in the third quarter of 2024, while Capula Management's Yan Huo reduced his holdings by 27.7% in the same period. Meanwhile, these two prominent billionaire investors increased their Bitcoin holdings through BlackRock's IBIT, with Englander adding 12.6 million shares to his IBIT holdings in the third quarter, while Yan Huo increased his by 1.1 million shares. This indicates that some institutional investors may be reassessing their portfolios, reallocating funds from traditional tech stocks to the cryptocurrency sector, possibly due to their expectations of long-term growth potential in cryptocurrencies.

4. Driven by the Trump Family Meme Coins, Solana's Daily Transaction Fees Reach $33.3 Million, Setting a New Record.

The Solana network's daily transaction fees have reached an all-time high. Data shows that Solana's network fees surged to $33.2 million. This spike was primarily driven by a large number of on-chain transactions resulting from the launch of meme coins TRUMP and MELANIA related to the Trump family. Since the launch of these tokens, the average daily on-chain transaction volume on Solana's decentralized exchanges has consistently remained above $27 billion, ranking first among all layer 1 public chains.

We believe that Solana's daily transaction fees reaching an all-time high reflects a significant increase in network activity. Solana has surpassed Ethereum to become the dominant chain for DEX trading, with its market share exceeding 30% in the fourth quarter of 2024. This growth is mainly attributed to the launch of meme coins TRUMP and MELANIA, which triggered a large number of on-chain transactions. The average daily on-chain transaction volume on Solana's decentralized exchanges continues to rank first among all layer 1 public chains. This indicates that the Solana network is attracting more users and trading activity, enhancing the vibrancy and appeal of its ecosystem.

5. Key Macroeconomic Events and Financial Data Forecast for This Week.

Key focus on Trump officially entering the White House, issuing a series of executive orders; the Davos World Forum taking place; whether the Bank of Japan will raise interest rates as scheduled on Friday.

January 20 (Monday): Trump is sworn in as the new President of the United States; U.S. stock markets are closed for Martin Luther King Jr. Day; the Davos World Economic Forum annual meeting is held.

January 21 (Tuesday): German Chancellor Scholz speaks at the World Economic Forum; European Central Bank Governing Council member Centeno speaks.

January 22 (Wednesday): European Central Bank Governing Council member Villeroy speaks; U.S. Conference Board Leading Economic Index for December; European Central Bank President Lagarde speaks.

January 23 (Thursday): Bank of England Monetary Policy Committee member Wilkins speaks at Fitch Ratings; U.S. initial jobless claims for the week ending January 18.

January 24 (Friday): Bank of Japan Governor Ueda holds a monetary policy press conference; European Central Bank President Lagarde speaks; U.S. January Markit Manufacturing PMI preliminary; U.S. December existing home sales annualized. The Bank of Japan announces its interest rate decision and economic outlook report.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。