Preface

Recently, a draft of an "Executive Order Supporting Cryptocurrency," allegedly drafted by the Trump team, unexpectedly leaked, quickly stirring up a storm in the market. The draft proposes that in the future, plans to incorporate cryptocurrency into the U.S. strategic reserves may prioritize cryptocurrency projects established in the U.S. and supported by U.S. institutions, such as XRP, SOL, and USDC. Following the news, both XRP and SOL saw significant short-term increases, sparking heated discussions in the market.

Notably, shortly after the exposure of this executive order draft, Trump himself announced on Twitter the issuance of a token named "TRUMP," promoting a "very special Trump community" to celebrate all the "victories" we represent. The market's interpretation of Trump's personal involvement in "issuing tokens" has been quite enthusiastic: some believe this signals a deeper binding of politics and the crypto space, while others question whether this will trigger broader regulatory controversies.

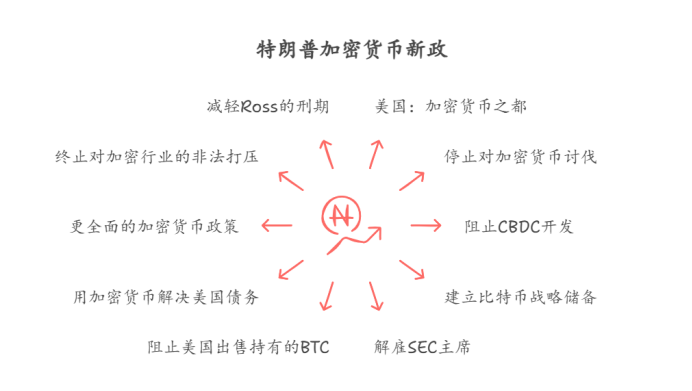

Looking back at Trump's repeated "clear support" for cryptocurrency during the election campaign, his proposed "Ten New Policies for Cryptocurrency" also became a significant factor in attracting a large number of crypto enthusiasts. Since successfully taking office, Trump has been gradually fulfilling his promises: for example, appointing Musk as the head of the "DOGE" Government Efficiency Department, appointing David Sacks as the head of cryptocurrency affairs at the White House, and appointing Paul Atkins as the new SEC chairman. These personnel changes reflect a strong signal: the Trump 2.0 government is very likely to "fully embrace" cryptocurrency from a policy perspective.

So, what exactly do the "Ten New Policies for Cryptocurrency" include? How do they align with Trump's new appointments? What impact will they have on the cryptocurrency ecosystem in the U.S. and globally? This article will start from the current state of the U.S. economy, analyze why Trump chooses cryptocurrency as a "breakthrough" under the pressure of trade deficits and national debt crises, and explore the investment opportunities hidden in this wave of cryptocurrency globalization, providing readers with a more comprehensive perspective on the "Trump Cryptocurrency Economic Framework."

(The following content is based on current public information, speculating and analyzing the development of U.S. politics and cryptocurrency around 2025, and is not established fact.)

1. Trade Deficit + National Debt Crisis

1.1 Starting from the "Reagan Cycle"

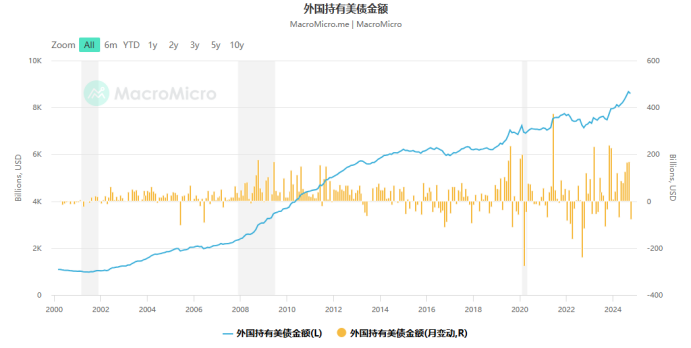

Source: MacroMicro.com

To understand Trump's 2.0 era's favor towards cryptocurrency, we must first review the long-standing "old problems" in the U.S. economic structure—trade deficits and national debt crises.

After World War II, the U.S., leveraging its status as a victorious nation and its strong power, injected a large amount of dollars (then linked to gold under the Bretton Woods system) into European countries through the "Marshall Plan" to assist these war-torn economies in rebuilding, while also solidifying relations with its allies. However, as Europe gradually recovered, countries were unwilling to accept the fixed exchange rate system and began exchanging their dollars for more stable gold, leading to a continuous loss of U.S. gold reserves. Ultimately, in the 1970s, the dollar completely decoupled from gold.

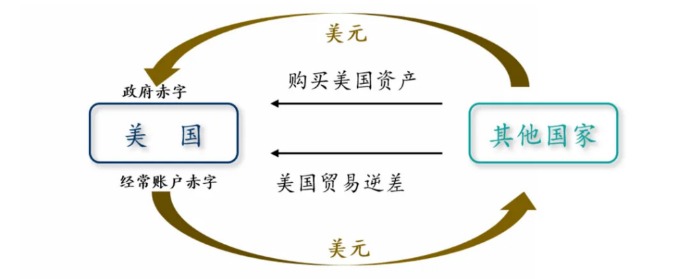

During the Reagan era (1980s), to consolidate the dollar's hegemonic position, the U.S. adopted policies of "massive tax cuts, increased defense spending, and high interest rates," establishing a global dollar circulation system, commonly referred to as the "Reagan Cycle":

- High interest rates attract global capital inflow into the U.S., with investors purchasing U.S. Treasury bonds and other dollar assets for high returns;

- A large influx of capital leads to dollar appreciation, making imported goods cheaper for the U.S.;

- The prices of exported goods rise, losing competitiveness, and the trade deficit continues to expand;

- These trade partners then recycle the dollars they acquire back to the U.S. by purchasing U.S. Treasury bonds, supporting the U.S. fiscal deficit and consumption.

Source: HUATAI SECURITIES RESEARCH

This cycle established the strong international position of the dollar but also laid the groundwork for the expanding trade deficit and U.S. debt risks.

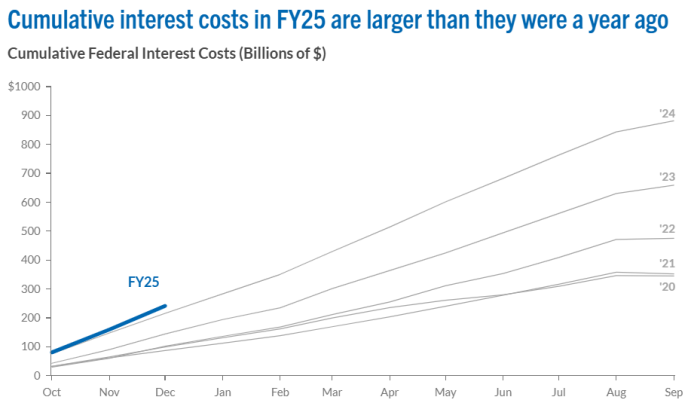

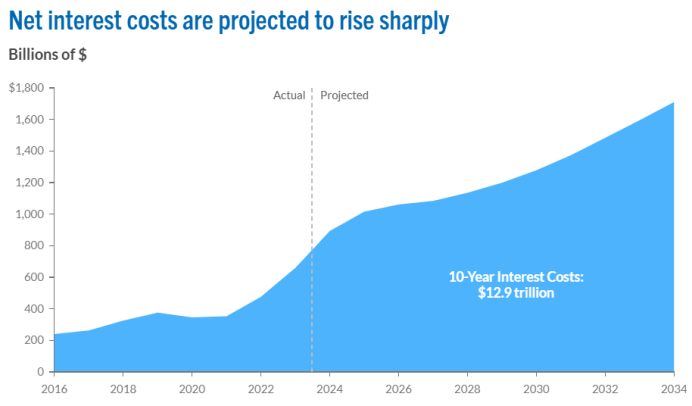

Source: Department of the Treasury

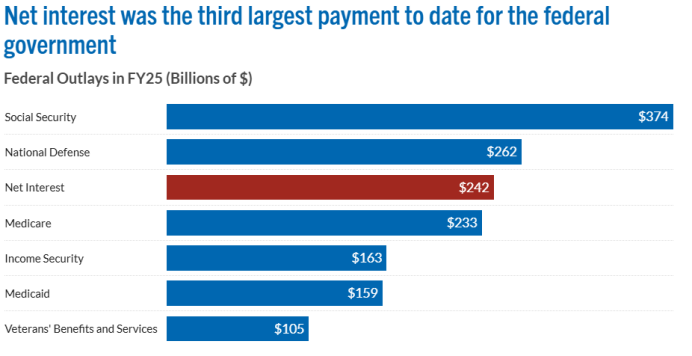

This cycle has lasted nearly 50 years, and the rapid accumulation of federal debt, coupled with rising debt interest rates (compared to the past decade), has increased the borrowing costs for the federal government. In fact, as of December 2024, the interest payments on national debt are higher than in previous years. Interest costs have become the third-largest expenditure category for the federal government, surpassing spending on Medicare, income security, Medicaid, and veterans' benefits and services.

Source: Department of the Treasury

1.2 China: The Largest Source of U.S. Trade Deficit

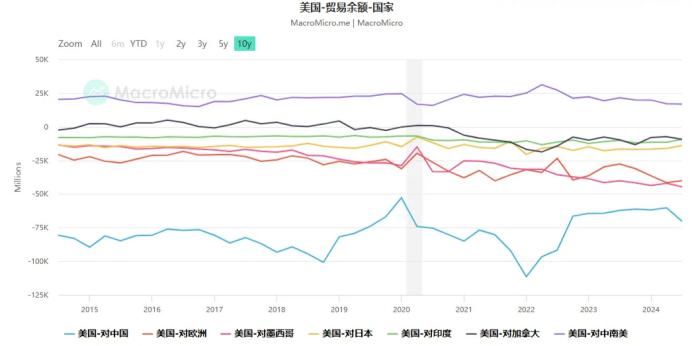

Source: MacroMicro.com

According to annual statistics from the U.S. Department of Commerce, the largest trade deficit for the U.S. currently comes from China, making China one of the largest creditors of the U.S. After 2018, Trump launched a trade war against China, hoping to reduce the deficit by raising tariffs, but overall, the U.S. still maintains a considerable trade deficit. For the Trump administration in 2025, how to reduce the trade deficit remains a major topic.

1.3 Trump's "Two-Pronged Approach" and "Finding New Paths"

The Trump administration's approach to reducing the trade deficit mainly consists of two strategies:

- Cutting costs: Raising tariffs to reduce imports

- Increasing revenue: Boosting exports

However, after implementing a tariff war, other countries may also impose higher tariffs on U.S. products, which could backfire. Therefore, Trump 2.0 will still adopt stimulus measures such as "reducing corporate taxes" to attract manufacturing and service industries back to the U.S. However, relying solely on corporate tax reductions is insufficient; a new toolset is needed to ensure that production returning to the U.S. can smoothly export.

This time, Trump chose cryptocurrency.

2. "Ten New Policies for Cryptocurrency": From Cutting to Building

From Trump's 2.0 economic policy, it is not difficult to see the continuation of the "Reagan model": using some dollar substitutes or dollar external circulation tools to consolidate the U.S.'s global financial position. The difference is that during the Reagan era, it mainly relied on U.S. Treasury bonds, while Trump attempts to create a new world economic cycle by vigorously promoting cryptocurrency.

Looking back at the "Ten New Policies for Cryptocurrency," they can be summarized into three main lines: "Cutting, Developing, Building."

2.1 Cutting

- Stop the "crusade" against cryptocurrency

Within an hour of taking office, Trump immediately fired former SEC Chairman Gary Gensler and appointed a more lenient regulator, halting frequent enforcement actions against cryptocurrency companies, making the regulatory environment more friendly to blockchain enterprises.

- End the illegal suppression of the crypto industry in the U.S.

Ending the illegal suppression of the crypto industry in the U.S. means that Trump may abolish the SAB 121 cryptocurrency accounting principles after taking office. SAB 121 is an accounting announcement issued by the SEC in 2022, requiring institutions holding crypto assets to record them as liabilities and correspondingly record the corresponding assets. In practice, this is almost equivalent to "prohibiting banks from custodial crypto," as the banking system finds it difficult to value and disclose according to this rule.

If SAB 121 is abolished, traditional financial institutions in the U.S. can legitimately provide cryptocurrency custody services, offering users more convenient custody solutions than hardware wallets and multi-signature wallets, which also means that the barriers between traditional finance and cryptocurrency will be broken down.

- Prevent the development of Central Bank Digital Currency (CBDC)

Trump has repeatedly stated that he will not allow the government to issue CBDCs, believing that this would grant the government excessive financial control and infringe on personal privacy. Instead, he emphasizes the need to uphold the public's right to self-custody of digital assets, adhering to the principles of "decentralization" and "freedom."

- Lessen the sentence of Silk Road founder Ross Ulbricht

Trump may grant "clemency" or significantly reduce the sentence of Ross Ulbricht, which serves both as a political gesture and symbolizes a renewed recognition of the initial "libertarian" values of cryptocurrency. On the regulatory front, this may also provide more legal space for private use of cryptocurrency.

2.2 Developing

- Establish a Bitcoin strategic reserve

The Trump administration is inclined to convert the Bitcoin currently held by the U.S. (including portions seized by law enforcement) into a national strategic reserve, further solidifying Bitcoin's status as "digital gold." Over the past decade, Bitcoin has increasingly been viewed by institutions and investors as an anti-inflation and risk-averse asset. If a world power like the U.S. officially incorporates BTC as a reserve, both allies and competitors may follow suit.

- Prevent the government from selling Bitcoin

In line with the "establishing strategic reserves" initiative, Trump hopes to prevent the U.S. government from selling its held Bitcoin on the market, in order to stabilize the "official recognition" of BTC. This will undoubtedly become an important factor in driving up Bitcoin prices.

- Use cryptocurrency to address debt issues

The U.S. government may incorporate seized Bitcoin or other crypto assets into fiscal measures to pay part of the national debt interest, alleviating government debt pressure. In 2024, federal government debt interest expenditures exceeded $880 billion (accounting for 3.1% of GDP). If digital assets like Bitcoin can participate in fiscal operations, it means that cryptocurrency has the opportunity to enter the realm of national fiscal tools.

Sources: Congressional Budget Office and Office of Management and Budget

2.3 Building

- Transform the U.S. into a Bitcoin mining powerhouse

By attracting mining companies to establish operations in the U.S. through lower energy costs, tax incentives, and other means, the goal is to control a higher proportion of global BTC hash power.

- Promote the "21st Century Financial Innovation and Technology Act"

This act may clarify the regulatory boundaries between the SEC and CFTC regarding cryptocurrency, strengthening information disclosure requirements. If Trump leans towards placing most cryptocurrencies under CFTC jurisdiction, it would mean that more tokens would be classified as "commodities" rather than "securities." This would create convenience for U.S. domestic companies to issue tokens abroad; once tokens are purchased by overseas users, it equates to the U.S. earning "export revenue," helping to reduce the trade deficit.

- Accelerate the establishment of a stablecoin system

The Trump administration plans to allow compliant stablecoin issuers to directly access the Federal Reserve's payment system, achieving faster settlements and lower costs, further expanding the dollar's trading advantages globally.

3. On the Eve of Taking Office: Trump Issues Tokens on Twitter

On January 17, 2025, Trump announced the launch of a cryptocurrency named $TRUMP on his social media platform. The token's price skyrocketed over 240 times within just 24 hours, with its fully circulating market value soaring from zero to $45 billion. Trump holds 80% of the token supply through his company CIC Digital LLC, which means his personal net worth could increase by tens of billions of dollars as a result. As mentioned earlier, the U.S. faces challenges of trade deficits and national debt crises, so it needs to "make money for itself." Trump's token issuance provides a reference for Wall Street institutions and global financing institutions, officially challenging traditional web2 financing methods with high-efficiency financing on web3 chains. Given the characteristics of the Trump 2.0 government, the future $TRUMP may even be used for government financial planning or as a buffer for U.S. debt interest costs.

Sources: X

4. From Twitter to the White House: Building a Dual Engine of Cryptocurrency and Technology

In addition to the "Ten New Policies," Trump's personnel arrangements have also released numerous signals:

4.1 Establishment of D.O.G.E. (Government Efficiency Department)

On November 12, 2024, Trump announced the formation of the "Department of Government Efficiency" (D.O.G.E.), co-led by tech giant Musk and young political figure Vivek Ramaswamy, aimed at reducing government bureaucracy, streamlining regulations, and cutting wasteful spending. Musk's well-known affection for DOGE has fueled speculation in the market that "Dogecoin may receive special support."

4.2 Appointment of David Sacks as Head of AI and Cryptocurrency Affairs at the White House

Sources: X

On December 5, 2024, Trump announced a significant appointment on social media: former PayPal COO David Sacks will be responsible for AI and cryptocurrency affairs at the White House. Sacks is a long-time supporter of Solana and has invested in the crypto fund Multicoin Capital, maintaining a close relationship with Musk from the PayPal era. This move indicates that the integration of the blockchain and AI industry chains will receive heightened attention.

4.3 Paul Atkins Appointed as SEC Chairman

Sources: X

On December 5, 2024, Trump officially nominated former SEC Commissioner Paul Atkins to serve as SEC Chairman. Atkins has a relatively open attitude towards digital assets and has consistently called for a balance between market transparency and investor protection. The arrival of the new SEC chairman will undoubtedly further promote the compliance and institutional development of cryptocurrency.

5. The Combination of Technology and Cryptocurrency: Boosting U.S. Exports

From these new appointments, it is evident that Trump 2.0 places significant emphasis on the integration of "blockchain + AI," which is directly related to the macro goal of "increasing exports through opening up."

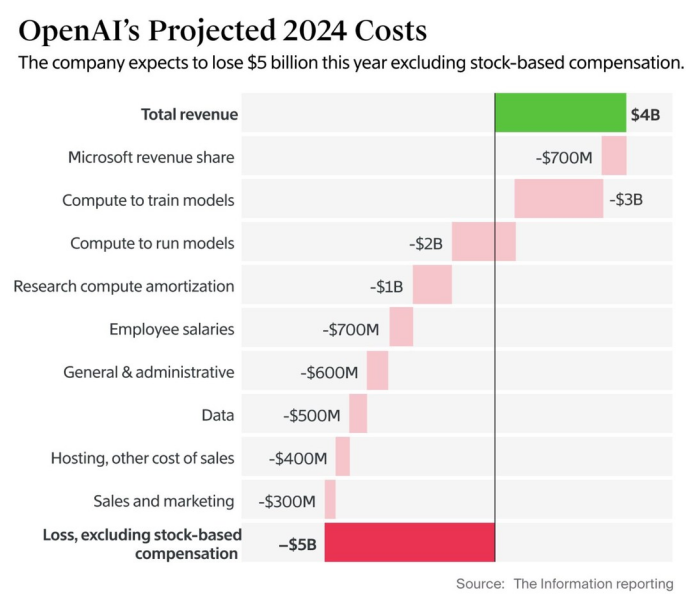

Currently, AI companies represented by OpenAI generally face high cost inputs and unclear profit models. OpenAI's total revenue for the entire year of 2024 was $4 billion, but it reported a loss of $5 billion. The revenue primarily comes from the monthly subscription fees of paid users of ChatGPT. Although the paid subscription revenue of ChatGPT has a certain scale, it is far from covering the enormous R&D and cloud computing costs.

If cryptocurrency were introduced into its business model, for example:

- Suppose OpenAI issues its own token, and users need to purchase this token to access AI services like ChatGPT;

- Global users would need to exchange dollars or other fiat currencies for tokens to make payments for these services;

Once this model is widely implemented, each token purchaser from around the world would equate to exporting services to the U.S. and paying "foreign exchange," thereby bypassing many tariffs and regulatory barriers, helping the U.S. form a new digital product export.

6. Unlimited Global Trading of Crypto Assets: An Alternative Breakthrough Amidst De-globalization

In the current climate of rising de-globalization sentiments, many countries (such as China and India) have strict foreign exchange controls, posing significant obstacles to traditional foreign trade. The characteristics of cryptocurrency, which allow for cross-border free circulation without being restricted by traditional SWIFT systems or bank regulations, provide a natural advantage for "decentralized finance." This advantage opens up new global trading channels for the Trump 2.0 government. With sufficient policy support, the U.S.'s first-mover advantage in the cryptocurrency field may further expand.

7. Investment Opportunities and Risk Warnings

7.1 Investment Opportunities

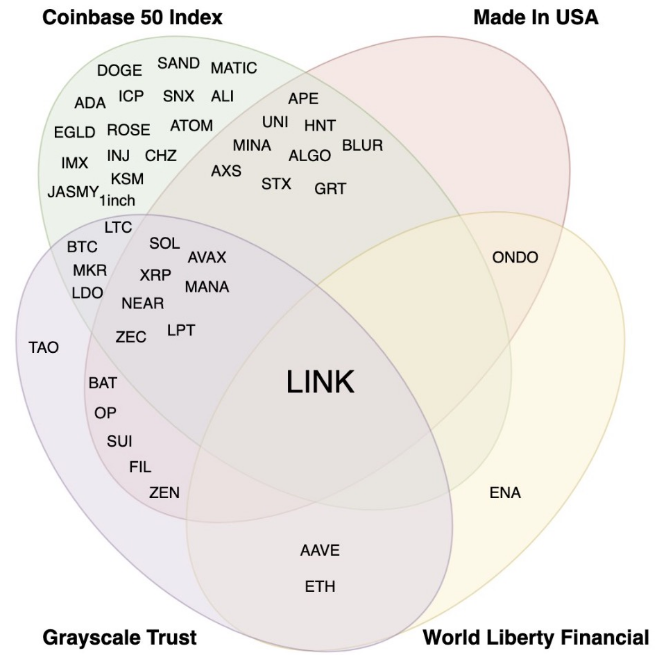

- Prioritize projects led by U.S. teams or companies

The Trump administration clearly favors supporting "Made in America" blockchain projects, such as XRP, SOL, and USDC. If related projects can collaborate with the White House, consortiums, and financial institutions, they may gain advantages in regulation, compliance, and bank custody.

- Pay attention to tokens included in Trump's "whitelist" (such as WLFI)

The DeFi project World Liberty Financial (WLFI) supported by the Trump family and its token list also represent potential avenues. However, it is important to note that such projects often carry "policy bias" risks; if political winds shift, the projects may face compliance risks.

- Focus on endorsements from large compliant institutions

In a more favorable regulatory environment in the U.S., traditional financial giants or compliant platforms like Coinbase, Grayscale, and BlackRock remain important indicators. Crypto projects that receive their support are usually more robust.

- Do not overlook MEME culture

Both Trump and Musk have strongly advocated for "community libertarianism" on social media, which aligns with the spirit of MEME coins like Dogecoin (DOGE). As the leading MEME coin, DOGE has the potential for significant price increases in response to any policy or social media hot events.

7.2 Risk Warnings

Regulatory changes: Although Trump is at the helm, there are still competing interest groups within the U.S. Congress, Treasury, Federal Reserve, and Justice Department, making policy advancement not a smooth process.

Market volatility: The cryptocurrency market has historically been highly volatile, and any unexpected events (black swan events or macro policy changes) can lead to price crashes.

8. Conclusion

Under the dual pressures of national debt and trade deficits, the U.S. urgently needs to expand outward-oriented income. The cryptocurrency "shortcut" strategy chosen by Trump 2.0 is not only a new attempt at the integration of finance and technology but may also become another tool in its international financial game.

However, any grand plan faces real-world constraints: internal political struggles in the U.S. and the vested interests of traditional financial institutions, the international community's vigilance against U.S. hegemony, and the high risks and regulatory challenges inherent in the crypto market all add significant uncertainty to this "crypto revolution." Regardless of the ultimate direction, the most important thing is to maintain rationality and actively follow regulatory and information changes in this policy reshaping and technological transformation, enabling more informed investment decisions amidst the intertwining of opportunities and risks.

Disclaimer: Readers are advised to strictly comply with the laws and regulations of their location; this article does not constitute any investment advice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。