Cryptocurrency Market Performance

Currently, the total market capitalization of cryptocurrencies is $3.5 trillion, with BTC accounting for 56.43%, valued at $1.98 trillion. The market cap of stablecoins is $208 billion, which has increased by 1.04% in the last 7 days, with USDT accounting for 66.22%.

This week, BTC's price has shown a volatile upward trend, with the current price at $102,089; ETH has also shown a volatile upward trend, with the current price at $3,423.

Among the top 200 projects on CoinMarketCap, most have risen while a few have fallen, including: XDC with a 7-day increase of 45.78%, FARTCOIN with a 7-day increase of 56.21%, XRP with a 7-day increase of 42.37%, and MORPHO with a 7-day increase of 36.97%.

This week, the net inflow for the U.S. Bitcoin spot ETF was $1.484 billion; the net inflow for the U.S. Ethereum spot ETF was $205 million.

On January 17, the "Fear & Greed Index" was at 75 (higher than last week), indicating a sentiment of greed over the past 7 days.

Market Prediction: This week, the market is influenced by U.S. CPI data, the impending inauguration of Trump, continuous growth of stablecoins, and significant inflows into U.S. spot ETFs, leading to a substantial market rise. The AI sector rebounded significantly in the first half of the week, while the second half saw a correction. Next week, the market is expected to experience significant volatility due to policies following Trump's inauguration, so position management is advised. This week, attention can be paid to "quasi-ETF" related tokens.

Understanding Now

Review of Major Events of the Week

On January 12, according to Glassnode data, there is a significant shift in Bitcoin ownership trends. The proportion of Bitcoin held by new investors (addresses holding for less than three months) has risen sharply, currently accounting for 49.6% of network liquidity. New capital is increasingly participating in the market, even as experienced investors are reallocating their holdings;

On January 12, FTX creditor representative Sunil disclosed the "Preliminary Distribution Timeline for FTX Repayment" on X:

"Creditors with claims under $50,000 are expected to receive approximately $1.2 billion in compensation; FTX requires creditors to complete pre-distribution requirements (claim registration) by January 20 to ensure participation in the initial distribution, with repayments expected not to start before this date; the first repayment is expected to begin on February 25 and may continue until March 4. This timeline provides creditors with clear guidance to meet FTX's requirements in a timely manner to receive compensation smoothly";

On January 13, according to CloverPool data, Bitcoin mining difficulty experienced an adjustment at block height 878,976, increasing by 0.61% to 110.45 T, a new historical high. The average hash rate over the past seven days is approximately 776.91 EH/s, with the next difficulty expected to increase by 0.70% to 111.22 T;

On January 14, according to CoinPost, the Japanese listed company Remixpoint increased its Bitcoin holdings by 33.34 BTC, valued at approximately 500 million yen, bringing its total Bitcoin holdings to 333.189 BTC, with a total value of about 4.89 billion yen;

On January 15, according to Yonhap News Agency, South Korean authorities arrested South Korean President Yoon Suk-yeol;

On January 15, the U.S. December seasonally adjusted CPI year-on-year rose to 2.9%, marking a rebound for the third consecutive month, reaching a new high since July 2024, in line with market expectations, up from 2.7%;

On January 16, according to market news, Nasdaq submitted a filing for the Canary Litecoin ETF 19B-4, initiating the regulatory review process;

On January 17, Tether launched the cross-chain stablecoin USDT0, aimed at expanding USDT to new blockchains, providing a seamless experience for users and developers while maintaining a 1:1 peg with USDT on Ethereum. USDT0 is built using LayerZero's OFT standard for deploying and transferring assets on new chains;

On January 17, according to official news, the crypto wallet Phantom announced the completion of a $150 million Series C financing round at a valuation of $3 billion, led by Sequoia Capital and Paradigm, with participation from a16z and Variant.

Macroeconomics

On January 15, according to The Block, outgoing U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler stated in an interview with Yahoo Finance that the SEC "has never said" that Bitcoin and Ethereum are securities, and neither he nor former SEC Chairman Jay Clayton has classified Bitcoin as a security;

On January 16, the SEC reached a settlement with crypto lending institution Plutus Lending, which paid a civil penalty of $1.65 million. The SEC stated that Plutus operated under the name Abra, launching a retail crypto asset lending product called Abra Earn, which was not registered with the agency;

On January 16, according to CME's "FedWatch" data, following the release of U.S. CPI data last night, the probability of a 25 basis point rate cut by the Federal Reserve in March slightly increased to 28.2%, up from 23.2% the previous day. The probability of no rate cut in March remains high at 71%;

On January 16, according to CoinDesk, investors are focusing on Trump's inauguration on January 20, which could be a key catalyst for Bitcoin and cryptocurrency prices. However, the Bank of Japan may raise interest rates on January 24. According to charts shared by analyst Michael Kramer on X, the market currently estimates a 90% probability of a rate hike on January 24;

On January 16, according to the Financial Times, pension funds are attempting to purchase Bitcoin. Pension funds in Wisconsin and Michigan have become some of the largest holders of U.S. stock market funds focused on cryptocurrencies, while some pension fund management institutions in the UK and Australia have also made small allocations to Bitcoin through funds or derivatives in recent months.

ETF

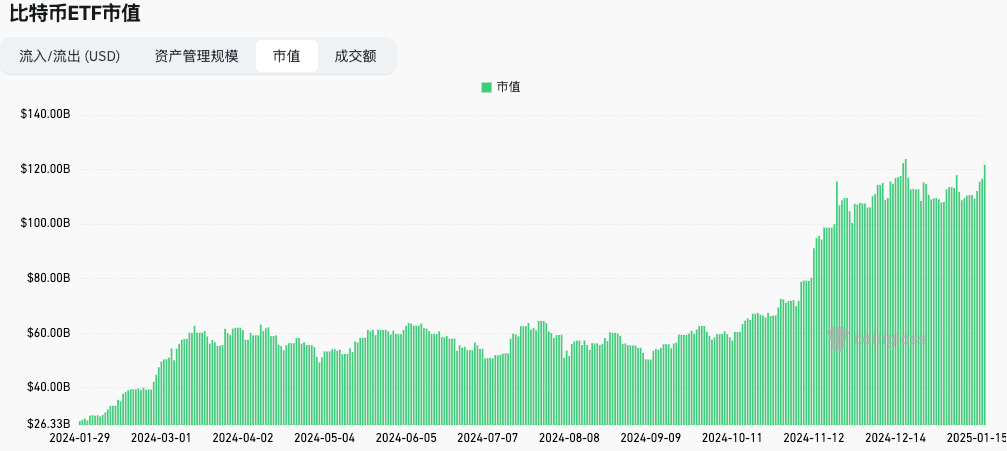

According to statistics, from January 13 to January 17, the net inflow for the U.S. Bitcoin spot ETF was $1.484 billion; as of January 17, GBTC (Grayscale) had a total outflow of $21.608 billion, currently holding $21.295 billion, while IBIT (BlackRock) currently holds $58.12 billion. The total market capitalization of U.S. Bitcoin spot ETFs is $121.722 billion.

The net inflow for the U.S. Ethereum spot ETF was $205 million.

Envisioning the Future

Event Preview

- CoinDesk will hold Consensus Hong Kong from February 18 to 20, 2025, in Hong Kong.

Project Progress

GraFun launched a new token issuance mechanism called Alpha Launch, with the first use case being the BNB Chain AI agent token BAD Coin, scheduled to launch on GraFun on January 20, 2025;

Pump Science released a roadmap update, with mouse experiments for Rifampicin (RIF) and Urolithin A (URO) scheduled for January 25, 2025; a new compound will be launched in collaboration with VitaDAO on February 25; supplement pre-orders and market launch will open on March 25; and human trials will take place on April 25;

The AI-based Telegram gaming platform Catton AI token CATTON will launch on the BNB Chain on January 26, 2025. Catton AI will integrate Wise Monkey IP and launch smart AI NPCs. 50% of the total supply of CATTON will be used for ecological airdrops, with 37% allocated to MONKY holders, 10% to Catton AI players, 2% to FLOKI holders, and 1% to ApeCoin DookeyDash players.

Important Events

Rostin Behnam, Chairman of the U.S. Commodity Futures Trading Commission (CFTC), will resign on January 20. In his final public speech, he stated that cryptocurrency has dominated every quarter of his term, and concerns about customer protection, increasing fraud and market abuse incidents, broader market resilience, and even financial stability have intensified in the absence of federal legislation;

Trump's U.S. presidential inauguration date is set for January 20, 2025;

SEC Chairman Gary Gensler will resign on January 20, 2025;

A U.S. judge has postponed the trial for the CFTC vs. Gemini case to January 21, originally scheduled for January 13. This case stems from the CFTC's allegations against Gemini in 2022, accusing it of providing false or misleading statements when applying to offer Bitcoin futures contracts in 2017;

Asset management company Calamos Investments will launch a Bitcoin exchange-traded fund (ETF) with 100% downside protection, CBOJ, which will go live on January 22 at the Chicago Options Exchange. This fund aims to protect against Bitcoin price volatility by combining U.S. Treasury bonds with options linked to the CBOE Bitcoin U.S. ETF Index.

Token Unlocking

Bittensor (TAO) will unlock 216,000 tokens on January 21, valued at approximately $10.4 million, accounting for 1.03% of the circulating supply;

Immutable (IMX) will unlock 24.52 million tokens on January 24, valued at approximately $34.39 million, accounting for 1.23% of the circulating supply;

Altlayer (ALT) will unlock 195 million tokens on January 25, valued at approximately $20.95 million, accounting for 1.95% of the circulating supply.

About Us

Hotcoin Research, as the core investment research department of Hotcoin, is dedicated to providing detailed and professional analysis for the cryptocurrency market. Our goal is to offer clear market insights and practical operational guidelines for investors at different levels. Our professional content includes the "Play to Earn Web3" tutorial series, in-depth analysis of cryptocurrency industry trends, detailed breakdowns of potential projects, and real-time market observations. Whether you are a newcomer exploring the crypto space for the first time or a seasoned investor seeking deeper insights, Hotcoin will be your reliable partner in understanding and seizing market opportunities.

Risk Warning

The cryptocurrency market is highly volatile, and investing carries risks. We strongly recommend that investors make investments based on a full understanding of these risks and within a strict risk management framework to ensure the safety of their funds.

Website: https://www.hotcoin.com/

Medium: medium.com/@hotcoinglobalofficial

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。