Author: Xiyou, ChainCatcher

Recently, there has been an increasing amount of news regarding public sales of cryptocurrency projects. Notably, these cryptocurrency projects have not chosen the early ICO platform Coinlist as their sales platform, but have instead turned to the new generation of ICO platforms that have risen quietly, such as Echo, Legion, and Buidlpad, which have already established influence in overseas cryptocurrency communities.

Several well-known cryptocurrency projects, including Ethena, Usual, Monad, Initia, MegaETH, Fuel, and Solayer, have raised funds from the community through these platforms. Many users from overseas cryptocurrency communities have admitted that participating in the fundraising activities of these emerging ICO platforms has become their main way to generate returns.

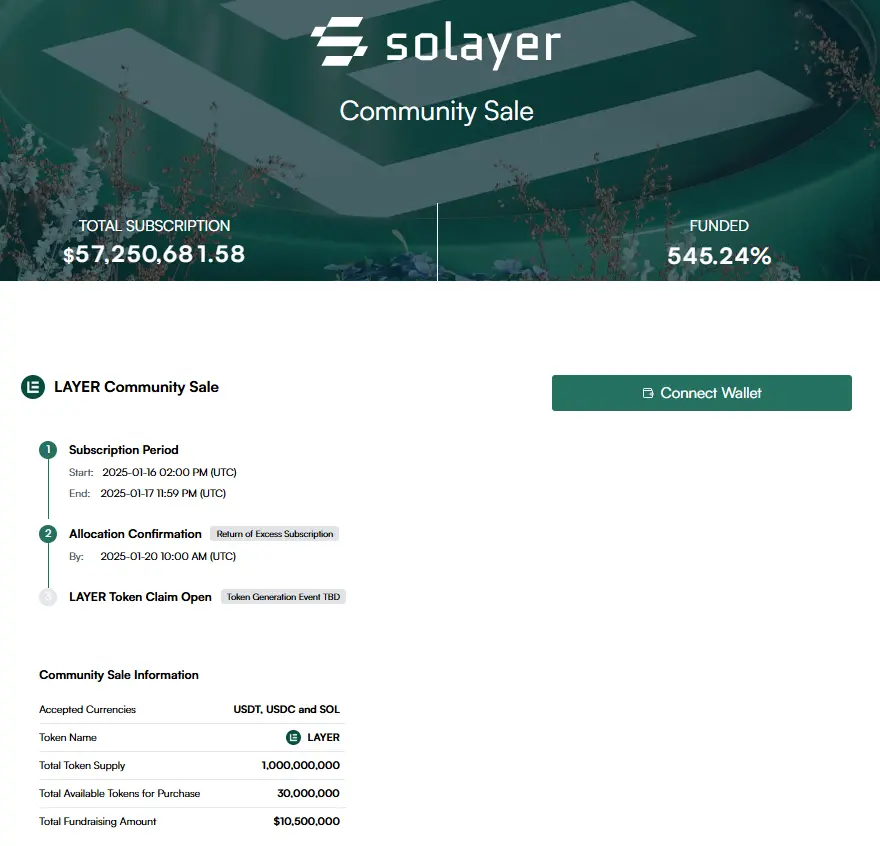

On January 18, the first public sale project Solayer (LAYER) on the ICO platform Buidlpad, created by former Binance executives, ended its sale, raising a total of $57.3 million, which is 545.24% more than the originally planned $10.5 million.

On January 13, Cobie, the founder of the Echo platform, revealed an interesting phenomenon: some VCs are trying to prevent cryptocurrency projects from offering discounts or conducting community sales to investors through platforms like Echo by applying pressure on them. In response, the ICO platform Legion, incubated by Delphi Labs, expressed resonance and confirmed that there are indeed VCs preventing projects from conducting public sales.

Although VCs are attempting to resist cryptocurrency projects participating in ICOs, this reflects that these ICO platforms have already gained a certain level of influence and occupy an important position in the minds of cryptocurrency projects and communities. For a long time, the cryptocurrency community has been troubled by "overvalued, high FDV, and low circulation" VC tokens, but these platforms provide users with early opportunities to participate in projects.

On the same day, Buidlpad stated that due to the overwhelming number of registered users participating in the Solayer public sale, its website's KYC process temporarily went down, forcing a delay in the sale time.

All of this seems to indicate that the cryptocurrency ICO field is likely to welcome a revival.

"Public Offering and Private Sale" Echo Crypto Angel Investor Community Alliance

Echo is a cryptocurrency financing platform created by crypto KOL @Cobie. Cobie, originally named Jordan Fish, joined Lido in 2021 to oversee TVL growth and is regarded by the community as a co-founder. He is also the initiator of the Web3 podcast UpOnly, having interviewed several big names in the crypto space, including Vitalik Buterin, Michael Saylor, and Mark Cuban.

In March 2024, Cobie announced the release of the Echo platform's beta version and completed the first financing transaction: Ethena raised $300,000 through Echo.

Unlike traditional public ICO platforms with large-scale user participation (like Coinlist), Echo is not a public fundraising platform aimed at retail investors; it is more like a community alliance of crypto investors. On the Echo platform, users can create their own investment communities as lead investors and share their investments with group members, investing together, and then the lead investor can take a share of the investment returns.

The working mechanism of Echo's product is similar to the syndicate investment product launched by the American startup fundraising platform AngelList, aiming to allow individual angel investors to raise funds from other individual investors like VCs find LPs, and then receive a share of the investment returns, giving those with less money but more resources the opportunity to play the role of VCs. Therefore, Echo is also referred to as a crypto angel co-investment platform.

In the early days, each financing amount on Echo typically concentrated in the hundreds of thousands of dollars, with the number of participating investors mostly around dozens, making it more suitable for early-stage angel rounds and VC financing stages.

Currently, users who want to invest in projects on the Echo platform must first go through KYC processes via email, wallet, X account, etc.

It is worth noting that all fundraising on Echo is private sales, with no details disclosed, no marketing or promotion, and only qualified investors can see the transactions. Investment users must join the groups created by lead investors to obtain fundraising information, and those wishing to become lead investors need an Echo invitation, with well-known figures in the crypto industry being more likely to be invited.

It has been reported that individuals such as The Block's CEO Larry Cermak and Aave founder Marc Zeller have created their own Echo communities, and users wishing to join must not only pass tests but also meet certain conditions to gain access to specific investment opportunities within the group.

Since its launch, over 30 cryptocurrency projects have raised funds through Echo, including well-known projects like Ethena, Morph, Usual, Hyperlane, OneBalance, Wildcat, Sphere, Dawn, Derive, Monad, Initia, and MegaETH. On January 17, the decentralized trading platform GTE_XYZ also raised $2.5 million through the Echo platform.

Among them, MegaETH's completion of $10 million financing through Echo in December attracted significant attention from the crypto community. According to an interview with MegaETH co-founder Shuyao Kong, MegaETH achieved its financing goal of $4.2 million on Echo in just 56 seconds, after which the project decided to raise an additional $5.8 million on Echo and completed this goal in 75 seconds.

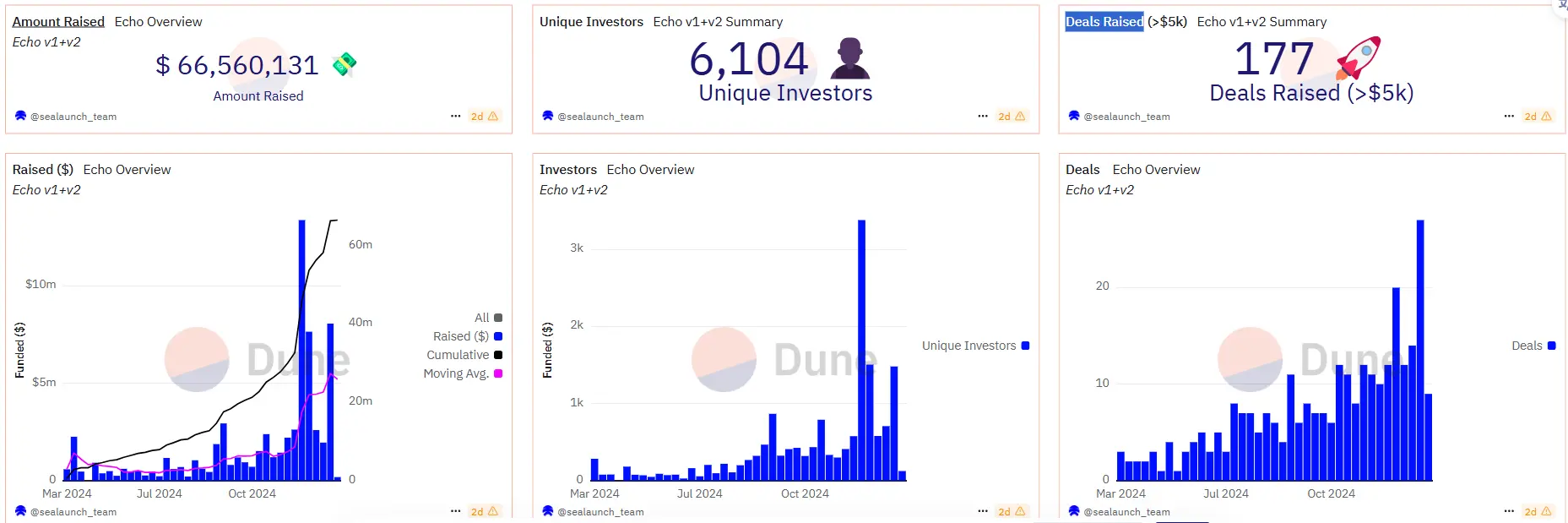

According to statistics from Dune, as of January 17, the total financing amount completed on the Echo platform has reached $66.6 million, with 6,104 investment users, and the number of financing transactions over $5,000 has reached 177. The average financing amount per transaction is about $360,000, with an average of 130 participants per transaction, and the average investment amount per user per transaction is $3,130.

Based on the publicly available investment project information, some cryptocurrency community users have summarized that Echo's lead investor recommendation mechanism and profit-sharing model have democratized trustworthy investments, and the platform tends to choose high-potential projects supported by a small circle of crypto elites.

Legion Crypto KOL Investor Alliance Incubated by Delphi Labs

Legion is an on-chain ICO platform incubated by crypto venture capital Delphi Labs, aiming to build a reputation system for investors, allowing projects to decide the amount of investment allocated to investors and the discount benefits. The platform announced the completion of a $2 million seed round financing in August 2024, led by Cyber Fund, with participation from AllianceDAO, Delphi Labs, LongHash, and others.

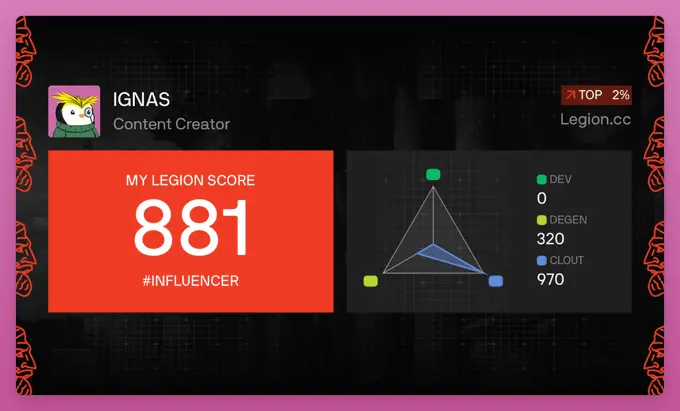

The specific implementation method is: Legion provides a Legion Scores score that aggregates on-chain and off-chain reputation systems, assigning each user on Legion a score to reflect their value and capabilities in various aspects.

After registering on the Legion platform, users connect their social accounts such as X, wallet addresses, and submit personal capability information or resources they can provide for projects, after which they will receive a score. Currently, the specific scoring criteria for Legion depend on user data in four areas: "social media influence, development experience, on-chain interaction experience, investment history, and value-added experience."

Through the Legion score, investors demonstrate their past trading capabilities and data, allowing projects to customize financing needs based on project requirements, using each investor's on-chain and off-chain standards to customize allocations, whitelists, discounts, etc., allowing only specific groups of investors to participate. For example, early-stage projects can choose users with significant social media influence and resources as the first batch of investment participants, who are also the initial candidates for launching the project community. If a user receives an allocation but does not invest, their investor score will decrease.

According to users in the investment community, Legion prefers KOLs with a large fan base. Therefore, Legion is also seen as a crypto KOL investment alliance.

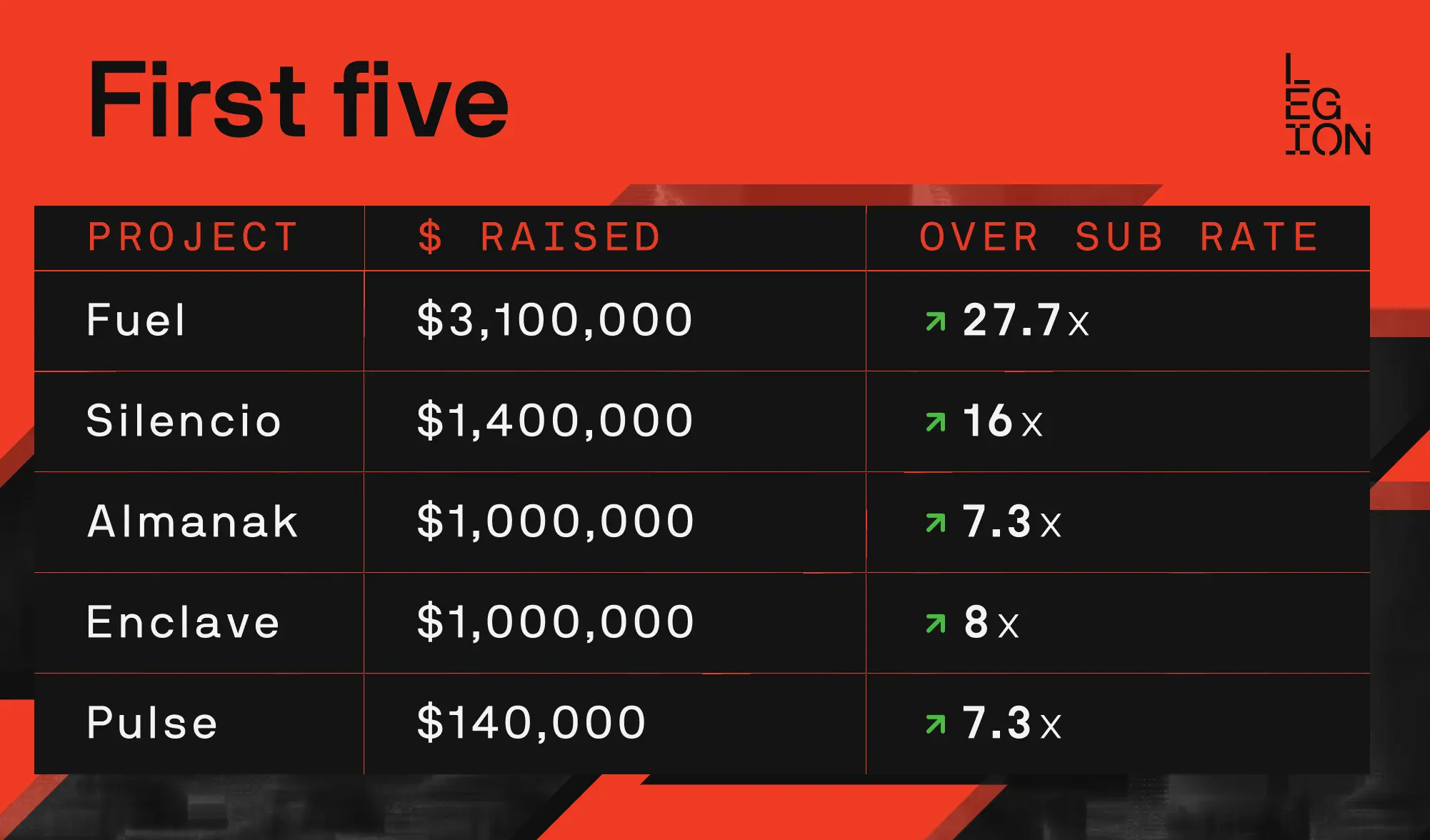

On January 15, Legion's official social media X account stated that since its launch six months ago, the Legion platform has completed fundraising for five cryptocurrency projects, including the modular L2 network Fuel, DePin network Pulse, DePIN project Silencio, privacy computing Enclave, and AI Agent platform Almanak.

Among them, Fuel was listed on the Bitget exchange on December 14, and after its listing, it surged to $8, with returns from investments through Legion exceeding 27 times. It is precisely the beneficial effect of Fuel that has brought Legion into the crypto community's spotlight.

Public Offering Platform Buidlpad Created by Former Binance Executives

Buidlpad is an ICO platform created by Erick Zhang, managing partner of Nomad Capital, who was also the head of Binance Research and responsible for the Launchpad platform. In December 2024, he announced the launch of the cryptocurrency public offering platform Buidlpad for KYC-compliant users in non-restricted regions.

On January 10, Buidlpad announced that the re-staking protocol Solayer from the Solana ecosystem would conduct a public sale of LAYER tokens on January 13, marking the first public sale since the launch of the Buidlpad platform.

However, on January 13, Buidlpad stated that due to the excessive number of registered participants (15 times higher than expected), the subscription start time for Solayer was postponed to January 16.

According to disclosed information, Solayer plans to raise $10.5 million at a valuation of $350 million, offering 30 million tokens at a price of approximately $0.35 each. In addition to the whitelist, which can obtain the right to purchase up to $5,000 worth of SOL, each participating address must purchase a minimum of $50 worth of SOL, with a maximum purchase limit of only $2,000 worth of SOL.

On January 18, the public sale of Solayer (LAYER) ended, raising a total of $57.3 million, which is 545.24% more than the originally planned $10.5 million.

Similarly, users wishing to use the Buidlpad platform must go through KYC certification.

However, compared to financing platforms like Echo and Legion, Buidlpad is more accessible to a broader user base, suitable for players who meet KYC qualifications, resembling the previous ICOs aimed at the general public.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。