Author: Sam Ruskin, Messari Analyst

Compiled by: Luffy, Foresight News

I want to make a few statements first:

- I am definitely not the first person to propose this idea, but a few days ago, I became convinced that XRP surpassing ETH is entirely possible.

- I believe that neither XRP nor ETH is reasonably valued at their current prices, but I am not here to discuss what I think their valuations should be.

In the months following the U.S. elections, XRP experienced a significant rise. Since then, the price of XRP has increased by over 460%, and its market capitalization has surpassed BNB, USDT, and SOL. In terms of fully diluted valuation (FDV), XRP's valuation is twice that of Solana and about two-thirds of Ethereum.

Data Source: Messari

It is safe to say that no cryptocurrency has benefited as much from this election as XRP.

Data Source: Messari

But I am not here to discuss BNB, SOL, or USDT, which have already been surpassed by XRP. Ethereum (excluding Bitcoin, for which I hope I never have to write a similar article) is the last one that has not yet been surpassed.

Quantitative Analysis of ETH and XRP

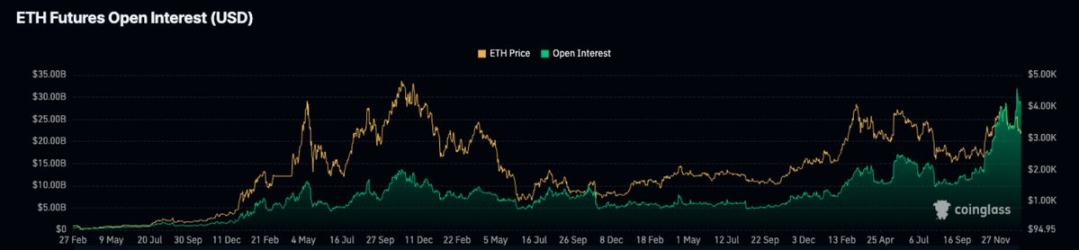

Data Source: Coinglass

From various metrics, Ethereum seems overvalued. The open interest is at a historical high, while the price of ETH is still down 30% from its historical peak of $4800.

Data Source: Coinglass

On the other hand, XRP's open interest is much healthier and has a higher correlation with price movements.

Due to the complexity of options, the open interest in the cryptocurrency market is often more closely associated with crypto-native investors than with ordinary retail investors. This suggests that on-chain demand for Ethereum has become relatively saturated.

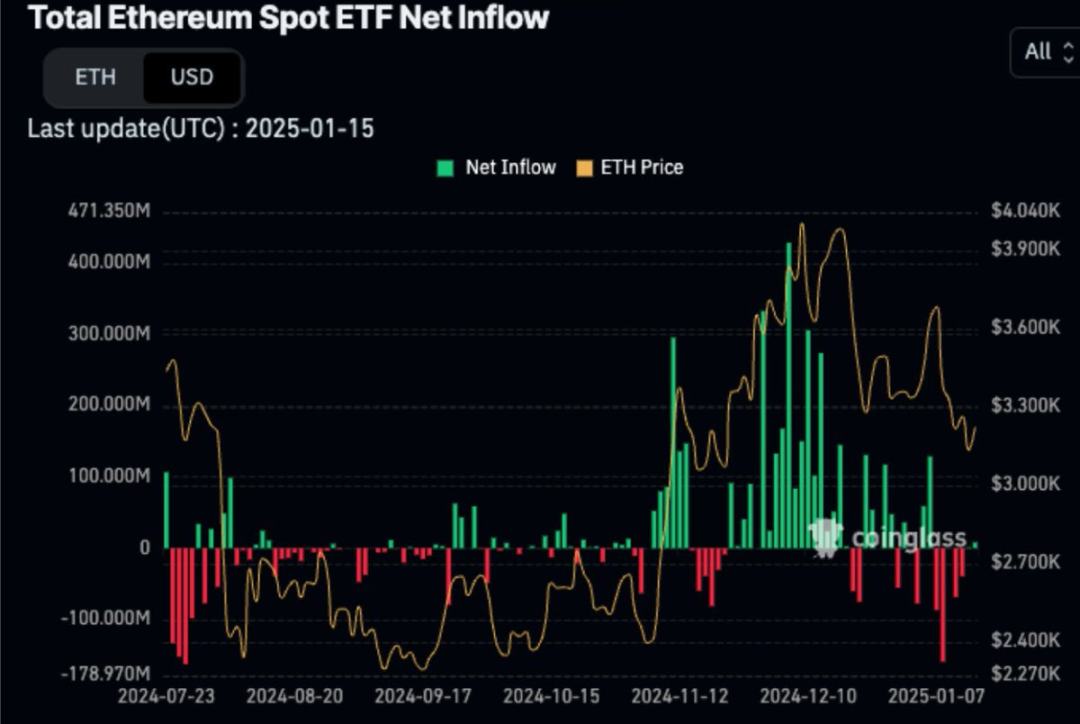

Data Source: Coinglass

The market capitalization of Ethereum ETFs accounts for 3% of Ethereum's total market cap, while Bitcoin ETFs account for nearly 10% of Bitcoin's total market cap. Retail enthusiasm for Ethereum is not as high as for Bitcoin, which affects on-chain morale.

Data Source: Artemis

In recent years, Ethereum L1 has faced numerous challenges, with competitors like Solana, Sui, and even its own L2 solutions like Base. There is still a divide in the Ethereum community about whether L2's economic growth is essentially parasitic or essential to L1. Regardless of which viewpoint is correct, this capital outflow is a concerning trend for ETH.

Looking at the price trends of XRP and Ethereum over the past year, it is hard to find a reason to buy Ethereum. As @mikeykremer stated in his thoughtfully written article: "Buy when confirmation is strong, sell when it is weak." Market indicators suggest that interest in XRP is currently higher than in ETH.

Over the past 6 to 12 months, sentiment on Twitter regarding ETH has noticeably declined. After the failure of the Blast airdrop, it became clear that the L2 ecosystem within Ethereum is oversaturated, and the funding and development efforts of the Ethereum community have been misallocated.

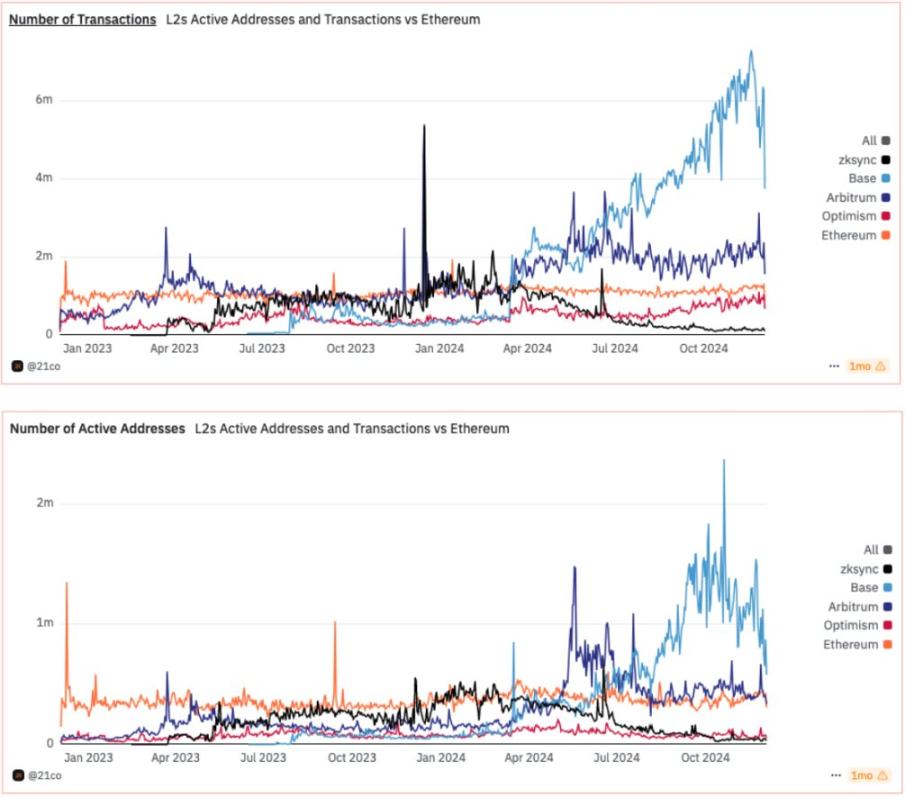

Data Source: Dune (21co)

When comparing active addresses and transaction volumes, Base significantly leads, becoming the most popular L2 on Ethereum.

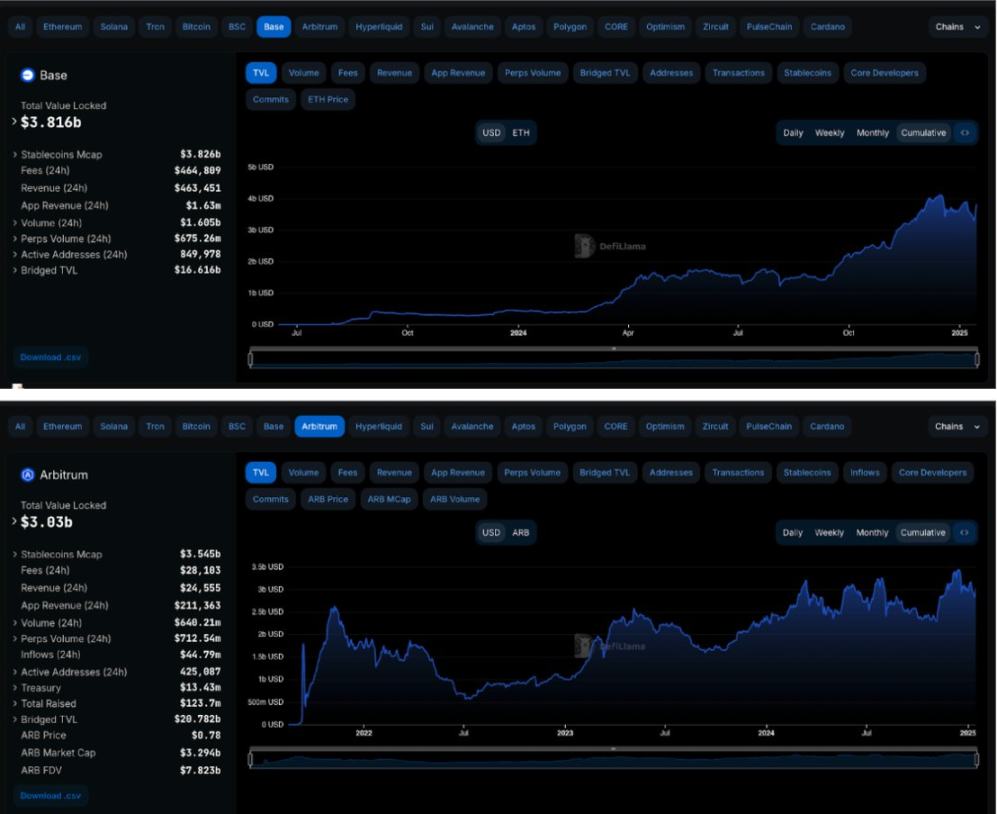

When comparing the total value locked (TVL) of the top two L2s, Base has a TVL approaching $4 billion after a year and a half, while Arbitrum has a TVL of $3 billion after three and a half years. By almost all metrics, Base is the leading L2 on Ethereum.

Qualitative Analysis of ETH and XRP

The L2 expansion roadmap (modular blockchain design) aims to achieve decentralization and increase throughput by using multiple Rollups and L2s as much as possible. Over-reliance on a single chain contradicts Ethereum's core goals, but Base is also Ethereum's last hope for ensuring on-chain activity. This creates a negative feedback loop, and I currently see no way out (unless Base becomes the sole representative of Ethereum).

On the other hand, XRP has almost no similar internal contradictions in its protocol roadmap. Instead, its community is united in the belief that XRP will play a core role in future finance. Before this belief is disproven or validated (which could drive XRP's price up), its core supporters are unlikely to waver.

Additionally, I believe there are four potential factors that could drive XRP's price up in the coming weeks:

- Trump's Inauguration: Given the recent macro signals bringing bullish momentum, Trump's inauguration looks more like a buying event. With Trump's involvement in the cryptocurrency gala, figures like Garlinghouse may also attend, potentially bringing more attention to XRP.

- ETF Applications: XRP has not yet applied for an ETF. Considering the price surges when ETH, SOL, and BTC announced their ETF applications, a similar effect could occur if XRP applies for an ETF.

- Capital Gains Tax Policy: Proposed cryptocurrency policies, such as the elimination of capital gains tax for U.S. companies, could drive demand for XRP due to tax incentives. As a U.S. project, XRP may attract capital reallocation due to potential tax advantages.

- "Senior Investor" Coin Rotation: Coins like XRP, HBAR, XLM, and ADA saw significant price increases shortly after Trump's election. A similar trend may occur around the inauguration, as it could attract buyers with similar interests and preferences.

Risks

To make a long story short, I am not trying to encourage those who are bearish on XRP:

- People wake up and realize that XRP is overvalued, which it indeed is. Fortunately, the entire cryptocurrency market is overvalued, so XRP does not stand out in this regard.

- Garlinghouse's activity in the White House is not as high as some expected. He did vote for Kamala, but XRP is still seen as the "Trump token," which illustrates how easily investors forget.

- An alternative banking solution could replace XRP, whether it be a cryptocurrency-based stablecoin or something entirely new.

Time Window

I am looking at short-term trading opportunities, possibly around a month after the inauguration. We are currently seeing a lot of front-running of this price trend, but I expect XRP to surpass ETH shortly after Trump's inauguration.

Assuming ETH's price rises slower than XRP's, I anticipate a further increase of 35-50% for XRP from now on.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。