With increased capital inflows and the potential launch of new ETF products, 2025 is expected to be a landmark year for crypto ETFs.

Author: Binance

Compiled & Edited by: Deep Tide TechFlow

Recently, Binance Research released its report summarizing 2024 and outlook for 2025, detailing the performance of various sectors in the crypto market over the past year with over 100 charts, and providing eight outlooks for 2025.

Considering the original report is lengthy, Deep Tide TechFlow has refined and distilled the original text, focusing on the overall review of 2024 and the outlook for 2025.

Key Points for 2024

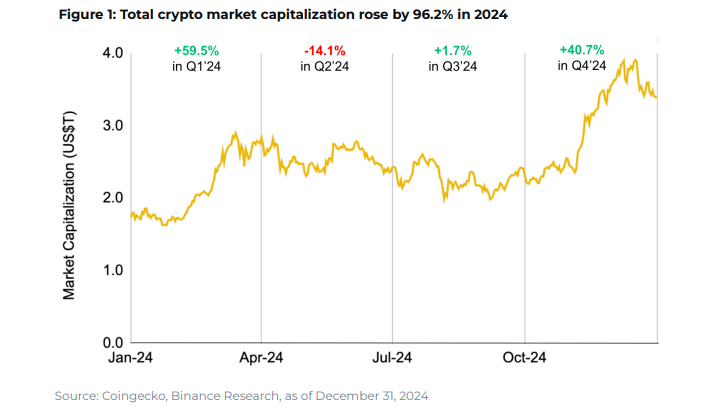

- Overall Market: In 2024, driven by strong growth in the first and fourth quarters, the crypto industry experienced significant growth, with a year-on-year market cap increase of 96.2%. The launch of the spot BTC ETF in January in the U.S. marked a key moment, boosting market sentiment and attracting new capital. Favorable macro conditions, such as the Federal Reserve's interest rate cut in September and positive regulatory expectations following the U.S. presidential election, further propelled the market.

Key Narratives for the Year: Point systems, re-staking, meme coins, AI agents, and stablecoins.

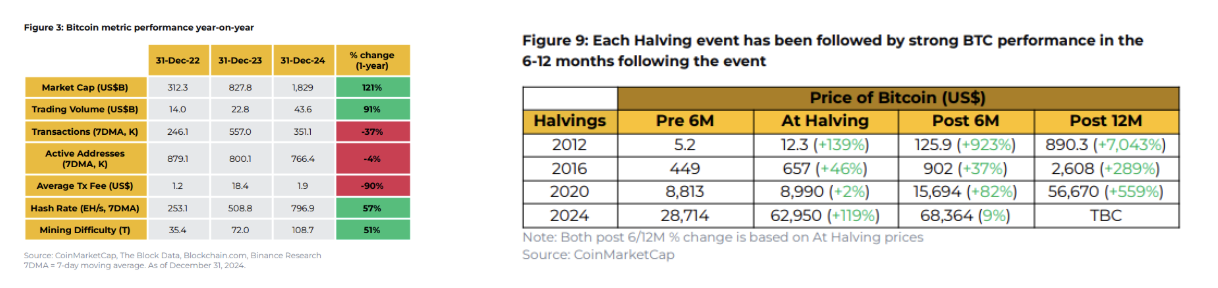

BTC: Bitcoin experienced a tumultuous 2024, including the approval of the U.S. spot ETF in January and breaking the long-awaited $100,000 mark in December. Historically, ETFs have been successful, attracting approximately $35B in net inflows, with total assets exceeding $105B. Bitcoin's dominance surpassed 60%, the highest level since 2021. In terms of demand, the fourth halving event halved Bitcoin's annual issuance, while the Bitcoin ecosystem thrived, with DeFi's total locked value growing by 6,400%.

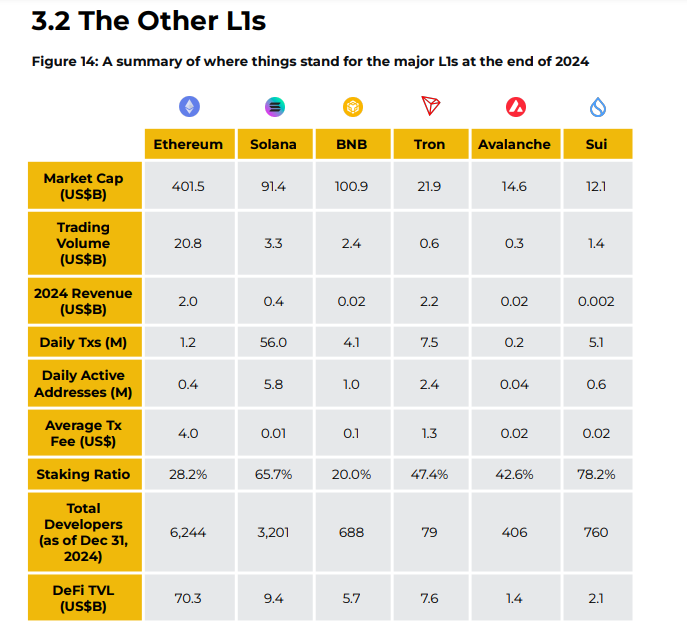

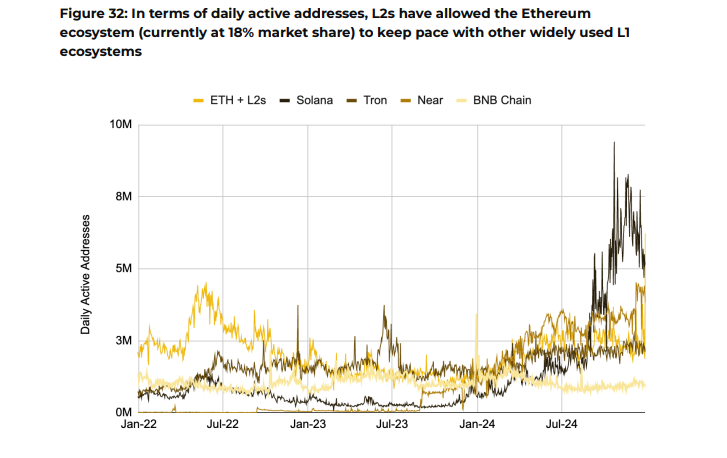

- Alt L1: In 2024, Ethereum led alt-L1 in metrics such as market cap, trading volume, and DeFi TVL, while activity metrics like daily transactions and active addresses were dominated by Solana, which also had the lowest average transaction fees. Key stories to consider for 2025 include the potential U.S. Ethereum ETF, more dApps launching their own chains, the Pectra upgrade, and Ethereum's priority dilemma. Solana's transaction fees and DEX trading volume repeatedly broke historical highs in 2024, with a significant increase in developer interest, although on-chain stablecoins remained relatively low.

The BNB Chain saw scalability improvements with opBNB and data storage development with Greenfield. Sui's development outpaced Aptos, while Avalanche achieved its largest update to date with Avalanche9000. Tron performed strongly in stablecoin trading (despite challenges to its position). TON slowed in the second half of 2024, but remains noteworthy alongside the launches of Berachain and Monad.

Base L2 stole the spotlight in 2024. Despite lacking a token, Base's total locked value (TVL) and daily active users accounted for 39% and 67% of the market share, respectively, making it a top L2 in both metrics.

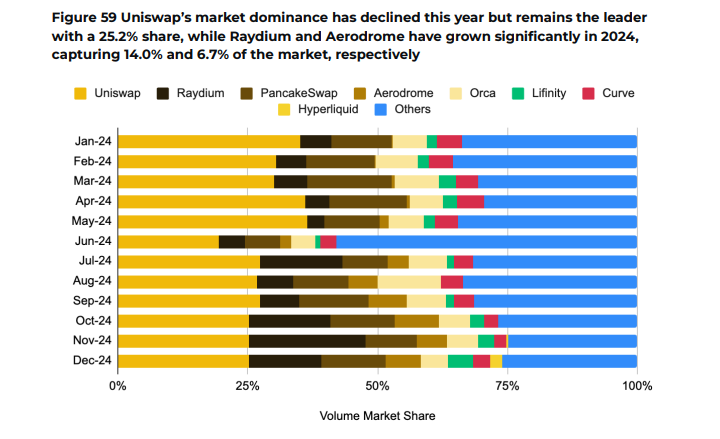

- DeFi: The total value locked has grown by 119.7% year-to-date, reaching $119.3B. This recovery has sparked a renaissance in the DeFi sub-industry, with core areas like money markets and decentralized exchanges (DEX) reaching new milestones. This year was characterized by the emergence of previously inaccessible on-chain financial primitives, a narrowing gap between DeFi and centralized exchange (CEX) experiences, increased consumer and institutional adoption, and intensified protocol competition.

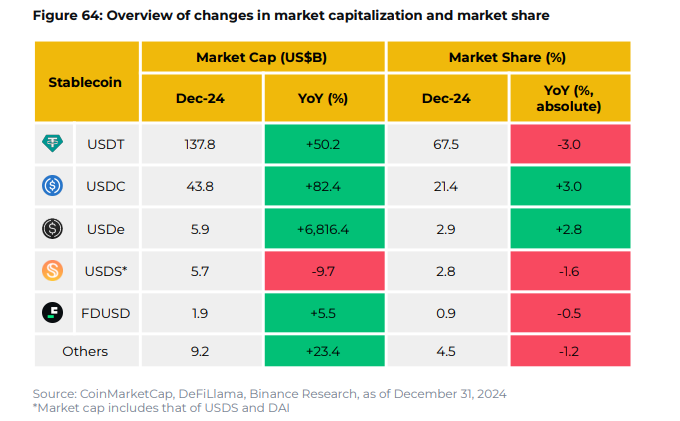

- Stablecoins: The market experienced significant growth in 2024, reaching a historical peak market cap of $205B, slightly declining to $204B by year-end, a year-on-year increase of 56.8%. The leading stablecoin USDT's market cap grew by 50.2%, but some market share was taken by USDC, which grew by 82.4%, with an absolute market share increase of 3%. Ethena's USDe launched in December 2023, quickly becoming the third-largest stablecoin with a market cap of approximately $5.9B.

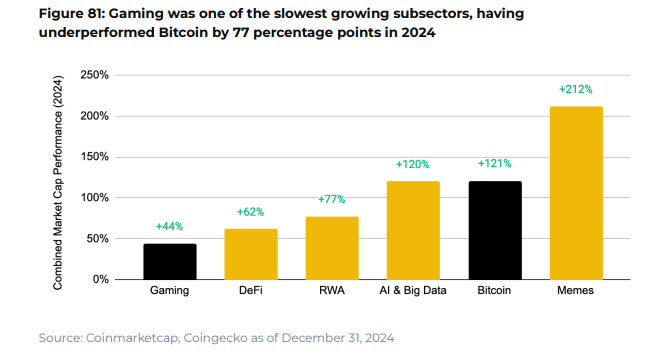

- Gaming: The total market cap of tokens grew by 44%, underperforming the overall crypto market's year-on-year growth of 96.2%. Despite the slower growth rate, the Web3 gaming industry made significant strides. The number of unique active wallets (UAW) interacting with games grew by 580% throughout the year, reaching over 50 million by year-end.

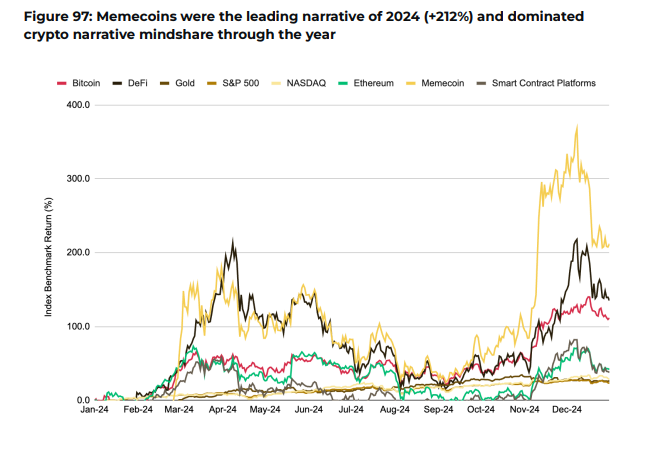

- Meme: Memecoins were the best performers in 2024 (+212%) and dominated the market. The top memecoins were divided between the Solana and Ethereum ecosystems, with Solana becoming the default chain for memecoin trading. The incredible growth of Pump.fun was also key to its success.

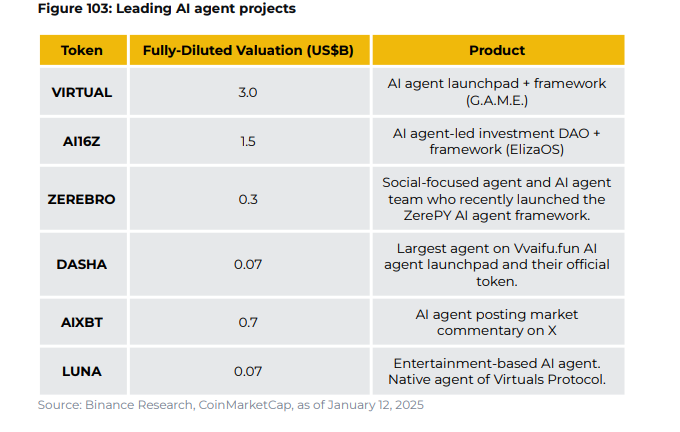

- AI: Initially sparked by Truth Terminal and $GOAT, the sector has captured the market since October and become mainstream. Infrastructure providers like Virtuals Protocol (GAME framework) and ai16z (ElizaOS framework) have been key players. The first batch of agents primarily focused on market commentary (aixbt) or entertainment (Luna, Eliza), with more content in development. Key areas to watch include the community (agent groups), web2 entering the AI agent space, and the rapid development and anticipated trajectory of AI x cryptocurrency.

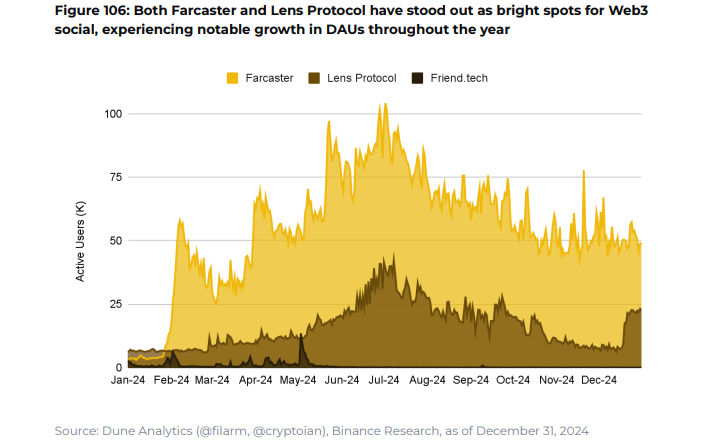

- SocialFi: UAW declined from a peak of 35 million in July to 11.3 million by year-end, highlighting the ongoing challenges of user retention for DeSoc products. However, dApps on social networks like Farcaster showed more stable growth, becoming a highlight in the field.

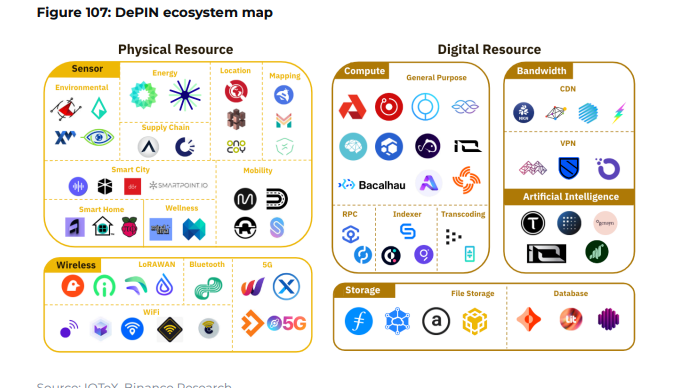

- DePIN has demonstrated practical applications in areas such as computing, telecommunications, and energy, attracting significant interest and investment. Despite having 249 projects, the situation varies widely, with some DePIN facing challenges in generating meaningful revenue.

- Web3 projects attracted a total of 1,432 investments, with total funding reaching $9.2B in 2024. Nearly $4B was invested in infrastructure projects, accounting for about 44% of the total funds raised in 2024. This was followed by DeFi at $1.5B (16% of raised funds) and gaming at $0.8B (9% of raised funds).

Eight Outlooks for 2025

- ### Spot ETF Boom

With increased capital inflows and the potential launch of new ETF products, we expect 2025 to be a landmark year for crypto ETFs. As cryptocurrency prices reach new highs and gain further mainstream attention, ETF inflows are expected to surge. By 2024, inflows for BTC and ETH ETFs were $35.2B and $2.7B, respectively, and these numbers could rise even higher.

Additionally, more institutional investors, including wealth management firms, corporations, and family offices, may explore exposure to cryptocurrencies through ETF tools. We also anticipate a broader range of ETFs being approved, involving various crypto assets, as evidenced by the recent applications for XRP and SOL ETFs. This trend will further solidify the role of ETFs in providing accessible and diversified investment opportunities in the crypto market.

- ### Shift in Token Value Models

As the U.S. government becomes more crypto-friendly and the regulatory outlook becomes clearer, the scope of value sharing for on-chain applications is expected to expand significantly. This shift could usher in a "dividend era," where more projects distribute value to token holders through treasury funds or revenue-sharing models, thereby increasing the appeal of native tokens.

This trend is already evident in DeFi, where leading dApps like Ethena and Aave have initiated discussions or proposals to implement fee conversion mechanisms that allow protocols to share revenue directly with users. With increased regulatory clarity and competitive pressure to accumulate token value, even previously resistant protocols like Uniswap and Lido may reconsider their positions. If these developments continue, they could reshape token demand in industries like DeFi, where protocol revenues have historically not been shared with token holders.

The shift towards enhancing value accumulation is also beginning to impact AI-related tokens, which have traditionally lacked strong mechanisms to align the value for token holders. Signs of change are emerging, with more projects exploring token burn and revenue-sharing models in 2025.

- ### BTCFi Will Continue to Advance

The narrative of BTCFi gained attention at the beginning of this cycle, thanks to Bitcoin's strong market performance and increased institutional interest through the spot BTC ETF. These factors have led to the accumulation of idle BTC holdings, creating opportunities to transform them from capital inefficiency to capital efficiency.

While the current focus is on staking derivatives and lending, this trend is expected to extend to other DeFi use cases. With Bitcoin's DeFi TVL growing from $0.1B to over $6.5B in 2024, a 6,400% increase, the wheels have already begun to turn.

Any upcoming traction from Bitcoin contracts and Bitcoin Improvement Proposals (BIPs) will also be a significant determining factor.

- ### Strong Momentum for High-Yield Stablecoins

Thanks to increased adoption rates from Web2 companies and clearer regulations, this favorable environment may benefit most stablecoins, as a rising tide lifts all boats. Among them, yield-generating stablecoins are expected to stand out, as evidenced by the rapid rise of Ethena's USDe. Demand for yield remains strong, and yield-generating stablecoins provide holders with a direct way to earn returns from their stablecoin holdings without the need for active management or complex strategies.

However, the success of yield stablecoins will not solely depend on their ability to generate returns. For these stablecoins to thrive, they must also ensure widespread availability across various platforms, provide simple entry and exit methods, and maintain deep liquidity.

- ### AI x Crypto is a Key Area to Watch

So far, the growth of the AI agent sub-industry has exceeded expectations, with significant developments anticipated in the coming months, including the entry of Web2 giants like OpenAI. Additionally, many top crypto AI teams are engaging in projects outside the AI agent space, where various projects are gaining new appeal. The collision of crypto technology and artificial intelligence is undoubtedly occurring, and we expect 2025 to be a meaningful year in this journey.

- ### Rising Importance of L2 Abstraction

Following the Decun upgrade, L2 has experienced rapid growth. There are now over 120 L2s at various stages of development. As the L2 space matures, the proliferation of application chains and dedicated L2s has made L2 chain abstraction commonplace, making it crucial to simplify the user experience.

We expect competition within the L2 ecosystem to continue intensifying, especially between rollup-as-a-service providers and L2 aggregators, which are becoming major brands vying to create the most widely used and diverse cross-chain ecosystem.

- ### Increasing Interest in Tokenization from Traditional Finance (TradFi) Participants

BlackRock and Franklin Templeton have already tokenized their money market funds, while Goldman Sachs plans to launch a tokenization-focused crypto trading platform within the next 12-18 months. The Monetary Authority of Singapore's "Project Guardian" is also moving forward, with financial institutions like JPMorgan, HSBC, and Deutsche Bank working to extend asset tokenization into capital markets.

- ### NFT Projects Launch More Tokens, but Not All Projects Will Succeed

Penguin's issuance of its PENGU token has pushed NFT trading volumes to new highs, showcasing the power of token launches to attract market attention. This success has also sparked speculative demand for other notable NFT collections, as traders anticipate more token launches that could similarly drive activity and interest.

Successful token launches have the potential to attract new participants and serve as a positive catalyst for the relatively stagnant NFT market.

However, maintaining long-term interest and prices remains a significant challenge. Projects must continuously evolve their ecosystems and enhance the accumulation of token value to sustain momentum.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。