Master Talks Hot Topics:

Recently, the market is still filled with FOMO emotions, and there’s nothing new in the macro data. The whole world is watching Trump's next moves. The "final big speech" on the 19th, the inauguration on the 20th, and the administrative agenda on the 21st.

It can be said that the emotional fluctuations over these three days will directly determine the market trend. Even the "serious assets" like U.S. stocks and bonds have become dull, waiting for Trump to speak. Although the big coin rebounded to 102k this morning, it’s still garbage time. Why?

Because everyone is not concerned about the present, but is focused on whether Trump will announce some big news about cryptocurrency. You should know that U.S. media has been more gossipy than the crypto circle these days, speculating on the content of Trump's speech: "Will he mention Bitcoin? Will he implement some big stimulus policy?" What about the fluctuations in the dollar index?

If you had asked Master last week what he thought, I would have probably said to make a medium-term layout when the big coin reached around 101k, but now Master has become timid. The closer we get to the 20th, the crazier the emotional market becomes, and we won’t be the ones to catch the falling knife. Especially since the 20th is a U.S. holiday, liquidity is so poor that even a splash of water can’t be stirred, yet the emotions are like they’ve been injected with adrenaline.

If Trump accidentally mentions cryptocurrency, the market is likely to reach a climax instantly. But if there’s no news on the 21st or 22nd, the heat of FOMO will cool down, and it will be a mess.

Speaking of mess, we also need to pay attention to Japan's interest rate meeting this week. There’s a 90% chance of a rate hike, and if that’s confirmed, the short-term market will feel like a needle prick, and it will be that kind of feeling that goes all the way down.

So for friends who are bullish, at this time, don’t be stubborn and chase the highs. Remember the last time Japan raised interest rates, the big coin dropped from 60k directly below 50k; this big needle is not a joke.

Therefore, the upcoming market is like a chain trap: Trump’s speech on the 19th ignites emotions, the market has no direction on the 20th holiday, and we look forward to the administrative agenda on the 21st, with a possible rate hike for the yen on the 23rd and 24th.

If the yen really strengthens, the market sentiment will change instantly, sending the bulls on a roller coaster. So in the short term, it’s better to have a little more respect and not let FOMO blind your eyes.

Additionally, for those holding altcoins who always fantasize about "Trump calling the shots," it’s better to wake up and see if CME is still open? Waiting for Trump to save altcoins? You might as well wait for him to film "Those Years of Trump in Washington." Don’t gamble, stay clear-headed; your wallet won’t lie to you!

Master Looks at Trends:

Resistance Level Reference:

First Resistance Level: 102000

Second Resistance Level: 102780

Support Level Reference:

First Support Level: 100000

Second Support Level: 98600

Today's Suggestions:

If a trend reversal occurs, further upward movement may happen, targeting 102k. For operations in the resistance area, it is recommended to focus on short-term short positions, paying attention to the adjustment amplitude and trading volume.

As long as the first support level is not broken, the rebound view will be maintained. If the daily close can stay above 99k and does not break yesterday's low, then one can look for opportunities to enter.

Frequent fluctuations around the 100k area are common, and short-term rapid rises are also seen. Therefore, when entering this area, it is advisable to gradually raise the take-profit line and flexibly adjust positions. Given that the V-shaped rebound has held the lower support area, the current view remains a rebound.

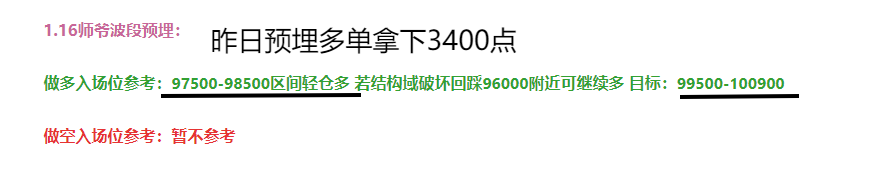

1.17 Master’s Band Strategy:

Long Entry Reference: Light long positions in the 97600-98600 range. If it pulls back to around 96100, go long directly. Target: 100000-102000.

Short Entry Reference: Light short positions in the 102000-102780 range. Target: 101000-100000.

This article is exclusively planned and published by Master Chen (WeChat public account: Coin God Master Chen). For more real-time investment strategies, liquidation, spot trading, short, medium, and long-term contract trading techniques, operational skills, and knowledge about candlesticks, you can join Master Chen for learning and communication. A free experience group for fans has been opened, along with community live broadcasts and other quality experience projects!

Warm reminder: This article is only written by Master Chen on the official account (as shown above). Other advertisements at the end of the article and in the comments section are unrelated to the author!! Please be cautious in distinguishing authenticity. Thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。