In the world of digital currency, Bitcoin (BTC) serves as the market leader, and its exchange reserve levels, long positions on major exchanges, and on-chain data are important references for investors analyzing market trends and sentiment.

1. Bitcoin Exchange Reserve Levels

Basic Concept: The exchange BTC reserve level refers to the total amount of Bitcoin held by major centralized exchanges (CEX), including user assets and the exchange's own assets.

According to CryptoQuant data, as of December 25, 2024, the Bitcoin reserve level on exchanges has dropped to 2.3 million BTC, the lowest level since January 2024. This trend reflects investors transferring assets to personal wallets for long-term holding.

Market Implications of Reserve Level Changes

● During bear markets or periods of FUD: A decline in exchange reserves typically reflects weakened market confidence.

For example, during the FTX incident, investors rushed to withdraw assets to personal wallets, leading to a significant drop in exchange reserves.

● During bull markets: An increase in exchange reserves may indicate potential selling pressure in the market, while a decrease in reserves may suggest that investors (including retail and institutional) are accumulating Bitcoin.

For instance, on January 11, 2024, after the approval of the Bitcoin spot ETF, exchange reserves decreased, primarily due to continued buying by institutional investors.

It is important to note that there is not a direct linear relationship between exchange reserves and Bitcoin prices. As of January 2025, the Bitcoin reserve level on centralized exchanges has dropped to approximately 2.35 million. Additionally, in September 2024, the JPEX exchange experienced a collapse, leading to a significant withdrawal of user assets and further decreasing exchange reserves.

2. Bitfinex BTC Long Positions (BTCUSD)

Market Position and Data Insights of Bitfinex

Bitfinex is a well-known cryptocurrency exchange that attracts a large number of whale investors, and its long position volume is also considerable. Long Position Trends and Market Predictions

From a long-term perspective, Bitfinex's long position volume typically decreases when Bitcoin prices rise and increases when prices fall. For example, in October 2023, following news of the Bitcoin spot ETF, Bitfinex's BTC long position volume continued to rise, indicating bullish sentiment among whale investors. However, the timing of these increases and decreases does not perfectly align with Bitcoin's price peaks and troughs, so it should only be used as a reference indicator for market sentiment.

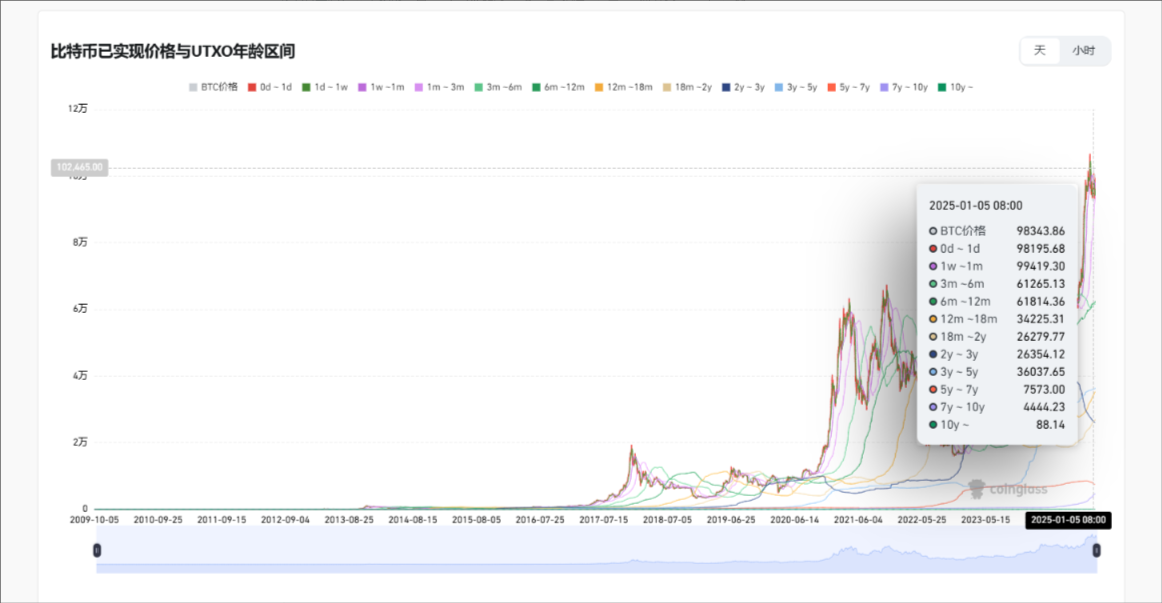

3. UTXO Age Distribution and Realized Price (On-chain Distribution of Chips)

Introduction to the UTXO System and Its Market Indicator Role

UTXO (Unspent Transaction Output) refers to the portion of Bitcoin transactions that has not yet been spent.

By analyzing the age distribution of UTXOs, one can understand the holding costs and holding times of different holders. Relationship Between Short-term and Long-term Holders' Behavior and Price

According to UTXO data, the price distribution of Bitcoin held by short-term holders (holding time less than 1 month) is as follows:

● 0 days-1 day, realized price is $96,529;

● 1 week-1 month, realized price is $98,136;

Currently, the Bitcoin price is around $100,000, indicating that most of the chips held by short-term holders are in profit.

Additionally, chips held for over 3 years have an average cost of about $30,000, showing that long-term holders have a relatively low cost.

By analyzing indicators such as Bitcoin exchange reserve levels, long positions on major exchanges, and on-chain data, investors can better grasp market trends and sentiment. However, these indicators should be used in conjunction with other market data and macroeconomic factors to develop a more comprehensive investment strategy.

If you have any questions, you can contact us through the following official channels:

AiCoin Official Website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AICoincom

Email: support@aicoin.com

Group Chat: Customer Service Yingying, Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。