1. U.S. Inflation Data Released, Market Sentiment Experiences Major Fluctuations

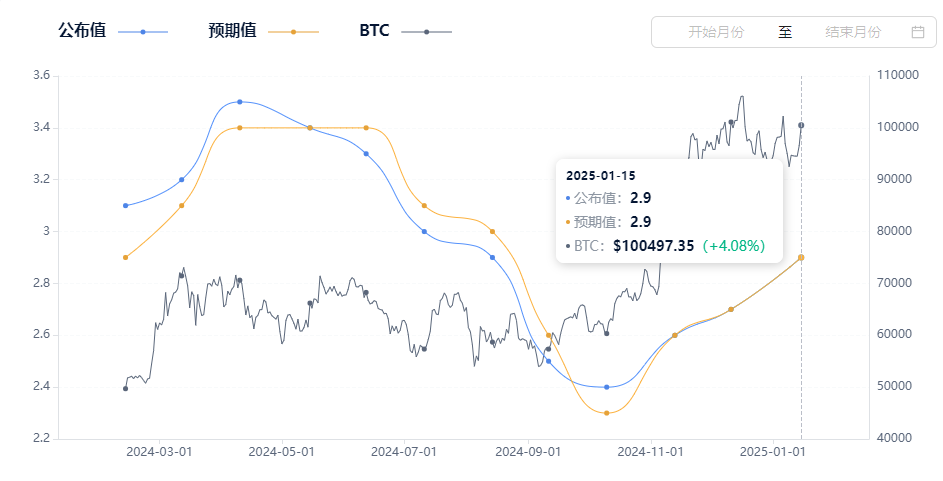

Previously, the U.S. Department of Labor released the Consumer Price Index (CPI) for December 2024, which showed that inflation data continued to accelerate for three consecutive months, remaining within market expectations. Nevertheless, the release of this data sparked widespread attention in the market, particularly regarding predictions for the future trends of the cryptocurrency market.

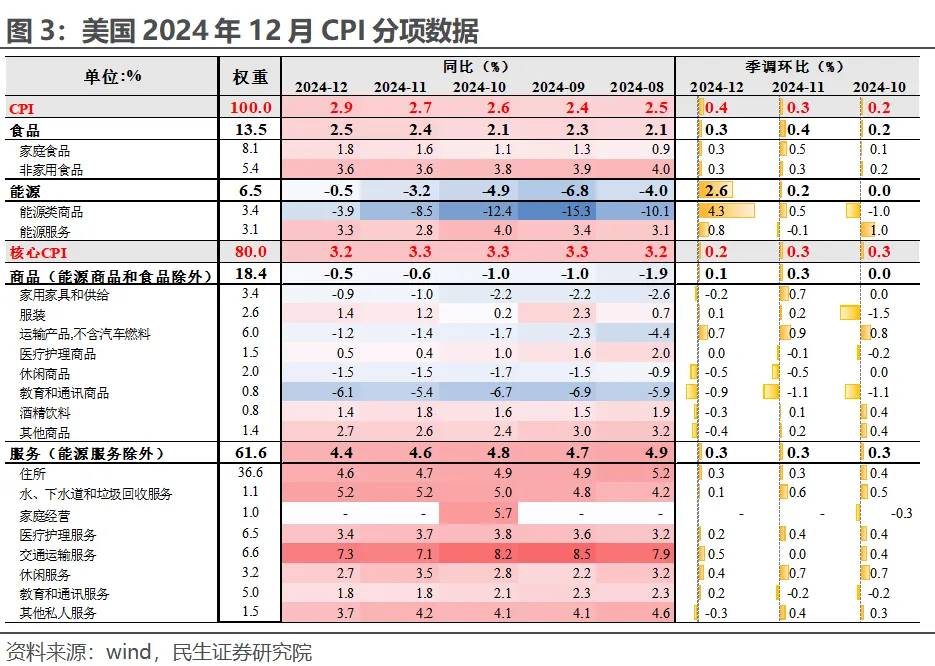

The data indicated that the CPI for December 2024 in the U.S. rose by 2.9% year-on-year, higher than the previous value of 2.7%, but in line with market expectations. Meanwhile, the core CPI, excluding food and energy, increased by 3.2% year-on-year, slightly below the expected 3.3%. While these figures may seem unremarkable, their subtle changes have become an important thermometer for market sentiment, directly influencing investor emotions and market trends.

Following the release of this data, the stock market reacted swiftly, with the Dow Jones, S&P 500, and Nasdaq indices all rising, as the market generally believed that the Federal Reserve would not raise interest rates in the short term. This expectation led to a significant drop in the U.S. dollar index, with non-U.S. currencies generally strengthening, boosting investor confidence in the future economy.

2. Dual Response of Stock and Cryptocurrency Markets: From Calm to Excitement

Against the backdrop of a thriving traditional stock market, the cryptocurrency market's response was also exceptionally rapid. According to AICoin data, after the CPI data was released, the price surged by 1.31% within five minutes, and within just two hours, Binance's BTC open contracts surged by $500 million. This phenomenon undoubtedly injected more confidence into the market, with investor enthusiasm for the crypto market quickly rebounding in a short time.

This response sharply contrasts with the direction of the traditional stock market. As the stock market rose, investor funds began to flow into the cryptocurrency market, indicating a shift in market risk appetite. The general rise of tech stocks such as Tesla, Meta, and Microsoft also reflects renewed investor interest in risk assets.

Driven by this sentiment, the cryptocurrency market saw a resurgence in trading activity. The trading volume and prices of mainstream digital currencies like Bitcoin and Ethereum experienced a rebound. This was not just a recovery of technical indicators but also a reflection of warming market sentiment, indicating investors' optimistic expectations for the future market.

3. Federal Reserve Policy Direction: A Game of Patience and Observation

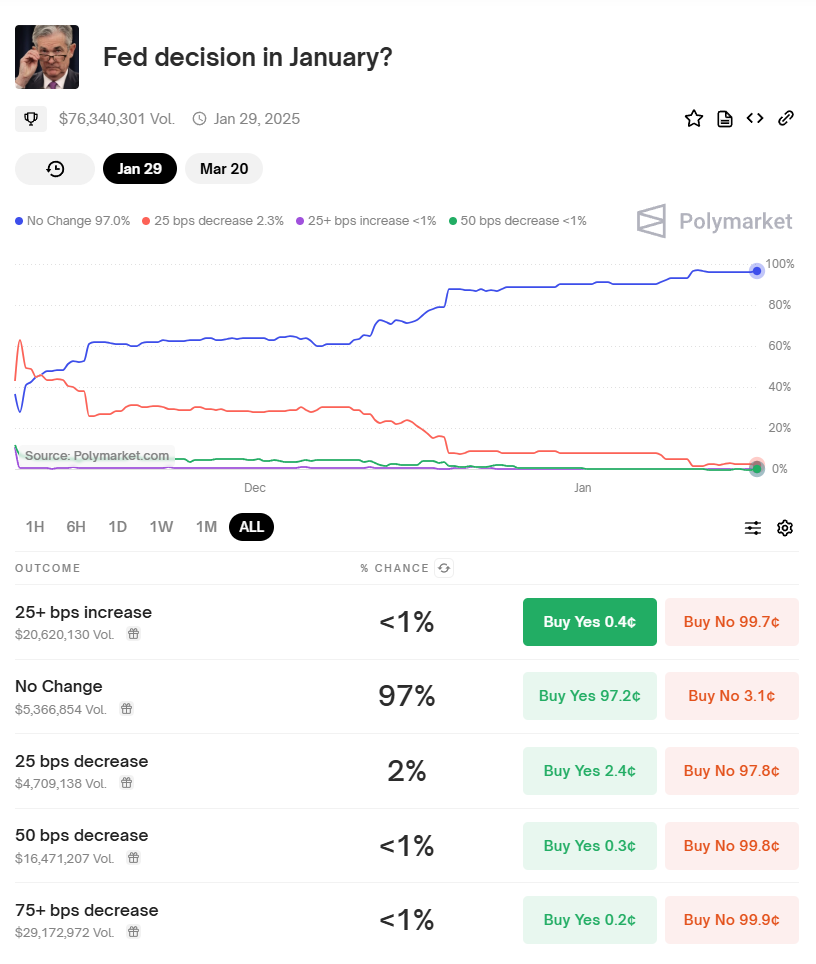

The release of inflation data undoubtedly heightened market focus on the Federal Reserve's policy direction. Currently, the probability of the Federal Reserve maintaining interest rates in January 2025 is as high as 97.3%, while the likelihood of a rate cut is almost negligible. This data suggests that, in the short term, the Federal Reserve may not take further tightening measures. The market's focus is gradually shifting to future changes in inflation data, particularly the trend of core CPI, which will become a key basis for investors to assess the Federal Reserve's monetary policy path.

The Federal Reserve's attitude will directly influence investor expectations. If the Federal Reserve continues to exercise patience, it may provide a relatively stable environment for the market, thereby driving up risk assets. In this context, the trajectory of the cryptocurrency market will increasingly depend on the release of macroeconomic data and changes in market sentiment.

Some experts point out that inflation changes may gradually slow down, and there may even be risks of imbalance. In this case, if the Federal Reserve decides to loosen monetary policy, it could further stimulate market liquidity, bringing more opportunities to the cryptocurrency market.

4. Expert Interpretation: Hidden Signals in Economic Data

In this grand performance of economic data, expert voices undoubtedly provide investors with more insights.

Rick Rieder, Chief Investment Officer of Global Fixed Income at BlackRock, stated that the progress of inflation may be slow and unstable, and changes in fiscal policy over the next year could bring more uncertainty. He believes that although current inflation data has not exceeded market expectations, future economic trends remain full of unknowns, and investors should remain cautious.

Meanwhile, Tina Adatia, Head of Fixed Income Client Portfolio Management at Goldman Sachs Asset Management, pointed out that although CPI data supports the possibility of a Federal Reserve rate cut, the Federal Reserve still has room to maintain patience in the short term. She believes that as more economic data is released, the market may gradually find a new balance under the guidance of the Federal Reserve's policies.

Experts generally agree that there remains significant uncertainty in the future economy. How the Federal Reserve responds to these changes will determine the future direction of the market. For the cryptocurrency market, this is undoubtedly a time full of challenges and opportunities. Investors need to pay attention to core inflation data and adjust their strategies in a timely manner to cope with potential future fluctuations.

5. Looking Ahead: Opportunities and Challenges in the Cryptocurrency Market

Looking ahead, the cryptocurrency market will continue to be influenced by macroeconomic data and expectations of Federal Reserve policies in the short term. With the release of inflation data, the market generally believes that the Federal Reserve will not rush to cut interest rates in the short term, providing a relatively stable external environment for the cryptocurrency market. In this environment, the market may continue to maintain growth momentum, especially as investors seek risk assets, the cryptocurrency market will once again welcome opportunities for an upswing.

However, in the long term, the trends in inflation and changes in Federal Reserve monetary policy will continue to profoundly impact the cryptocurrency market. If inflationary pressures gradually ease and the Federal Reserve begins to loosen monetary policy, the market will gain more liquidity, further driving market growth. At the same time, market uncertainty will also increase, and the cryptocurrency market may face more competition and challenges.

The future of the cryptocurrency market is not set in stone; investors should remain vigilant and flexibly adjust their investment strategies based on macroeconomic changes. After all, in this highly volatile market, rationality and patience are always the best weapons to cope with uncertainty.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。