Author: Alex Thorn, Gabe Parker, Galaxy

Compiled by: Luffy, Foresight News

Introduction

2024 is a landmark year for the cryptocurrency market, marked by the launch of spot Bitcoin exchange-traded products (ETPs) at the beginning of the year and the arrival of the most cryptocurrency-supportive president and Congress in U.S. history in November, bringing a successful conclusion to the year. In 2024, the total market capitalization of the cryptocurrency circulation market increased by $1.6 trillion, a year-on-year growth of 88%, reaching $3.4 trillion by the end of the year. The market capitalization of Bitcoin alone increased by $1 trillion, approaching $2 trillion by year-end. The development trend of the cryptocurrency market in 2024 was driven on one hand by the rapid rise of Bitcoin, and on the other hand influenced by Memecoins and AI-related cryptocurrencies. For most of the year, Memecoins were popular, with most on-chain activities occurring on the Solana blockchain. In the second half of the year, AI agents in cryptocurrency became the new focus.

In 2024, venture capital (VC) in the cryptocurrency space remained challenging. Mainstream hotspots like Bitcoin, Memecoins, and AI agents are not particularly suitable for venture capital. Memecoins can be launched with just a few clicks, and cryptocurrencies related to Memecoins and AI agents operate almost entirely on-chain, utilizing existing infrastructure primitives. Popular areas from the last market cycle, such as decentralized finance (DeFi), gaming, the metaverse, and non-fungible tokens (NFTs), either failed to attract significant market attention or have already been built out, leading to reduced funding needs and intensified competition for startups. Most businesses related to cryptocurrency market infrastructure have been built out and are entering a later stage of development, and with anticipated regulatory changes from the next U.S. government, these areas may face competition from traditional financial service intermediaries. There are signs that some new hotspots are emerging, which could become important drivers of new capital inflows, but most are still immature or in their infancy: notable among them are stablecoins, tokenization, the integration of DeFi with traditional finance (TradFi), and the intersection of cryptocurrency and AI.

Macroeconomic and broader market forces also pose resistance. The high-interest-rate environment continues to pressure the venture capital industry, with capital allocators less willing to take on higher risks. This phenomenon has squeezed the entire venture capital industry, and the cryptocurrency venture capital sector, due to its higher risk perception, may be affected even more severely. Meanwhile, most large comprehensive venture capital firms still maintain an avoidance attitude toward the sector, perhaps still haunted by the collapse of several well-known venture-backed companies in 2022.

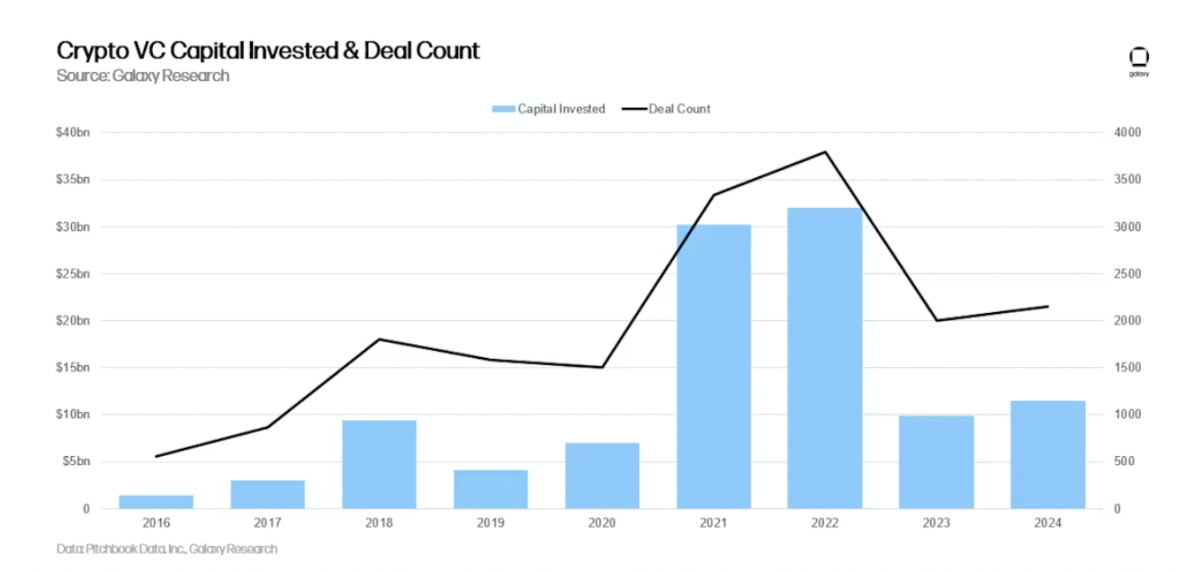

Therefore, despite significant opportunities in the future, whether through the revival of existing primitives and narratives or the emergence of new things, cryptocurrency venture capital remains competitive and relatively subdued compared to the frenzy of 2021 and 2022. The number of transactions and investment amounts have increased, but the number of new funds has stagnated, and the capital allocated to venture capital funds has decreased, creating an environment of particularly intense competition that is more favorable to founders in valuation negotiations. Overall, venture capital remains well below the levels of the last market cycle.

However, the increasing institutionalization of Bitcoin and digital assets, the growth of stablecoins, and the new regulatory environment may ultimately facilitate the integration of DeFi and TradFi, all of which point to new opportunities for innovation. We expect that venture capital activity and attention may significantly rebound in 2025.

Key Points Summary

- In Q4 2024, venture capital investment in cryptocurrency startups amounted to $3.5 billion (up 46% quarter-on-quarter), involving 416 transactions (down 13% quarter-on-quarter).

- For the entire year of 2024, venture capital firms invested $11.5 billion in cryptocurrency and blockchain startups, totaling 2,153 transactions.

- Early-stage transactions attracted the most capital investment (60%), while late-stage transactions accounted for 40% of investment capital, showing significant growth from 15% in the third quarter.

- The median valuation of venture capital transactions rose in the second and third quarters, with the valuation growth of cryptocurrency transactions outpacing the overall venture capital industry, but remained flat quarter-on-quarter in the fourth quarter.

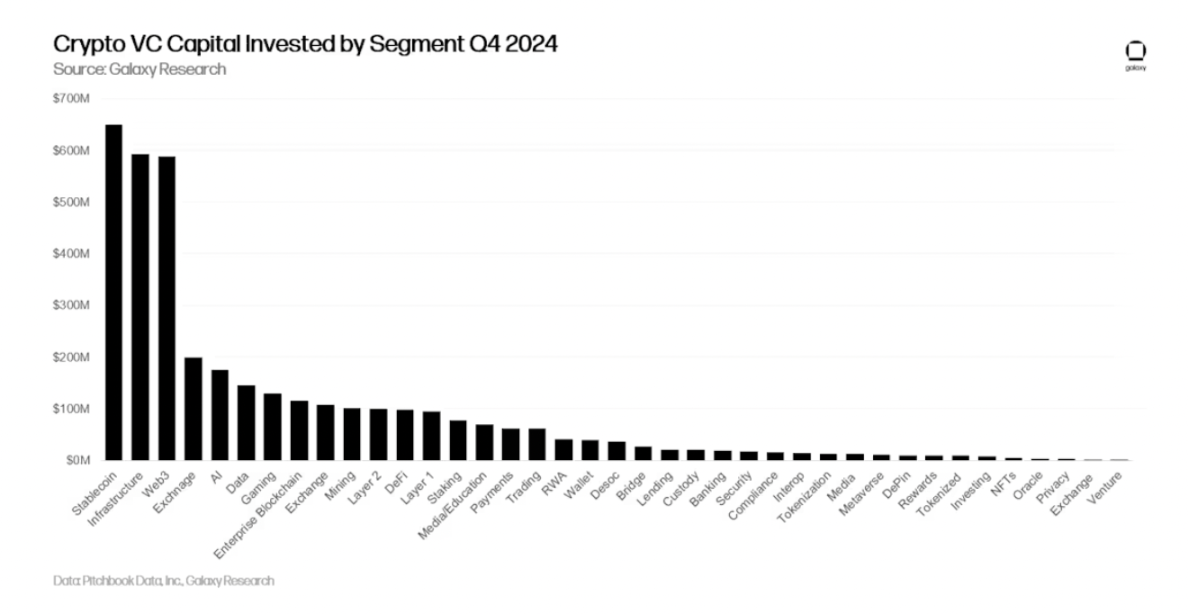

- Stablecoin companies raised the most funds, with Tether securing $600 million from Cantor Fitzgerald, followed by infrastructure and Web3 startups. The number of transactions in Web3, DeFi, and infrastructure companies was the highest.

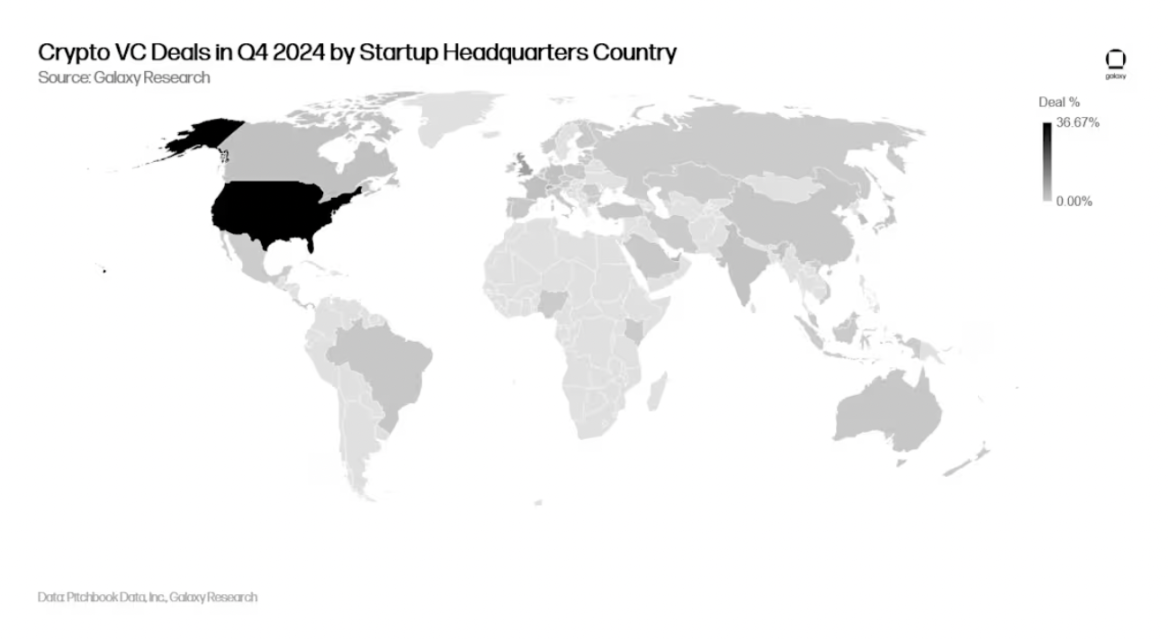

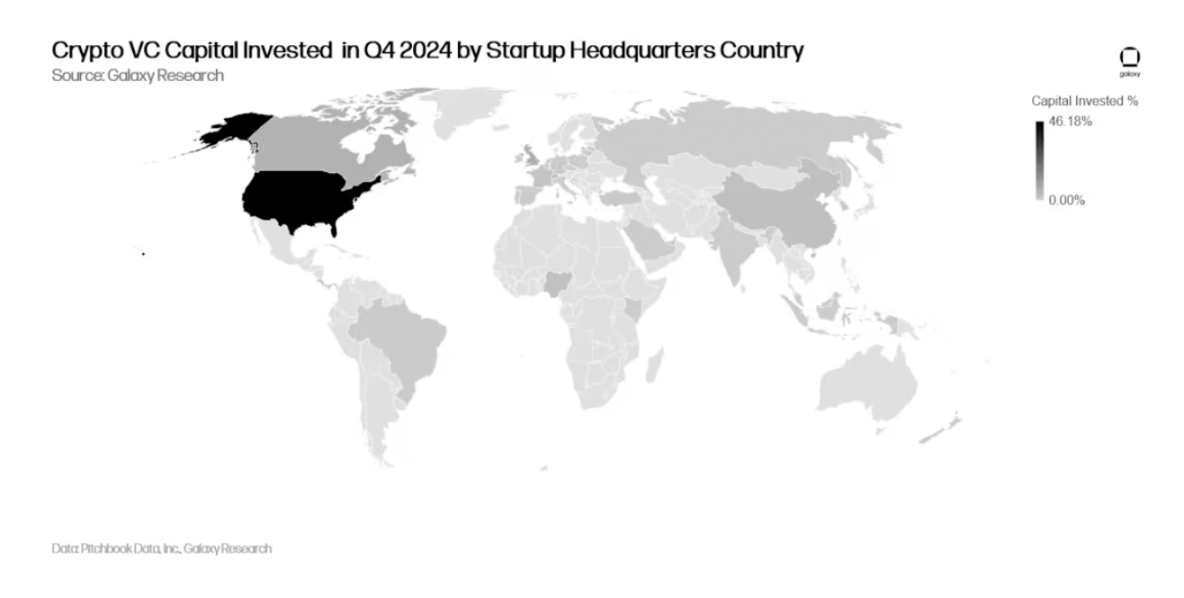

- In Q4 2024, U.S.-based startups received the most investment (46%), while investment in Hong Kong companies rose to 17%. By transaction count, the U.S. accounted for 36%, leading, followed by Singapore (9%) and the UK (8%).

- In fundraising, capital allocators' interest in cryptocurrency-focused venture capital funds dropped to $1 billion, involving 20 new funds.

- At least 10 cryptocurrency venture capital funds raised over $100 million in 2024.

Venture Capital Situation

Transaction Volume and Investment Amount

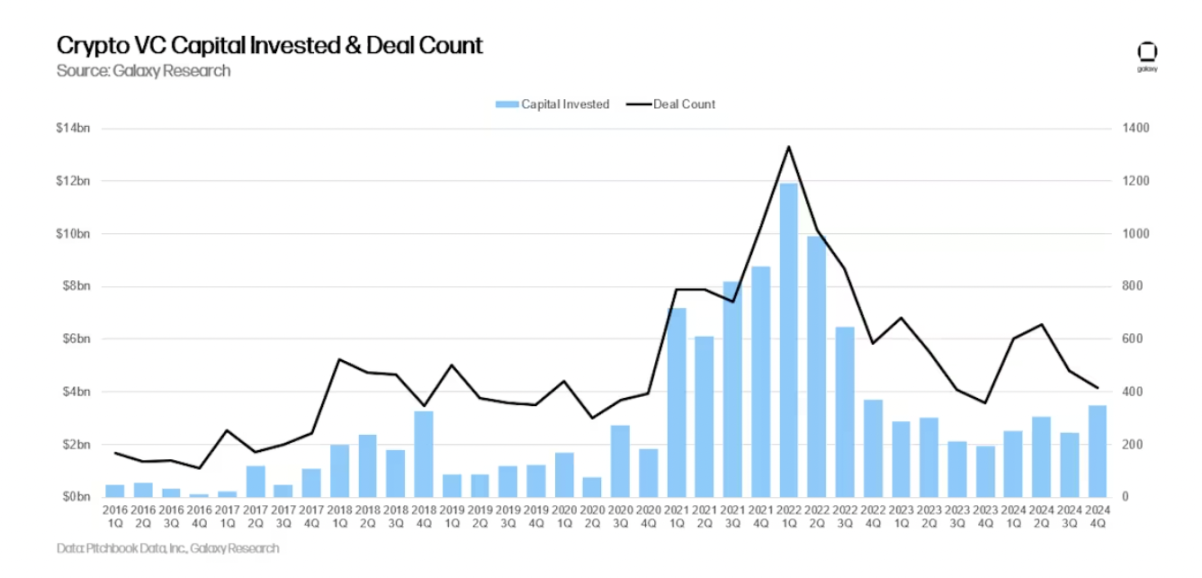

In Q4 2024, venture capitalists invested $3.5 billion in cryptocurrency and blockchain-focused startups (up 46% quarter-on-quarter), with a total of 416 transactions (down 13% quarter-on-quarter).

For the entire year of 2024, venture capitalists invested $11.5 billion in cryptocurrency and blockchain startups, totaling 2,153 transactions.

Investment Amount and Bitcoin Price

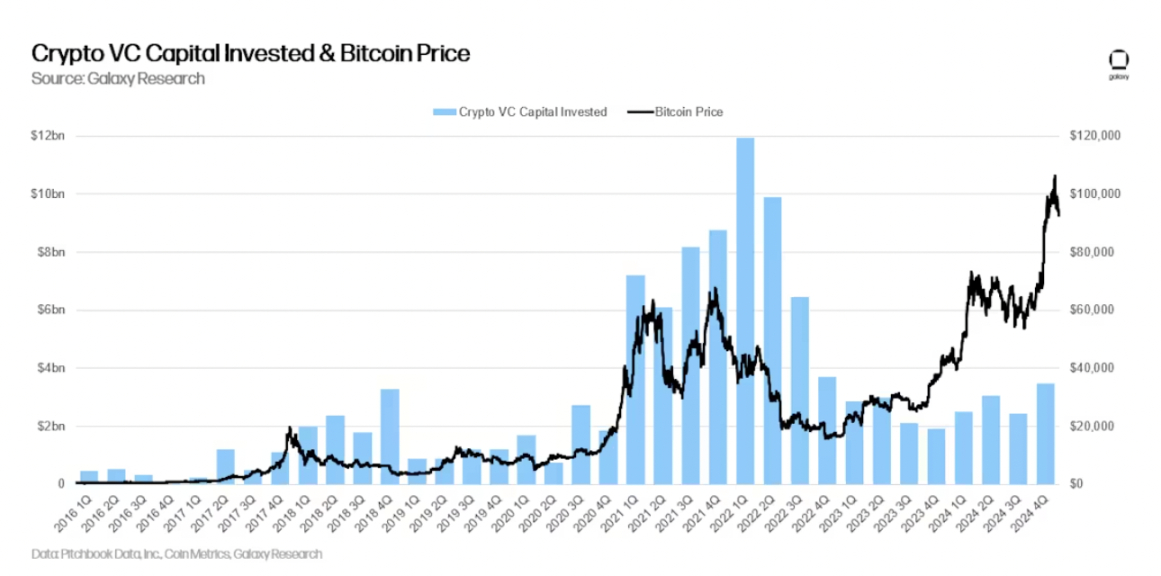

In past cycles, there has been a long-term correlation between Bitcoin prices and the investment amounts in cryptocurrency startups, but this correlation has not been evident over the past year. Since January 2023, Bitcoin prices have surged, while venture capital activity has not kept pace. The waning interest of capital allocators in cryptocurrency venture capital and overall venture capital, coupled with the cryptocurrency market's preference for Bitcoin narratives that overlook many popular narratives from 2021, partially explains this discrepancy.

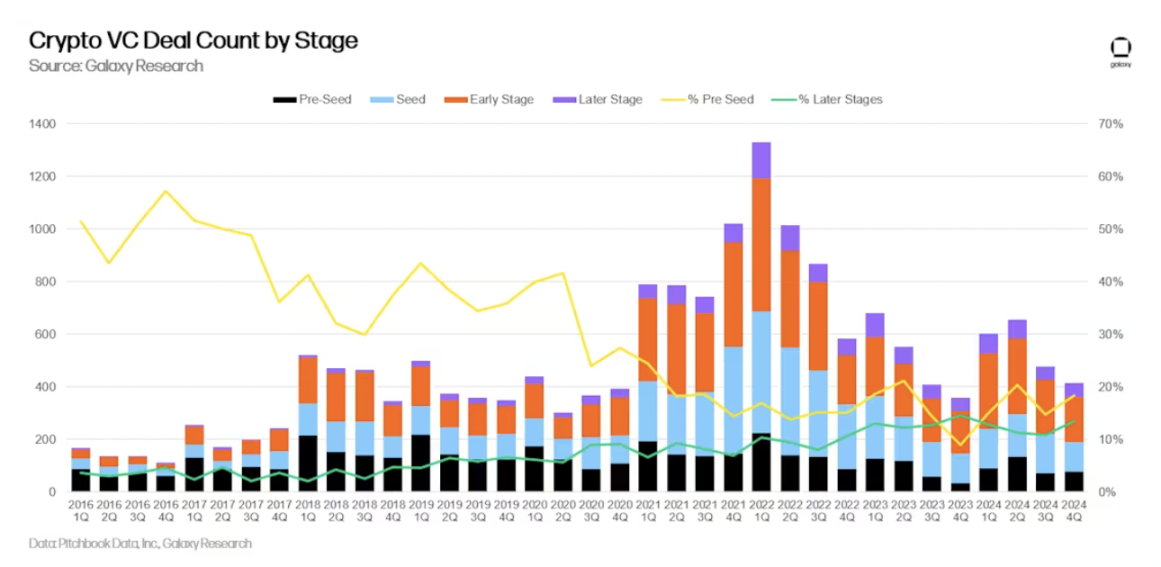

Investment by Stage

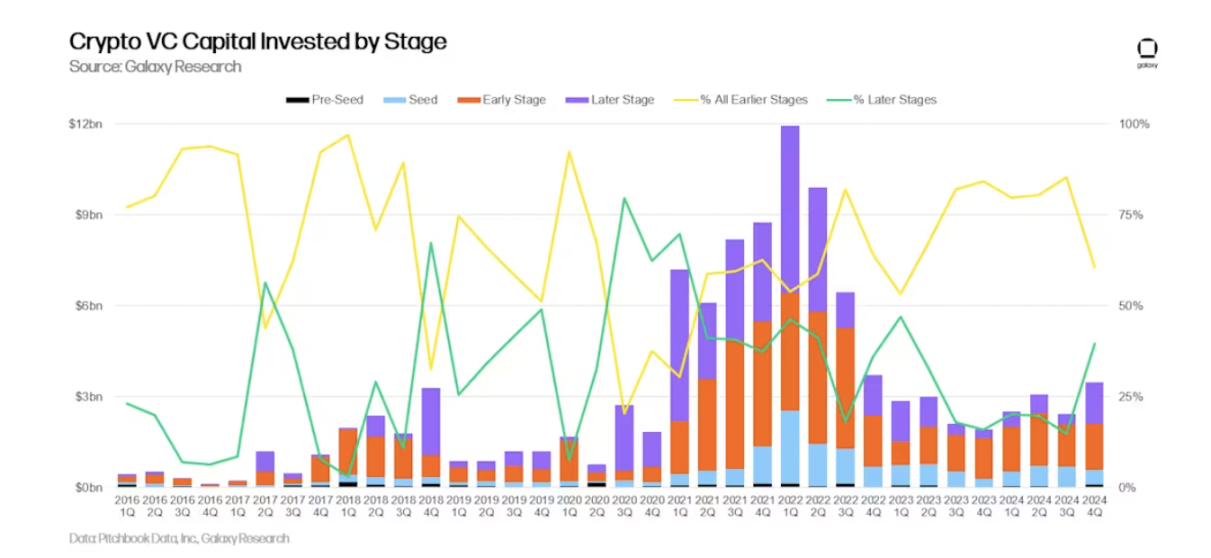

In Q4 2024, 60% of venture capital was directed toward early-stage companies, while 40% went to late-stage companies. In 2024, venture capital firms raised new funds, and funds focused on the cryptocurrency sector may still have available capital from large-scale fundraising a few years ago. Since the third quarter, the proportion of funds received by late-stage companies has increased, which can be attributed to the reported $600 million financing Tether received from Cantor Fitzgerald.

The proportion of pre-seed transactions has slightly increased, maintaining a good trend compared to previous cycles. We measure the activity level of entrepreneurial behavior by tracking the proportion of pre-seed transactions.

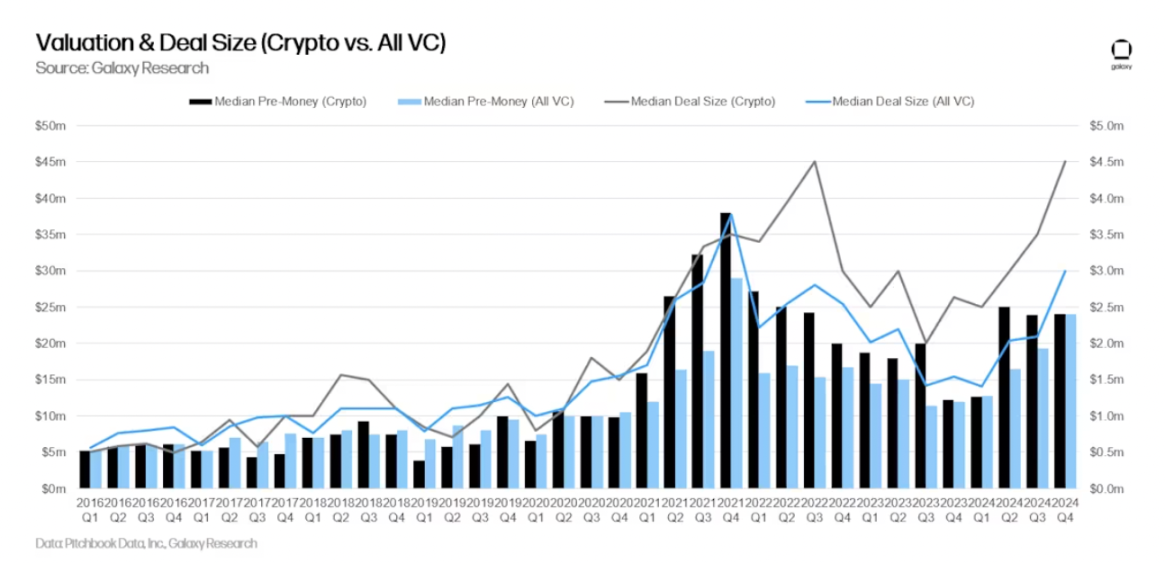

Valuation and Transaction Size

In 2023, the valuations of venture-backed cryptocurrency companies significantly declined, dropping to the lowest level since Q4 2020 in Q4 2023. However, with Bitcoin hitting an all-time high in Q2 2024, valuations and transaction sizes began to rebound. In Q2 and Q3 2024, valuations reached their highest levels since 2022. The rise in cryptocurrency transaction sizes and valuations in 2024 aligns with a similar upward trend in the overall venture capital sector, although the rebound in the cryptocurrency sector is stronger. The median pre-money valuation for transactions in Q4 2024 was $24 million, with an average transaction size of $4.5 million.

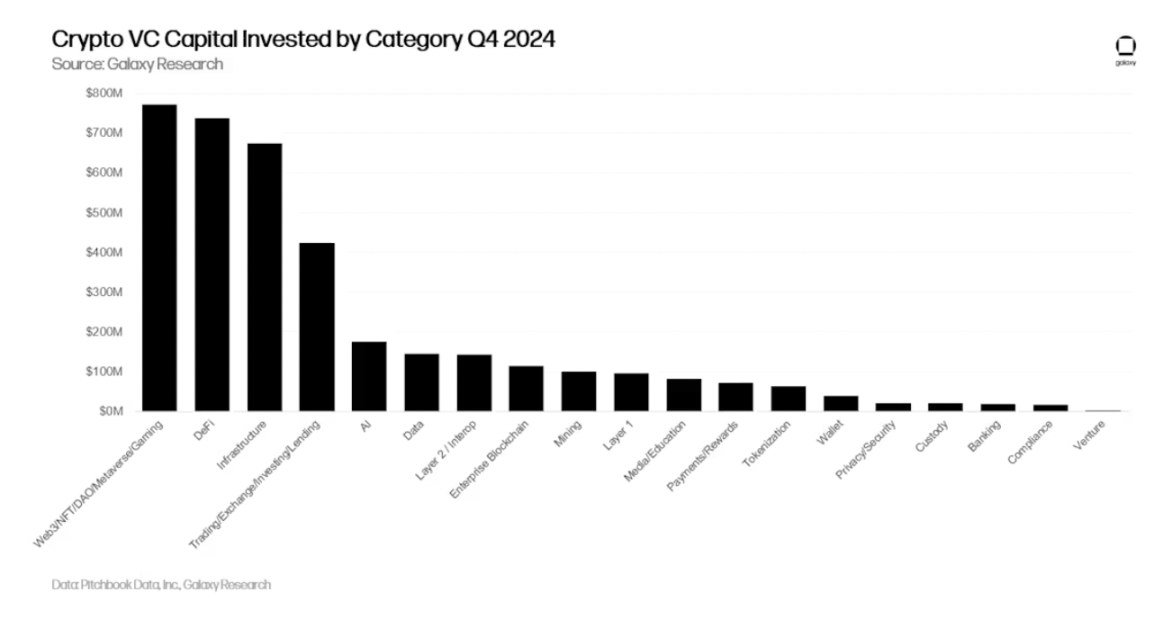

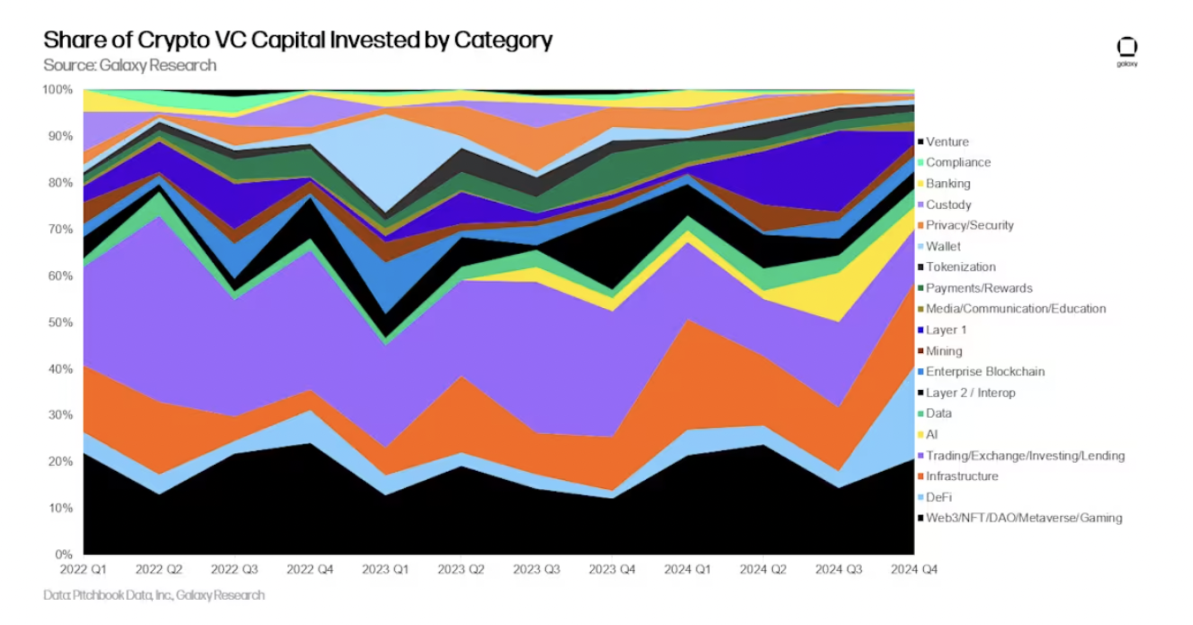

Investment by Category

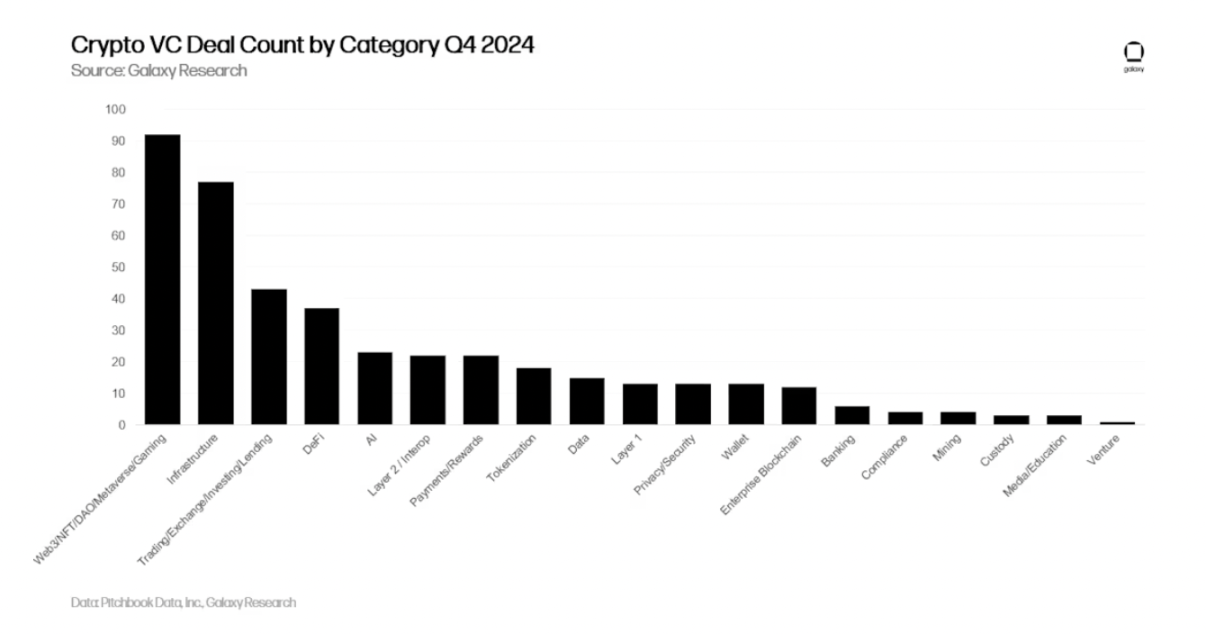

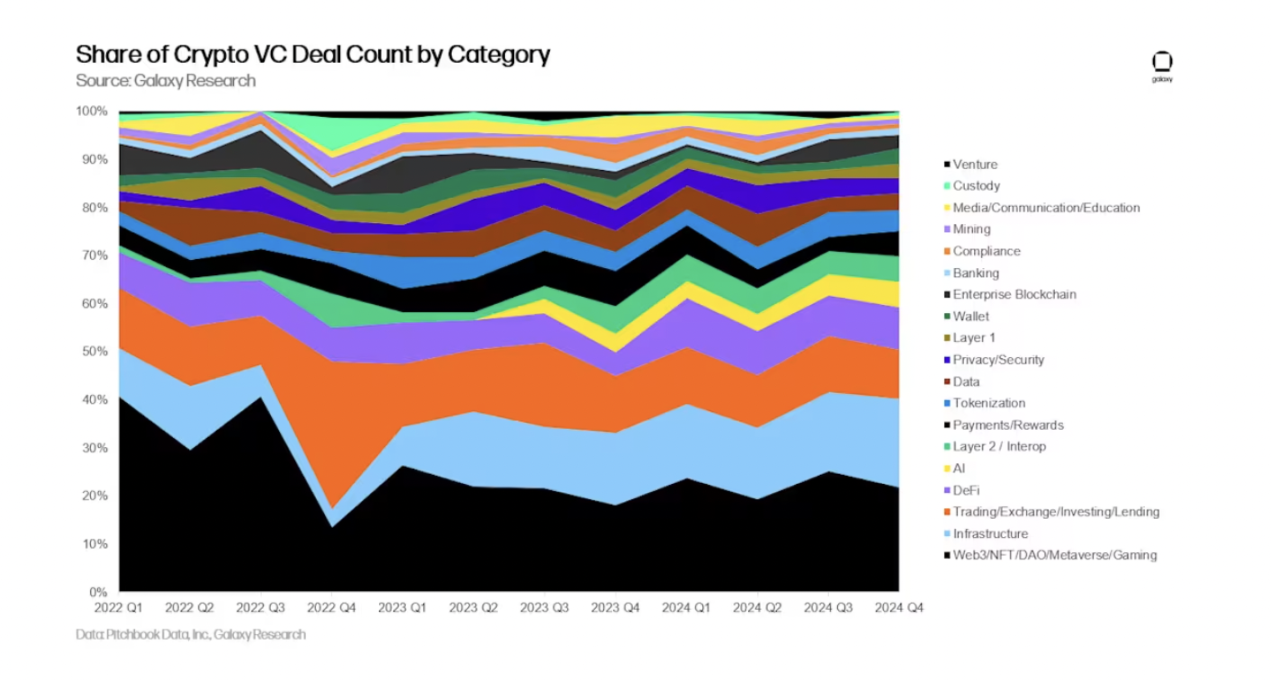

In Q4 2024, companies and projects in the "Web3/NFT/DAO/Metaverse/Gaming" category received the largest share of venture capital funding (20.75%), totaling $771.3 million. The three largest transactions in this category were Praxis, Azra Games, and Lens, raising $525 million, $42.7 million, and $31 million, respectively. DeFi's dominance in the total cryptocurrency venture capital amount is attributed to Tether's $600 million transaction with Cantor Fitzgerald, which acquired a 5% stake in the company (stablecoin issuers fall under our broad definition of the DeFi category). Although this transaction is not a traditional venture capital structure deal, we include it in our statistics. Excluding Tether's transaction, the DeFi category would drop to seventh place in Q4 by investment amount.

In Q4 2024, cryptocurrency startups building Web3/NFT/DAO/Metaverse and infrastructure products saw their share of the total quarterly cryptocurrency venture capital increase by 44.3% and 33.5%, respectively. The proportion of capital allocated to headquarters deployment increased mainly due to a significant decline in capital allocation to Layer 1 and crypto AI startups, which dropped by 85% and 55%, respectively, since Q3 2024.

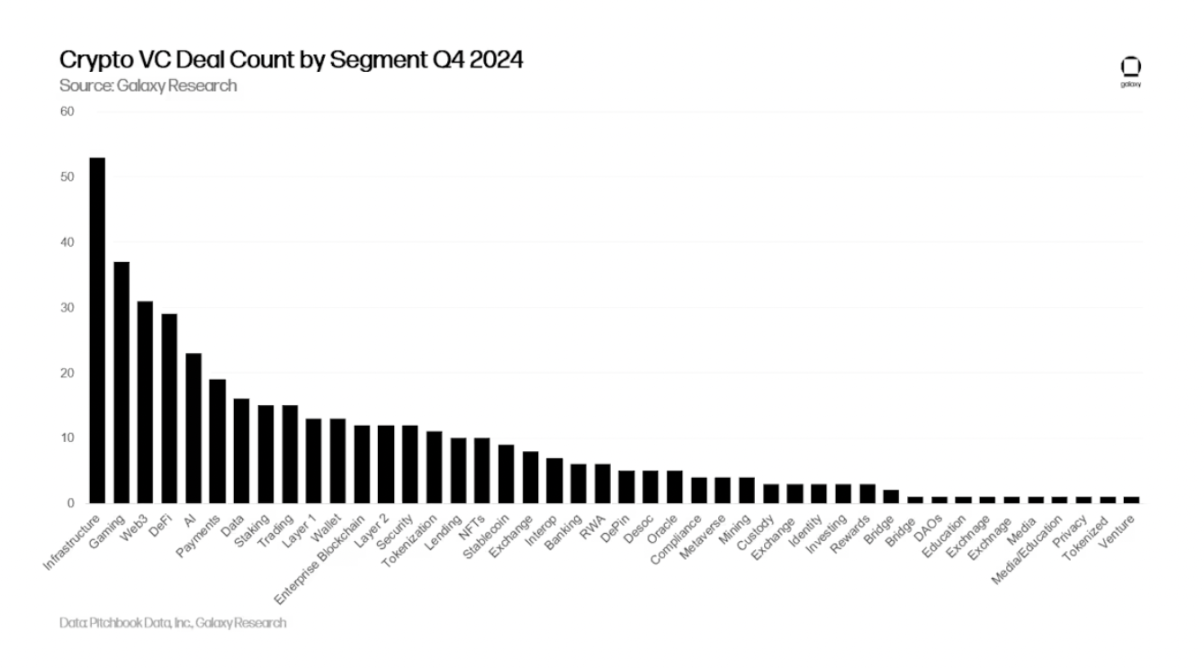

When further breaking down the larger categories, cryptocurrency projects building stablecoins received the largest share of investment in Q4 2024 (17.5%), raising a total of $649 million across 9 tracked transactions. However, Tether's $600 million transaction accounted for the majority of the total investment in stablecoin companies in Q4 2024. Cryptocurrency startups developing infrastructure secured the second-largest amount of venture capital, raising a total of $592 million across 53 tracked transactions. The three largest crypto infrastructure deals were Blockstream, Hengfeng Company, and Cassava Network, raising $210 million, $100 million, and $90 million, respectively. Following crypto infrastructure, Web3 startups and exchanges ranked third and fourth in funding from cryptocurrency venture capital firms, totaling $587.6 million and $200 million, respectively. Notably, Praxis was the largest Web3 deal in Q4 2024 and the second-largest overall deal, raising up to $525 million to build an "Internet-native city."

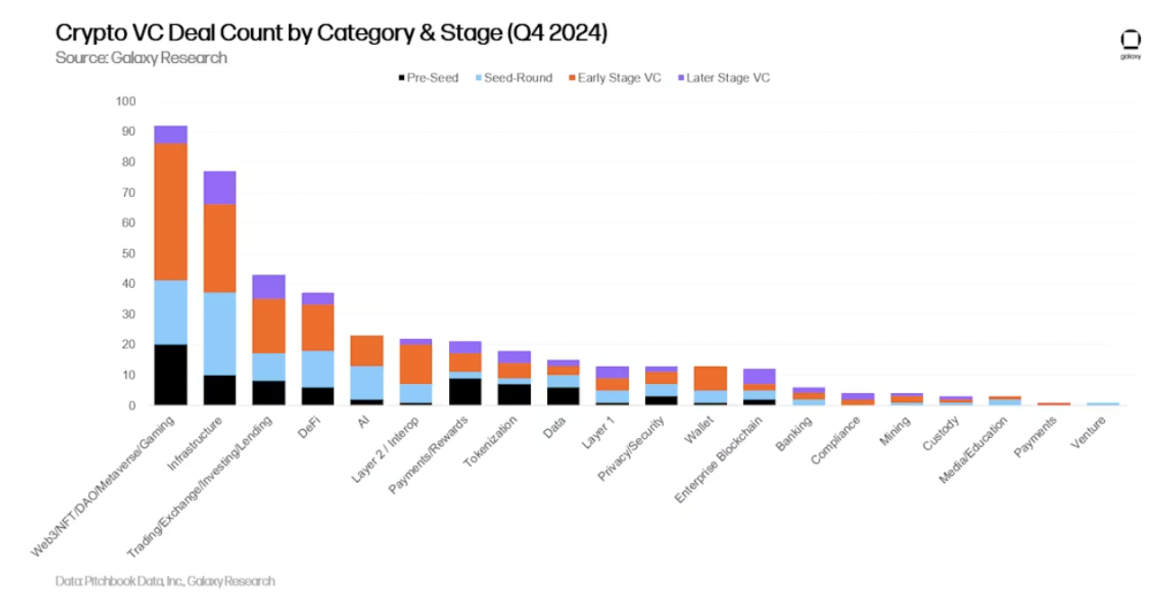

In terms of transaction volume, the Web3/NFT/DAO/Metaverse/Gaming category led with a 22% transaction share (92 transactions), including 37 gaming transactions and 31 Web3 transactions. In Q4 2024, the infrastructure and trading/exchange/investment/lending categories had 77 and 43 transactions, respectively.

Projects and companies providing crypto infrastructure ranked second in transaction volume, accounting for 18.3% of total transactions (77 transactions), with an 11% quarter-on-quarter increase. Following crypto infrastructure, projects and companies building trading/exchange/investment/lending products ranked third in transaction volume, accounting for 10.2% of total transactions (43 transactions). Notably, cryptocurrency companies building wallets and payment/reward products saw the largest quarter-on-quarter increases in transaction volume, reaching 111% and 78%, respectively. Despite the large percentage increases, wallet and payment/reward startups only involved 22 and 13 transactions in Q4 2024.

When further breaking down the larger categories, projects and companies building crypto infrastructure had the highest number of transactions across all subfields (53 transactions). Gaming and Web3-related cryptocurrency companies followed, completing 37 and 31 transactions in Q4 2024, nearly the same ranking as in Q3 2024.

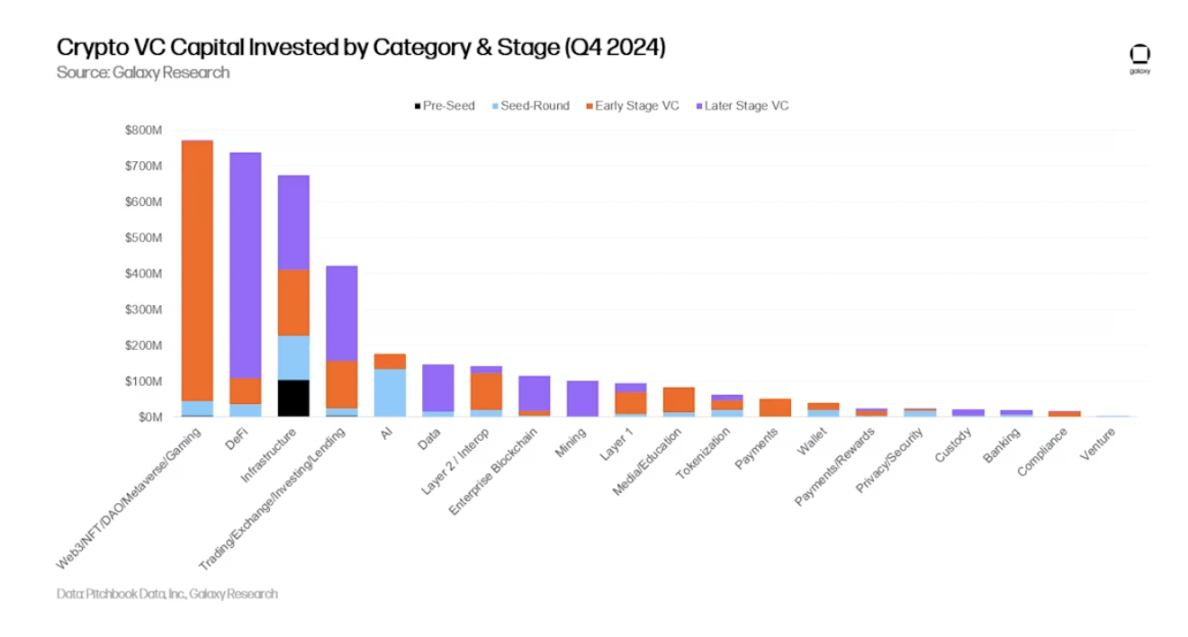

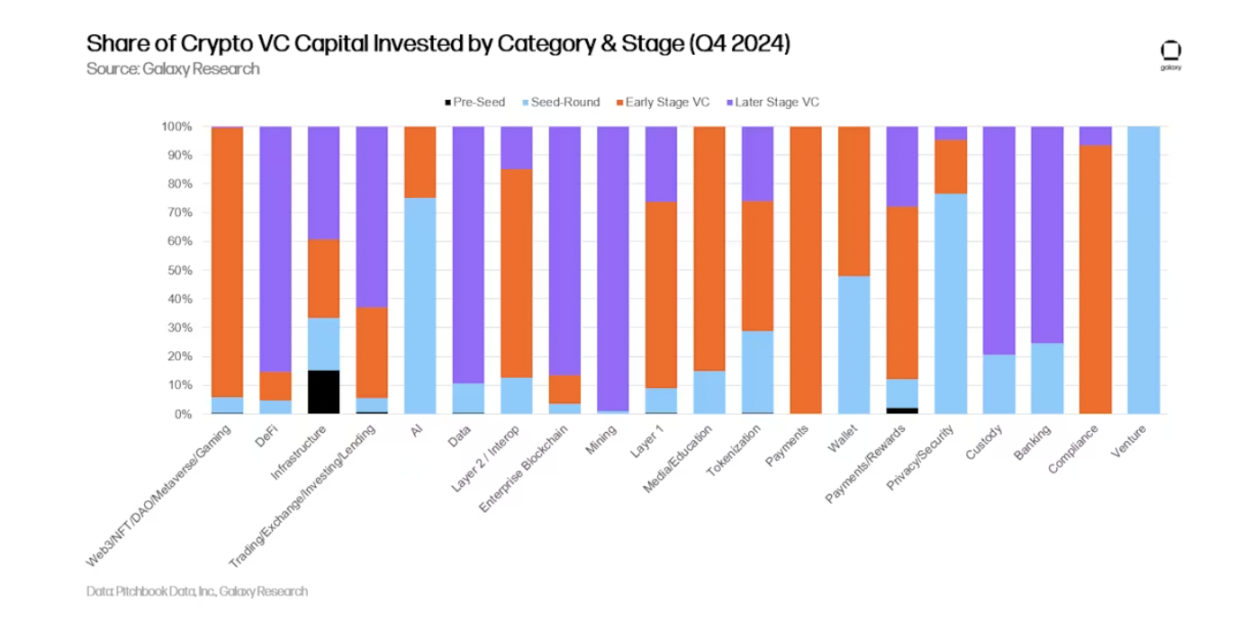

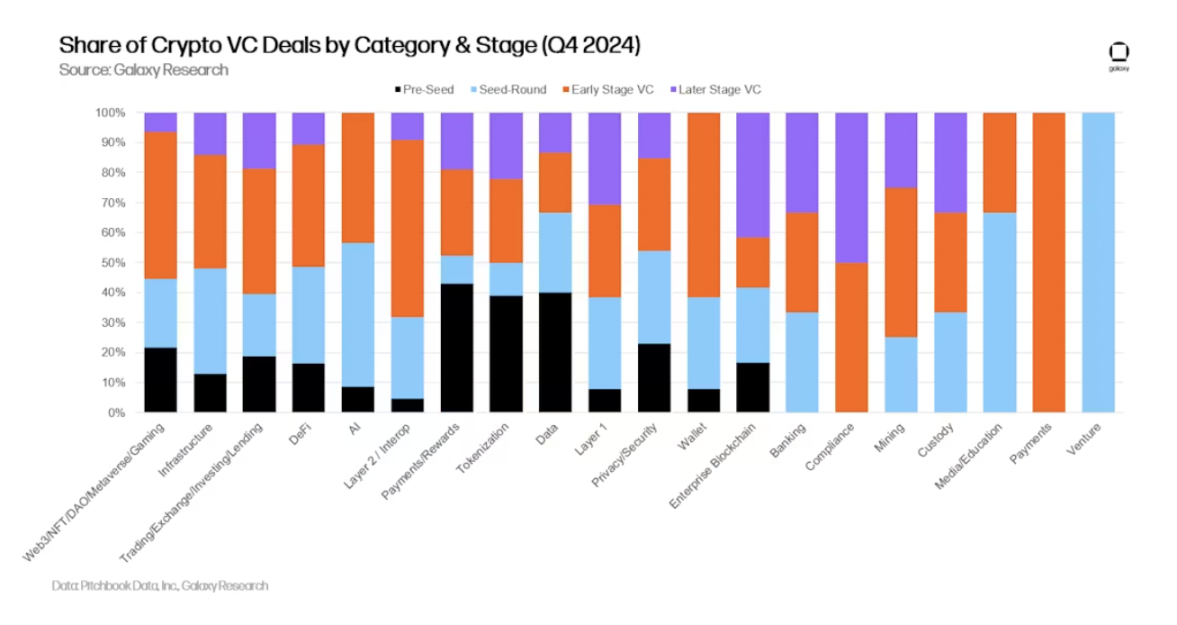

Investment by Stage and Category

By breaking down investment amounts and transaction numbers by category and stage, we can gain a clearer understanding of which types of companies are raising funds in each category. In Q4 2024, the vast majority of funds in the Web3/DAO/NFT/Metaverse, Layer 2, and Layer 1 sectors flowed to early-stage companies and projects. In contrast, a significant portion of venture capital funding in DeFi, trading/exchange/investment/lending, and mining sectors flowed to late-stage companies.

Analyzing the distribution of investment funds across different stages in each category reveals the relative maturity of various investment opportunities.

Similar to the cryptocurrency venture capital situation in Q3 2024, a large portion of the transactions completed in Q4 2024 involved early-stage companies. The tracked cryptocurrency venture capital transactions in Q4 2024 included 171 early-stage transactions and 58 late-stage transactions.

Studying the transaction shares of different stages within each category helps to understand the various development stages of each investable category.

Investment by Geography

In Q4 2024, 36.7% of transactions involved companies headquartered in the U.S., with Singapore in second place at 9%, the UK at 8.1%, Switzerland at 5.5%, and the UAE at 3.6%.

U.S.-based companies received 46.2% of all venture capital, a quarter-on-quarter decrease of 17 percentage points. In contrast, venture capital funding for startups based in Hong Kong saw a significant increase, reaching 17.4%. The UK accounted for 6.8%, Canada for 6%, and Singapore for 5.4%.

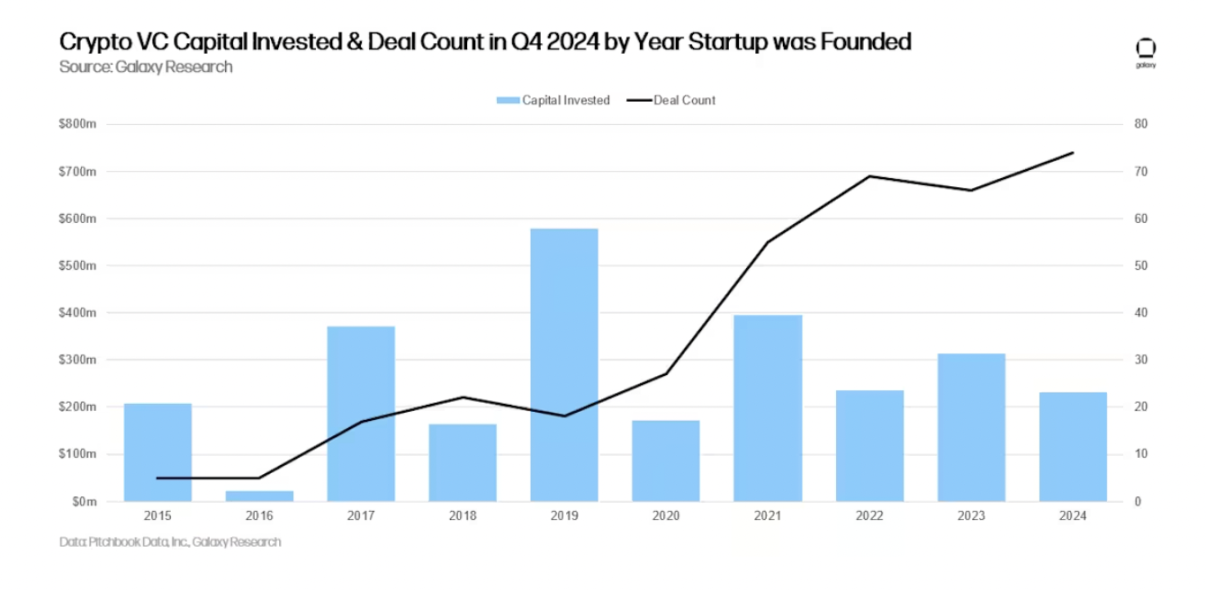

Investment by Year of Company Formation

Companies and projects established in 2019 received the largest share of funding, while those formed in 2024 had the highest number of transactions.

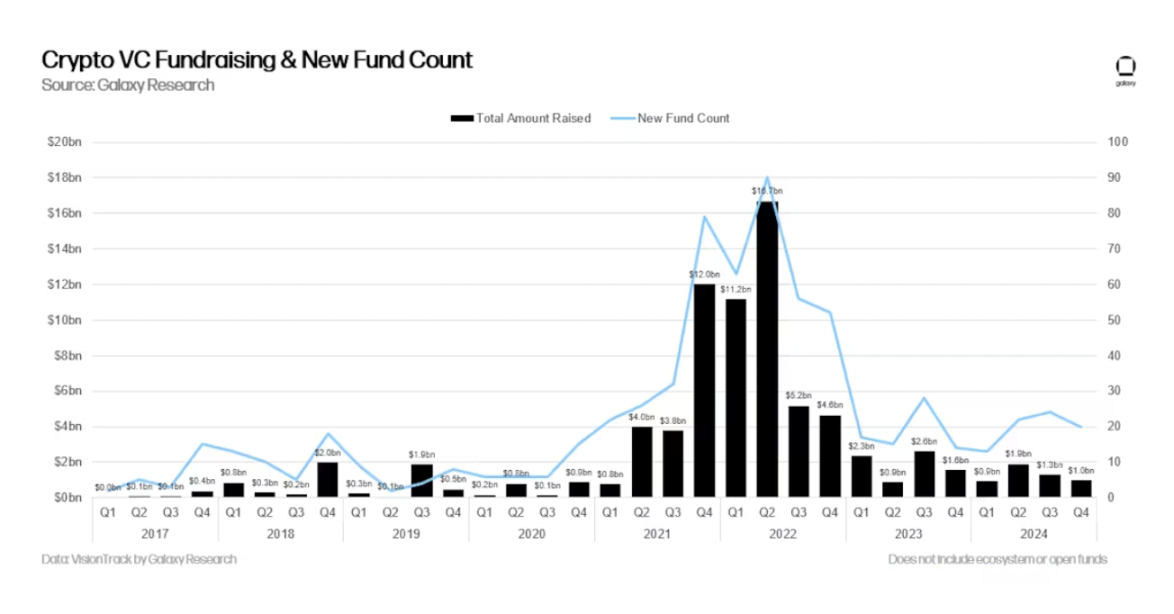

Venture Capital Fundraising Situation

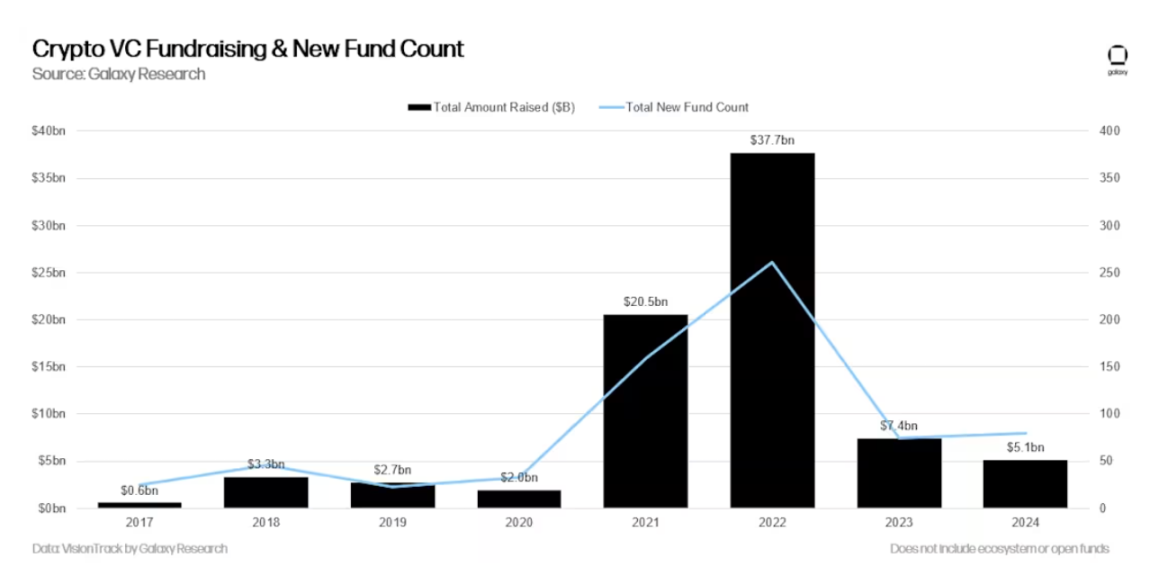

Fundraising for cryptocurrency venture capital funds remains challenging. The macro environment of 2022 and 2023, along with the volatility in the cryptocurrency market, has led some capital allocators to no longer commit to cryptocurrency venture capital at the same scale as in early 2021 and 2022. At the beginning of 2024, investors generally believed that interest rates would decline significantly throughout the year, although rate cuts did not begin to materialize until the second half of the year. Since Q3 2023, the total funds allocated to venture capital funds have continued to decline quarter-on-quarter, despite an increase in the number of new funds throughout 2024.

2024 is the weakest year for fundraising in cryptocurrency venture capital since 2020, with 79 new funds raising a total of $5.1 billion, far below the frenzied levels of 2021-2022.

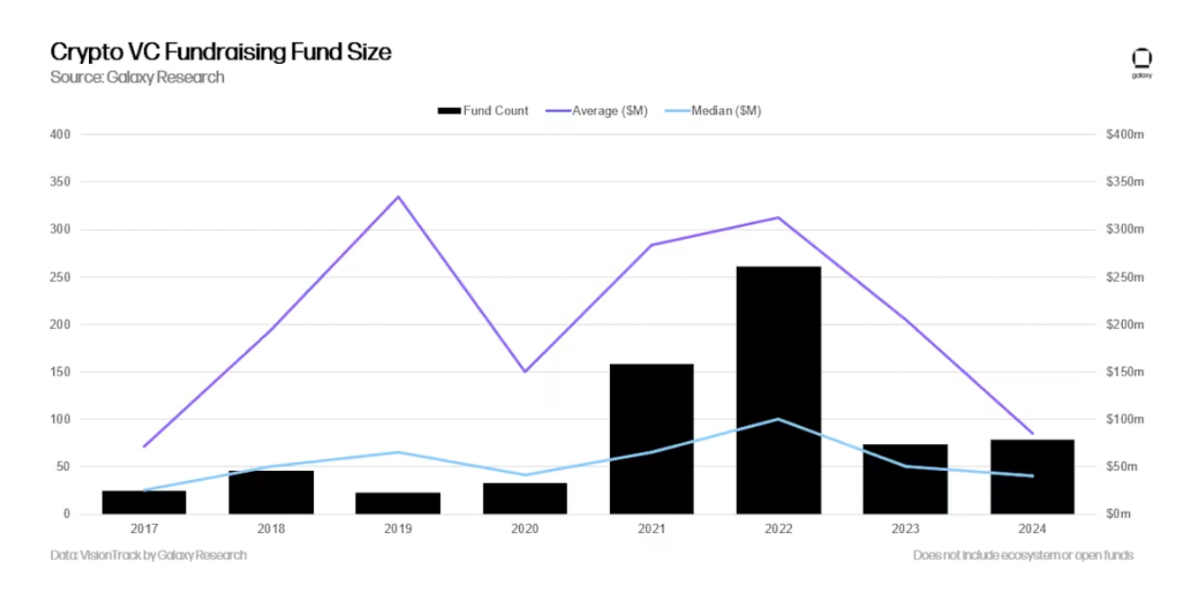

Although the number of new funds has slightly increased year-on-year, the decline in interest from capital allocators has also led to smaller fund sizes raised by venture capital firms, with the median and average sizes of funds in 2024 dropping to their lowest levels since 2017.

In 2024, at least 10 cryptocurrency venture capital funds actively investing in cryptocurrency and blockchain startups raised over $100 million for new funds.

Summary

- Market sentiment is improving, and investment activity is increasing, but it remains far below the peaks of previous cycles. Although the cryptocurrency circulation market has clearly rebounded since the end of 2022 to early 2023, venture capital activity is still far from the levels seen during the previous bull markets. In the bull markets of 2017 and 2021, venture capital activity was closely related to the circulating prices of crypto assets, but in the past two years, despite the rebound in cryptocurrency prices, venture capital activity has remained sluggish. The stagnation in venture capital is caused by various factors, including a "barbell market," where Bitcoin occupies the center stage, while new marginal net activity mainly comes from Memecoins, which face significant funding challenges and questionable sustainability. There is rising enthusiasm in the market for projects at the intersection of artificial intelligence and cryptocurrency, and anticipated regulatory changes may bring opportunities in the stablecoin, DeFi, and asset tokenization sectors.

- Early-stage investment transactions continue to dominate. Despite the many obstacles facing venture capital, the focus on early-stage transactions is a positive sign for the long-term healthy development of the broader cryptocurrency ecosystem. Late-stage investments made progress in the fourth quarter, primarily due to Cantor Fitzgerald's $600 million investment in Tether. Even so, entrepreneurs are still able to find investors willing to back innovative ideas. We believe that in 2025, projects and companies related to stablecoins, artificial intelligence, DeFi, tokenization, Layer 2, and Bitcoin are expected to perform well.

- Spot exchange-traded products (ETPs) may put pressure on venture capital funds and startups. In the U.S., some capital allocators have made notable investments in spot Bitcoin exchange-traded products, indicating that some large investors (pension funds, endowments, hedge funds, etc.) may prefer to enter the field through these large-scale, liquid instruments rather than opting for early-stage venture capital. Interest in spot Ethereum exchange-traded products is also beginning to rise, and if this trend continues, or if new exchange-traded products covering other Layer 1 blockchains are launched, the investment demand for areas like DeFi or Web3 may shift towards these exchange-traded products rather than the venture capital space.

- Fund managers still face a challenging environment. Although the number of new funds in 2024 has slightly increased year-on-year, the total funds allocated to cryptocurrency venture capital funds are slightly lower than in 2023. The macro environment continues to pose challenges for capital allocators, but significant changes in the regulatory environment may reignite their interest in the cryptocurrency space.

- The U.S. continues to dominate the cryptocurrency startup ecosystem. Despite a highly complex and often hostile regulatory framework, U.S.-based companies and projects still account for the majority of completed transactions and investment amounts. The incoming presidential administration and Congress are expected to be the most cryptocurrency-friendly in U.S. history, and we anticipate that the U.S. dominance will further strengthen, especially if certain regulatory matters, such as stablecoin frameworks and market structure legislation, are implemented as expected, allowing traditional financial services companies in the U.S. to truly enter the cryptocurrency space.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。