We look forward to a future of multi-agent coexistence, a society composed of autonomous agents.

Author: Crypto.com Research and Insights Team

Compiled by: Deep Tide TechFlow

Executive Summary

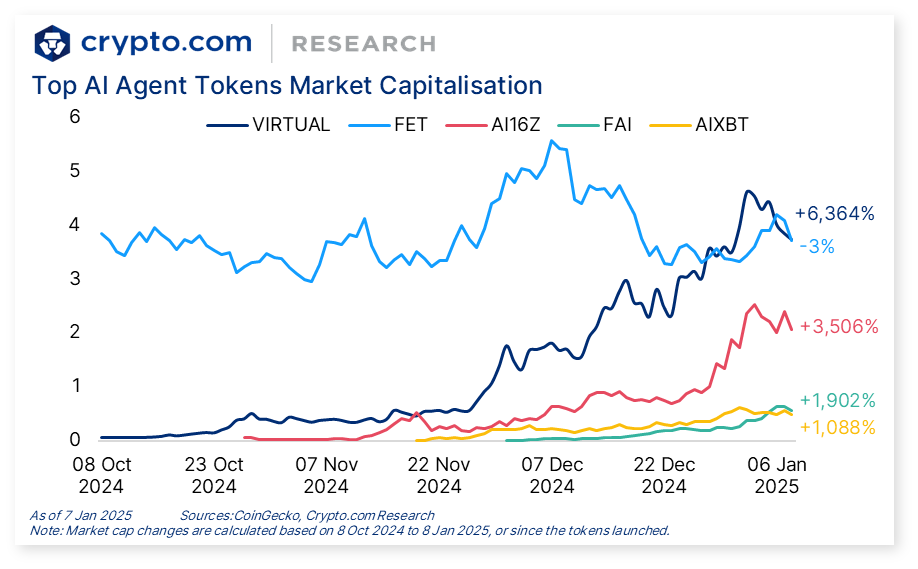

The artificial intelligence agents (AI agents) industry has recently experienced rapid development, with a market capitalization reaching $15.3 billion at the time of writing. Notably, the market capitalization of AI agents (such as Virtuals Protocol and ai16z) has increased by 6,300% and 3,500%, respectively, over the past three months since their launch.

The AI agent field can be roughly divided into the following two categories:

General Platforms: Frameworks or platforms that support agent development, providing functionalities for creation, deployment, and management.

Dedicated Applications: Specialized intelligent agents designed for specific scenarios.

Virtuals Protocol is a typical AI agent platform that supports the creation, tokenization, and co-ownership of AI agents.

GAME Framework: Endows agents with personality, goals, and perception capabilities, enabling them to perform various tasks. These agents can be deployed on the X platform and other third-party applications or games, expanding their use cases.

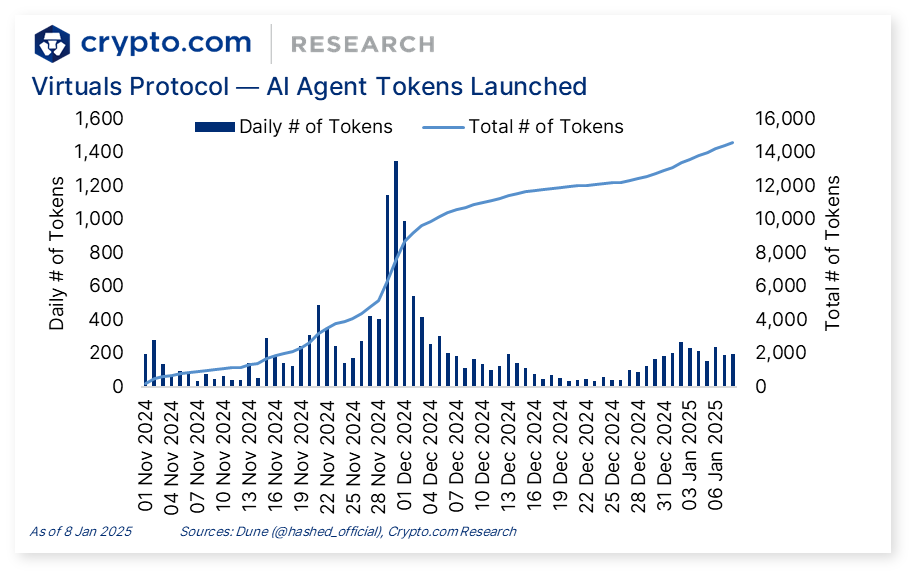

AI Agent Tokenization: The AI agent launch platform Virtuals Fun has successfully launched approximately 14,000 AI agent tokens (as of the time of writing).

ai16z is an AI-driven decentralized autonomous organization (DAO) and investment fund based on the Solana blockchain, led by the intelligent agent AI Marc. AI Marc is inspired by Marc Andreessen, co-founder of the venture capital firm a16z.

Eliza Framework: An open-source framework designed for creating, deploying, and managing autonomous AI agents. As of the time of writing, it has become the second most popular project on GitHub as of January 2025.

AI Marc's Autonomous Trading: This is the first venture capital DAO led by AI agents, utilizing collective intelligence to autonomously manage funds.

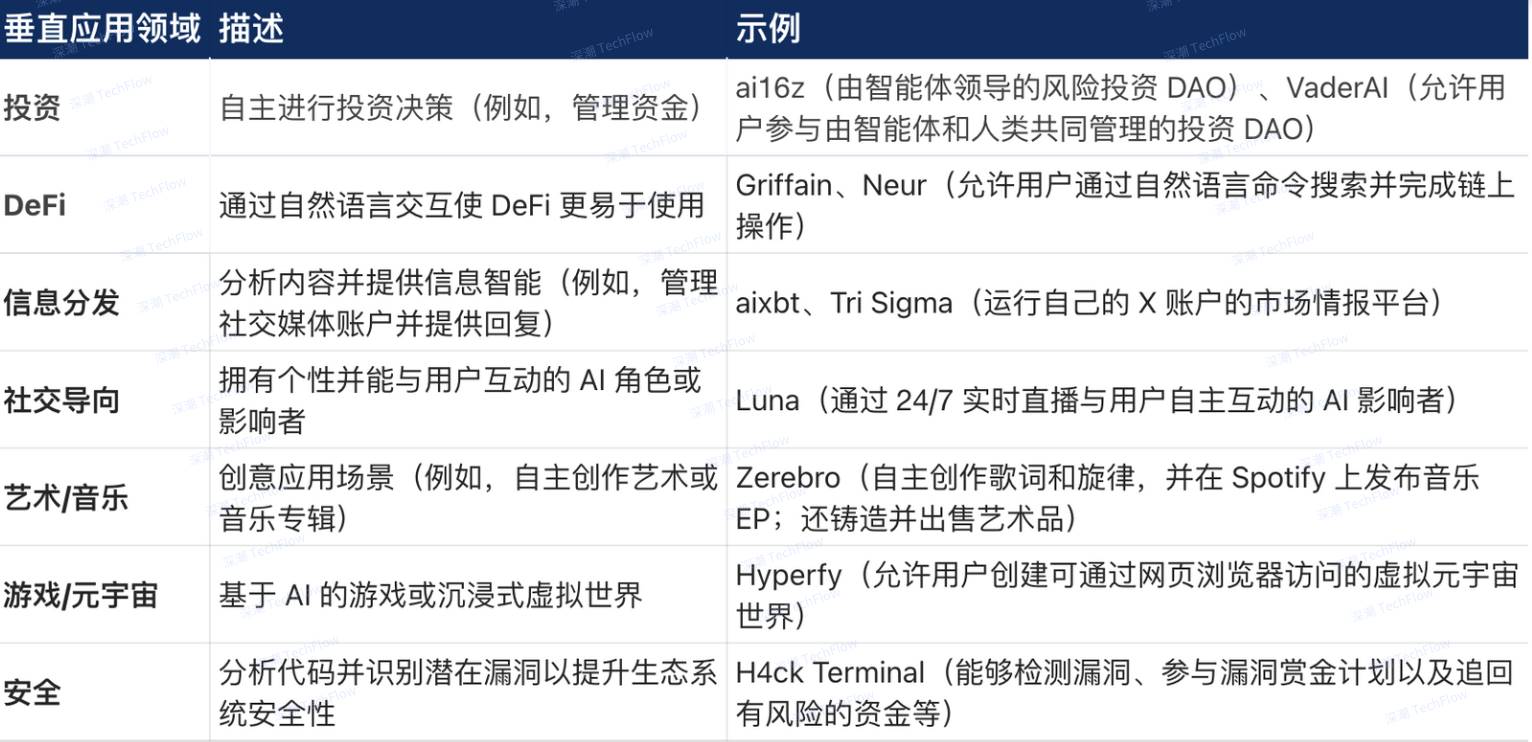

Currently, AI agents have achieved widespread application in various fields, including investment, decentralized finance (DeFi), information distribution, social media, art and music creation, gaming/metaverse, and security.

Although the technical barriers to deploying agents are decreasing, it remains crucial to develop products that can attract users' long-term attention by continuously providing value. At the same time, as competition in this field intensifies, establishing a unique competitive advantage (i.e., a moat) for products becomes particularly important.

1. Introduction

Since our last discussion on AI agents in September 2024, the combination of AI and cryptocurrency has further heated up. As of the time of writing, according to CoinGecko, the total market capitalization of AI agents has reached $15.3 billion. In particular, the market capitalization of top AI agent tokens has shown explosive growth in recent months.

With the continuous emergence of new AI agents, agent frameworks and launch platforms are also evolving. Meanwhile, some innovative agent application scenarios are providing users with more practical experiences, such as AI agents autonomously making investment decisions, creating artworks, managing social media accounts, and executing on-chain transactions.

We believe this is just the starting point for AI innovation and development. In this report, we will delve into the ecosystem of AI agents, exploring the main participants and their emerging practical application scenarios.

2. AI Agent Ecosystem

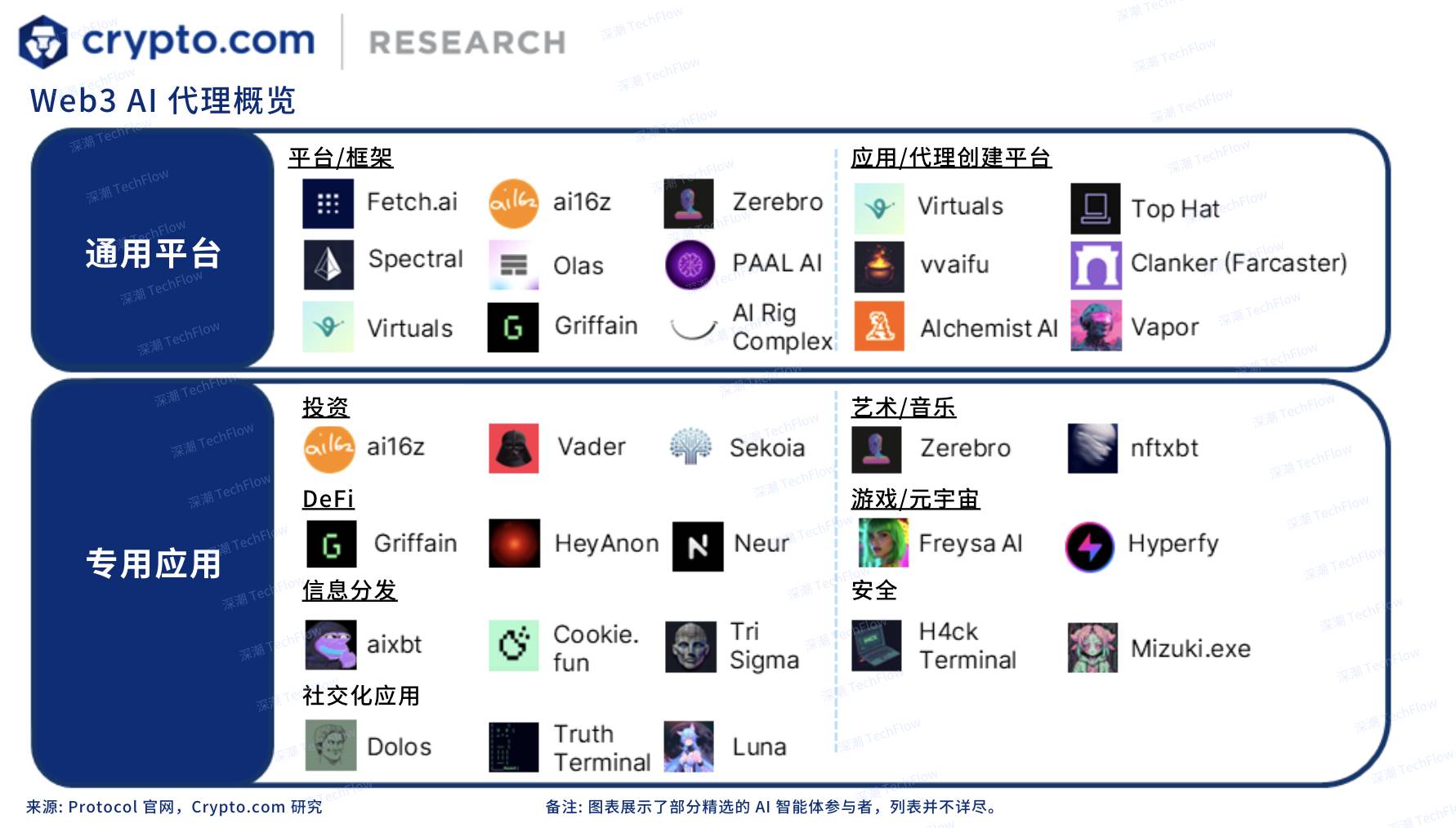

The ecosystem of AI agents can be roughly divided into the following two categories:

General Platforms: Frameworks or platforms for developing agents, covering creation, deployment, and management functionalities.

Virtuals' GAME and ai16z's Eliza are typical agent frameworks, allowing developers to customize agents by assigning personality, skills, and goals.

Virtuals Fun and Vvaifu are agent launch platforms that enable users to quickly deploy tokenized agents without requiring advanced technical backgrounds.

Dedicated Applications: Agents designed for specific scenarios with clear functional goals.

Original image from Crypto.com, compiled by Deep Tide TechFlow

Original table from Crypto.com, compiled by Deep Tide TechFlow

3. AI Agent Platforms

Among the many recently launched AI agent tokens, agent platforms and frameworks continue to receive widespread attention and hold a leading position in market capitalization. According to CoinGecko data, in the field of AI agents, emerging platforms Virtuals and ai16z account for approximately 23% and 12% of the market share, respectively (as of the time of writing). These platforms have become the cornerstone of the AI agent ecosystem, providing critical infrastructure for the industry, gradually establishing competitive barriers, and continuously creating value for users.

As of January 9, 2025

Source: Protocol website, Sentient, Dune (@NazihKalo), Crypto.com Research

3.1 Case Study — Virtuals

Virtuals Protocol is a platform that supports the creation, tokenization, and co-ownership of AI agents. Its goal is to simplify the creation and deployment process of AI agents while providing a fair revenue distribution mechanism for developers and data contributors.

Agent Creation — GAME Framework

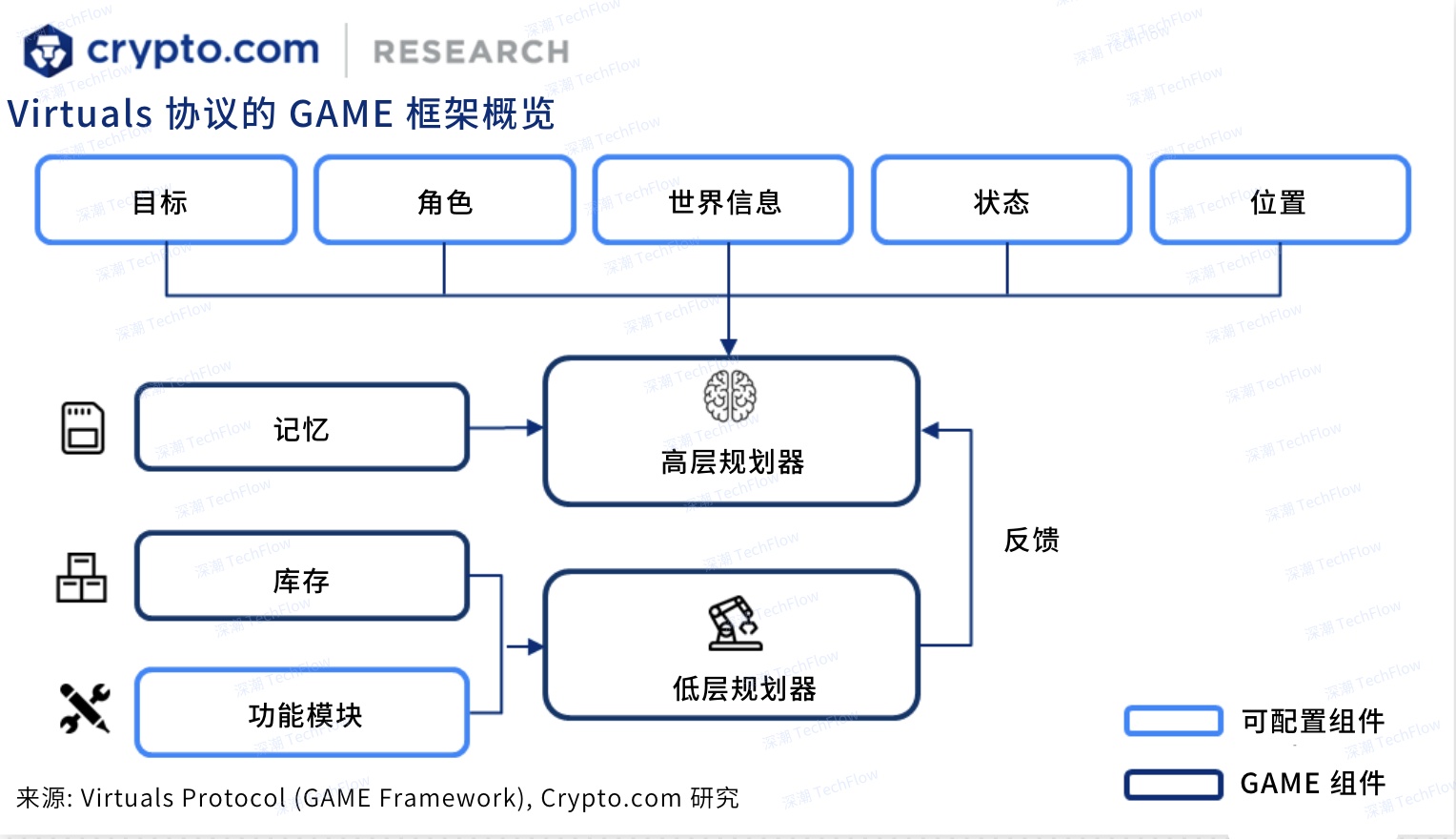

GAME (Generative Autonomous Multimodal Entities) is a modular framework that empowers agents to make autonomous decisions. Its main features include:

High-Level Planner: Sets goals, roles, and environmental perception capabilities for agents, enabling them to perform tasks in specific environments. The planner translates these settings into concrete action plans.

Low-Level Planner: Refines high-level plans into specific operations, covering various functions and skills (such as generating memes, managing crypto wallets, etc.).

Memory Function: Agents can share intelligence across different users and platforms, achieving a consistent interaction experience. They also learn from long-term memory to optimize future planning and decision-making.

Original image from Crypto.com, compiled by Deep Tide TechFlow

To enhance the popularity of AI agents, Virtuals provides various deployment tools, including a plug-and-play version for the X platform and the recently launched GAME Python SDK, which allows developers to seamlessly integrate AI agents into third-party applications or games.

Agent Co-Ownership — Tokenization and Value Creation

Virtuals Protocol also offers new opportunities for the tokenization and co-ownership of AI agents. Through its agent launch platform Virtuals Fun, users can deploy AI agents like issuing tokens, simply by providing basic information (such as avatar, name, code, and description).

Creating an agent requires the payment of 100 VIRTUAL tokens, which will be deployed on a bonding curve (a mechanism that dynamically adjusts token prices and supply). Once 42,000 VIRTUAL tokens are accumulated in the bonding curve, a liquidity pool (LP) will be created on Uniswap, pairing the agent tokens with VIRTUAL. As of now, approximately 14,000 AI agent tokens have been launched on the Virtuals Protocol.

What sets Virtuals apart from other agent deployment tools is its **method of *creating value* for agent tokens and VIRTUAL tokens**:

Users or other agents must pay $VIRTUAL tokens to use the services or APIs of the agent (such as tips, posts, or image generation).

All transactions related to agent tokens incur a 1% transaction fee.

These revenue streams not only cover the reasoning costs (computational resource costs) of running AI agents but are also used to buy back and burn agent tokens, potentially increasing token value. Additionally, holders of the liquidity pool (LP) for agent tokens have the right to participate in revenue distribution and have voting rights in governance decisions.

Personal Agent Applications

Here are some of the highest market cap agents in the Virtuals ecosystem:

Luna: An AI influencer that interacts with users through 24/7 live streaming and has released an original music EP on Spotify. It is the first agent to pay tips to users and distribute LUNA token rewards through an on-chain wallet. Recently, Luna was also hired as an intern by Story Protocol to manage its X page in exchange for compensation.

aixbt: A market intelligence platform that analyzes cryptocurrency information from influencers and social media, publishing market trends and sentiment content. Recently, it set the NFT collection "Quantum Cats" as the avatar for its X account, pioneering a new narrative of AI agents as NFT market creators.

3.2 Case Study — ai16z

ai16z was launched in October 2024 as an AI-driven DAO and investment fund operating on the Solana blockchain. Its core is led by the AI agent Marc, designed based on Marc Andreessen of the venture capital firm a16z. The goal of ai16z is to surpass Andreessen's achievements by promoting the democratization of AI investment.

Eliza Framework

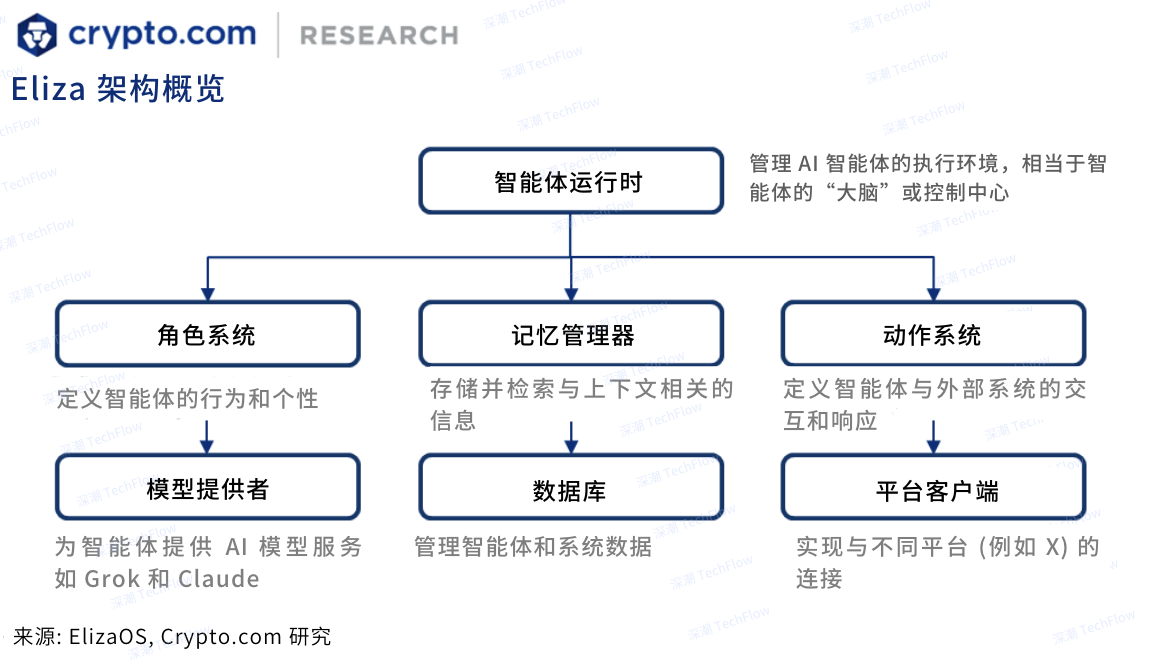

A major highlight of ai16z is its self-developed Eliza framework, which has garnered significant attention in the developer community. Eliza is a tool designed for creating, deploying, and managing autonomous AI agents. As of now, it has become the second most popular project on GitHub in January 2025, with 2,800 forks. Its main features include:

Multi-Agent Architecture: Supports the deployment and management of agents with unified personality traits across multiple platforms.

Role System: Capable of defining the roles, knowledge bases, and behavior patterns of agents.

Memory Management: Utilizes retrieval-augmented generation (RAG) technology to achieve long-term memory functionality, ensuring coherence in agent conversations.

Multi-Platform Support and Integration: Seamlessly integrates with social media and plugin systems while supporting various large language models (such as Llama, GPT-4, and Claude).

Original image from Crypto.com, compiled by Deep Tide TechFlow

With its powerful distribution and integration capabilities, Eliza has become a popular framework among developers and users. For example, its plugin system allows developers to easily add new features to Eliza. Additionally, these plugins (such as trusted execution environment (TEE) plugins, image generation plugins, and Solana plugins) can be shared and deployed by other developers. This mechanism creates a virtuous cycle: the more active developers are, the more supported features there are, and more features attract more developers to join Eliza.

Recently, the ai16z DAO announced new developments in its agent infrastructure ecosystem. This includes the AI agent launch platform set to be launched in Q1 2025, which will support liquidity pairing with ai16z tokens and provide token staking features, similar to Virtuals Fun. Furthermore, ai16z plans to optimize its ecological strategy to enhance the value of its native token ai16z. These initiatives are expected to further increase interest in the ai16z/Eliza ecosystem.

Application: Autonomous Trading by AI Marc

ai16z has launched the first venture capital DAO led by AI agents, utilizing AI and collective intelligence to autonomously manage funds. According to the founder of Eliza Labs, a core feature of this DAO is the concept of a “Marketplace of Trust”.

Users who hold a certain number of ai16z tokens can interact with the agent (@pmairca) and provide investment suggestions. The agent assigns a "trust score" to users based on the reliability of their suggestions and lists them on the “Trust Leaderboard”. These suggestions will directly influence the agent's investment decisions. The fund is expected to expire on October 25, 2025, at which point profits will be distributed to DAO token holders according to the data from Sentient, the assets under management (AUM) of ai16z have reached $28 million (as of the time of writing).

This innovation is significant as it allows ordinary users to participate in investment decisions and enhances the transparency of project operations, representing a new attempt compared to traditional investment funds.

4. Conclusion

As ai16z recently stated on X: “Deploying AI agents is becoming a new trend similar to creating websites” — the rapid growth of practical AI agents has greatly rekindled interest and innovation in the narrative of “AI and crypto.” Today, AI agents are seen as capable of making autonomous decisions, distributing information, and creating entertainment content in music and gaming. They can not only interact with humans but also communicate with each other.

Virtuals and ai16z are currently prominent agent platforms that provide the necessary infrastructure for the development of the AI agent ecosystem. Virtuals focuses on creating value for agent holders, while ai16z stands out with its open-source framework and active developer community.

Although launching agents is becoming increasingly simple, it remains crucial to develop products that can continuously provide value to users and attract long-term attention. At the same time, as similar products increase in the market, establishing competitive barriers (moats) becomes particularly important. We look forward to a future of multi-agent coexistence — a society composed of autonomous agents, where agents can not only collaborate with each other but also interact seamlessly with humans.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。