Author: ChainCatcher, Tesa

In 2024, Memecoin has become the biggest hotspot in the Crypto world. Its market capitalization skyrocketed from $20 billion in 2023 to over $100 billion in 2024. Memecoin not only solidified its position in the crypto market but also outperformed mainstream cryptocurrencies like Bitcoin and Ethereum, becoming the most dazzling asset class of the year.

Amid this trading frenzy, a large number of "whale" players have emerged. They paid hefty transaction fees in Memecoin trading, directly driving the prosperous development of public chains like Solana, and allowing Memecoin infrastructure platforms such as Raydium, Jito, and Pump.fun to reap substantial profits.

Recently, ChainCatcher, in collaboration with the Memecoin smart trading platform Tesa and the Memecoin project Evan the Hobo, jointly released the "2024 Memecoin Annual Consumption Report." This report deeply analyzes the consumption data of Memecoin players with transaction amounts exceeding $1,000 from approximately 4 million user addresses on the Solana chain in 2024, starting from the distribution of transaction fees to comprehensively present the consumption behavior of Memecoin users and the benefits to various platforms throughout the year.

If you need to check your personal Solana consumption report for 2024, please visit this link: https://report.tesa.top/

Key Data Overview

Total transaction fees for Memecoin on the Solana chain: over $3.093 billion.

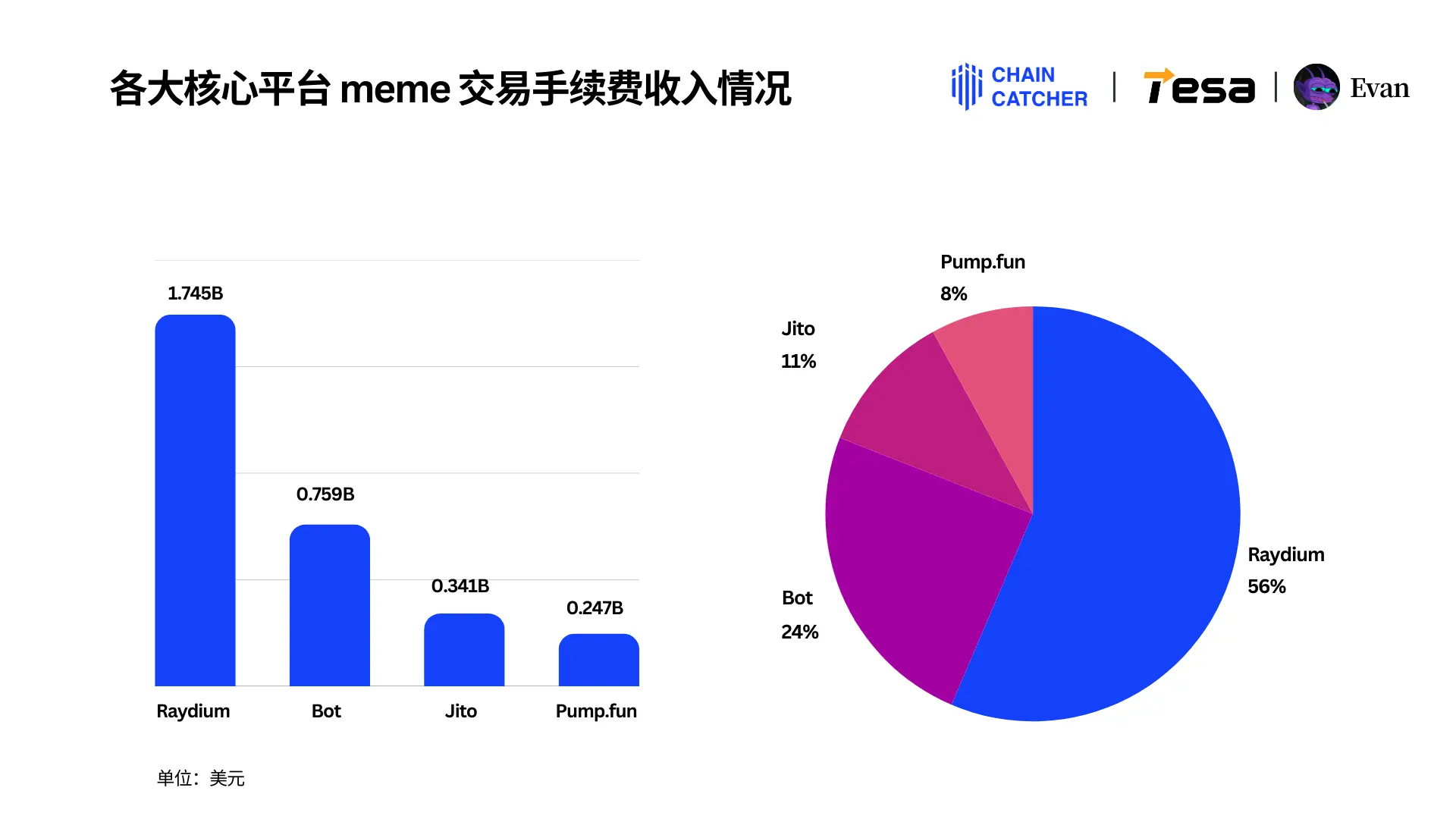

Revenue situation of major core platforms:

DEXs like Raydium: earned $1.7 billion in fees, accounting for 56%.

Trading BOTs: accumulated $750 million in fees, accounting for 24%, with Photon leading at a 33% share.

MEV infrastructure Jito: earned $340 million, accounting for 11%.

Pump.fun: earned $240 million, accounting for 8%.

User concentration: The top 10% of users contributed 90% of the fees, with whale users averaging a spending of $13,000.

Top users: The largest "whale player" on Raydium spent nearly $130 million in a year.

Total Scale of Memecoin Fees and Consumption Distribution

1. Total fee amount exceeds $3 billion

As the most popular Memecoin public chain in 2024, the on-chain fee data from Solana almost mirrors the consumption situation of the entire Memecoin market. By analyzing approximately 4 million Solana user addresses with transaction amounts exceeding $1,000 in 2024, it was found that the total fees generated from Memecoin trading on the Solana chain reached $3.093 billion, showcasing Solana's dominant position in Memecoin trading.

2. DEXs like Raydium are the biggest beneficiaries, earning over $1.7 billion in fees

The over $3 billion in fees contributed by Memecoin users mainly flowed to four major platforms: decentralized exchanges (DEXs) like Raydium, trading BOTs (such as Photon), MEV infrastructure Jito, and one-click token issuance platform Pump.fun.

Among them, DEXs like Raydium topped the list with over $1.7 billion in fee income, accounting for 56% of the total, with Raydium's fee income making up 80% of all DEXs. Trading BOTs ranked second with $750 million, accounting for 24%.

Jito, which provides priority trading (anti-sniping) services, earned $340 million with its unique capabilities, accounting for 11%. Meanwhile, Pump.fun simplified the token issuance process, earning $240 million, accounting for 8%.

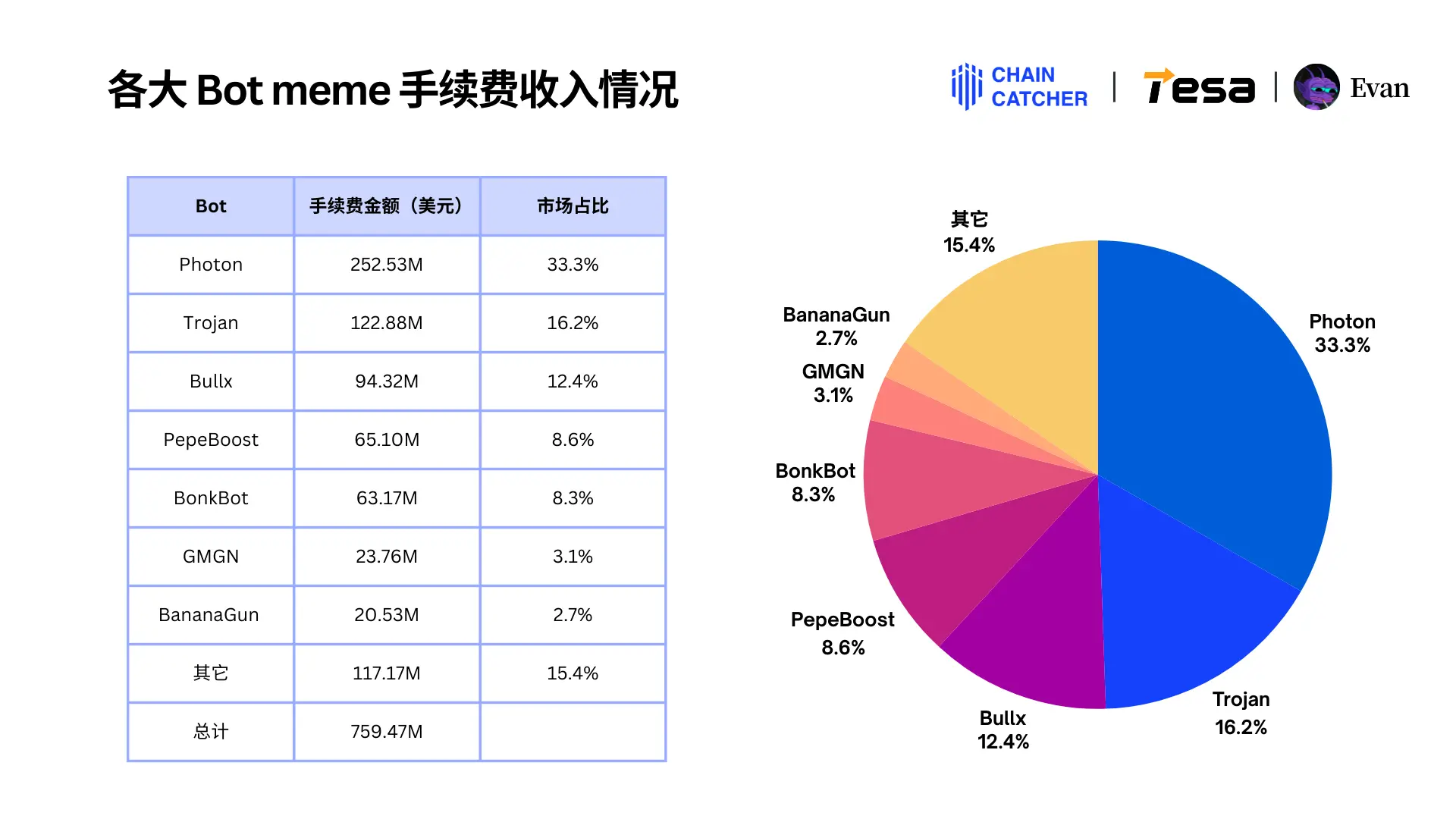

3. Photon is the most popular trading BOT, with fees accounting for over 33%

Among various trading BOTs, Photon performed the best, earning $250 million in fees in 2024, accounting for 33.3% of the total fees from all trading BOTs. Following closely are Trojan and Bullx, which earned $123 million and over $94,000 in fees, accounting for 16.2% and 12.4%, respectively.

Additionally, other BOTs also generated considerable income: PepeBoost earned $65.1 million, accounting for 8.6%; BonkBot earned $63.17 million, accounting for 8.3%; GMGM and BananaGun earned $23.76 million and $20.53 million, accounting for 3.1% and 2.70%, respectively.

At the same time, the data provider for this report, the Tesa meme trading platform, offers users a completely different choice. Compared to traditional BOTs that charge 1% of the transaction amount, Tesa adopts a subscription model to reduce user trading costs. Moreover, Tesa has launched a CEX token sniping feature.

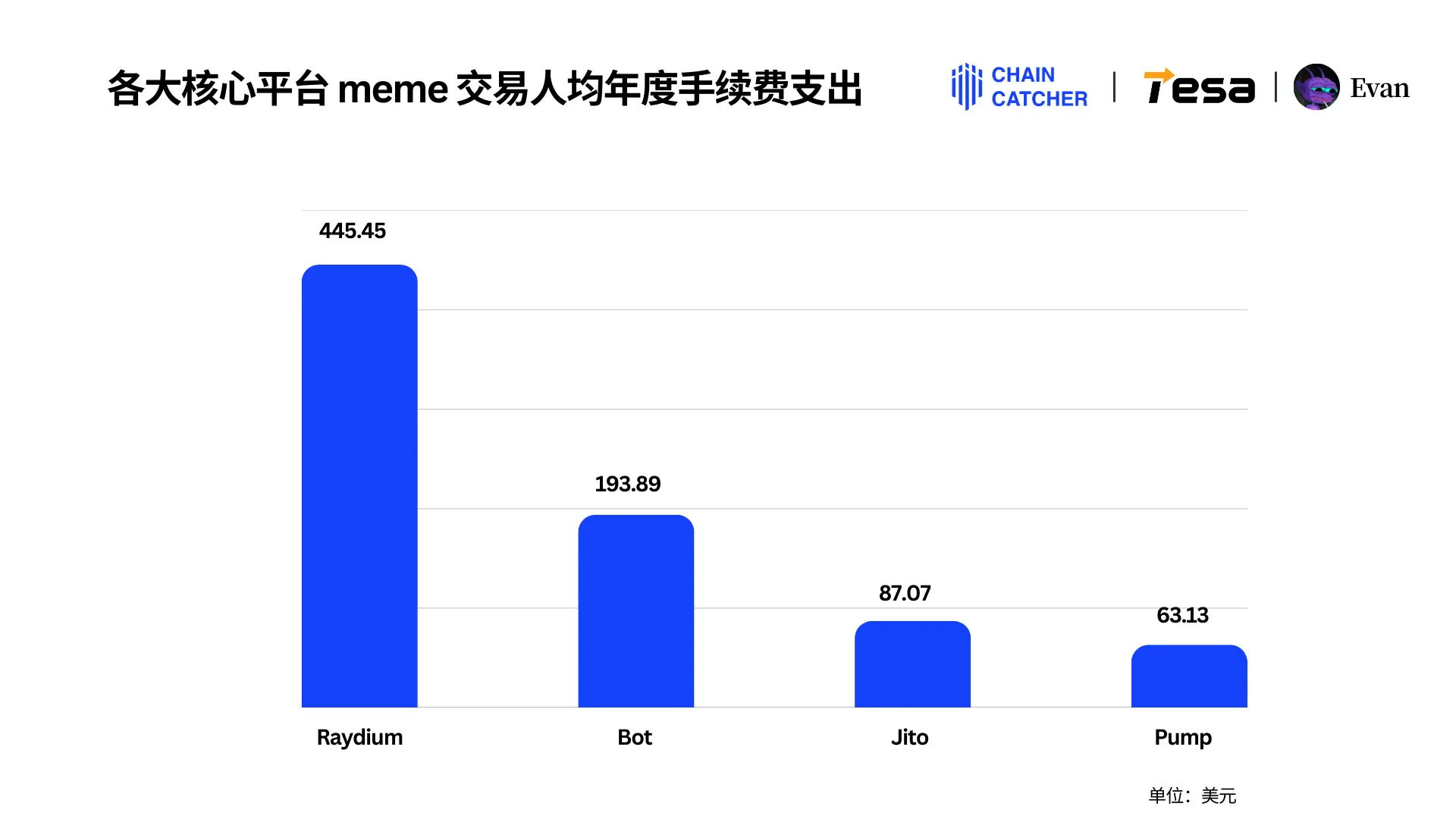

4. Whale users spent an average of $13,000 in fees on Memecoin trading in 2024

In 2024, the average fee expenditure of Memecoin players across major platforms showed significant differences:

- Raydium: $445.45/user

- Trading BOTs: $193.89/user

- Jito: $87.07/user

- Pump.fun: $63.13/user

Based on the fee amounts, users can be divided into three categories:

- Whale users (top 5% with the highest fees): average annual expenditure of $13,000.

- Regular users (fees in the 20%-30% range): average expenditure of $171.28.

- Novice users (bottom 25% with the lowest fees): average expenditure of only $17.67.

In terms of platform preference, Raydium and trading BOTs are the main fee expenditure venues for whale and regular users, while novice users tend to prefer trading BOTs and Pump.fun.

5. The largest "whale player" on a single platform spent $129 million in fees

In 2024, the Memecoin market saw the emergence of a true "whale player." Among them, the user address MfDuWeq on platforms like Raydium paid fees as high as $129 million in a year, far surpassing other platforms.

In contrast, the highest fee expenditures on other platforms were relatively "modest":

- Trading BOTs: $1.43 million

- Jito: $6.1399 million

- Pump.fun: $2.3992 million

This significant disparity further highlights Raydium's dominant position in the Memecoin trading market.

II. Concentration of Memecoin User Spending and Cross-Platform Characteristics

1. The top 10% of users contribute over 90% of the fees

The consumption behavior of Memecoin users exhibits a clear "80/20 rule": a small number of top users contribute the majority of the fees. Specific data is as follows:

- The top 1% of users contributed 67.46% of the fees, with an average fee amount of $53,000;

- The top 10% of users contributed 90.97%, with an average fee amount of about $7,182;

- The top 20% of users contributed 95.24%, with an average fee amount of about $3,760.

This highly concentrated consumption pattern indicates that the fee income in the Memecoin market primarily relies on a small number of high-spending users, while the fee expenditure of most regular users is relatively low.

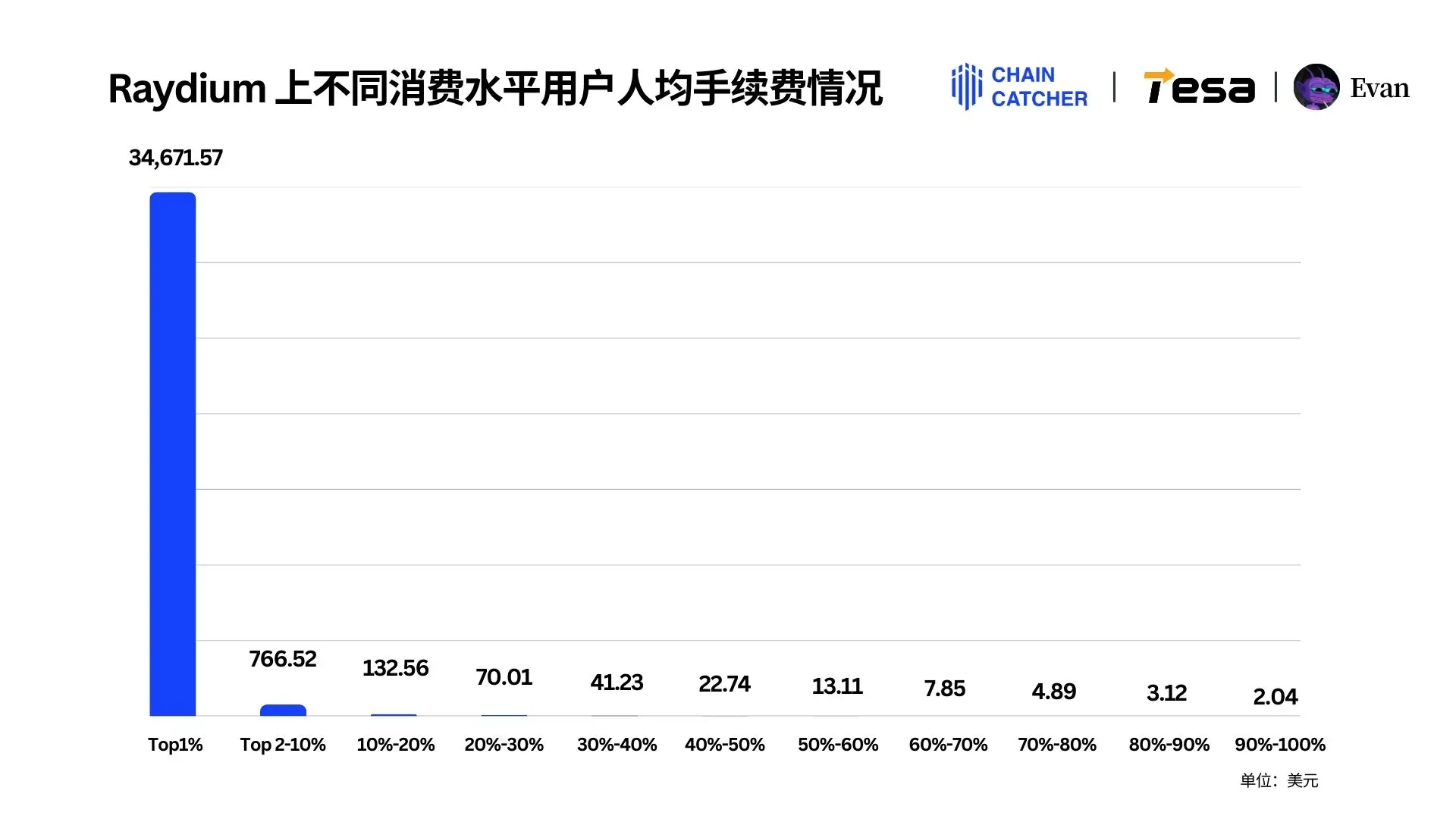

2. Raydium has the highest consumption concentration, while Pump.fun is relatively the lowest

Among the four types of Memecoin platforms—Raydium, trading BOTs, Jito, and Pump.fun—Raydium has the highest consumption concentration. Data shows that the top 1% of users contributed $1.358 billion in fees, accounting for 79.88% of the total fees of $1.7 billion, with an average fee of $34,700; while users ranked 2-20% had an average fee of less than $800, and long-tail users ranked below 20% had an average fee of less than $100. This also reflects Raydium's high dependence on top users.

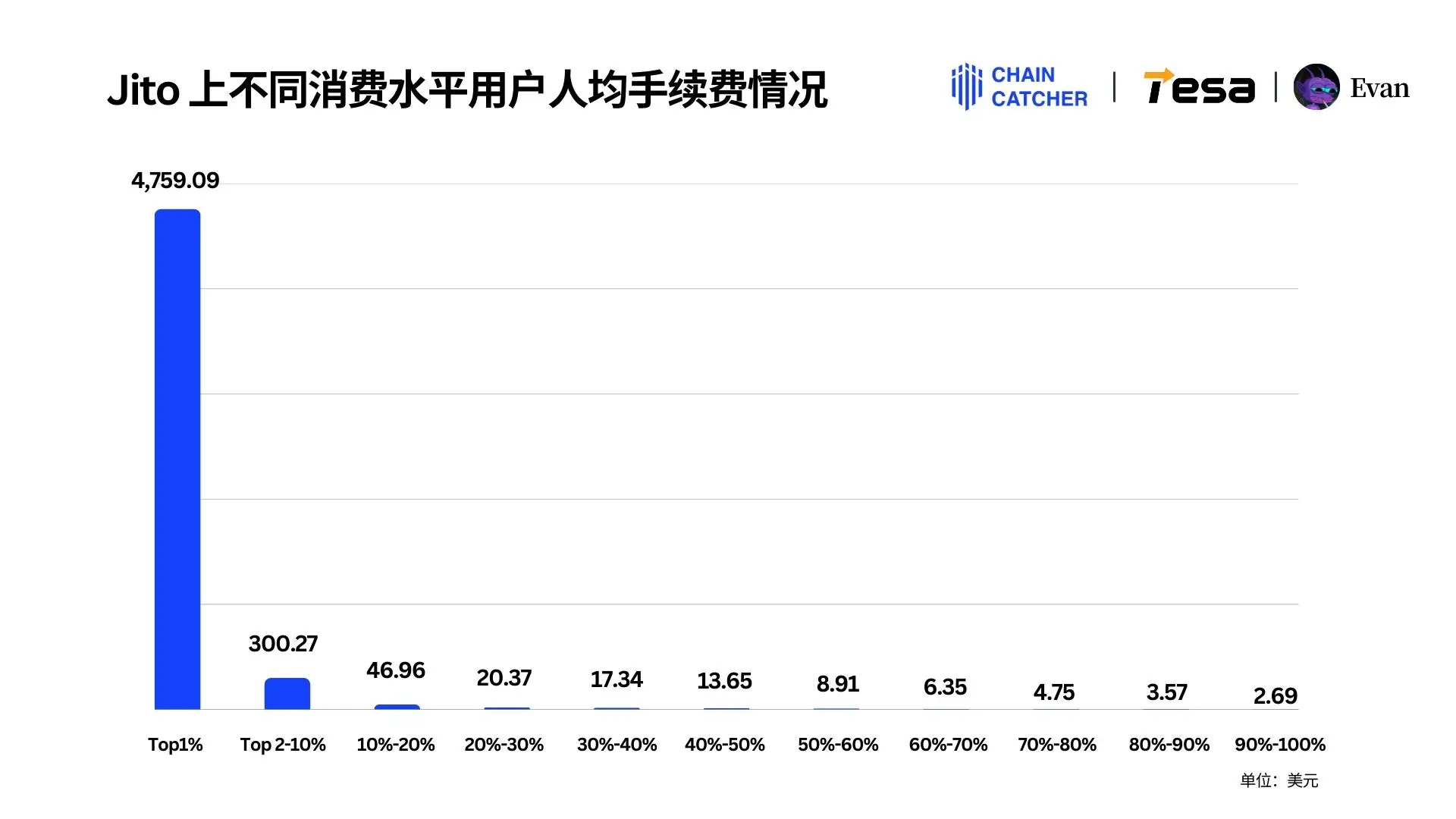

In contrast, the top 1% of users on Jito contributed $186 million in fees, accounting for 54.55%. Although this concentration is lower than that of Raydium, it still exceeds half. The average fee for the top 1% of Jito users is approximately $4,759, while users ranked in the 2%-10% range drop to $300, and long-tail users ranked below 10% have an average fee of less than $50.

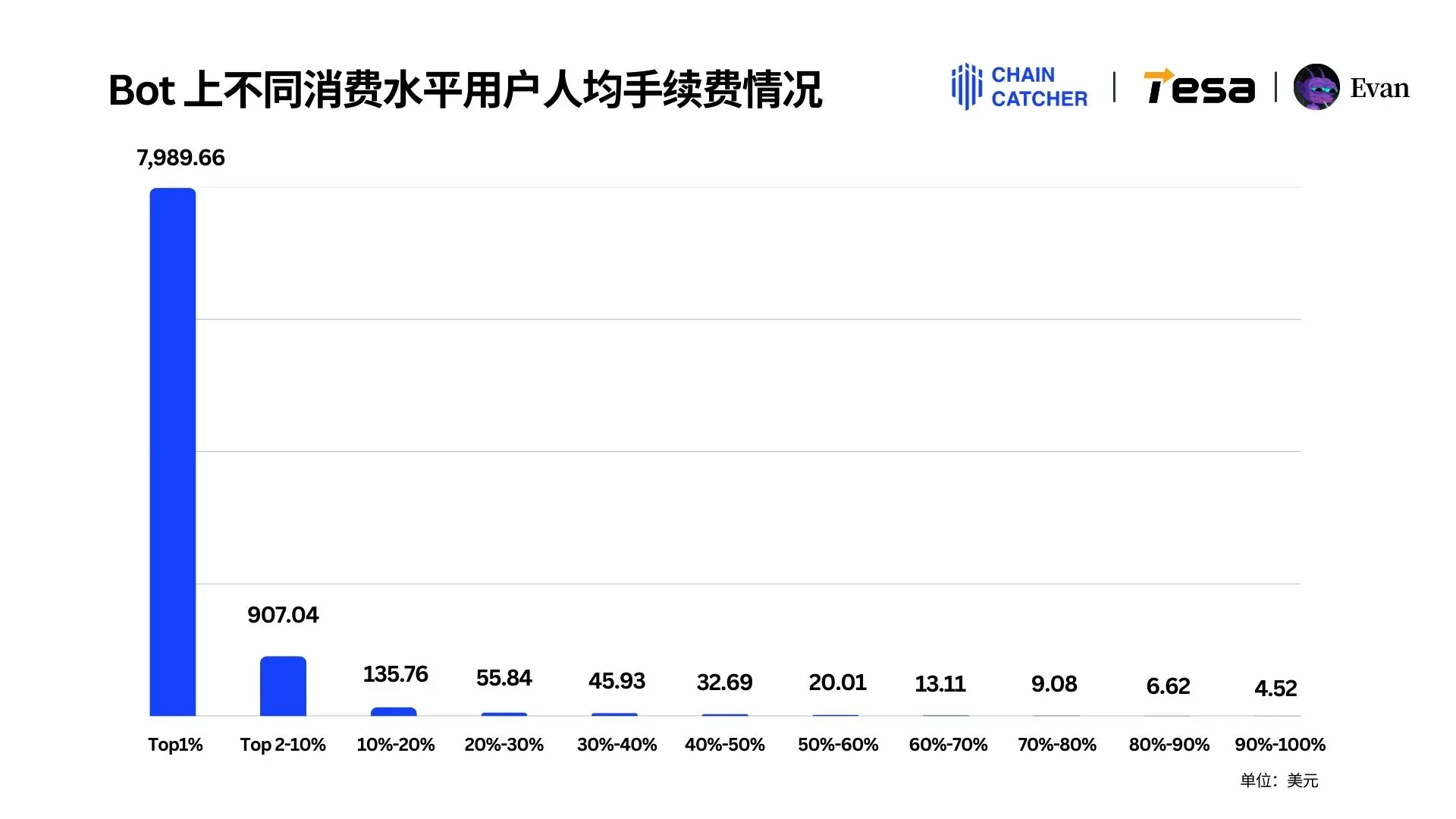

The concentration of top spending on trading BOTs and Pump.fun is relatively low:

- Trading BOTs: The top 1% of users contributed $313 million, accounting for 41.24%.

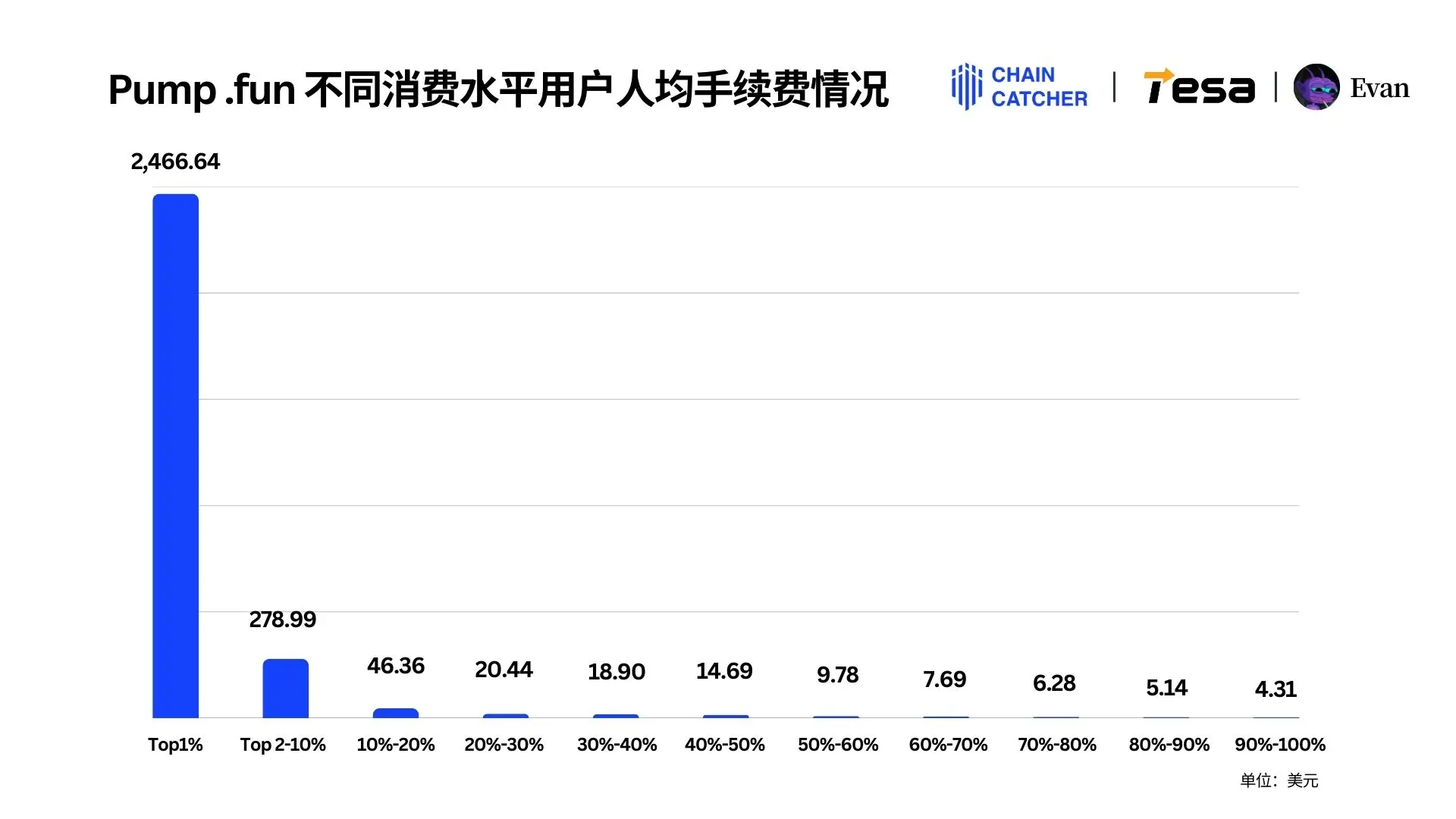

- Pump.fun: The top 1% of users contributed $96.62 million, accounting for 39.07%.

This difference indicates significant distinctions in user structure and profit models across different platforms.

In terms of average fees, there is also a significant disparity between top users and long-tail users on trading BOTs and Pump.fun. The average fee for the top 1% of users on trading BOTs reached $7,990, while users ranked in the 2%-10% range earned less than $1,000, and users in the 20% range earned below $60.

On Pump.fun, the average fee for the top 1% of users reached $2,467, while users ranked in the 2%-10% range earned less than $300, and users ranked below the 20% threshold earned less than $50.

3. Raydium has the highest usage rate, with over half of users relying on trading BOTs

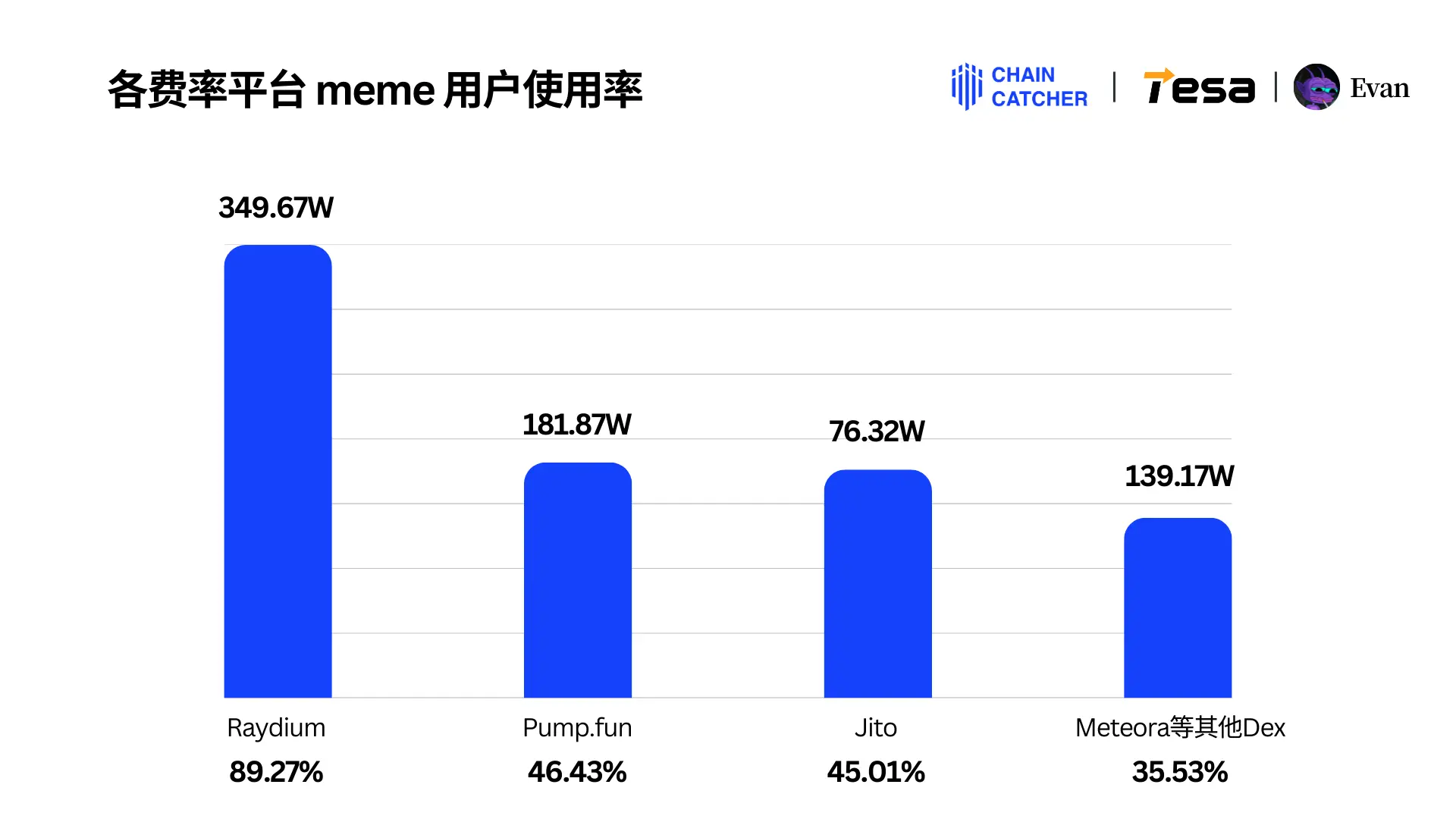

In the Solana DEX ecosystem, despite Raydium's higher trading fee rate (0.25%) compared to Meteora's lower rate (0.16%), Raydium still attracts the vast majority of users due to its strong market advantage. Statistical data shows:

- Among approximately 4 million Solana addresses, about 89.27% (3.4968 million addresses) have used Raydium.

- In contrast, the total usage rate of Meteora and other DEXs is only 35.53% (1.3917 million addresses).

This phenomenon indicates that Memecoin users do not solely base their choice of trading platform on fee rates but also consider comprehensive factors such as liquidity, user experience, and platform stability.

Additionally, the use of trading BOTs is also very common:

- Over 2.11 million addresses use trading BOTs, with a usage rate of 53.83%.

- In comparison, the usage rates for Pump.fun and Jito are 46.43% and 45.01%, respectively, still not surpassing half.

These data reflect users' high dependence on efficient and convenient trading tools, while also showcasing Raydium's absolute dominance in the market.

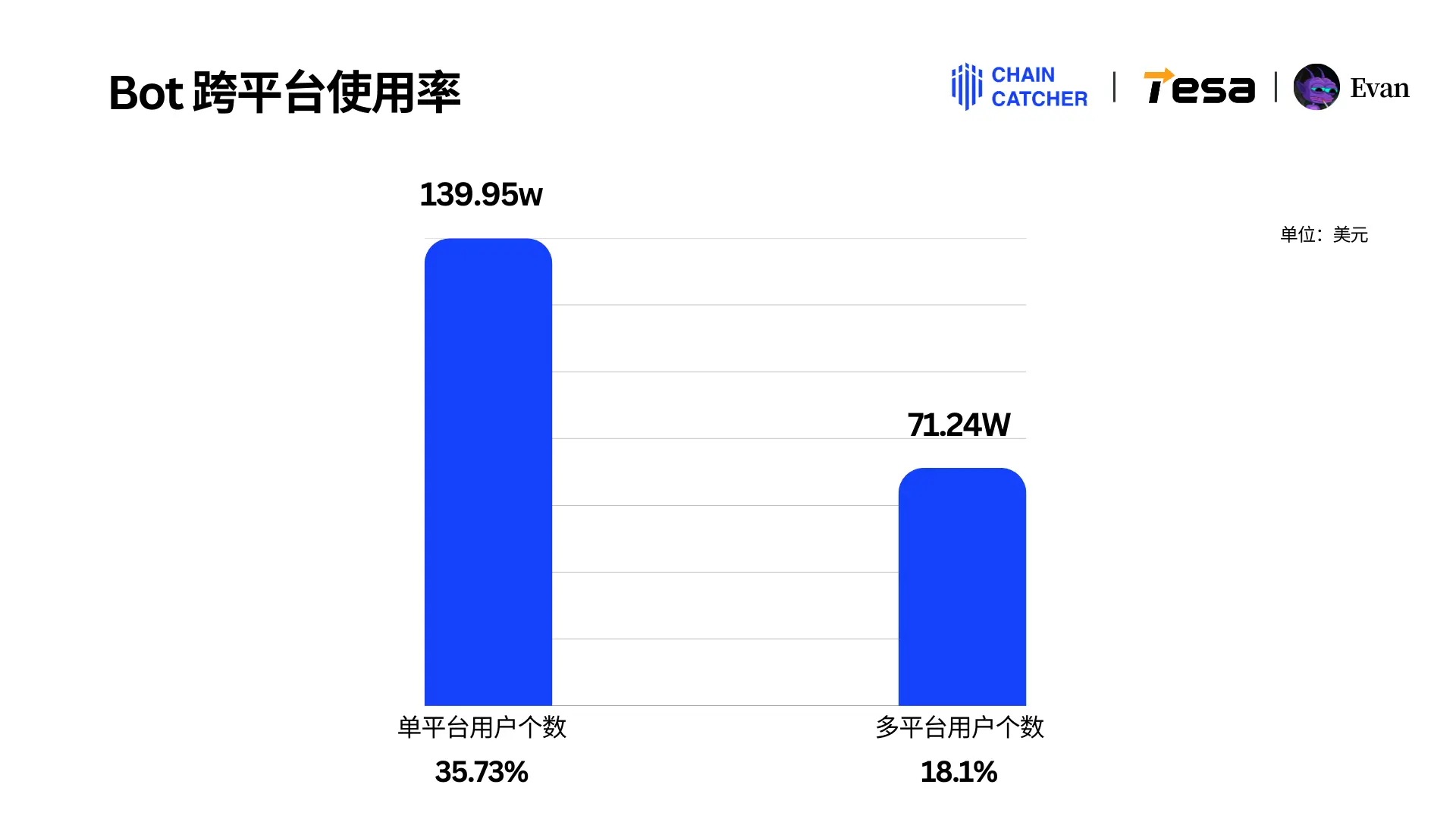

4. Over half of BOT users only use a single BOT platform

In the trading BOT market, user choices show a clear concentration. Data indicates:

- 66% (1.3995 million) of BOT user addresses only use a single trading BOT.

- 34% (712,400) of users choose to use multiple BOTs for trading.

This ratio indicates that users have a high loyalty to their chosen BOT platform, or due to the lack of significant differentiation between platforms, users lack the motivation to switch or trade across multiple platforms after selecting one BOT.

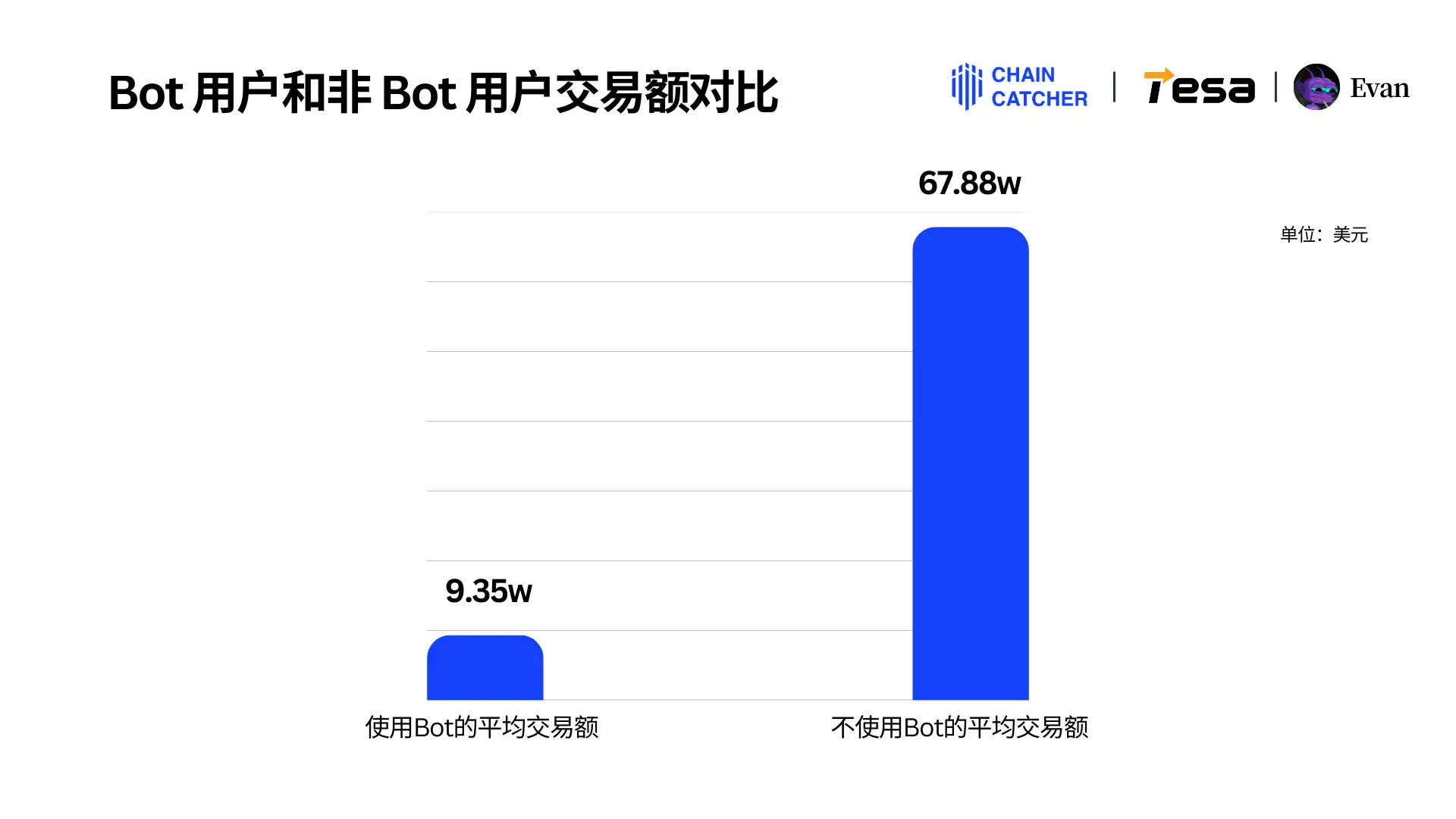

5. Users not using BOTs have significantly higher trading volumes

Compared to users using trading BOTs, those not using BOTs have average trading volumes several times higher:

- Users using BOTs: average trading volume of $93,500.

- Users not using BOTs: average trading volume reaches $678,800.

This data may reflect that the user group of BOT users consists of a larger proportion of regular and novice users, while high-volume whale users tend to prefer manual operations or use efficient tools for more precise control.

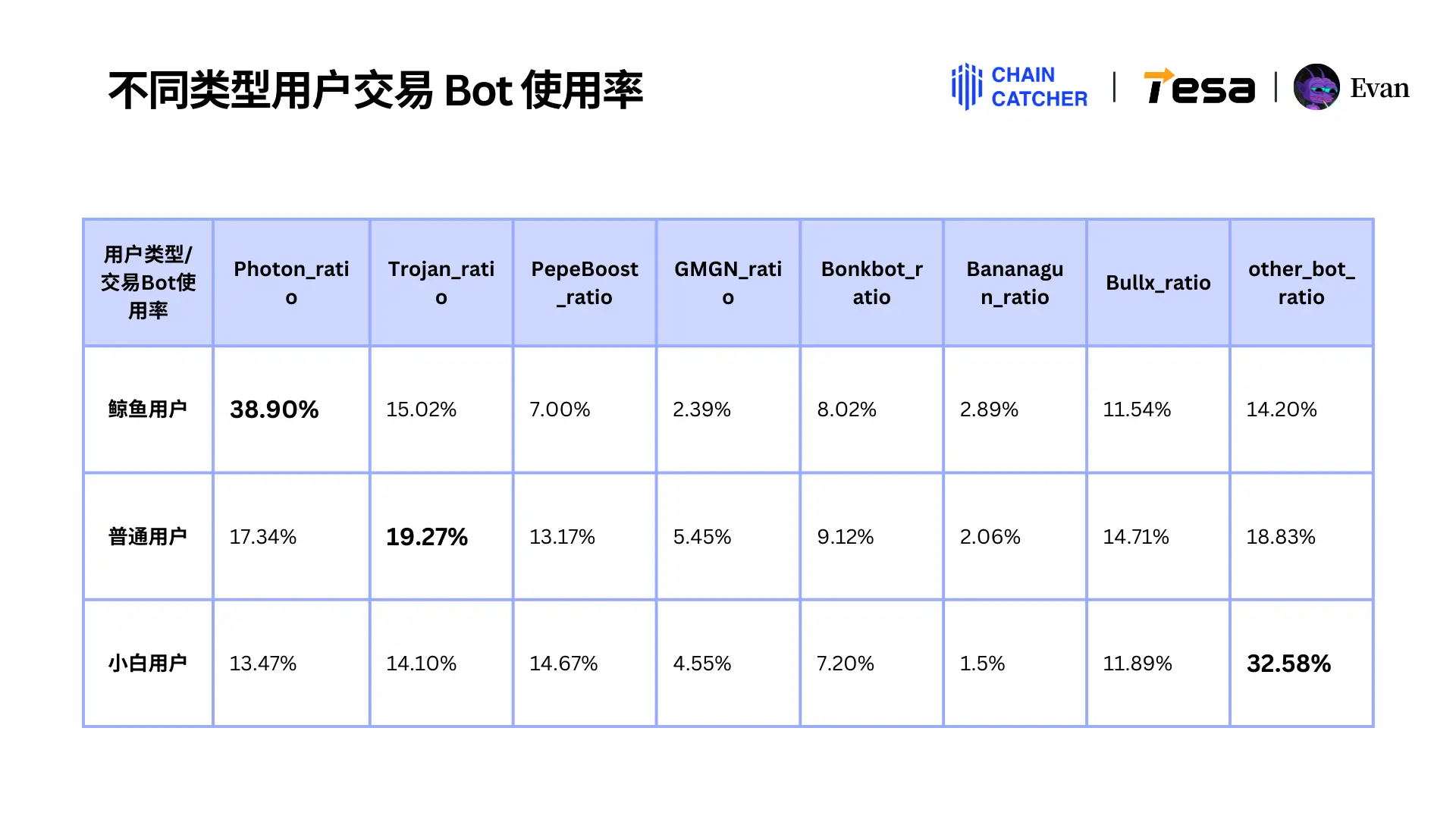

6. Whale users prefer Photon, while regular users lean towards Trojan

Users of different spending levels show significant differences in their choice of trading BOTs:

Whale Users (Top 5%)

- Photon is the most popular trading BOT, contributing 38.9% of the fees.

- Trojan follows closely, accounting for 15.02%.

This choice indicates that whale users prefer to use the powerful and stable Photon BOT.

Regular Users (20%-30%)

- Trojan becomes the first choice for regular users, accounting for 19.27% of total fees.

- Photon and Bullx rank second and third, with 17.34% and 14.71%, respectively.

Regular users' choices are more diverse, showing a broad acceptance of different BOT characteristics.

Novice Users (Bottom 25%)

- Novice users' choices are relatively scattered, with Trojan, Photon, PepeBoost, and Bullx being the main trading BOTs, each contributing over 10% of the fees.

This distribution reflects that novice users tend to try various tools when using BOTs rather than concentrating on a single platform.

III. Analysis of the Top 10 Memecoin Consumption Addresses in 2024

1. Five addresses have fees exceeding $10 million, with the highest spending reaching $133 million

In 2024, the top 10 user addresses in Memecoin trading show extremely high consumption concentration, with five addresses having total fees exceeding $10 million:

- MfDuWe: $133 million (fee rate 0.3%, total trading amount $44.855 billion).

- kpqUj8: $19.86 million.

- YubQzu: $18.20 million.

- HBGdum: $11.90 million.

- 7vi5dy: $11.89 million.

2. Comparison of the highest and lowest fee users

- The address with the highest fees, MfDuWe, shows a massive trading scale and expenditure, with its fees accounting for 0.3% of the total trading amount.

- In contrast, the addresses 13g21m and 89VB5U have fee rates of only 0.005%, the lowest level.

This data fully reflects the consumption differences among different users in the Memecoin market, as well as the significant contribution of top users to overall fee income.

3. Details of the total fees for the top 10 addresses on platforms like Raydium, Jito, and Pump.fun

The top 10 user addresses on the Raydium platform show extremely high fee contribution, with each address's annual fee expenditure exceeding $10 million, indicating that these users almost concentrate all their fee spending on the Raydium platform. Details of the top 10 addresses:

The total fees for the top 10 addresses on Jito range from $1.2 million to $6.2 million. Details of the top 10 addresses:

The total fees for the top 10 addresses on Pump.fun range from $500,000 to $2.4 million. Details of the top 10 addresses:

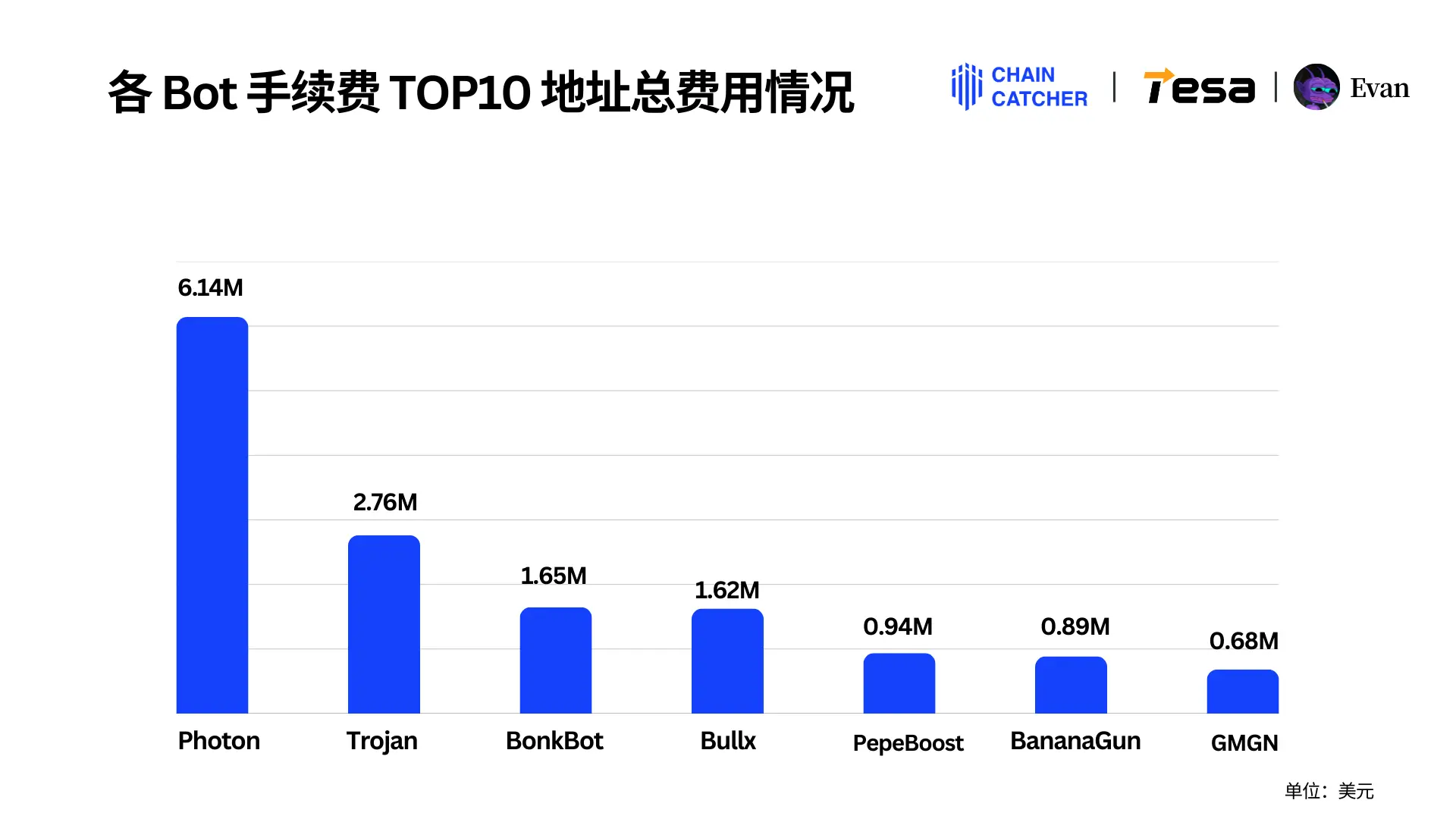

4. Total fee details for the top 10 of various BOTs

IV. If you need to check your personal 2024 Memecoin consumption statement, please refer to:

https://report.tesa.top/

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。