Berachain is not only expected to become an efficient trading platform but will also become an important and unique presence in the DeFi ecosystem.

Berachain is undoubtedly the only public chain that has attracted widespread attention before its mainnet launch in 2024. Its strong financing background, collaborations with several leading projects, and enticing airdrop expectations have reignited the enthusiasm of DeFi enthusiasts. Overall, Berachain has many noteworthy aspects in terms of project background, innovation, and data performance. Through an analysis of these dimensions, we will reveal Berachain's advantages in technical architecture, community building, and market performance, as well as its development potential in the future Layer 1 track.

1. Project Overview

Berachain is a Layer 1 blockchain project built on the Cosmos SDK and compatible with the Ethereum Virtual Machine (EVM), aimed at solving liquidity challenges in the DeFi (Decentralized Finance) space through its unique Proof of Liquidity (PoL) consensus mechanism. The PoL mechanism ensures the security and vitality of the network by encouraging users to provide liquidity to the network, which differs from the traditional Proof of Stake (PoS) mechanism as it places liquidity at the core of network security and efficiency.

PoL (Proof of Liquidity) Mechanism:

• Liquidity Staking: Berachain requires validators to stake liquidity rather than simply holding tokens. This mechanism promotes the health and sustainable development of the network by rewarding users who provide liquidity to the network.

• Three Token System:

○ BERA: The gas token of the network, used to pay transaction fees and support the basic operations of the network.

○ HONEY: Berachain's stablecoin, designed to provide stable value storage and a medium of exchange, similar to stablecoins in other ecosystems.

○ BGT (Berachain Governance Token): Used for governance, non-transferable, ensuring that decision-making power belongs to long-term holders who genuinely care about the network's development.

Team Background:

Berachain was founded by a group of DeFi enthusiasts who met in the Olympus DAO community and have rich backgrounds in the DeFi space. They initially entered the market through the NFT project Bong Bears. Berachain completed a $42 million Series A funding round in April 2023, with investors including top crypto investment institutions such as Polychain Capital, OKX Ventures, and Hack VC, and completed a $100 million Series B funding round in April 2024. This not only proves the market's recognition of Berachain's innovative mechanism but also provides strong financial support for the project's subsequent development.

2. Data Presentation

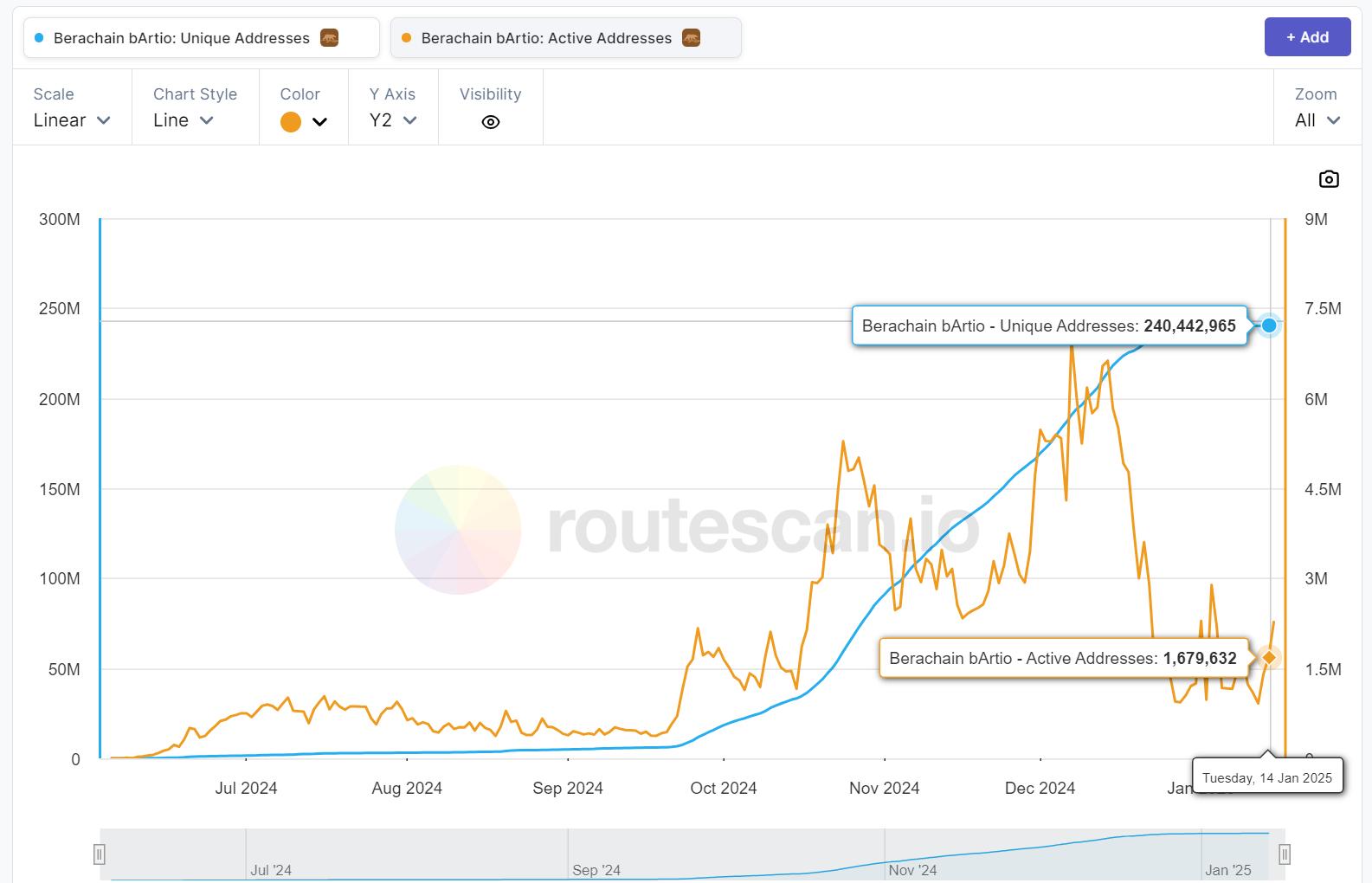

The development of Berachain's ecosystem is very rapid; even before the mainnet launch, over 270 projects have committed to participating, mainly focusing on consumer applications. Its second testnet (v2 Bartio) launched in June 2024, and during the B2 testnet phase, the number of addresses showed exponential growth after September. In less than a month, the number of addresses surged from 6.4 million to 33.3 million, continuing to grow from October to December. Currently, the number of unique addresses has reached 240 million, with daily active addresses peaking in December at 7 million.

Data: https://80084.testnet.routescan.io/

Since the opening of pre-deposits, the Berastone vault has received 87,307 ETH from 100,357 unique addresses, with a Total Value Locked (TVL) of $273 million.

Data: https://dune.com/rudexxx/berachain-vault-berastone

The pre-deposit pool in collaboration with Ethena, Etherfi, Lombard, and Stakestone has reached a total TVL of $1.064 billion.

Data: https://dune.com/lindyhan/berachain-pre-boyco-deposits

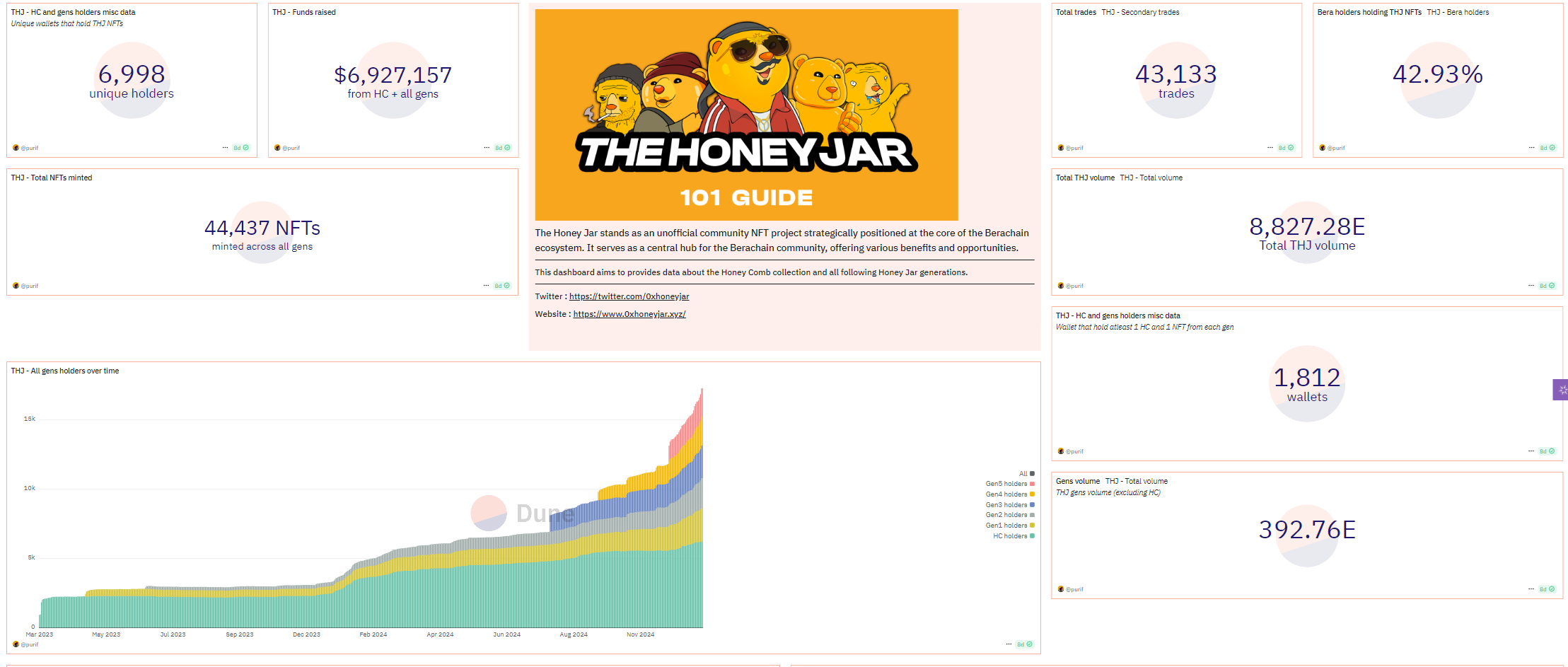

The unique holders of the ecosystem NFT THJ number 6,998, with over 44,000 minted, raising $6.927 million. The trading volume reached 8,827 ETH.

Data: https://dune.com/thj/thehoneyjar

3. Key Milestones

2021.8 Bong Bears NFT minted and issued

2021.11 Berachain mentioned for the first time

2022.3 Olympus DAO OIP-87 proposal for Berachain's seed round financing approved, Berachain to receive $0.5 million from Olympus at a $50 million valuation

2023.4 Berachain completed a $42 million Series A funding round, valued at $420 million, led by Polychain

2024.1 Berachain testnet launched

2024.2 LayerZero announced new support for Berachain

2024.3 Tabi Chain announced it will deploy an NFT marketplace, Launchpad, and event platform on Berachain

2024.4 Berachain completed a $100 million Series B funding round, valued at $1.5 billion, led by Framework Ventures

2024.6 Launched the second public testnet (v2 Bartio)

2024.7 The first joint testnet of the chain abstraction alliance launched in collaboration with Berachain and modular chain abstraction L1 Particle Network

2024.9 Launched the RFB incentive program and collaborated with several liquidity deposit projects such as Stakestone

2024.10 Magic Eden announced new support for Berachain

2025 Q1 TGE upcoming

4. Collaborative Projects

In addition to the collaborative projects introduced in the key development milestones above, after the launch of the V2 testnet this year, Berachain also launched the Request For Broposal (RFB) incentive program in September 2024 to provide liquidity support and other assistance to early teams. The RFB consists of three parts: Boyco, Request for Application, and Request for Community.

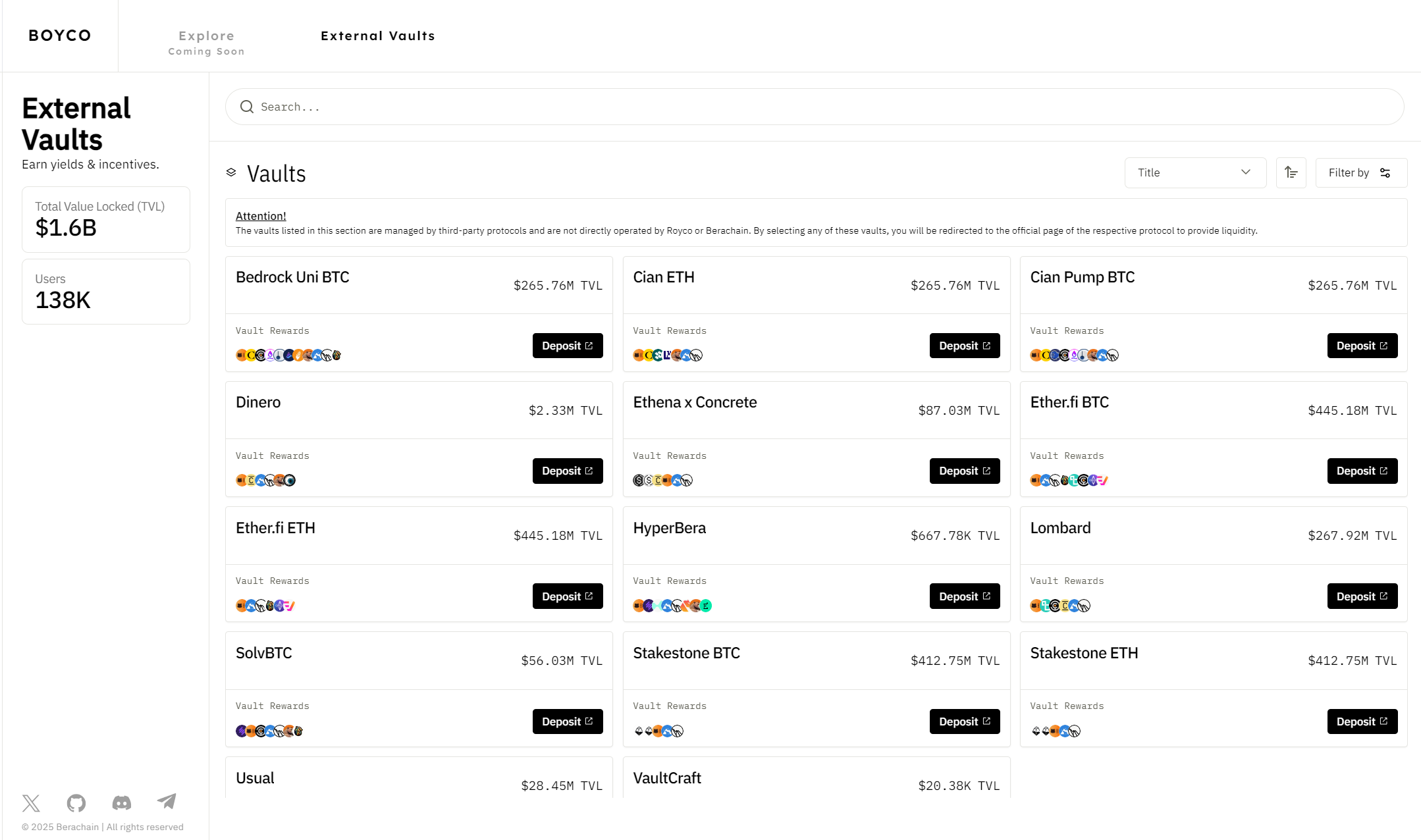

Boyco is a liquidity market that provides liquidity support for the Berachain mainnet to ensure there is sufficient liquidity for ecosystem DApps. Users can make "pre-deposits" through the Boyco vault to receive corresponding tokens and rewards when the mainnet launches.

Boyco has currently partnered with multiple DeFi protocols for external deposit pools, with a total TVL reaching $1.6 billion. Collaborative projects include Bedrock, Cian, Dinero, Ethena+Concrete, Etherfi, Lombard, Solv, Stakestone, Usual, VaultCraft, and ListaDAO. Here are a few key partners:

- Stakestone

The cross-chain liquidity asset protocol StakeStone announced a strategic partnership with Berachain last August, with the STONE token fully deployed on the Berachain bArtio testnet. Users will be able to participate in the Berachain ecosystem and earn rewards using StakeStone's liquidity assets STONE, ssBTC, and STONEBTC. At the same time, the yield product issuance platform StakeStone Vault was launched. The first phase collaborated with the RWAFi chain Plume to launch the StakeStone x Plume pre-deposit Vault, using STONE and SBTC for participation.

In December, StakeStone launched the second phase of the Vault product, Berachain Vault, which aims to provide a one-stop service for Berachain pre-deposits (Boyco pre-deposit activities) and subsequent Berachain PoL (Proof of Liquidity) liquidity mining exclusive rewards. At the same time, through its treasury LP certificates beraSTONE/beraSBTC, users can unlock more blue-chip DeFi application opportunities, including trading, lending, and leveraged yield operations. Participants in the Berachain Vault will receive liquidity rewards, including up to 1.5% of the total supply in STO governance tokens, BERA token rewards from Berachain's pre-mining, PoL mining rewards after the Berachain mainnet launch, and rewards from Berachain ecosystem projects, including but not limited to Kodiak and Dolomite token rewards. The StakeStone Berachain Vault was jointly released with partners such as Pendle, Royco, Morpho, Dolomite, Kodiak, Native, and over 20 Berachain ecosystem projects/communities, with deposits exceeding $111 million within 24 hours of launch and over 30,000 addresses participating. Subsequently, beraSTONE has surpassed stETH to become the largest Ethereum yield-bearing asset, and the beraSTONE/ETH liquidity pool on Uniswap V3 has also become the largest liquidity pool on Uniswap V3.

- Lombard

Lombard is a project focused on Bitcoin DeFi, providing collaboration opportunities with Berachain. Lombard's Bitcoin Bera Vault attracted a large amount of funds in a short time, demonstrating its strong appeal in the market. Users can earn rewards from multiple protocols, including Berachain, Lombard, and Babylon, by depositing LBTC or wBTC into Lombard's Vault.

- Ethena

Ethena Labs announced in a tweet last December that it has launched Ethena Berachain pre-deposit Vaults, supporting deposits in USDe, sUSDe, USDC, and USDT. Additionally, Concrete launched two Ethena pre-deposit Vaults for Berachain's deposit program, allowing users to maintain dollar exposure while earning Berachain rewards and participating in its ecosystem. After the Berachain mainnet launch, the pre-deposit Vaults will deploy liquidity in whitelisted protocols within the Berachain ecosystem. Deposits in USDe and sUSDe will be eligible for Ethena rewards, Concrete points, BERA, and native ecosystem rewards.

- Etherfi

The Ethereum re-staking protocol ether.fi announced on January 1 that it has launched a Berachain incentive pre-deposit vault, supporting deposits of weETH, WETH, stETH, eBTC, wBTC, cbBTC, and LBTC. After the Berachain mainnet launches, deposits will remain locked for 90 days.

- Usual

Usual officially announced on January 5 that the Boyco pre-deposit Usual Bera Vault, jointly launched by Usual and Berachain, has surpassed $15 million in TVL within 24 hours. Users can earn an annual percentage yield (APY) of 37% along with incentives from Berachain, Kodiak, Dolomite, and Veda. Important notes include:

• Vault deposits earn USUAL rewards at the displayed annual yield (APY) and can only be claimed on the Vault page.

• Deposits can be made using USD0, USD0++, USDC, or DAI.

• Withdrawals will be made in USD0++.

• Positions will be locked for 1-3 months after the mainnet launch.

- Bedrock

The multi-asset liquidity re-staking protocol Bedrock launched the uniBTC Berachain Vault on January 6, supporting a cross-chain reward mechanism aimed at bridging Ethereum and the Berachain ecosystem. Users can achieve automated yields, cross-chain asset management, and participate in Berachain's Boyco pre-deposit activities through this Vault. The Vault features a four-tier reward structure, including native Berachain rewards, Bera DeFi returns, CIAN reward layers, and CIAN points. During the pre-deposit phase, users can earn multiple rewards, including ETH mainnet rewards, Berachain rewards, Pendle, EQB, and Corn. Additionally, there is a 30% referral bonus. To participate in this Vault, users need to visit the Bedrock dApp, select and deposit supported assets (such as uniBTC, WBTC, cbBTC, or FBTC), and receive pre-deposit certificates.

5. Ecosystem Projects

Berachain Exchange (BEX):

BEX is the native decentralized exchange (DEX) of the Berachain ecosystem, providing an efficient trading experience through its unique liquidity pool mechanism. What sets BEX apart is its close integration with the PoL mechanism, enhancing the overall liquidity of the network by rewarding liquidity providers. It is also tightly integrated with other DeFi protocols on Berachain (such as BEND and BERPS), forming a complete decentralized finance ecosystem.

The design philosophy of BEX is to simplify the trading process, allowing users to easily participate in DeFi activities. It leverages Berachain's unique Proof-of-Liquidity (PoL) consensus mechanism, which effectively separates gas tokens from governance tokens, thereby enhancing the user experience.

Overall, as a core component of Berachain, BEX is committed to providing users with a secure, efficient, and user-friendly decentralized trading platform, driving the development of the entire DeFi ecosystem.

The Honey Jar (THJ):

The Honey Jar (THJ) is a community project based on Berachain, acting as a coordinator between users, bApps, and the Berachain protocol. THJ is not only the educational and community center for Berachain but also responsible for project incubation and matchmaking, dedicated to promoting the development of the ecosystem. The core functions of THJ include creating Honeycomb NFTs, providing liquidity, and establishing reward mechanisms.

In the THJ ecosystem, users can earn BGT rewards by participating in liquidity provision and stake these rewards for more rewards and bribes. THJ emphasizes deep integration with partners, going beyond simple brand collaborations to explore new possibilities and innovative combinations.

Overall, The Honey Jar is a multifunctional ecosystem aimed at providing users with rich experiences and rewards through innovation and collaboration.

Beradrome:

Beradrome focuses on Restaking, further optimizing the network's resource utilization by allowing users to use their liquidity for multiple purposes (such as staking and mining). Beradrome began its NFT activities during the testnet phase, promising a BGT airdrop after the mainnet launch to incentivize early participants.

Additionally, Beradrome has partnered with other protocols like Beramonium, which is developing a game and has committed to providing $125,000 in bribes to attract liquidity. This indicates that Beradrome is not just a liquidity platform but is actively collaborating with other projects to promote ecosystem development.

Overall, Beradrome is a protocol aimed at enhancing user engagement through liquidity incentives and governance mechanisms, with its own unique features in functionality and application.

Sudoswap:

As an NFT liquidity market, Sudoswap plans to deploy on Berachain, providing liquidity solutions for NFTs. This is not just a simple NFT trading platform but aims to enhance the diversity and interactivity of the Berachain ecosystem through NFT bridging.

Infrared Finance:

Infrared Finance is a protocol focused on liquid staking, aiming to provide Berachain users with one-click access to Proof of Liquidity (PoL) solutions. As the first and only dedicated liquid staking tool on Berachain, Infrared Finance optimizes liquid staking rewards, ecosystem participation, and Berachain's three-token model ($BERA, $BGT, $HONEY), while simplifying user experience and improving capital efficiency.

Infrared Finance has currently launched two products: $iBGT and $iBERA, allowing users to perform liquidity deposits, earn $iBGT, and stake $iBGT on Berachain's testnet. The goal of the protocol is to maximize value capture and provide users with an easy-to-use liquid staking solution.

Infrared Finance has also secured $2.5 million in seed funding, including strategic investments from Binance Labs. The protocol collaborates with Solv Protocol to further advance the infrastructure surrounding Berachain's Proof of Liquidity mechanism.

As the Berachain mainnet approaches, the $iBGT ecosystem is continuously evolving, with new use cases being launched daily. The launch of Infrared Finance is seen as an important milestone in DeFi innovation, encouraging users to participate in liquidity provision and other related activities to earn $iBGT on the testnet.

Overall, Infrared Finance is committed to promoting the development of the Berachain ecosystem through its innovative liquid staking solutions, providing users with more efficient capital utilization methods.

KodiakFi:

KodiakFi primarily provides BGT mining pool services, aiming to allow users to participate in the governance and earnings of Berachain in a more decentralized manner through mining pools. By closely collaborating with projects such as Infrared Finance and Beradrome, KodiakFi offers users a richer ecological experience. Additionally, KodiakFi has launched automated liquidity management (ALM) islands in partnership with several collaborators, including Mozaic and Gamma Strategies, further enhancing liquidity management capabilities.

Ooga Booga:

Ooga Booga is a decentralized trading aggregator operating on Berachain, providing the cheapest cryptocurrency exchange rates by scanning over six exchanges, thereby improving trading efficiency. According to data from its website, the number of unique wallets interacted with has exceeded 460,000, with a total trading volume exceeding $2.5 billion.

Future Outlook

Berachain, with its innovative PoL mechanism and diverse ecological projects, demonstrates how to solve long-standing issues in the blockchain field through technological innovation. With the launch of the mainnet and the addition of more projects, Berachain is expected not only to become an efficient trading platform but also to emerge as an important and unique presence in the DeFi ecosystem. Future development will depend on its continued incentives for community participation, further optimization of technology, and interaction and integration with other ecosystems.

Despite the significant potential shown by Berachain, the following risks should be noted:

Technical Risk: The stability and security of the new PoL mechanism and the three-token model require time for validation.

Ecological Growth Risk: The mainnet's ability to continuously attract sufficient protocols and users will determine the long-term development of the chain.

Market Competition Risk: Establishing differentiation and competitive advantages compared to other public chains remains a challenge.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。