This column focuses on sharing major mainstream cryptocurrencies such as BTC/ETH/EOS/XRP/ETC/LTC/DOGE for a long time. Follow the public account "Yinbi" to avoid getting lost and enjoy more service guidance.

The price of Bitcoin at 10.08 fully represents the final downward pressure of the previous round at 10.2.

This means that during last night's rebound process, the price has already reached the final pressure point!

Cycle View:

10.08 serves as the final defense point during the retracement phase of the previous round at 10.2. No matter how strong the increase, as long as it cannot break through, it indicates that this round is still in the retracement phase. However, once it breaks through completely, it will directly announce the end of the retracement phase, followed by a new high!

From the first round of pressure this morning, the standard rebound pressure point at the top has temporarily confirmed the effectiveness of the pressure. At the key level, it is recommended to prepare for a medium to long-term short position. Even if it breaks through, the loss will only be small.

Since this round has confirmed the pressure, it is undoubtedly a no-brainer to look bearish.

As the dividing line between bulls and bears, it is also the last short position point, which is completely worth taking the risk to enter again.

During the day, pay attention to the rebound pressure point in the 10-10.05 range for another medium-term bearish outlook.

For the subsequent pullback strategy, exit in batches at 9.65 (10-20%), 9.4 (50-60%), and 8.5 (30-20%).

On the defense level, pay attention to 10.2. Even if it breaks, compared to the space we are looking at, the risk taken is completely worth it.

Ethereum had a slight rebound in the early morning, ultimately synchronizing to touch the current top pressure of the chips.

When it touched the pressure in the morning and immediately fell, it was a standard signal of market pressure and retracement.

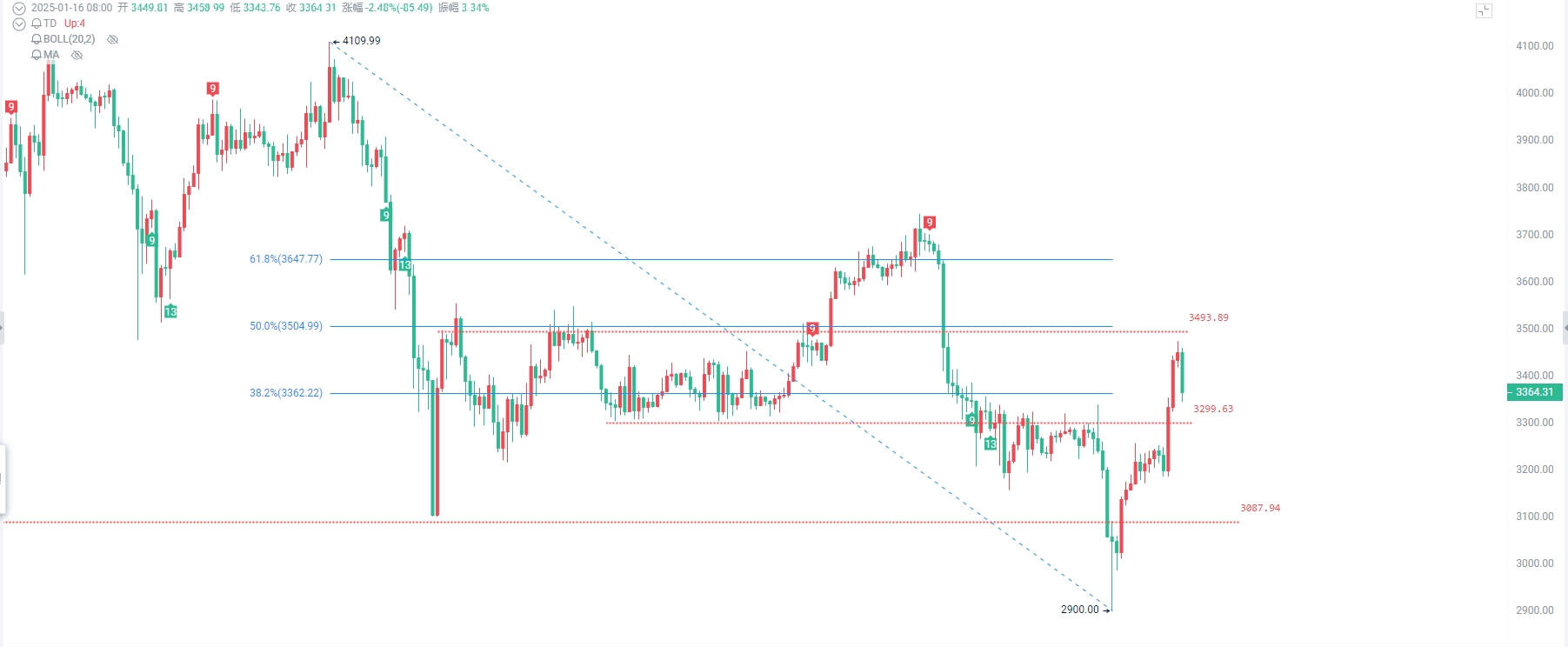

At the same time, 3500 is also the Fibonacci 0.5 pressure point of this round's large cycle, combined with Bitcoin touching the large cycle's 0.618 golden ratio. Ethereum's performance is relatively weak, and touching the secondary 0.5 pressure also aligns with this.

The top 3500 corresponds to the previous top pressure level of 3700, and currently, it is considering the timing for a medium-term bearish outlook:

Due to the weak performance, a certain decline has already occurred in the morning. During the day, pay attention to the pressure opportunity at 3410-3430, and for the downward pullback, focus on 3200 (10-20%), 3100 (40%-50%), and 2900 (30-40%).

For defense against pressure, pay attention to 3510, which represents the top pressure of the chips. If it breaks through, even if you exit, there may be a suspicion of another rebound in the new round.

BCH: Looking for pressure points above 460 again, with 480 as defense, and looking down at 430-410.

DOGE: Seeking secondary pressure at 0.38, with defense at 0.4, and targeting down to 0.33-0.31.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。