12 Memes that Tell the Story of Opportunities and Fun Moments Over the Year

Author: Deep Tide TechFlow

After seeing so many institutional annual reviews and forecasts, are you feeling a bit of aesthetic fatigue?

Recently, CoinMarketCap also released a 2024-25 Crypto Market Yearbook, summarizing the major innovations, market-shocking moments, and unforgettable milestones from the past year, while also looking ahead to 2025.

Interestingly, this yearbook is lively and interactive:

In the review section, CMC presents the major events of the past year in a more design-oriented, vibrant, and playful style; while in the outlook section, unlike expert predictions from institutions, CMC hands the decision-making power to the market — you get to vote on the trends that may occur in 2025.

For example, which projects do you think will make big news in 2025? Is it the purely Meme Fartcoin, or the Trump-related World Liberty Financial?

Additionally, the yearbook is filled with collectible charts and analyses, which Deep Tide TechFlow has refined and interpreted as follows.

Suits & Ties VS Laser Eyes, Both Are Winners

Throughout 2024, from the perspective of retail investors, you might be contemplating the rise and fall of certain coins; however, amidst the ever-changing landscape of the crypto market, the yearbook summarizes a more macro trend — “Suits & Ties VS Laser Eyes.”

This is indeed a very precise cultural comparison.

Suits & Ties represent the traditional financial sector (Wall Street), symbolizing conservatism, professionalism, and established financial institutions; typical representatives include traditional financial institutions like BlackRock and Goldman Sachs.

Laser Eyes are a cultural symbol of the cryptocurrency community, originating from Bitcoin supporters adding red laser eyes to their avatars on social media, representing cryptocurrency believers and supporters of emerging digital assets.

In 2024, both groups are actually winners.

These seemingly opposing groups have achieved a true integration in terms of assets for the first time:

Traditional financial institutions (like BlackRock) have begun to launch Bitcoin/Ethereum ETFs; Meme coins have reached a market cap of a billion dollars, gaining mainstream recognition.

Perhaps Wall Street and Web3 are no longer opposites, but partners influencing each other at the same negotiation table.

From past opposition to each carving out their own piece of the pie, the cryptocurrency market has entered a new stage of maturity.

Best Crypto Story of the Year: The Rise of TON

In the wave of AI Agents, have you forgotten about the soaring success of TON last year?

The L1 corresponding to Telegram saw astronomical growth: users increased from 100,000 to an astonishing 17.4 million, ranking 8th on CoinMarketCap. With 1,400 dApps and seamless integration with Telegram's 950 million users, TON has proven it is not just another Layer 1; it is a movement.

And this movement has transcended the crypto circle.

On August 24, 2024, Telegram CEO Pavel Durov was arrested in Paris, facing charges related to controlling platform activities. This news could have triggered waves of uncertainty, but instead, it sparked a fire.

The Tg community united, posting supportive messages on social media and launching a Meme project, becoming a rallying cry for justice.

CMC's yearbook also elevated the significance of this event:

“This is a declaration of the crypto spirit. It reminds people that decentralization is power, and the purest technology is a tool for freedom, not a tool for error. At that moment, the TON community showed the world that it is not just a blockchain; it is a revolution driven by resilience, unity, and unwavering belief.”

Although TON may not be as prominent now, it remains one of the many standout events from last year.

Best Asset Class of the Year: Meme Leads, A Flourishing Diversity

Considering popularity, the yearbook identifies the asset classes and projects that performed well:

- MEME:

MEW: The fifth-largest Memecoin, utilizing unique token economics, with 90% of LP tokens burned, promoting a stable price floor and market confidence.

Popcat: The first cat-themed Memecoin to reach a market cap of $1 billion on Solana, achieving a valuation of $120 million and pioneering the "cat coin" concept.

WIF: Became the third-largest meme coin after DOGE and SHIB within four months, with a market cap reaching $3 billion, driven by community engagement and endorsement from Elon Musk.

- Application Field:

Polymarket: Invested $3.3B in the 2024 U.S. presidential election, leading decentralized prediction markets, dominating the field through automated smart contracts and KYC-free methods.

Pump.fun: Revolutionized Memecoin creation on Solana, facilitating the development of over 3M tokens, attracting 150,000 users, while generating significant revenue. The platform has a major impact but also controversy, sometimes fueling the most severe meme culture.

Binance Launchpool: Enhanced user engagement through innovative farming mechanisms for new tokens, including successful releases like Notcoin, Scroll, and Catizen.

- Notable New Stars:

Story Protocol: Pioneered blockchain-based IP management, attracting over 100 projects while fundamentally changing creator rights through programmable IP licensing infrastructure.

Monad: Next-generation Layer 1 achieving 10,000 TPS and finality in 1 second, raising $225 million while introducing the innovative MonadBFT consensus mechanism.

Berachain: Launched the Artio testnet with liquidity proof consensus, attracting 230 active development teams through unique DeFi integration.

Considering innovation, from AI-enhanced DeFi to real-world asset platforms, from decentralized infrastructure to core scaling solutions — the following projects have pushed the boundaries of on-chain possibilities:

AI Sector:

Bittensor: Built a framework for decentralized AI development, expanding to 64 subnets while achieving full Ethereum compatibility and launching complex AI models.

Prime: Leading the AI gaming frontier with flagship games Parallel TCG and Colony, backed by OpenAI integration and the Wayfinder protocol for autonomous AI agents.

Near: Built the world's largest 1.4T parameter open-source AI model, launched the Nightshade 2.0 upgrade, achieving a 400% increase in transaction speed through innovative sharding.

DeFi Sector:

LIDO: Maintained dominance in liquid staking by staking 9.8 million ETH, launching institutional solutions and reducing validator requirements from 32 ETH to 2.4 ETH.

Pendle: Innovated yield tokenization in DeFi, increasing TVL from $230 million to $1 billion through liquidity re-staking tokens and launching the Boros margin trading platform.

EigenLayer: Dominated re-staking with an 80% market share, achieving a TVL of $12.9B, re-staking 4.5 million ETH while fundamentally changing Ethereum's security model.

DePIN Sector:**

Render: The leading decentralized GPU rendering service has successfully migrated to Solana, expanding to real-time streaming and dynamic NFTs, while serving major entertainment and architectural clients.

Arweave: A permanent storage solution that has maintained stable growth amid market fluctuations, pioneering a "one-time payment, permanent storage" data storage model.

Aethir: A decentralized cloud computing platform that transforms GPU capabilities into shared resources for gaming and AI, supported by a $100 million ecosystem fund and major partnerships with Nvidia and Filecoin.

RWA Sector:

Ondo: The first platform to tokenize U.S. Treasury bonds exceeding $500 million within four months, capturing over 25% market share through partnerships with BlackRock and JPMorgan.

Clearpool: Redefined institutional liquidity in DeFi, with total loans exceeding $500 million, and launched Ozean, a Layer 2 network based on OP Stack for RWA yields.

Ethena: A synthetic dollar protocol that became the fourth-largest stablecoin, pioneering risk management through delta-neutral strategies involving spot and short positions.

Infrastructure:

SUI: Built the world's largest 1.4T parameter open-source AI model, launched the Nightshade 2.0 upgrade, achieving a 400% increase in transaction speed through innovative sharding.

Wormhole: Built the world's largest 1.4T parameter open-source AI model, launched the Nightshade 2.0 upgrade, achieving a 400% increase in transaction speed through innovative sharding.

Arkham: Launched an on-chain perpetual trading platform utilizing intelligence data, pioneering entity-based blockchain analysis.

Note: The selection of all the above projects represents the views of the yearbook. Interested readers can also visit the original website to view introductions for each project, which are accompanied by a short video for explanation.

Due to space limitations, some projects from different ecosystems are not elaborated on in detail, and are listed as follows.

6 Treasure Charts to Take You Through 2024

As we all know, CMC excels in data analysis and visualization.

The yearbook also selected 6 charts that depict the changes in the crypto market in 2024 from different data dimensions.

- Best and Worst Performing Tracks: Smart Contracts vs. Storage

Smart contract-related projects topped the list with a 6000% return, while the storage track performed the worst with an annual return of -24%.

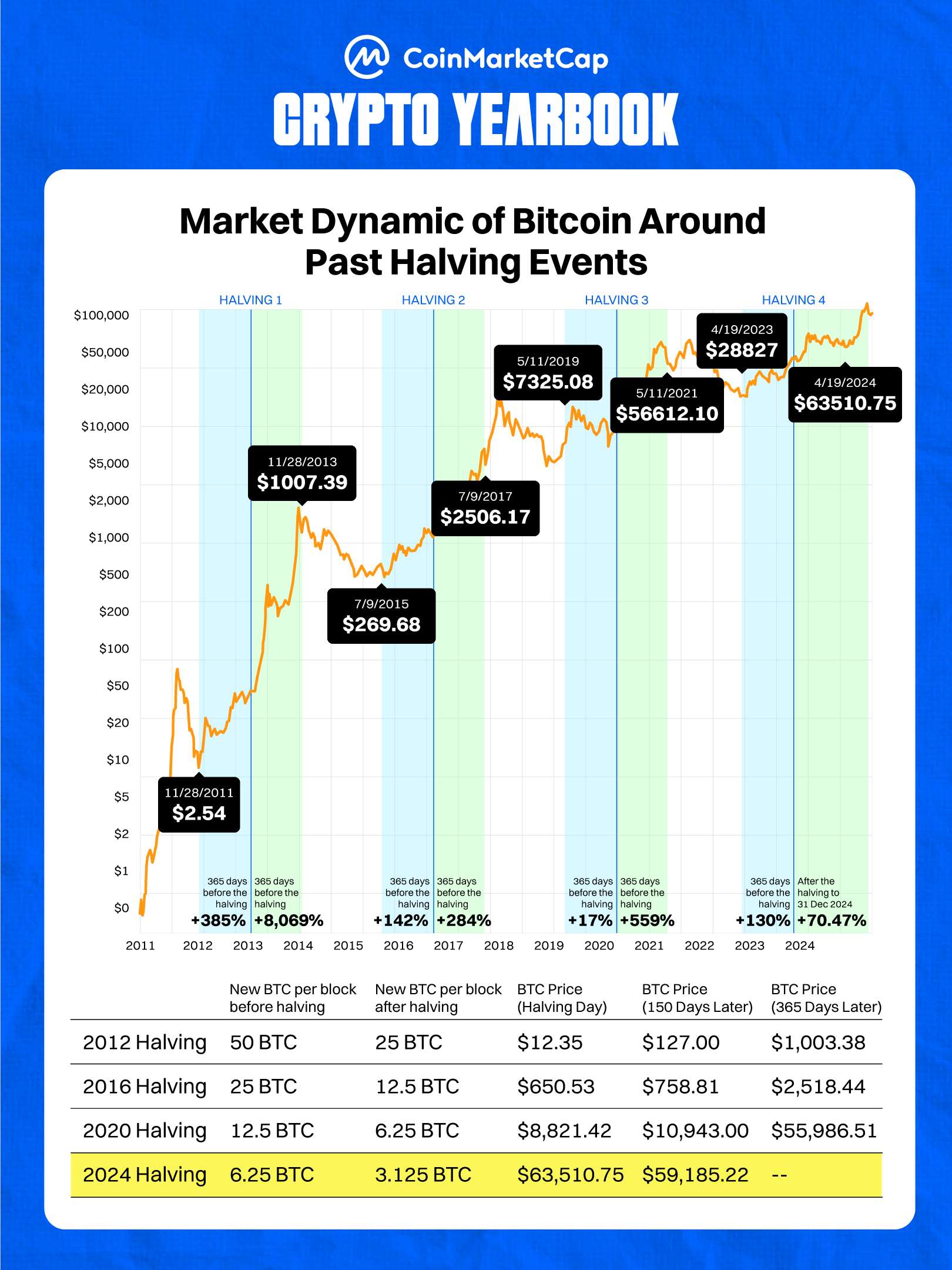

- The Pattern of Bitcoin's Rise After Halving Continues

In 2024, Bitcoin halved, with a price around $63,000; we have all witnessed the journey from an experiment to $100,000, spanning 16 years of BTC's relentless run.

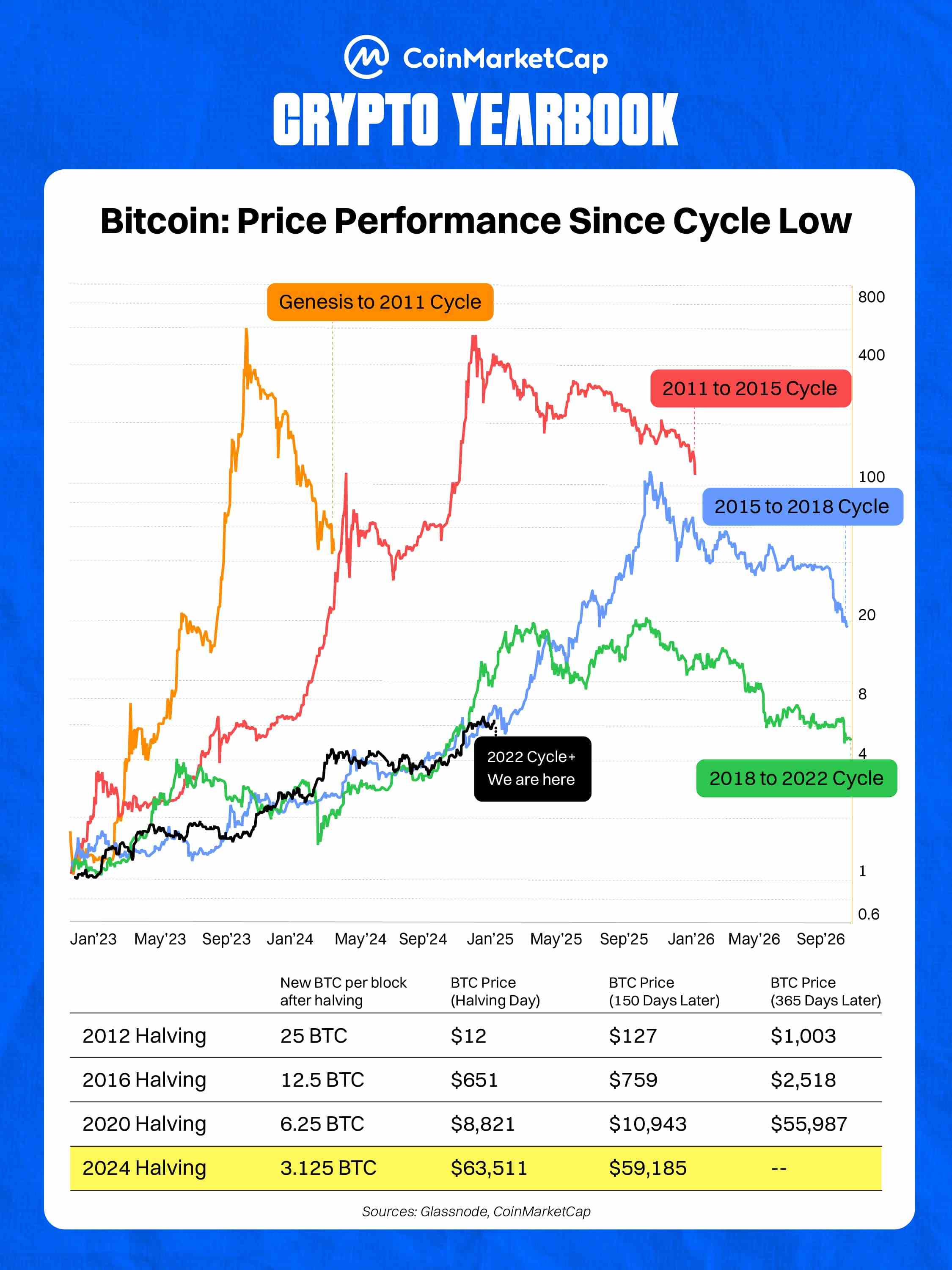

- Learning from History, the Bear Market Turning Point Seems Yet to Arrive

Bitcoin and the overall market generally follow a 3-4 year cycle. The chart below clearly shows that in the new cycle of 2024 (the black line), Bitcoin's price has not shown a significant downward trend.

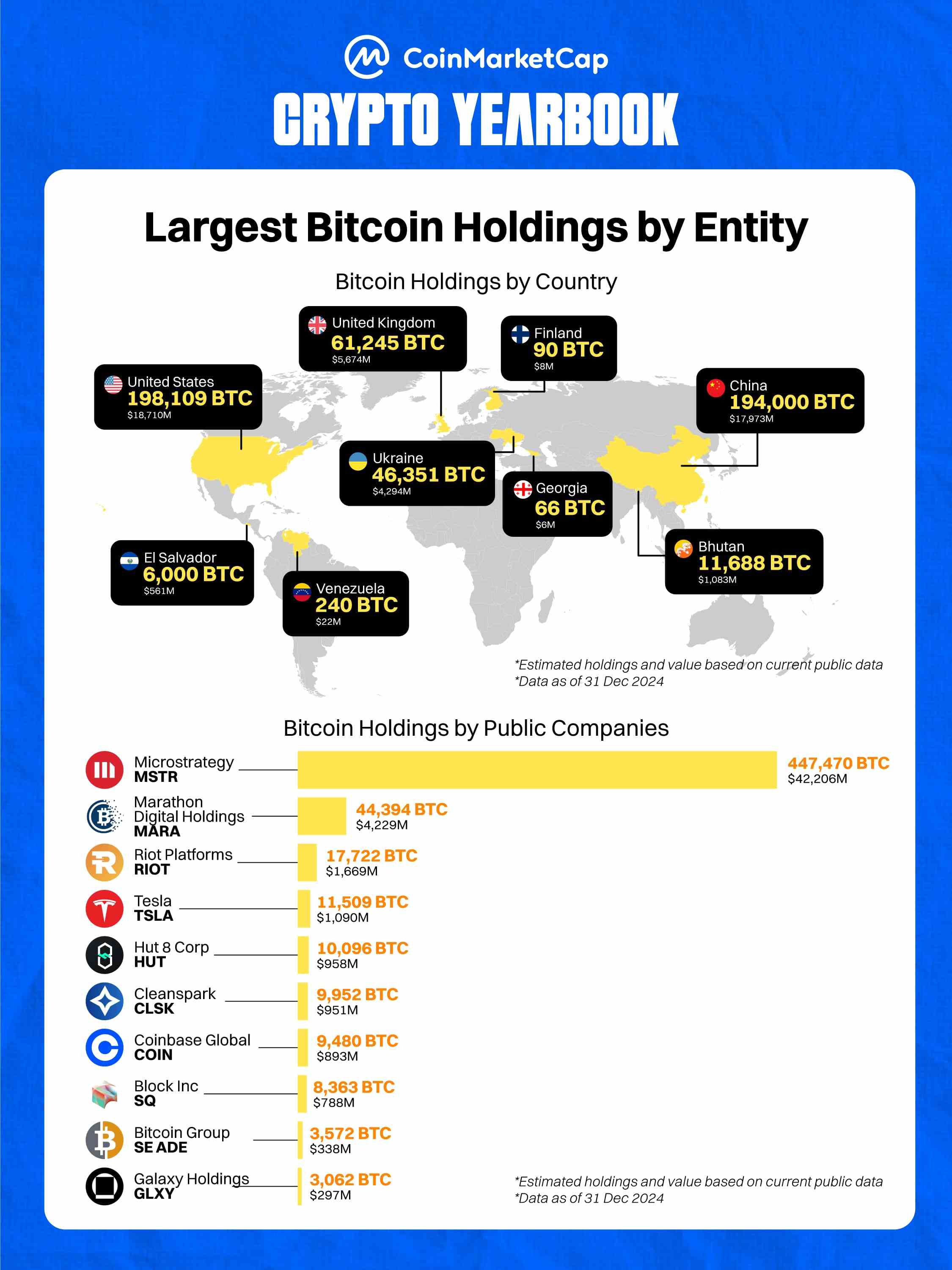

- MicroStrategy Leads, Overview of Global Institutional/Country Bitcoin Holdings

MicroStrategy leads the world with a staggering 440,000 Bitcoin holdings, surpassing any country's BTC holdings; meanwhile, the U.S. and China have not widened the gap in Bitcoin holdings.

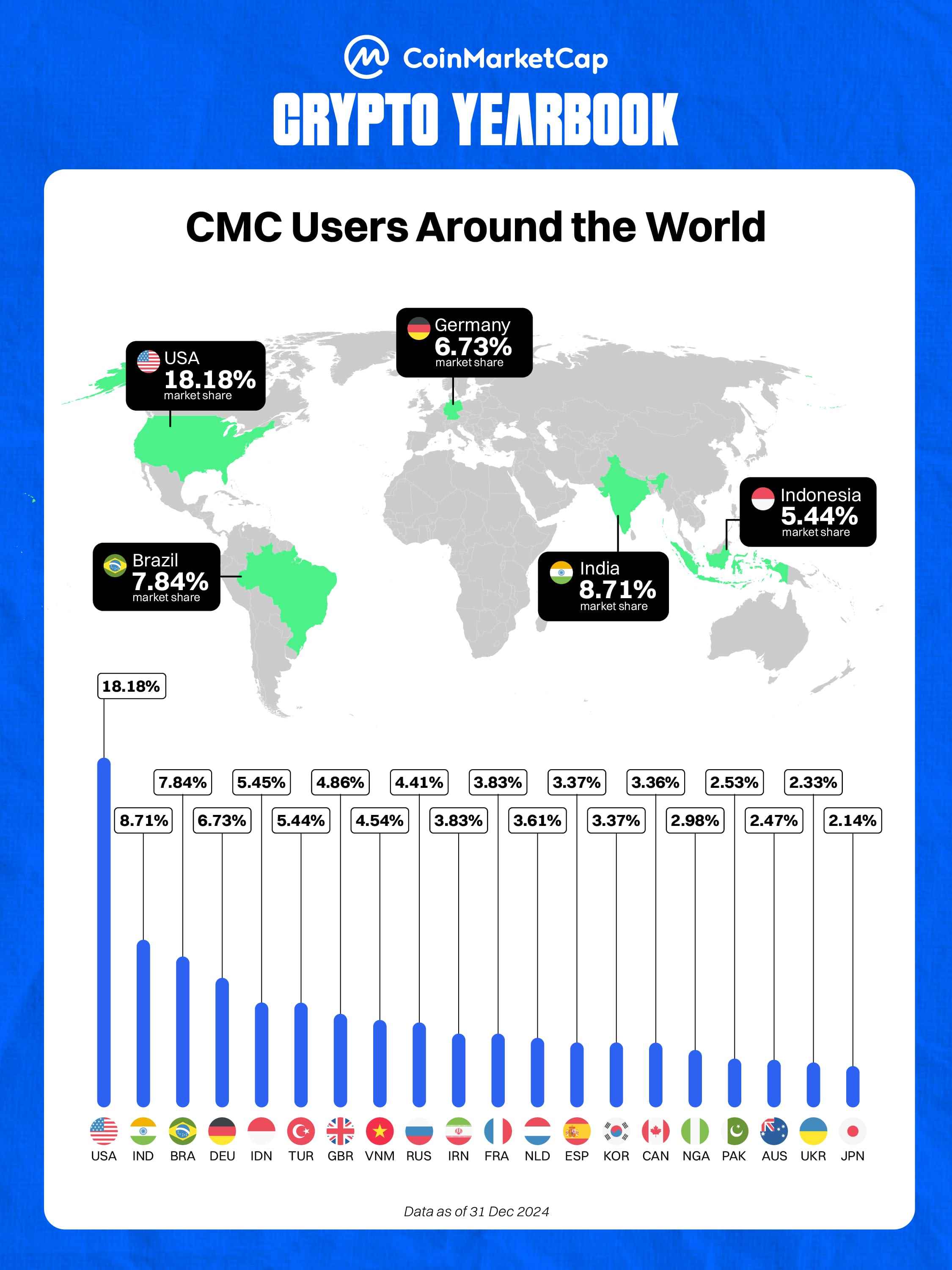

- The U.S. Remains the Country with the Most Users on the CMC Website

Surprisingly, the second place is India.

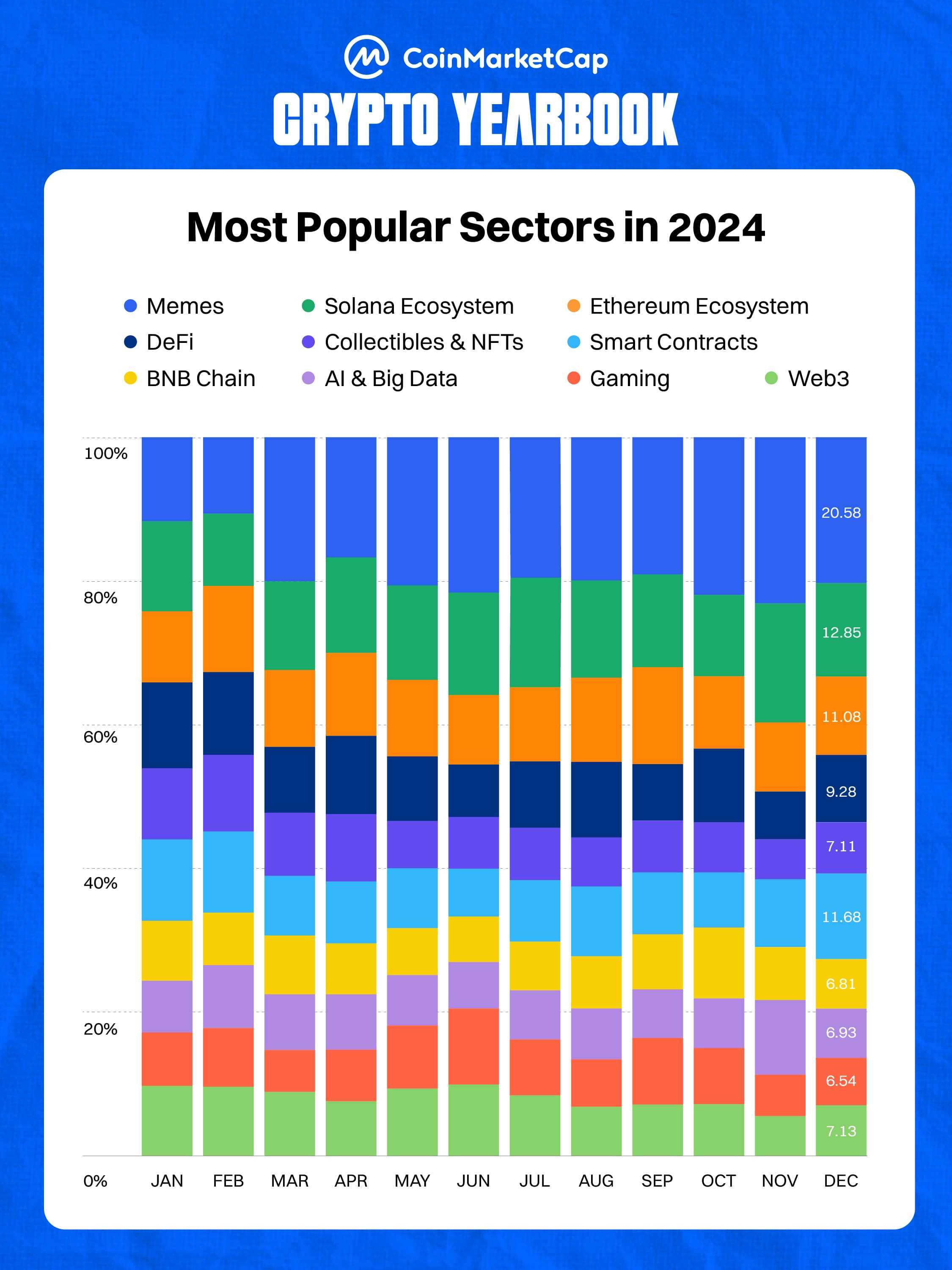

- The Most Popular Track: Meme Gradually Establishing Its Value (Blue Area in the Chart Below)

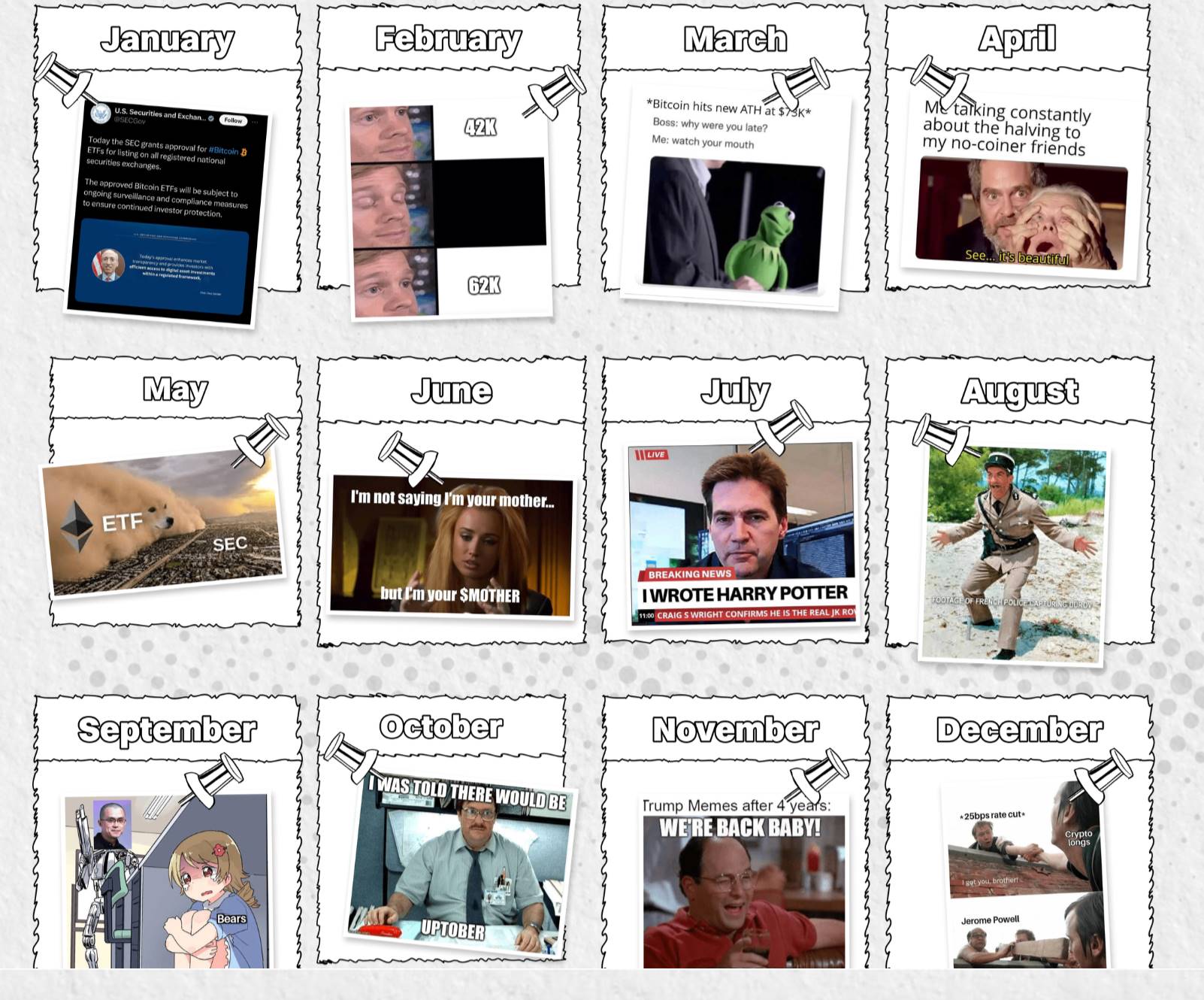

12 Memes that Tell the Story of Opportunities and Fun Moments Over the Year

Last year presented many opportunities. If you seized one or two, your story would surely be different.

If you missed too many opportunities, take a moment to reflect on the context and developments of the past year's opportunities through these Meme images.

January: SEC Slower than Hackers. The SEC's official Twitter was hacked to announce "Bitcoin ETF Approved," and a few hours later, the SEC officially announced the ETF approval…

February: Will the market rise after ETF approval? In fact, BTC was quite dull in February.

March: BTC reached a new high of 73K, while Degens were busy claiming airdrops.

April: BTC holders explained the significance of halving to their friends and family, or dragged them into the halving discussion.

May: Heard you are bearish on Ethereum? SEC approved the ETH ETF!

June: Iggy launched a coin, starting the trend of celebrity coins; please call her "Mother."

July: The "True or False Satoshi" meme resurfaced, with Craig Wright's "Satoshi Identity Verification" case.

August: France arrested the Tg founder, the community reacted, and related Memes emerged, actually leading the trend of political coins.

September: That man, CZ is back! The market is looking up.

October: The "October Must Rise" law has been postponed…

November: Comrade Trump returns, crypto gains a foothold in Washington and the White House.

December: Expectations for interest rate cuts gradually materialize, and the crypto market seems to see a savior.

Looking Ahead to 2025, What Are Your Choices and Predictions?

In this section, CoinMarketCap conducted an open poll, giving users the decision-making power for the outlook of 2025, essentially a market survey to see which tracks and projects everyone is optimistic about.

At the same time, the topics designed for the outlook section are as follows. Which projects do you think will come out on top?

- Which projects will make big news this year?

Nominees: ETH, PEPE, Monad, Fartcoin, World Liberty Financial (Trump-related).

- Which narrative will ignite the scene this year?

Nominees: NFT/Gaming, Quantum-resistant tokens, Crypto IPOs, RWA, and AI agents.

- Which asset will be approved for ETF?

- Who will quietly enter the top 30 by market cap?

Alternates: Virtuals, FET, Pengu, Ethena, Ondo.

- Which old coins will bloom?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。