Original: ArringtonCapital

Translation: Yuliya, PANews

On February 8, 2025, the AO mainnet is set to launch, marking a significant milestone for the AI and cryptocurrency community. AO aims to provide a highly parallel computing layer for agent applications, with the underlying permanent data storage network Arweave playing a crucial role. This article will delve into Arweave's permanent storage architecture, AO's ultra-parallel computing model, and how both are driving the future development of on-chain autonomous agents. Additionally, it will explore the challenges faced by AR and AO, market dynamics, and how to get involved.

Overview of Arweave

Arweave is a decentralized permanent data storage network. Users only need to make a one-time payment for storage fees to receive permanent data storage services. Unlike other storage networks (such as Filecoin) that require ongoing payments, Arweave employs a unique block structure called "blockweave." Each new block not only links to the previous block but also randomly links to earlier historical blocks, ensuring that miners must hold the complete historical data to generate new blocks, thus achieving long-term data preservation.

Arweave's native token, AR, is used to pay for storage fees and reward miners. When users upload new data and pay fees, about 85% of the tokens are deposited into a fund for future miner rewards. This design ensures that miner incentives are independent of user activity, enhancing confidence in the permanent storage of data.

Growth Trajectory

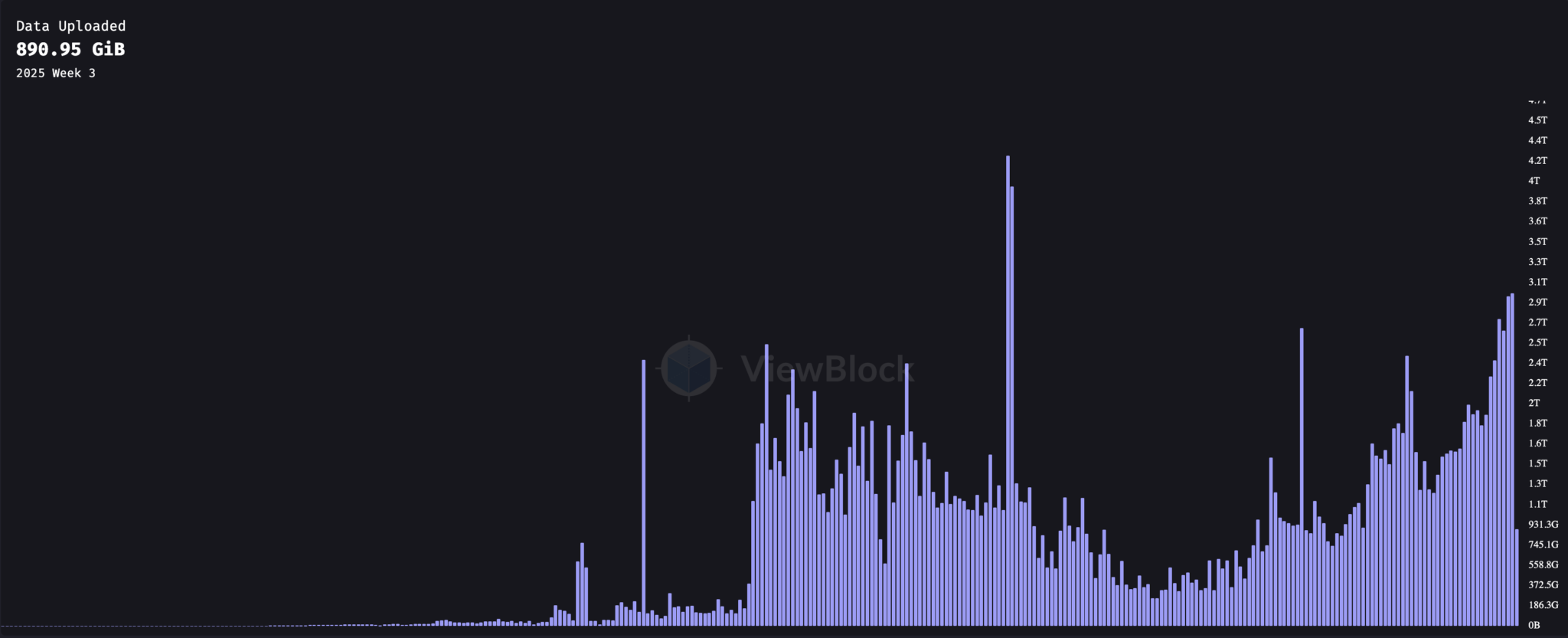

Since its launch in June 2018, Arweave's usage saw significant growth in 2021. The following chart tracks weekly data uploads since the network's inception:

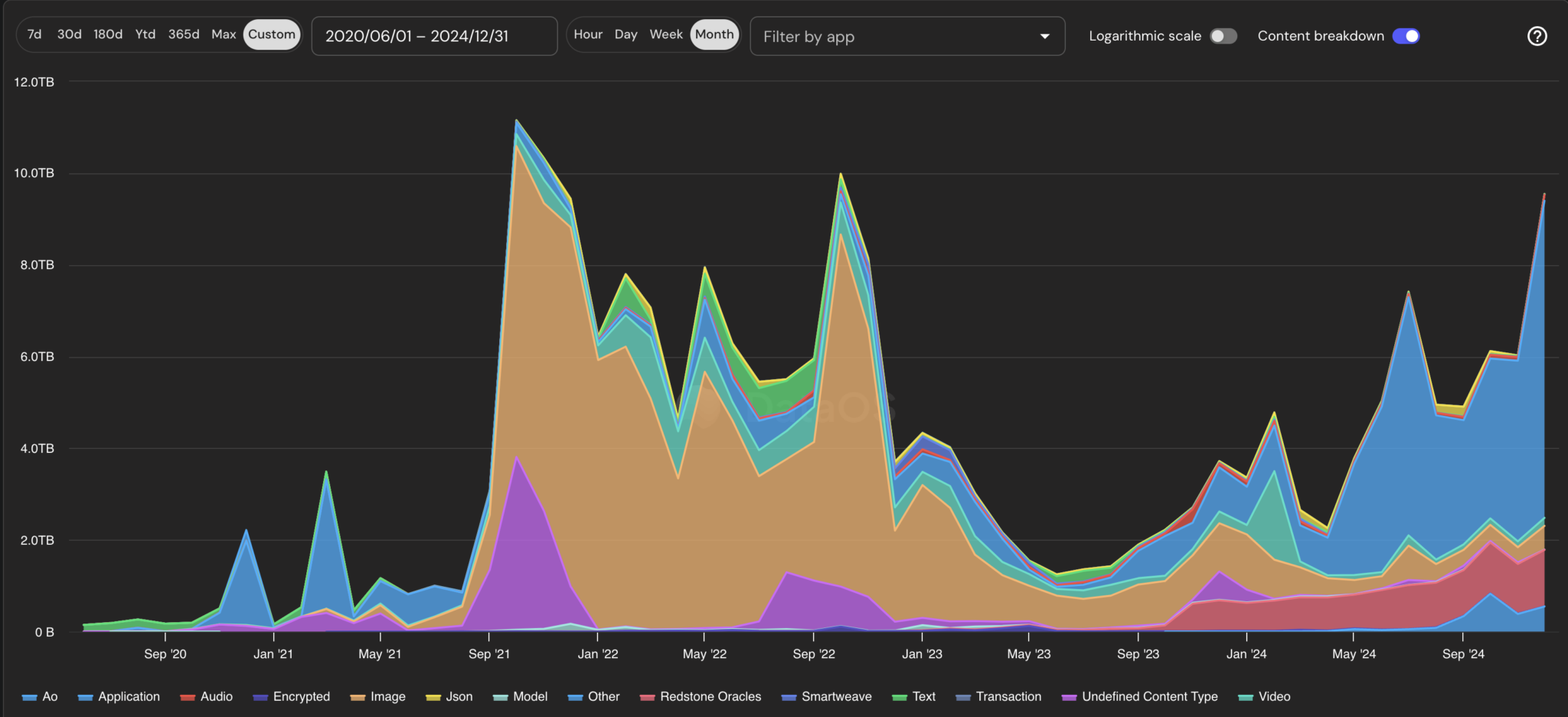

Data storage peaked in September 2021, bottomed out in June 2023, and has since steadily climbed. The following chart breaks down the types of data uploaded each month.

Arweave usage over time (by size)

In 2021, the rise of NFTs drove the first significant increase in demand for Arweave data storage. Creators began uploading JPEGs and images to Arweave instead of relying on centralized hosting services, leading to a surge in Arweave's usage. Due to its permanence and decentralization, Arweave became an ideal choice for storing NFT artwork data.

Since 2023, a series of new use cases have emerged. Among all categories, applications have occupied the most storage space. These are primarily bundler applications that package multiple transactions and data together and publish them to Arweave. This includes Bundlr (which has rebranded to Irys.xyz and will launch its own data chain in addition to bundler applications) and Ardrive Turbo. The data packaged by these applications includes content that may have previously been classified as images, videos, or other blockchain data. In addition to these bundler applications, other projects are leveraging Arweave's permanent storage capabilities, including Lens's social application Hey, content publishing platform Mirror, and AI application scenario Ritual.

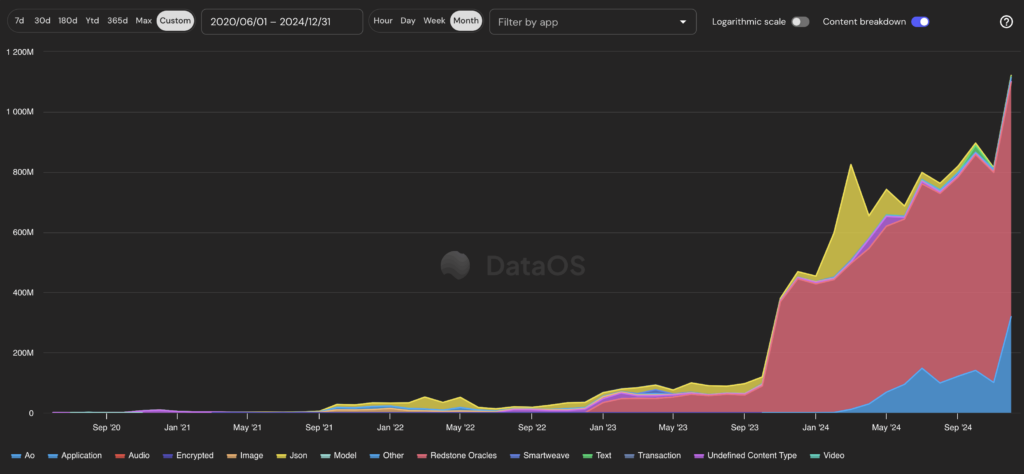

In terms of transaction volume, although Arweave charges fees based on the size of stored data, the growing number of use cases may indicate the future direction of Arweave.

Arweave usage over time (by transaction count)

Transaction volume data shows that the two fastest-growing use cases in the blockchain ecosystem are Redstone and AO.

Redstone

Redstone is one of the fastest-growing oracle networks in the crypto space, providing price data for multiple assets across all major EVM chains. The rapid development of this network is attributed to its expanding partnerships and product features.

AO

AO is a parallel computing and agent messaging layer built on Arweave. While still in the testnet phase, its mainnet is scheduled to launch in February 2025. AO is designed to provide efficient computational infrastructure for agent applications, leveraging Arweave's permanent storage capabilities to support on-chain autonomous agents.

Criticism of Arweave

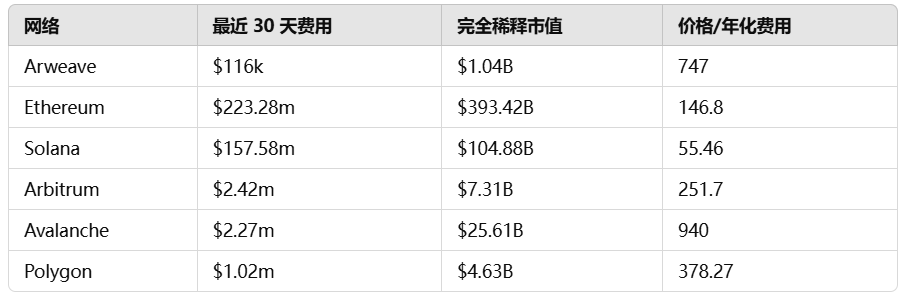

Despite the recognition of Arweave's storage model, it faces some criticism, particularly regarding its low fee revenue. The following compares the PE ratios of different blockchains:

In terms of price/fee ratio, Arweave performs slightly better than Avalanche among L1 chains. The lower ratio indicates that users are paying higher fees relative to the network's fully diluted value (FDV). This data reflects the total fees generated but does not account for miner payments or contributions to Arweave's donation fund. Since Arweave allocates a larger proportion of fees to miners, its short-term profits may appear smaller compared to other chains.

Performance of AR Token

In 2024, following the announcement of the AO project, AR experienced significant growth. After the announcement, the price of Arweave tokens surged from under $10 each to over $40. The market has shown strong interest in the potential that AO brings to cryptocurrency and the expected increase in Arweave's activity.

Starting in February 2024, AR holders can accumulate AO tokens simply by holding AR in their wallets. Currently, 33% of newly created AO tokens are circulating to holders, and these tokens will be transferable upon the launch of the AO mainnet in February 2025.

After the mainnet launch, AR holders will continue to receive one-third of the AO token issuance until the creation cap of 2.1 million AO tokens is reached. These rewards are calculated every five minutes, with a monthly rate of 1.425% of the remaining supply, meaning the token issuance will decrease over time.

AR Price (USD)

As the overall market declined, AR's price also fell during the summer. Compared to tokens with AI value attributes like RENDER, TAO, and NEAR, AR's performance lagged. On-chain capital flow may be a significant factor contributing to this phenomenon.

Since September 2024, the market has observed a large holder continuously selling off a significant amount of AR tokens. The identity of this investor has some clues but remains unconfirmed. The wallet address dRFuVE-s6-TgmykU4Zqn246AR2PIsf3HhBhZ0t5-WXE acquired over 10 million AR tokens in November 2021 (the total supply of AR is less than 66 million). This wallet had transfer records before 2023 and still held 5 million tokens by 2024 (valued at approximately $80 million at a current price of $16).

On September 6, this wallet transferred the remaining 5 million tokens to two new addresses. These addresses subsequently transferred the tokens to exchanges, indicating that these may be market maker addresses. Of the 5 million tokens, about 1.35 million tokens remain in what is speculated to be market maker addresses awaiting transfer to exchanges.

The behavior of transferring tokens from the two addresses to the same target address suggests that this is likely the same market maker operation. This wave of selling pressure represents a significant portion of the circulating supply, exceeding 7% of the total AR token supply. Market analysis suggests that once the remaining tokens are sold off, the downward pressure on the AR market may ease.

Overview of AO

AO is a decentralized "super-parallel" network that breaks through the traditional limitations of on-chain computing scale and type while maintaining the verifiability of all operations. At its core, AO is a messaging layer that supports independent and parallel processes, utilizing Arweave to provide permanent data storage, ensuring that all updates and interactions are permanently recorded.

"AO" stands for "Actor Oriented," allowing developers to build modular programs (actors), each of which can choose its own virtual machine (VM), consensus mechanism, and payment model, while communicating with other actors through standardized message formats. This design enables cloud applications (like Amazon EC2) to connect to AO's decentralized network and collaborate with decentralized smart contracts to achieve their goals.

Features of AO

Existing Applications

Some AO agents are already in use. For example, one agent can continuously optimize crypto asset yields across multiple lending protocols; another agent can automatically execute dollar-cost averaging strategies on DEXs based on user-defined parameters. These agents utilize Trusted Execution Environments (TEE) to protect user privacy, allowing users to host private keys, thus enabling fully autonomous operation without additional instructions.

Auto-Wake Functionality

Unlike other Layer 1s, AO programs can autonomously "wake up" without external calls. This design supports fully autonomous services. For instance, a yield optimization agent can reallocate assets to higher-yield strategies while the user sleeps, without manual triggering.

AO Architecture

1. Processes:

Processes are equivalent to individual "actors" on AO, starting from an initial state and recording all received messages. Data is stored on Arweave, ensuring it is not lost or censored. By separating data recording from actual computation, AO can handle larger tasks than typical blockchains.

2. Messages:

Messages are the means of interaction between processes and users, transmitted over the network with a unique ID for tracking. Message delivery must be correct to ensure messages are permanently recorded while providing flexibility in traffic control.

3. Scheduler Units:

Scheduler units add incremental time slot numbers to messages and ensure they are uploaded to Arweave, maintaining a consistent record of message sequences. Depending on use case requirements, they can be centralized or decentralized.

4. Compute Units:

Compute units are responsible for the actual execution of processes, freely choosing which processes to compute, forming a competitive market for computational services. Upon completion of work, they return signed proofs of process state changes.

5. Messenger Units:

Messenger units are responsible for the transmission of messages within the network, ensuring that messages are delivered to compute units after being recorded by scheduler units on Arweave, until all operations are completed.

Challenges Facing AO

The AO project faces several significant challenges. Every network ultimately needs to establish an advantage in one or two verticals. For example, Arbitrum focuses on DeFi, Solana excels in meme coins and DePIN, and IMX specializes in gaming. Arweave has always revolved around content storage, blockchain archiving, and the permanence of oracle data. AO attempts to redefine decentralized content and DeFi, particularly facing challenges in promoting the application of AI agents in the DeFi space.

1. Adoption Challenges in DeFi

While AO is committed to promoting the integration of DeFi and AI, the adoption of AI agents in the DeFi space has been slow, with no breakthrough applications emerging. The closest attempts have been to introduce machine learning models on-chain for yield optimization. However, these models are often simplistic, primarily used for yield prediction and cost comparison of strategy switches. In contrast, large language models exhibit highly nonlinear and nondeterministic characteristics, still facing difficulties in basic computations.

2. Background of Non-DeFi Chains

Arweave is not a traditional DeFi public chain, and past attempts to build DEXs on it have not succeeded. Therefore, AO needs to attract both the existing Arweave community and new user groups. The token economics designed by the team reflects a deep understanding of this challenge, such as rewarding users who bridge DAI and stETH to attract capital. Currently, AO's TVL has reached $578 million, and maintaining the activity of this capital is key.

Token Economics and Participation Methods

After the mainnet launch in February 2025, anyone can contribute computing resources or deploy their own processes and agents. Cross-chain bridges will open, supporting the transfer of any tokens to the AO network. As more people join and develop advanced AI or automated services, AO's decentralized and efficient architecture will unlock new possibilities in trust and high computational demand areas.

Airdrop Mechanism

- Total Token Supply and Release Plan: The total supply of AO tokens is 21 million, released in halved intervals as set.

- Airdrop Eligibility: AR holders receive AO airdrops based on their holdings; users bridging DAI and stETH will also receive allocations.

- Distribution Method: Since February 27, 2024, 1.03 million AO tokens have been allocated to holders and bridge users; AR holdings are counted every 5 minutes to calculate distribution ratios.

Participation Methods

- Hold AR Tokens: One-third of newly issued AO tokens are allocated to AR holders.

- Cross-chain Transfer of DAI or stETH: Currently, two-thirds of AO tokens are allocated to cross-chain users.

- Use AO Mainnet Applications: Multiple trading and lending platforms will be available after the mainnet launch.

- Provide Computing Resources: Anyone can contribute computing power to various processes on AO without permission.

*Disclaimer:_ The author, Arrington Capital, is an early investor in Arweave and holds AR and AO tokens._

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。