In 2025, the cryptocurrency market accelerated its mainstream adoption driven by multiple innovations such as the Bitcoin ETF breakthrough, Ethereum scaling optimizations, AI agents, and RWA tokenization, but still faced regulatory and technical challenges.

Written by: Siddhant Kejriwal

Translated by: Baihua Blockchain

As we step into 2025, market optimism is high, supported by actual progress and breakthrough innovations. This article summarizes the core narratives in the cryptocurrency space for the year, integrating personal insights and research findings from leading industry institutions, including Bitwise, VanEck, Ark Invest, a16z, and others.

Let’s explore the trends shaping the future of digital assets.

1. Bitcoin Gains Economic Traction

In 2024, the market dynamics of Bitcoin underwent significant changes, laying the groundwork for key narratives in 2025.

The launch of the Bitcoin spot trading platform exchange-traded fund (ETF) in January 2024 marked a milestone event in the integration of cryptocurrency with traditional finance. Among them, the iShares Bitcoin Trust (IBIT) managed by BlackRock stood out, attracting nearly $38 billion in net inflows in its first year, making it the most successful ETF launch in history.

Notably, the inflows into IBIT even surpassed those of the well-known fund tracking the Nasdaq 100 Index—Invesco QQQ Trust (QQQ). By mid-2024, IBIT's year-to-date inflows were approximately $18.97 billion, slightly ahead of QQQ's $18.9 billion.

BTC ETF Inflows | Image Source: Coinglass

1) Historic ETF Inflows and Growth Potential

Historical data shows that ETFs typically attract moderate inflows in the early stages, which significantly increase as investors become more familiar and confident in these instruments. Given this pattern, the strong early performance of the Bitcoin ETF in 2024 suggests that 2025 may see broader adoption and greater capital inflows.

2) Macroeconomic Tailwinds: Interest Rate Cuts

The macroeconomic environment at the end of 2024 provided favorable conditions for Bitcoin and other risk assets. In the fourth quarter, the Federal Reserve cut interest rates four times, totaling a 1% reduction. This monetary easing policy aimed at controlling inflation is expected to continue into 2025.

The rate cuts reduced the opportunity cost of holding non-yielding investments, thereby enhancing the appeal of risk assets like Bitcoin and providing strong support for its growth.

3) Institutional Adoption: Interest from Corporations and Governments

In 2024, the Bitcoin market shifted from a retail speculation-driven landscape to large-scale institutional investment.

Corporate Interest: Under the leadership of Michael Saylor, MicroStrategy significantly expanded its Bitcoin holdings, purchasing approximately 258,320 BTC throughout the year for a total of about $22.07 billion, achieving a return on investment of 74.3%. This aggressive accumulation strategy solidified MicroStrategy's position as a leading corporate Bitcoin holder while showcasing the potential high returns of such investments, which may influence other corporations to make similar allocations in 2025.

Government Interest: At the government level, the incoming administration of President Donald Trump signaled a supportive stance towards cryptocurrencies and explored the possibility of establishing a strategic Bitcoin reserve through executive orders. Although the details and feasibility of this reserve plan are still under discussion, the mere consideration of Bitcoin as a strategic asset by the U.S. government could prompt other countries to explore incorporating Bitcoin into their national reserves, further enhancing the legitimacy and stability of the cryptocurrency market.

Trump's Commitment to Establish a Bitcoin Strategic Reserve at the Nashville Conference | Image Source: Financial Times

4) Conclusion

The successful launch of the Bitcoin ETF, favorable macroeconomic policies, and increased institutional interest indicate that Bitcoin is entering a transformative period. As 2025 unfolds, these narratives will drive Bitcoin's transition from a speculative asset to a mainstream financial instrument, attracting a more diverse range of investors and solidifying its position in the global financial ecosystem.

2. Bitcoin: A Unique Safe-Haven Asset?

In traditional finance, a "safe-haven" asset refers to a secure asset that investors tend to choose during economic uncertainty or market volatility. Government bonds and gold are representative of this category, favored for their relative stability and support from sovereign entities.

Government Bonds: Debt securities issued by national governments, promising regular interest payments and the return of principal at maturity. Their low default risk and predictable returns make them attractive during market downturns.

Gold: As a store of value, gold is highly regarded for its scarcity and intrinsic value, typically maintaining or appreciating during financial crises.

In recent years, particularly analyses from ARK Invest suggest that Bitcoin is gradually evolving into a safe-haven asset, demonstrating the potential to provide shelter for investors during turbulent times. Here are the key observations:

Intrinsic Safe-Haven Characteristics

Bitcoin offers financial sovereignty, reduces counterparty risk, and enhances transparency. Its decentralized nature ensures it is not controlled by a single entity, mitigating risks associated with centralized financial systems.

Advantages Over Traditional Assets

Bitcoin's decentralization, limited supply, high liquidity, and convenience far surpass those of bonds, gold, and cash. These attributes make Bitcoin a versatile asset in the digital age, enabling seamless global transactions.

1) Outperformance Compared to Traditional Assets

Over the past seven years, Bitcoin has achieved an annualized return of 60%, far exceeding the average 7% return of bonds and other major assets. Bitcoin investors have consistently made profits over a five-year holding period, while the purchasing power of bonds, gold, and short-term U.S. Treasury bills has declined by 99% over the past decade.

Adaptability to Interest Rate Changes

Bitcoin's price appreciation has persisted across various interest rate environments, showcasing its resilience and potential to hedge against monetary policy fluctuations.

Performance During Safe-Haven Periods

During recent financial crises (such as regional bank failures), Bitcoin's price surged over 40%, demonstrating its potential as a safe-haven asset.

Low Correlation with Other Asset Classes

From 2018 to 2023, Bitcoin's correlation with bonds was only 0.26, while the correlation between bonds and gold was 0.46. This low correlation indicates that Bitcoin can effectively enhance portfolio diversification.

Potential to Disrupt the Safe-Haven Asset Market

Currently, Bitcoin's valuation is approximately $1.3 trillion, representing only a small fraction of the $130 trillion fixed income market, indicating significant growth potential once Bitcoin is accepted as a safe-haven asset.

Bitcoin's unique positioning and strong performance as a safe-haven asset are redefining the global financial market, providing investors with an unprecedented diversification option.

Recognition of Bitcoin as a Safe-Haven Asset is Increasing | Image Source: Ark Invest

2) Shift in Perception of Bitcoin from "Risk Asset" to "Safe-Haven Asset"

Although Bitcoin's past high volatility led many to classify it as a "risk asset," perceptions are changing as it matures and its aforementioned characteristics become more pronounced. As the global economic environment evolves, Bitcoin's role in investment portfolios may further expand, potentially redefining traditional asset allocation strategies.

3. Cryptocurrency Stocks to Watch in 2025

In 2024, cryptocurrency companies made waves on Wall Street, becoming one of the highest-gaining sectors of the year. Many companies plan to go public in 2025, while others may surpass traditional financial (TradFi) institutions in market capitalization.

1) Cryptocurrency Companies Likely to Go Public in 2025

Analysts predict that 2025 will be the "Year of Crypto IPOs," with the following companies expected to make their debut:

Circle: The issuer of the USDC stablecoin has announced plans to relocate its headquarters to New York City before its IPO.

Kraken: A cryptocurrency exchange platform expected to go public in 2025.

Anchorage Digital: A digital asset platform set to enter the public market.

Chainalysis: A blockchain data platform anticipated to go public.

Figure: A fintech company planning an IPO.

2) Coinbase's Market Cap May Surpass Charles Schwab

As the assets managed by Coinbase grow rapidly, many believe it could surpass Charles Schwab in 2025, becoming the largest brokerage in the world. This potential shift is attributed to Coinbase's diversified revenue streams, including its Ethereum Layer 2 network Base, staking services, and stablecoin business.

3) Impacts of These Developments

Enhanced Industry Legitimacy: The entry of well-known cryptocurrency companies into the public market will bolster the legitimacy of the cryptocurrency industry, attracting previously hesitant investors.

Broader Investor Access: Going public allows more investors to engage with the crypto industry through traditional investment tools like stocks, without needing to purchase cryptocurrencies directly.

Changes in Market Dynamics: Including cryptocurrency companies like MicroStrategy and Block in major indices such as the S&P 500 may attract funds from index funds, ETFs, and investors, further integrating cryptocurrencies into mainstream finance.

Evolving Competitive Landscape: As cryptocurrency companies grow in market capitalization and influence, traditional financial institutions may face greater competition, driving innovation and adaptive changes in the financial industry.

These changes signify the maturation of the cryptocurrency industry, indicating its transition from a niche market to an essential component of the global financial ecosystem.

4. Stablecoin Market May Double in 2025

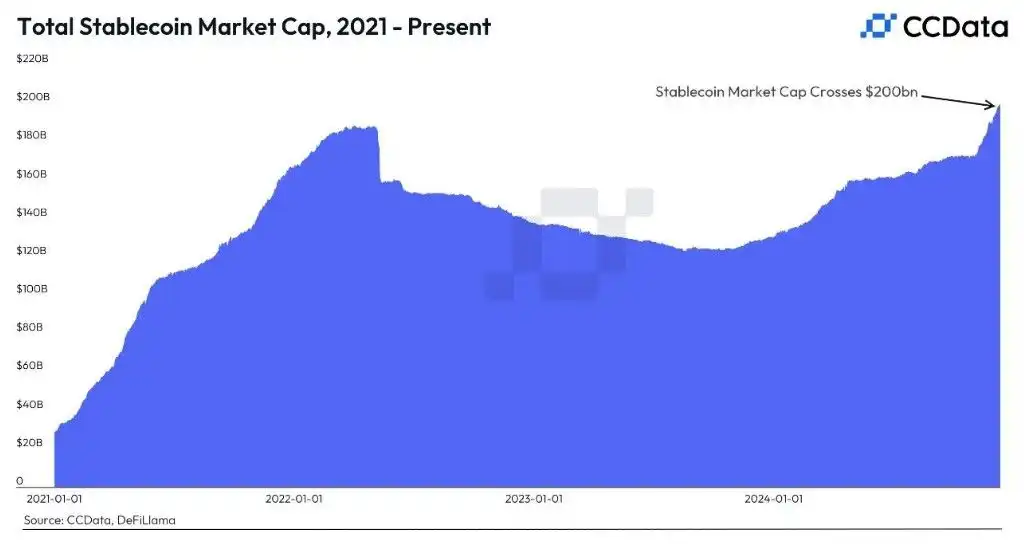

In 2024, the stablecoin market achieved significant growth, with its market capitalization surpassing $200 billion. This expansion is expected to accelerate in 2025, with the market potentially doubling in size.

1) 2024 Growth and 2025 Forecast

In 2024, the stablecoin market's market capitalization surged to $200 billion, reflecting increased adoption and integration with various financial systems.

Growth Drivers: The demand for digital assets continues to rise, providing both the stability of traditional fiat currencies and facilitating seamless transactions, while also serving as a hedge against the volatility of cryptocurrencies.

With increasing adoption rates, the market outlook for stablecoins remains broad, and 2025 may become a turning point for their growth.

Stablecoin market capitalization reached $200 billion in 2024 | Image Source: CoinDesk

Industry analysts predict that by the end of 2025, the stablecoin market size could double. This forecast is based on several factors:

Increased acceptance of digital payments

Rapid development of blockchain technology

Clearer regulatory frameworks

These factors collectively create a more favorable environment for the adoption and use of stablecoins.

2) Stablecoins and Dollar Hegemony

Contrary to early concerns that stablecoins might undermine the dollar's position, recent analysis by Reuters suggests that stablecoins may actually strengthen the dollar's dominance.

Dollar-pegged stablecoins can support cross-border transactions priced in dollars, enhancing the dollar's utility in the global financial system.

This development highlights the dollar's adaptability in the evolving digital economy.

3) Impacts of Stablecoin Growth

Enhanced Financial Inclusion: Stablecoins provide access to financial services in areas with limited banking infrastructure, promoting broader economic participation.

Increased Transaction Efficiency: Using stablecoins simplifies cross-border payments, significantly reducing costs and settlement times compared to traditional banking systems.

Regulatory Factors: As the stablecoin market expands rapidly, regulators are accelerating the development of frameworks to ensure financial stability and prevent illegal activities.

Integration with Traditional Finance: The growing acceptance of stablecoins by financial institutions indicates that the integration between traditional finance and digital assets is accelerating. This could lead to the creation of more innovative financial products and services.

5. RWA: An Important Crypto Narrative for 2025

The tokenization of Real World Assets (RWA) is rapidly developing, digitizing traditional assets such as credit, U.S. Treasury bonds, commodities, and stocks, enhancing liquidity, transparency, and accessibility in financial markets.

1) Growth Prospects for 2025

According to data from Bitwise, the tokenization of the RWA market has grown from less than $2 billion three years ago to approximately $13.7 billion. With increasing adoption and technological advancements, Bitwise predicts that this market will grow to $50 billion by 2025.

Venture capital firm ParaFi estimates that the RWA market could reach $2 trillion by 2030, while the Global Financial Markets Association (GFMA) estimates its potential market value could be as high as $16 trillion by 2030.

2) Growth Drivers

Superior Asset Management

Tokenization offers instant settlement, lower costs than traditional securitization, and continuous liquidity. It enhances transparency and provides easier access to various asset classes.

Institutional Adoption

Large financial institutions are increasingly embracing RWA tokenization. For example, BlackRock has partnered with Securitize to tokenize a USD institutional digital liquidity fund on Ethereum, which currently holds $515 million in assets, making it the largest tokenized U.S. Treasury fund.

Technological Advancements

The development of blockchain technology and smart contracts facilitates the efficient and secure tokenization of assets, attracting more investors and issuers.

3) Impact on the Financial Ecosystem

Enhanced Liquidity

Tokenization allows assets to be held in fractions, enabling investors to buy and sell portions of assets, thereby increasing market liquidity.

Expanded Investment Access

Investors can access previously illiquid or hard-to-invest-in asset classes, achieving investment democratization.

Increased Operational Efficiency

By automating processes through smart contracts, the administrative burden and costs associated with asset management and trading are reduced.

Regulatory Considerations

As the market grows, regulatory frameworks are continuously evolving to address challenges related to security, compliance, and investor protection.

4) Conclusion

The tokenization of Real World Assets (RWA) is reshaping the financial landscape, bringing higher efficiency, accessibility, and liquidity. It is expected that by 2025 and beyond, this field will see significant growth, with tokenized RWA becoming a cornerstone of modern finance, attracting both institutional and retail investors seeking innovative investment opportunities.

6. AI Agents Set for Exponential Growth

In 2024, AI agents became a hot narrative in the cryptocurrency space, driven by platforms such as Virtuals and ai16z. These platforms have developed no-code solutions that make the deployment of AI agents more convenient. These dedicated AI bots are designed to understand user intent and execute complex tasks, streamlining processes across various applications.

1) Expansion of AI Agents in 2025

It is expected that in 2025, the integration of AI agents within the crypto ecosystem will significantly expand, moving beyond decentralized finance (DeFi) into multiple domains:

Social Media: AI agents (like AIXBT) are transforming platforms such as Crypto Twitter by providing real-time market intelligence and trend analysis, enhancing the efficiency of information dissemination.

Financial Analysis: AI-based analytical tools provide investors with deep insights, helping them make more informed decisions in the highly volatile crypto market.

Entertainment and Interactive Applications: AI agents are being used to create engaging content and interactive experiences, enriching user engagement within the crypto community.

2) Proliferation of AI Agents

With the increasing availability and cost-effectiveness of AI agent development, their numbers are expected to surge. Currently, there are over 10,000 AI agents, with millions of daily active users. By the end of 2025, the number of AI agents could grow to 1 million, indicating their widespread application across platforms.

AI agents achieved exponential growth in 2024 | Image Source: VanEck

3) Rise of AI-Themed Meme Coins

The fusion of AI technology with meme culture has given rise to AI-themed meme coins, adding a new dimension to the crypto market. The success of projects like Terminal of Truths and $GOAT meme coins has sparked a wave of similar initiatives that combine humor with advanced AI capabilities. This trend is expected to continue gaining momentum in 2025, attracting the attention of investors and crypto enthusiasts.

4) Impact on the Crypto Ecosystem

The rapid growth of AI agents and AI-themed meme coins signals profound changes in the crypto space:

Enhanced Accessibility: No-code platforms enable users without technical backgrounds to develop complex AI tools, democratizing innovation.

Diversified Use Cases: The expansion of AI agents across multiple domains fosters a tighter and more diverse ecosystem, accelerating broader adoption.

Changing Market Dynamics: The rise of AI meme coins brings new investment opportunities and challenges, profoundly impacting market sentiment and investor behavior.

5) Conclusion

The integration of AI agents and the rise of AI-themed meme coins will play a key role in shaping the narratives in the crypto space in 2025, driving innovation and expanding the boundaries of the digital asset market.

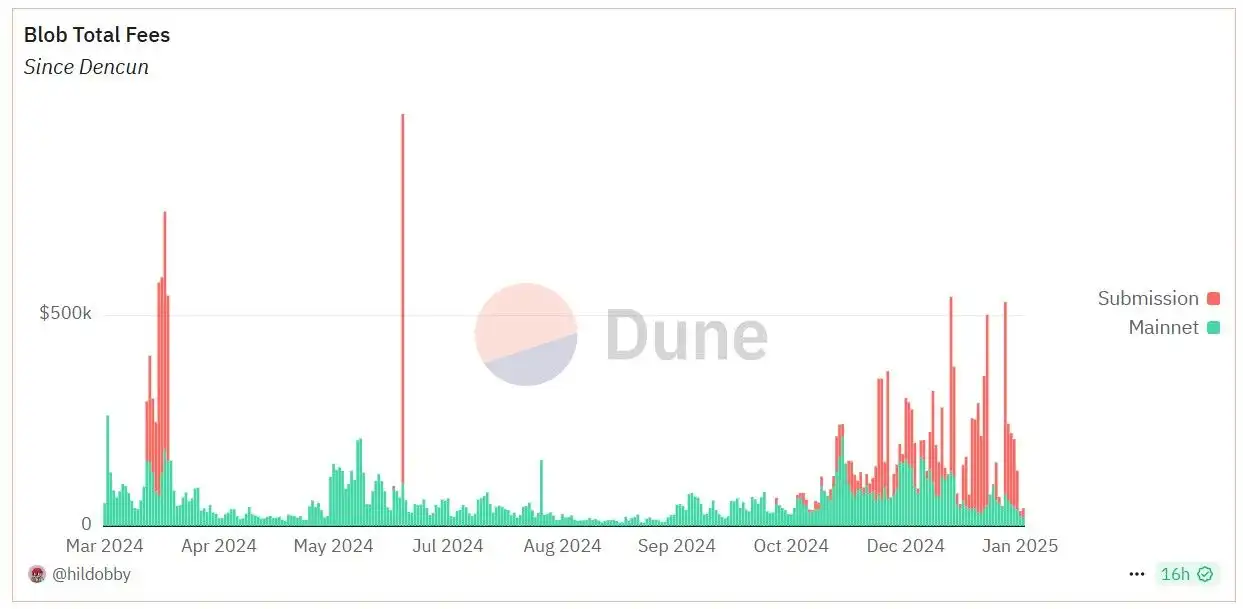

7. Ethereum Blob Fee Market Expected to Break $1 Billion Barrier

EIP-4844 (also known as Proto-Danksharding) significantly enhances Ethereum's scalability by introducing "transactions carrying Blob data," optimizing data storage for Layer 2 (L2) networks. This development also introduces a separate fee market known as the "Blob Gas Market."

1) EIP-4844 and Blob Data Transaction Analysis

EIP-4844 improves Ethereum's scalability through a new transaction type (carrying large amounts of data, or "Blob"). These Blob data are temporarily stored in Ethereum's beacon nodes, allowing L2 solutions to publish data without competing for gas fees with Layer 1 (L1) transactions.

Result: Reduced costs and increased operational efficiency for L2.

2) Dual Fee Markets and Base Fee Burn Mechanism

With the introduction of Blob data transactions, Ethereum now operates two parallel fee markets:

Layer 1 Fee Market: Handles traditional transactions and smart contract executions.

Blob Gas Market: Exclusively for L2 transactions utilizing Blob data.

Both markets employ the base fee burn mechanism established by EIP-1559. Under this mechanism, a portion of transaction fees is burned, thereby reducing the overall supply of ETH and potentially enhancing its value.

3) Current Utilization and ETH Burn Predictions

Since November 2024, validators have been publishing over 20,000 Blob data daily on Ethereum.

Prediction: If this trend continues or accelerates, Blob fees could burn over $1 billion worth of ETH by 2025. This milestone will further solidify Ethereum's evolving security and economic model.

The Blob Gas Market saw significant growth in the fourth quarter | Image Source: Dune Analytics

4) Factors Driving Blob Space Expansion in 2025

Several key factors are expected to drive the rapid expansion of Blob space usage in 2025:

A. Explosive Growth of L2

Surge in Transaction Volume: The annualized transaction volume of Ethereum Layer 2 (L2) has exceeded 300%, as users migrate to L2 platforms to save costs and enjoy high throughput for DeFi, gaming, and social applications.

Rise of Consumer-Grade DApps: The increase in decentralized applications (DApps) on L2 will lead to more transactions returning to the Ethereum mainnet for final settlement, significantly increasing demand for Blob space.

B. Rollup Optimization

Technological Advancements: Improvements in rollup technology, such as more efficient data compression and lower data publishing costs, will encourage L2 to store more transaction data in Ethereum's Blob space, achieving higher throughput while maintaining decentralization.

C. Introduction of High-Fee Use Cases

Rise of Enterprise-Level Applications: The emergence of high-value transactions such as zk-rollup-based financial solutions and tokenization of real assets will prioritize security and immutability, while increasing the willingness to pay Blob space fees.

5) Impact on the Ethereum Ecosystem

Enhanced Scalability: By shifting L2 data storage from the Ethereum main chain to Blob space, the network can handle more transactions without congestion, improving the user experience.

Economic Impact: Blob fees burning ETH will reduce supply, potentially exerting upward pressure on ETH prices, benefiting holders and network participants.

Security Considerations: The increased use of Blob space highlights the need for ongoing monitoring to ensure that the network's consensus security remains robust under higher data throughput.

6) Conclusion

The implementation of EIP-4844 and the development of the Blob Gas market mark significant progress for Ethereum in terms of scalability and economic models. As Layer 2 adoption accelerates and new use cases emerge, the utilization of Blob space is expected to grow substantially in 2025, further solidifying Ethereum's position as a leading platform for decentralized applications.

8. Summary and Outlook

Looking back at the transformative trends shaping the cryptocurrency space, it is clear that 2025 is filled with tremendous potential. However, in the face of this rapidly evolving market, we must maintain a balance of optimism and caution.

1) Key Takeaways

Innovation and Growth

The rapid development of AI agents, the expansion of Ethereum Layer 2 solutions, and the tokenization of real-world assets highlight the vibrancy and dynamism of the crypto ecosystem.

Mainstreaming Process

The integration of cryptocurrencies into the traditional financial system is accelerating, with increased institutional investment and the rise of stablecoins indicating that digital assets are being more widely accepted and recognized.

Regulatory Dynamics

Changes in regulatory policies under the current U.S. government are expected to profoundly impact the development path of the crypto market, potentially bringing new opportunities as well as new challenges. This reminds us to remain cautious in the face of a rapidly changing market.

2) Recommendations for Investors

In-Depth Research

Before making any investment decisions, it is essential to have a comprehensive understanding of the relevant assets and technologies.

Avoid Over-Leverage

Leveraged trading can amplify gains but also exacerbate losses. It is advisable to adopt conservative leverage strategies to reduce potential risks.

Diversify Investments

Avoid concentrating your portfolio in a single asset or industry. Diversification helps spread risk and enhance potential returns.

Stay Informed

The crypto market is highly dynamic. Regularly monitor the latest developments, regulatory changes, and market trends.

3) Conclusion

While the cryptocurrency market presents unprecedented opportunities, it is crucial to invest with a mindset of self-discipline and information awareness. By maintaining caution amidst optimism, investors will be better equipped to navigate this evolving market, capturing its potential while mitigating inherent risks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。